Monday

Aug152011

Demand To See Your Mortgage Note! -- Brand New Website Makes It Simple

Where's your note? Has it been lost somewhere along the way?

You can also verify your loan servicer with MERS online -- takes about 45 seconds:

---

---

Aug 15, 2011 at 1:00 PM

Aug 15, 2011 at 1:00 PM

Reader Comments (47)

--

But Mark, why play Br'er Rabbit by demanding that nobody throw you into dat der foreclosure moratorium patch, when you can hop right in yourself? And what is the tar baby, here, anyway? EXCEPT for the pending foreclosure mess -- and all that might come with it -- the banks have been in high cotton of late.

Or, forget the rabbit. Why didn't banks stop foreclosing (quietly) instead of "tricking" everybody else into demanding that they stop foreclosing?

Foreclosure logjam threatens Fannie & Freddie...

Here's a new one...

http://www.bloomberg.com/news/2010-10-12/obama-backs-state-foreclosure-probe-against-nationwide-freeze-gibbs-says.html

http://www.huffingtonpost.com/2010/10/12/gmac-mortgage-reviews-foreclosure-documents_n_760034.html

New one from tonight...

http://www.huffingtonpost.com/2010/10/12/neil-barofsky-sigtarp-gmac-foreclosure-probe_n_760349.html

Now Barofsky wants a piece of GMAC's ass because they fall under his jurisdiction over TARP....this is not going to end well for anyone involved...

Foreclosure Moratorium Would Be 'Catastrophic,' SIFMA Says

http://market-ticker.org/akcs-www?singlepost=2208797

4. The entire industry stopped keeping track of who bought and sold. This brings us back to the aforementioned MERS. Headquartered in Reston, MERS was founded by this guy Paul Mullings who is now an executive at Freddie Mac and it is currently helmed by a fellow named R.K. Arnold who according to one account spends his leisure time collecting military toys. MERS was created to sidestep the process by which buyers and sellers of homes used to record transactions with local authorities by just entering deed and lien information electronically into a database. MERS did not even have to lobby anyone to change any laws do this, apparently: “The mortgage industry just changed how the land title system worked without getting anyone’s okay,” a law professor explained to the Washington Post. Various libertards are now arguing that since mortgages change hands a lot more often than actual houses do, MERS is the only “efficient” way of doing things, which might be true were there any evidence they were actual “doing” anything; two lawyers I spoke with and everyone quoted by anyone else who has actually done any reporting into the matter say that MERS has a pretty sloppy record of recording this stuff, since it has almost no employees of its own. That has not stopped MERS from volunteering its name to be used on the “plaintiff” side of millions of foreclosure actions, despite having no claim to anything at all except a poorly-kept database no one uses, but they have stopped doing that so much in recent months because a lot of judges have decided it might be against the law. But really, should someone have to have a claim on your house to file a foreclosure notice on it?

http://www.washingtoncitypaper.com/blogs/daskrapital/2010/10/11/5-things-david-axelrod-must-have-missed-about-the-foreclosure-thing/

I was stalking Dr. P. for an opinion - so I posted off-topic, and it just snowballed from there.

More on the Foreclosure Scandal and the Mortgage Machine

http://www.propublica.org/blog/item/more-on-the-foreclosure-scandal-and-the-mortgage-machine

