Why Wind Power Won't Work

Wind Wake Turbulence

---

Scroll down for more photos

Guest post from 'Earth, Wind and Fire John'

The photo demonstrates turbine wake turbulence in large wind farm arrays and why the potential for wind energy is substantially overestimated by most sources. The first turbine to catch the wind will produce appreciable energy, while turbines in its wake, down wind of that unit, produce exponentially less energy due to air turbulence. The low level fog, known as sea smoke, clearly shows this and is one of the best photographs ever taken that demonstrates this effect.

The first 4 articles below pertain to how Independent System Operators (ISOs) and Independent System Administrators (ISAs) attempt to incorporate intermittent electrical sources onto the grid. Pacificorp was purchased by Warren Buffet and several stories are included regarding Buffett's energy ventures. I have also included a document from an ISO which defines Spinning and Non-Spinning Reserve, and a good piece from the LA Times explaining how renewable energy cannot reduce carbon or other emissions, and actually makes them worse.

Energy Imbalance Markets will raise prices in the West

Some western energy markets are currently challenged by the increased development of variable renewable energy resources (i.e., wind and solar that vary depending on the availability of the resource and therefore must be integrated onto the electric grid whenever they are available, day or night) promoted through federal tax incentives and renewable portfolio standards in some states. Many of these resources are under development even though the economic recession has reduced the need for electric generation in many areas in the West.

While there are several efforts underway in the West to address integration of these variable resources at reasonable and affordable cost to consumers, creation of an “energy imbalance market” (EIM) is being touted by wind developers and the U.S. Department of Energy (DOE) as the only way to handle renewable energy integration, and is being fast-tracked by DOE through its oversight of the federal Power Marketing Administrations (PMAs) that own significant transmission and generation assets in the West (see APPA issue brief on March 16, 2012, memo from DOE Secretary Chu on his priorities for the PMAs).

As proposed, such an EIM would be a sub-hourly, real-time, centrally dispatched energy market intended to improve the integration of increasing levels of variable generation from renewable resources. The theoretical benefit of an EIM is that the larger array of generation available for dispatch would provide a greater balance of intermittent resources and reduce the need for backup power. For example, if the wind or sunlight is low in one region of the EIM it might be greater in another area, thus reducing the total variability. But this benefit can only be fully achieved if there is adequate transmission capacity from the sources of generation to the demand for power.

California ISO and Pacificorp enter MOU on Energy Imbalance Markets

On February 12, 2013, the California Independent System Operator Corporation (CAISO) and neighboring utility, PacifiCorp, entered a Memorandum of Understanding to cooperate on the development of an energy imbalance market (EIM) in each entity’s respective balancing authority areas, in the hopes of laying groundwork for a broader effort across the western region. Hailed by the CAISO as the “first step in bringing PacifiCorp and ultimately other Western balancing authorities into an automated real-time [five]-minute dispatch system” the CAISO and PacifiCorp agreed in the MOU to work towards implementing the EIM by October 2014.

In statements issued with the release of the MOU, the parties noted their hope that the EIM will integrate resources efficiently and reliably, including, in particular, the significant renewable resources that have come online in the West in recent years.

Spinning and non-spinning reserve (California ISO)

Spinning Reserve is the on-line reserve capacity that is synchronized to the grid system and ready to meet electric demand within 10 minutes of a dispatch instruction by the ISO. Spinning Reserve is needed to maintain system frequency stability during emergency operating conditions and unforeseen load swings.

Non-Spinning Reserve is off-line generation capacity that can be ramped to capacity and synchronized to the grid within 10 minutes of a dispatch instruction by the ISO, and that is capable of maintaining that output for at least two hours. Non-Spinning Reserve is needed to maintain system frequency stability during emergency conditions.

Rise in renewable energy will require use of more fossil fuels - LA Times

The Delta Energy Center, a power plant about an hour outside San Francisco, was roaring at nearly full bore one day last month, its four gas and steam turbines churning out 880 megawatts of electricity to the California grid. On the horizon, across an industrial shipping channel on the Sacramento-San Joaquin River Delta, scores of wind turbines stood dead still. The air was too calm to turn their blades — or many others across the state that day. Wind provided just 33 megawatts of power statewide in the midafternoon, less than 1% of the potential from wind farms capable of producing 4,000 megawatts of electricity.

One of the hidden costs of solar and wind power — and a problem the state is not yet prepared to meet — is that wind and solar energy must be backed up by other sources, typically gas-fired generators. As more solar and wind energy generators come online, fulfilling a legal mandate to produce one-third of California's electricity by 2020, the demand will rise for more backup power from fossil fuel plants.

