Bailout News, Photos & Cartoons For March 7th-14th: Everything We Missed And Then Some

1) JPMorgan Chase CEO Jamie Dimon wants taxpayers and politicians to stop being so mean to him.

“When I hear the constant vilification of corporate America, I personally don’t understand it,” Dimon said in his speech. “I would ask a lot of our folks in government to stop doing it because I think it’s hurting our country.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=a3xPFlNxi7i4&refer=home

2) The industrial, post-modern, global economy loves debt and so do their governments.

The Economist says "Weighed Down: Rich Countries Are Racking Up Debt"

"AMERICA, Britain and China are among the many countries that have adopted spend-now-pay-later policies to stave off economic disaster. But giant fiscal stimuluses, tax cuts and bail-outs are weighing heavily on public finances. In a paper prepared for the forthcoming G20 summit, the IMF sets out new forecasts for government debt. Japan's debt burden, which is already the largest of the world's big economies, will reach a sumo-sized 225% of GDP in 2010. Rich countries' debt is set to grow from 83.3% of GDP in 2008 to almost 100% in 2010. Developing economies will see much smaller growth from 35.7% to 37.8% in two years, but these countries also have lower debt tolerance than rich ones."

3) Ben Stein though still an idiot, is less so this week. Mark to Market Accounting.

Suggestions #1 and #2 won't help, but I concur with suggestion #3:

"Don’t allow speculators with no insurable interest to buy credit-default swaps CDS on bonds. When used properly, these instruments can function as a legitimate kind of insurance. Yes, if you are a real buyer of the bonds of a given company, you should be able to buy insurance. But you shouldn’t if you are just a shark circling prey, bringing blood into the water."

http://www.nytimes.com/2009/03/08/business/08every.html

http://www.bloomberg.com/apps/news?pid=20601039&refer=columnist_reilly&sid=aD11FOjLK1y4

Related to MTM accounting and the uptick rule:

Jim Chanos Says We Will See Orange Jumpsuits Soon

Will Suspending Mark To Market Suspend Reality?

Congressman Barney Frnak On The Uptick Rule And MTM Accounting

4) What we are experiencing today is nothing new.

Option Armageddon : Panics And Booms, A Lesson From 1897

"It’s a great read, particularly now when most observers remain conflicted about what kind of economic funk we’re in. Mr. Holt described quite clearly the economic conditions we face today, a depression created by over-indebtedness. And he offers a prescription for how to dig ourselves out: pay back debt. It’s a prescription I endorse wholeheartedly.

The paper is so good, for posterity’s sake, I have reproduced it here in full. Another reason: Irving Fisher generally gets credit for having created the “debt deflation theory of depressions,” but Holt beat him to it by 36 years."

5) New York Attorney General Andrew Cuomo deserves some blame.

The Village Voice: "Andrew Cuomo And Fannie And Freddie: How The Youngest HUD Secretary In History Gave Birth To The Mortgage Crisis"

http://www.villagevoice.com/content/printVersion/541234?

6) United States Treasury CDS prices headed North.

"Everyone wants to know, how long will it take before the Uncle Sam goes bust?"

http://usacreditdefault.blogspot.com/2009/03/projecting-cds-curve-us-treasuries.html

Related:

Land of the Free and Home of the Broke: The United States of Inoslvency

The Last Remaining Asset Bubble Is Cracking

7) The Confidence Game and why this is the big one.

http://theconfidencegame.blogspot.com/2008/10/all-money-including-gold-is-based-on.html

8) Most of Jim Cramer's fans are market novices.

Cramer is the AOL(America On Line) of investing. He attracts people who are new to the markets, and as soon as they learn something, they either get smart and handle their own investments or they move on to other clowns and gurus.

Online heavyweight Gawker has done a fair compendium of the sins of Cramer.

"Jim Cramer knows how easy CNBC is to fool. He used to play the network himself. Here are five episodes from the stock speculator's past that could use some dusting off."

http://gawker.com/5169531/the-jim-cramer-indictment-five-more-counts

Related:

Jon Stewart Versus James Cramer: The Complete Uncensored Interview

The Video Back And Forth Between Stewart and Cramer

9) There are many smart people who own, manage and work at hedge funds. Others, not so much.

Vanity Fair: 'Over The Hedge'

"The five hotshots who took Fortress Investment Group public were worth billions at first. Today they look like arrogant showboats, and their story helps explain why hedge funds are imploding by the thousands—and why there’s still a truckload of money to be made."

10) Former Bear Stearns CEO Jimmy Cayne and Tim Geithner do not play well together.

The bridge-playing, pot-smoking former CEO has some nice quotes in a new book 'House Of Cards: A Tale Of Hubris And Wretched Excess On Wall Street' by William D. Cohan to be published next month.

Cayne on Treasury Secretary Geithner:

"This guy thinks he's got a big dick. He's got nothing, except maybe a boyfriend."

"You're not an elected officer. You're a clerk. Believe me, you're a clerk. I want to open up on this fucker, that's all I can tell you."

http://nymag.com/daily/intel/2009/03/jimmy_cayne_lets_loose_on_time.html

Related:

http://www.smh.com.au/opinion/obamas-economic-saviour-savaged-as-keating-lets-rip-20090306-8rk7.html

Hey Tim, Do Us All A Favor And Step Down Now

Puff Daddies Jimmie Cayne And Charlie Gasparino

Video: Barry Ritholtz From The Big Picture On Tim Geithner

SNL Videos On Geithner and The Rock Obama From March 7th

11) Countrywide and IndyMac executives get paid coming and going.