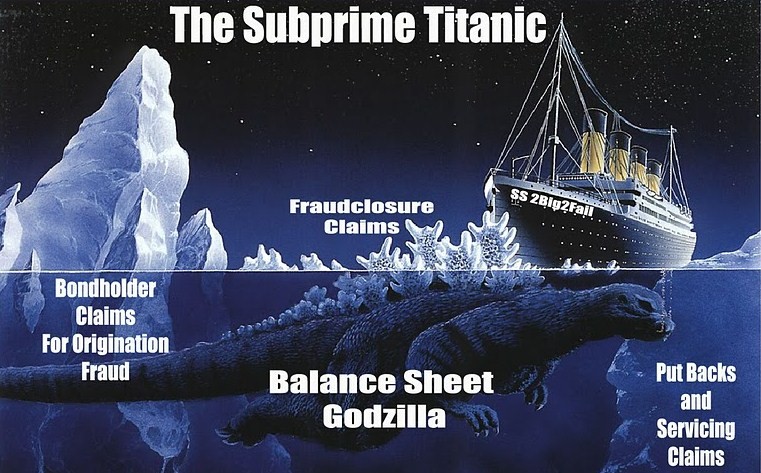

http://www.zerohedge.com/article/robo-signing-mess-just-tip-iceberg-mortgage-putbacks-will-be-harbinger-collapse-big-banks-wi

The Reggie Middleton piece...my last link...all the others were new besides this one...i think...

DB and I have both asked, Why go through all of the kabuki when you can just stop foreclosing (quietly) without going through all the kabuki, especially when the plot might not turn out the way you planned? Banks have been avoiding foreclosure in some cases, anyway.

So, why would they do this? And what's to be gained by risking what by all appearances could be a total clusterf***k for the banks themselves?

What am I missing? You're plot makes some logical sense except for the fact that they can get all the benefits without the risks by simply avoiding foreclosures.

"Within 30 days, most banks will lift their self-enforced moratoriums on foreclosure and announce that the problem is now solved..."

You mean after the elections when incumbents no longer need the people to think something will be done to help them.

"As I said earlier in the thread, home buying season is over. Why would you want to take responsibility of any property now?"

Perhaps it is a ploy to hold off till January before taking more properties, that way the tax bills will go to the current owners.

Good point, Gomp!

Look at what you're saying. The banks have stopped foreclosing voluntarily. Check. There are financial benefits (potentially) for doing this. OK...

And yet they're gaming the public, the media and congress for a mandatory moratorium on foreclosures, thereby bringing attention to a something that only the black helicopter crowd was paying attention to, something which could blow the banks themselves sky high. Alright. That's where you've lost me. Obviously a piece is missing from this puzzle. A little help?

But I don't care about that. What I care about is that the municipalities, who can't print money, but have to pay cops and teachers and loans for new schools and roads get 100% of the money from RE taxes they're supposed to, not 87.3%.

So if the banks want to let deadbeats squat for a year or two, I'm totally cool with that, as long as somebody continues to pay the RE taxes. And if the bank wants to sit on McMansions "until the market gets better...", I think they're nuts, but okay, as long as they keep the taxes current.

from business insider:

"....One highly reputable data provider with a huge database of first mortgage liens has been reporting an REO inventory in excess of one million since last summer. Whatever the number is, it seems clear that the vast majority of these properties are not currently on the market."

http://www.businessinsider.com/the-7-million-shadow-inventory-could-set-off-a-housing-price-avalanche-2010-9

Fucked-up paperwork is the least of the banks problems right now. Paying all the expenses associated with a million-plus properties and counting - that's a problem.

Some people whose initials are DB have asserted that this "robosigning" scandal exposes the banks to "hunderds of billions" in liability exposure. I disagree. But I would like to sit in on a few of the hearings:

"They just throw'd me out 'o my own house, just'n 'cause I ain't paid the mortgage in a year and a half"

There a sleazy old management trick that goes, "Don't fire him, make him quit." That way, it was his idea not yours and he has to bear the consequences of the decision (even though it was actually yours). I see the same sort of dynamic at work here.

No way this blows the banks sky-high. none. It's all sizzle and no steak.

But hey, Something had to knock Gold off the front page of the business section. Don't want too many people thinking about why gold is valuable and how ink on paper is just ink on paper.

---

http://dailybail.com/home/josh-rosner-foreclosure-fraud-nightmare-scenario-could-dwarf.html

"The mortgage is still owed, but there's going to be a problem figuring out who actually holds the mortgage, and they would be the ones bringing the foreclosure. You have a trust that has been getting payments from borrowers for years that it has no right to receive. So you might see borrowers suing the trusts saying give me my money back, you're stealing my money. You're going to then have trusts that don't have any assets that have been issuing securities that say they're backed by a whole bunch of assets, and you're going to have investors suing the trustees for failing to inspect the collateral files, which the trustees say they're going to do, and you're going to have trustees suing the securitization sponsors for violating their representations and warrantees about what they were transferring.