"The public hears solar is free, wind is free," said Mitchell Weinberg, director of strategic development for Calpine Corp., which owns Delta Energy Center. "But it is a lot more complicated than that." Wind and solar energy are called intermittent sources, because the power they produce can suddenly disappear when a cloud bank moves across the Mojave Desert or wind stops blowing through the Tehachapi Mountains. In just half an hour, a thousand megawatts of electricity — the output of a nuclear reactor — can disappear and threaten stability of the grid.

Buffett buys Pacificorp for $5.1 billion in cash - Background

Striking the second biggest deal of his career and making a major move in the energy industry, billionaire investor Warren Buffett agreed Tuesday to pay $5.1 billion in cash to acquire Western states electric utility PacifiCorp.

Buffett's MidAmerican starts wind projects before credits end

MidAmerican Energy Holdings Co., the power provider owned by Warren Buffett’s Berkshire Hathaway, completed 300 megawatts of wind farms in California ahead of the expiration of a tax credit at the end of this year.

MidAmerican Renewables LLC completed the 168-megawatt Pinyon Pines Wind I and the 132-megawatt Pinyon Pines Wind II projects near Tehachapi, the Des Moines-based company said today in a statement. The 100 Vestas Wind Systems 3-megawatt turbines will supply Southern California Edison with electricity under long-term contracts.

Western Wind acquires 4000 mw wind project pipeline

Western Wind Energy Corp. is pleased to announce it has executed a Term Sheet with Champlin/GEI Wind Holdings ("CGEI Wind") to acquire the rights and title to a 4,000 MW wind energy development pipeline, with near term projects in Hawaii and Utah. Additional large projects are in California and throughout the US in niche markets with strong Renewable Portfolio Standards and Power Purchase Agreement pricing.

Cost of the acquisition is $20 Million US, payable by the issuance of 8 Million common shares at a deemed value of $2.50 per share US. The term sheet will be subject to completion of due diligence, formal documentation, board approvals and approval of the TSX and the applicable securities regulatory agencies including applicable escrow provisions.

Brookfield renewable gains control of Western Wind

We are referring to one of the more unusual events in recent Canadian corporate history: the bid by Brookfield Renewable Energy Partners to acquire Western Wind for $2.60 a share. At the close of business Thursday Brookfield Renewable announced that it had acquired 59.7% of the shares held by the independent shareholders. Adding in the stake held by Brookfield – a stake it purchased last year – Brookfield said that it now has a 66.1% stake in Western Wind.

Apex buys right to wind energy project

Property intended for a wind farm south of the Hoopeston area has again changed hands. Development of the Hoopeston Wind farm has been ongoing since 2008. The most recent coordinator, GDF SUEZ Energy North America Inc in Houston, Texas, took over in 2011 when it purchased the previous wind farm developer, International Power.

Apex Wind Energy, Inc. is an independent renewable energy company based in Charlottesville, Va. Since its founding in 2009, Apex has completed 10 acquisitions and has project sites in 20 states, including Illinois, Indiana and Wisconsin.

Related:

Maersk Line and Apex partnership

Jim Trousdale relationship map

BP to buy back $8bn in stock after Russian sale

Offshore wind resource substantially overestimated

Estimates of the global wind power resource over land range from 56 to 400 TW. Most estimates have implicitly assumed that extraction of wind energy does not alter large-scale winds enough to significantly limit wind power production. Estimates that ignore the effect of wind turbine drag on local winds have assumed that wind power production of 2–4 W m−2 can be sustained over large areas.

New results from a mesoscale model suggest that wind power production is limited to about 1 W m−2 at wind farm scales larger than about 100 km2. We find that the mesoscale model results are quantitatively consistent with results from global models that simulated the climate response to much larger wind power capacities. Wind resource estimates that ignore the effect of wind turbines in slowing large-scale winds may therefore substantially overestimate the wind power resource.

These images are worth the click.

3-D images of wind turbine wake turbulence (very cool)

Senators back breaks for offshore wind

U.S. Sen. Susan Collins of Maine is co-sponsoring a bill to boost offshore wind energy generation, which is being aggressively pursued in the state. Collins, a Republican, joins Democratic Sen. Tom Carper of Delaware in introducing the Incentivizing Offshore Wind Power Act. A House version of the bill is also being introduced.

The proposals provide financial incentives for investment in offshore wind energy. They seek to extend investment tax credits for the first 3,000 megawatts of offshore wind facilities placed into service, or about 600 wind turbines. The sponsors say the tax credits are vital for wind energy technology because of the longer lead time for the permitting and construction of offshore wind turbines, compared to onshore wind energy.

