Full Text: Fed Statement On QE3

'Lacker is the only one who voted against Bernanke...'

---

Fed launches QE3 of $40 billion MBS each month

WASHINGTON (MarketWatch) -- By an 11-to-1 vote, the Federal Reserve on Thursday decided to launch a new program of open-ended bond purchases -- so-called QE3 -- saying it will buy $40 billion of agency mortgage-backed securities each month, starting Friday. It's also keeping in place so-called Operation Twist, which consists of swapping short-dated securities for longer-term securities, as well as reinvesting the proceeds of maturing securities, so the central bank will be adding $85 billion of long-term securities each month through the end of the year. The Fed also extended its pledge to keep interest rates exceptionally low -- Fed funds rates are currently targeted at a rate between 0% and 0.25% -- from late 2014 to "at least through mid-2015." The Fed said it's acting "to support a stronger economic recovery" and expects the new program to put downward pressure on longer-term interest rates, support mortgage markets and help make financial conditions more accommodative. Richmond Fed President Jeffrey Lacker, the only dissent, opposed both the asset purchases and the description of the time period will remain exceptionally low.

---

Full FOMC Statement on QE3

“Information received since the Federal Open Market Committee met in August suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has continued to advance, but growth in business fixed investment appears to have slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation has been subdued, although the prices of some key commodities have increased recently. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen.

Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and preferred to omit the description of the time period over which exceptionally low levels for the federal funds rate are likely to be warranted.”

---

Related:

Lacker Tells Charlie Rose: 'More QE Is NOT The Answer'

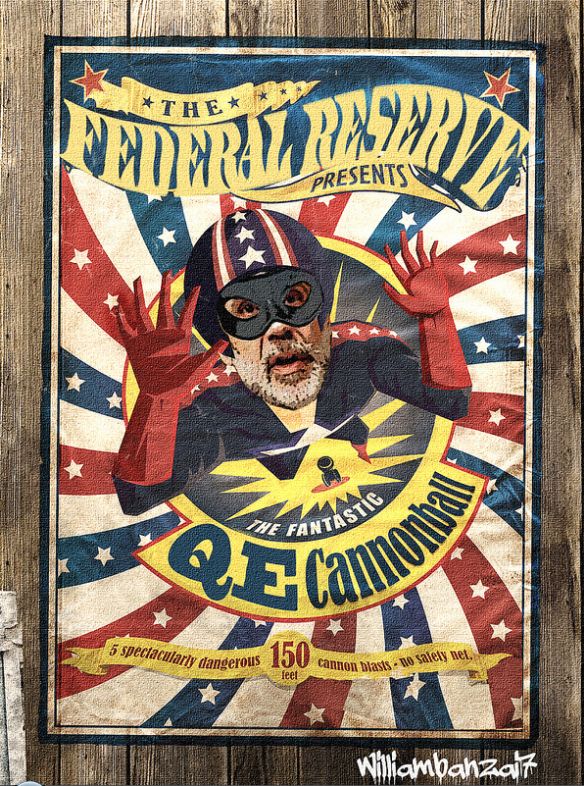

Photos (combat art) by William Banzai

Sep 13, 2012 at 4:35 PM

Sep 13, 2012 at 4:35 PM

Reader Comments (6)

http://www.marketwatch.com/story/fed-to-launch-qe3-of-40-billion-mbs-each-month-2012-09-13

[snip]

How do I unsubscribe from the e-mail notification?

"To support a stronger economic recovery... the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities."

Translation: Fed hands over money for insolvent banks to blow on bonuses, real econonmy deteriorates, Fed hands even more money to insolvent banks, etc.

Why don't Bernanke and Geithner just confiscate all private wealth in the U.S. and give it to big banks? If Professor Bernanke's theory had any validity whatsoever, the economy would rebound instantly. What's with these half-assed measures?

If you mean the daily email that feedburner sends with my stories, then look at the bottom of the email and there is an unsubscribe button. 2 clicks and you're done.

"Bernanke's statement was that he would keep QEing until unemployment falls to where he wants it. What happens if it does not come down at all, but rather goes up?"

http://www.market-ticker.org/akcs-www?post=211490