Also, an Assignment of Mortgage must accompany each note and this almost never happens.We believe nearly every single loan transferred was transferred to the Trust in “blank” name. That is to say the actual loans were apparently not, as of either the cut-off or closing dates, assigned to the Trust as required by the PSA.

Rather than continue to fight for the “put-back” of individual loans the investors may be able to sue for and argue that the “true sale” was never achieved."

---

Think about the consequences of that last sentence...there's no conspiracy mark bin-laden...;)

So how 'bout that gold stuff? Should hit all-time highs again this week.

This bit from Rosner:

"You have a trust that has been getting payments from borrowers for years that it has no right to receive. So you might see borrowers suing the trusts saying give me my money back, you're stealing my money. You're going to then have trusts that don't have any assets that have been issuing securities that say they're backed by a whole bunch of assets, and you're going to have investors suing the trustees for failing to inspect the collateral files, which the trustees say they're going to do, and you're going to have trustees suing the securitization sponsors for violating their representations and warrantees about what they were transferring."

Correct me if I'm wrong, but often the securitization trust is just an SPV wholly owned by Citi or Morgan Stanley or whoever. And even if not, in cases where the bank was the originator, putting this stuff in a courtroom is going to throw all kinds of unwanted light on fraud and abuse at the point of origination. More loans could be coming right back at the banks who wrote them five years ago.

If we can live with that, we can live with this.

You can ride the pony when 5 people go to jail over this - 'till then just enjoy the circus!

Public justification for another round of bailouts?

"And yet they're gaming the public"

It really is a game, ask any lobbyist, if they will admit it. Remember, I played the game.

--

Not at all. It's another important aspect, but if avoiding property taxes were the main concern, they could just let people squat.

"Let me also point out that the US Treasury has issued 1.3 Trillion in new debt so far this year, yet a "true sale" never occurs there."

--

Yes, that's some scary shit -- and believe me, I've thought about it. I passed the Eskimo test once, remember.

But T-bonds weren't going into the MBS, mortgages were (supposed to). Besides, I don't want to "live with it." I want to see this used to strangle the sons of bitches. They ran roughshod over the law and committed fraud every step of the way. This foreclosure scandal just provides a means of focusing on a visible, concrete example of that fraud. Lawyers will see to it that this actually happens. I'm not counting Brian Williams and Katie Couric, of course.

i've rolled the bailout idea over a few times, but how would that work out? I'm cynical as you are, but I can't imagine how the pols would be able to do another bailout. They did just get through telling us how great TARP was, but TARP can't be so great if they have to do a bailout within six months of telling us how great TARP was.

http://www.youtube.com/watch?v=4BtYTEmnsEU

The banks need to pretend that they still have an appetite for houses. They really do. If people understood that their bankster would rather piss on spark plug than take their house, 60% of all mortgages would be current, not 87%.

And keep in mind, you are dealing with sociopaths here. I mean that sincerely. They can't empathize so they have no idea how things play in other peoples ears. They have to fake it. So you get things like, "God's work" and "yes, all six of us TBTF banks traded perfectly last quarter...so?" They already were quietly slowing down foreclosures, but I think this story gave them the opportunity to throw it into park.

The best way for getting public support for a moratorium is to suggest that the banks are doing things that are extra-sleazy, even for banks. Trust me on this: There's plenty of "Stop the Foreclosures!!!" kooks out there; you just need something to solidify them. Give them a good enough reason to hate the banks more and they're putty in your hands....

Politicians have selective hearing, so they couldn't hear the people who opposed Bernanke, but they'll manage to hear the stop the foreclosure crowd. How easy would it be to write that speech:

"I will not stand by and let families get thrown out onto the streets by bankers who have no legal claim to that property!"

(crowd goes wild - throw tootsie rolls)

People think they've won something, politicians get to granstand, and banks get a free pass on foreclosures.