Biden caught with hand in cookie jar (Must Read)

BrightSource Is “Sustained By An Impressive Array” Of Subsidies

Brightsource Is “Sustained By An Impressive Array Of Federal, State And Local Subsidies, Including A $1.6 Billion Loan Guarantee From The Department Of Energy.”“Fortunately for BrightSource, its efforts are sustained by an impressive array of federal, state and local subsidies, including a $1.6 billion loan guarantee from the Department of Energy, one of the largest solar guarantees on record. The company notes federal provisions providing solar projects with a 30% investment tax credit through 2016, as well as accelerated depreciations of capital costs for solar entities, among other goodies.” (Editorial, “Secretary Of Subsidy,” The Wall Street Journal, 6/2/11)

Sany Electric completes first wind farm in Texas

News of the self-funded project first emerged in December 2010. Sany has a development pipeline in the Texas Panhandle—in the north of the state--and in Central America. But it has no firm plans as yet to build a second US wind project, according to project development advisor Stacy Rowles.

Fellow Chinese manufacturers Goldwind and Guodian have recently built or are developing US projects in an to forge a track record in the country's market. In March, Guodian United Power signed a deal to supply six 1.5MW turbines to a small ‘distributed power’ project in Corpus Christi in south Texas. Last year, Goldwind completed a 4.5MW pilot project in Pipestone, Minnesota - its first US project.

Congressional oversight needed for wind rulemaking

After 20 years and many extensions, the federal Production Tax Credit (PTC) was scheduled to expire at the end of 2012. Neither the House nor the Senate saw fit to extend this overly generous corporate benefit when it was considered on its own merits, and the PTC did, in fact, expire.

But in the final hours of the fiscal cliff negotiations, a provision in the American Taxpayer Relief Act surreptitiously added a $12 billion, 1-year extension of the PTC. This move was done behind closed doors, without debate, any opportunity for amendment, or obligation of the Congress to find a way to pay for it.

The abuse of the Public Trust did not end there. With this extension, a critical change to the PTC was introduced that relaxed the eligibility requirements for the credit. Renewable energy projects now need only ‘commence construction’ by January 1, 2014, to qualify for the credit, instead of the projects being ‘placed-in-service’ by that date.

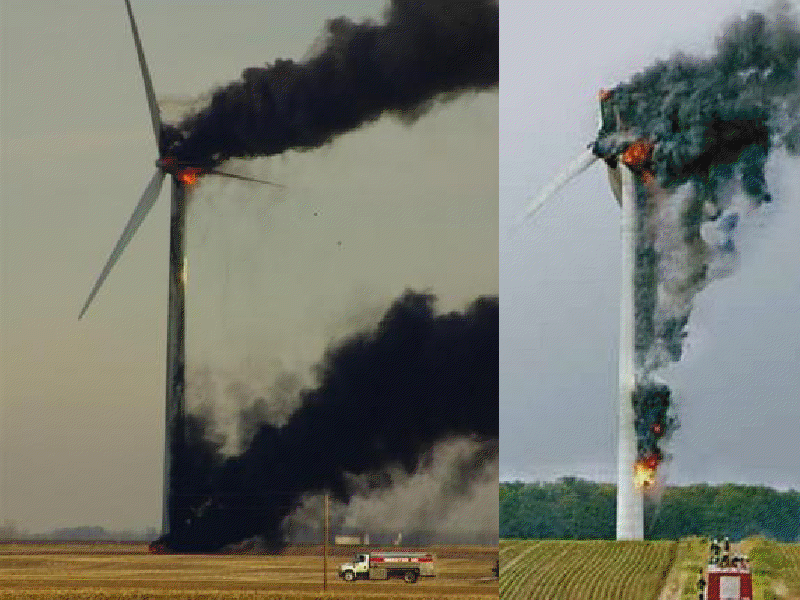

Wind Turbine Fires

Forest fires and wind turbines; the danger no one talks about

Despite all that has been written about wind power, a vitally important issue has barely been mentioned. When turbines fail, blades may fall to the ground or send fragments that land up to a mile away. Turbines often catch fire, and when they do they often send flaming shards into fields and forests.

In California, one such fire burned 68 acres, another 220 acres, and in Palm Springs several “spot fires” had been generated in surrounding areas. In Hawaii, 95 acres were burned. Australia lost 80,000 acres of forests located mostly in a national park. Spain lost nearly 200 acres from one fire. A comment on a German fire mentioned that “burning debris” from a turbine had traveled several hundred meters from the site. In Holland, three burning blades from a mere 270-foot tower cast a 50-foot flaming shard 220 feet from the site.