New York Times: 'Ex Leaders Of Countrywide Profit From Bad Loans With PennyMac'

http://www.nytimes.com/2009/03/04/business/04penny.html

http://www.portfolio.com/views/blogs/market-movers/2009/03/05/pennymac-mortgage-servicing-hero

"Whether they deserve to be or not, Countrywide Financial and its top executives would be on most lists of those who share blame for the U.S. economic crisis. After all, the banking behemoth made risky loans to tens of thousands of Americans, helping set off a chain of events that has the economystaggering. So it may come as a surprise that a dozen top Countrywide executives now stand to make millions from the home mortgage mess."

12) Moody's admits they are completely full of shit. Seriously.

Johnathon Weil, columnist Bloomberg wrote: 'Moody's Says Don't Inhale The Smoke. It's Puffery.'

"Finally, Moody’s has delivered a sensible explanation for how its ratings became so unreliable: It didn’t believe its own platitudes, or at least it didn’t think they would be binding in court. The defense hasn’t worked, though. On Feb. 18, the judge in the case rejected Moody’s puffery argument, and ordered that the lawsuit proceed."

"As bad as Moody’s missteps have been, though, it’s hard to think of anything potentially more damaging to the company’s reputation than its own claim that its talk of independence and integrity was just smoke. The problem for Moody’s is that, this time, the public might believe it was speaking the truth."

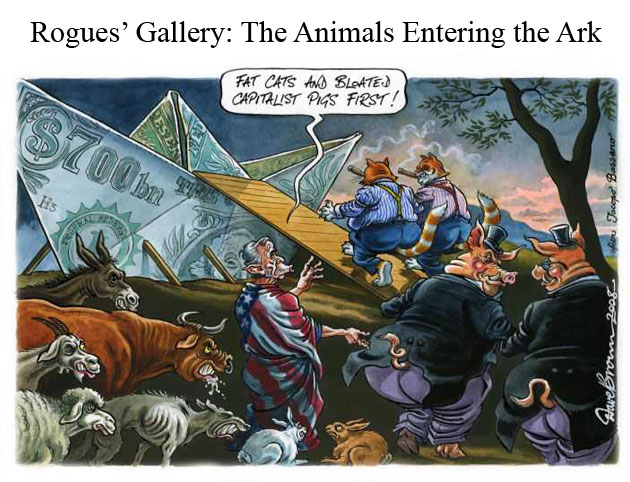

13) More Cartoons

More are coming. I will be adding to this page as the day progresses. It's too cold to golf so I will be fomenting revolution instead.

Mar 14, 2009 at 1:31 PM

Mar 14, 2009 at 1:31 PM

Reader Comments (14)

More lawsuits coming.

They did not do you justice. This is an amazing website. Keep it up.

http://www.cnn.com/2009/TECH/02/24/recession.web.sites/index.html

They list you first but don't say very much about the site.

"As bad as Moody’s missteps have been, though, it’s hard to think of anything potentially more damaging to the company’s reputation than its own claim that its talk of independence and integrity was just smoke. The problem for Moody’s is that, this time, the public might believe it was speaking the truth."

I think the ratings agencies are guilty to a certain degree but it was the investment banks who pushed Moody's and others to give everything a AAA.

This is beyond outrageous.

http://www.nytimes.com/2009/03/15/business/15AIG.html?_r=1&hp

WASHINGTON — Despite being bailed out with more than $170 billion from the Treasury and Federal Reserve, the American International Group is preparing to pay about $100 million in bonuses to executives in the same business unit that brought the company to the brink of collapse last year.

Thanks for the link. I had not seen that. Now my Saturday night is ruined.

http://dailybail.com/contact-washington/

You will find all the contact information for everyone in Washington at that link.

Let's make some calls Monday and tell them how we feel about AIG.

Thanks Deuce for providing the link on the AIG bonuses.

Here it is:

http://sqworl.com/?i=c83d6d

I will add and subtract stories and it should always remain updated.

Again, the tab can be found at the top.

"Though the story never mentioned Cuomo—whose three-year, eight-point goal hike exceeded Bush's more gradual six-point increase—it did quote his top aide William Apgar, who helped craft the 2000 policy, saying: 'It was a mistake.' Apgar, who now teaches at Harvard, conceded, 'In hindsight, I would have done it differently.'"

"The HUD secretary is also required to produce voluminous rules that govern how the GSEs meet those goals, and the 187-page rules Cuomo issued opened the door to abuse."

Wow a two-point goal increase and 187-page rules that opened the door to abuse are supposed to be a smoking gun? This is text-book fluff. Cisneros took a cautious approach? Are you f***ing kidding me? Franklin "just following the rules" Raines warned that Cuomo's rules were moving Fannie into risky territory? This seems more like an apology piece for Cisneros and Raines and a smear piece on Cuomo. Dig deeper Mr. Barrett. We expect more.

At least he admitted "These risky adventures, according to the 2004 HUD report, prompted Freddie to claim that 'the increased goals created tension in its business practices between meeting the goals and conducting responsible lending practices,' a self-serving attempt to plant the blame back on HUD." Self -serving indeed.

Sorry, though I will concede that Cuomo possibly deserves some blame, there is little to merit it from this piece. Or maybe my own bias has clouded my judgment.

I'm not calling blaming Cuomo for the crisis by any means. Just thought it was an interesting read. It's obvious the author has a personal vendetta against Cuomo, I will give you that.

That was outstanding reading. It took me about 60 minutes to read all the links.

On Cuomo, he seems to be following the path of Elliot Spitzer.

Let us hope he doesn't get brought down by political enemies.