Win-win-win

By the time we realize this isn't such a big deal, it'll be time to start bailing out the States.

"I've rolled the bailout idea over a few times, but how would that work out? I'm cynical as you are, but I can't imagine how the pols would be able to do another bailout."

They never worry about polls when it comes to things like this historically, they create a climate of fear, panic, and impending doom to justify their actions. Remember the sky is falling, and martial law claims prior to the last bailout? All prior "panics" operated in this fashion. Do you see any fear, panic, and impending doom going around these days?

"Not at all. It's another important aspect, but if avoiding property taxes were the main concern, they could just let people squat."

They already are.

http://www.washingtonpost.com/wp-dyn/content/article/2010/03/04/AR2010030405442.html

http://www.californiabankruptcyattorneyblog.com/2010/03/report-says-banks-increasingly-allow-squatting-by-foreclosed-homeowners.html

http://housingstorm.com/2010/07/the-average-squatting-time-is-up-to-449-days/

http://www.irvinehousingblog.com/blog/comments/squatting-among-the-rich-and-famous/

I share your frustration, but the way I see it, justice will be served in other ways. Saying, "Fuck you, We don't want your houses, your mortgages, your stocks and bonds, or anything of the other paper shit you got....But if you've got any silver left, I'll swap you some of your paper for it."

These clowns only know one trick - printing money to solve every problem. Plan accordingly.

It's way past sleaze. I dig sleazy girls. Barrry's piece has it right--we're dealing with willful criminals. Act accordingly or die. It's not rocket science. Assume the worst and you'll be fine.

And Goddamnit, get your hands on silver NOW.

--

OK, now I get it. (told you I was slow). That's the tar baby.

Conspiracy or not, it won't stop the litigation freight train, though. And any foreclosure moratorium could still screw up that 87% number. If you're up against the wall with your mortgage and a foreclosure moratorium is called, you might just stop paying. I don't know. All of this still assumes that Brian Moynihan knows what he's doing.

Are you taking action on that?

What exactly do you think "Think tanks" are for?

takes about 60 seconds...

http://www.mers-servicerid.org/sis/

It is not about not foreclosing, it is about delaying foreclosure. Banks are business's, all business functions under similar fundamentals when it comes to creative ways to increase profits for the quarter or fiscal, protect stock valuation, and legally minimize annual tax liability.

Slowing foreclosure in the slow sales market does several beneficial things, it offsets costs (expenses) associated with the foreclosures until another quarter or fiscal thereby showing less expenses, therefore giving the appearance of higher profit (good for stock).

It minimizes the properties you are currently sitting on (which losses will become a write off), and associated costs (grass mowing, winterization, etc.), which would lower "profit" for this quarter or fiscal (bad for stocks).

It would remove temporarily the tax obligations for said properties from their books since they have not taken possession yet ( good for stocks).

Sometimes it is to your advantage to push expenditures to another quarter or fiscal for both tax, stock valuation, and bonus building reasons.

The quietly part is about not drawing to much attention to the title issues on the distressed properties, imagine if people who are paying their mortgages begin questioning the validity of the demands for payment and start demanding proof. What if proof cannot be found?

The next round of bailouts will have to have a "helping families, not banks" flavor to it. What better way than to say you're "trying to keep families off the streets..." Of course, you accomplish this by handing more money over to the banks.

They must first create more fear of impending doom, remember, you create the "problem" (set of circumstances to justify what you wanted to do anyway) to make your "solution" ( what you wanted to do all along) more palatable...

And bonuses, accolades, and promotions will abound.

Tah dah.

I think this story will keep people chattering until the elections, but they'll need something scarier after that.

http://www.marketwatch.com/story/wells-fargo-no-plans-for-foreclosure-moratorium-2010-10-12-2155510

Wells says "we don't need to stop"

http://shalurani.com/call-girl-escort-service-dwarka.html

http://shalurani.com/call-girl-escort-service-gurgaon.html

https://sites.google.com/view/primalbeastusa/miracle-root-gummies