The most dramatic report emanated from Wales where “great balls of fire” landed more than 150 yards away, causing a hillside to burn. Fearing more forest fires, an Australian province enacted a law banning placements of wind towers near wooded areas. Yet, in heavily forested Maine, all of our wind power sites have been approved without even considering that turbines have often caused forest fires.

That 220-acre California fire had been contained by 45 firefighters, two helicopters and two bulldozers. The 69-acre fire was contained with the help of 15 fire engines, four hand crews and four planes. A 5-acre California fire was extinguished by six fire engines, three water trucks, two helicopters, two tanker planes, a bulldozer and three hand crews.

Here are some photos of wind turbine fires and failures.

Wind turbine fires and failures - Must See Photos

The coming US carbon tax via the US Treasury (Must Read)

I sought emails and other documents from two offices: Environment and Energy (really), and Legislative Affairs. This action after the administration first ignored us, which they followed with an unfortunate stumble, trying to delay us with fees — even absurd and surely anti-’green’ ones, like $1,800 to photocopy electronic mail, typically copied on a disc for no charge — which fees, even when they’re not mindlessly trumped up like that one, not-for-profit groups which disseminate government information are exempt by statute from paying.

Delay can only work only so well once we file suit, and recently Treasury turned over a first production of approximately 770 pages of reports. Despite its better efforts Treasury managed to hand over some docs that in an attentive world should prove extremely useful, offering fantastic language if often buried in pointy-headed advice they received in Power Points and papers from the IMF, G-20 and, in graphic terms, an analysis from the World Bank on how to bring a carbon tax about.

These documents represent thoughtful advice on how to mug the American taxpayer and coerce them out of unacceptable and anti-social behavior, diverting at least 10% of the spoils to overseas wealth transfers. The major focus is language, how to sell it to the poor saps not by noting the cost or that it is a tax but as, for example, the way to be the leader in something like solar technology.

***

Read last week's story:

The Mafia Is Moving Into Green Energy

Note to readers

I have very serious reservations regarding financial and transparency issues surrounding the renewable industry. These issues need to be addressed fully before permits are issued, offshore tracts are auctioned, and projects on federal/state lands, or any other project using taxpayer assistance (financial incentives, grants, etc) are given. We must have full public disclosure of true ownership of developers and their partners and affiliates, with a particular focus on government agencies and employees.

john

May 3, 2013 at 1:47 PM

May 3, 2013 at 1:47 PM

Reader Comments (121)

http://www.scotsman.com/news/environment/scots-face-world-s-biggest-energy-bills-from-wind-power-1-3029517

[snip]

THE unreliability of wind power could mean an independent Scotland would have to import energy from England – leaving it with the highest household bills in the world, it was claimed yesterday.

In an interview with Scotland on Sunday, Sir Donald Miller, former chairman of both the South of Scotland Electricity Board and of ScottishPower, has described the SNP’s current energy policy on producing 100 per cent of Scotland’s needs from renewables as “disastrous”.

First Minister Alex Salmond has claimed that an independent Scotland would be the “Saudi Arabia of renewables”. But Sir Donald warned that Scots could face the highest bills in the world once a single UK energy market ceased to exist and they had to pay for imported power.

Sir Donald said an independent Scotland could find itself in the same position as Denmark, which produces much of its energy from wind and has the highest household bills in the world – about 70 per cent more than the UK – because it has to import at premium prices from Norway when the wind is not blowing.

===========

This is from a couple of days ago...

U.K. Grants Offshore Wind Triple Market Electricity Price

http://www.bloomberg.com/news/2013-06-27/u-k-to-pay-offshore-wind-companies-triple-market-rate-for-power.html

The U.K. will pay offshore wind developers triple the market price for electricity they generate under a subsidy program to boost renewable energy that by 2020 will cost consumers 7.6 billion pounds ($11.6 billion) a year.

http://communities.washingtontimes.com/neighborhood/climatism-watching-climate-science/2013/aug/28/wind-turbines-clutter-north-german-countryside/#.Uh6Wlwo3HmM.twitter

[snip]

But all is not well with the Energiewende. According to figures from the German Federal Ministry, the 22,962 wind turbines operating at the end of 2012 provided only 7.3 percent of the nation’s electricity and about 1.8 percent of the nation’s energy consumption. Despite the location of many turbines on the windy North Sea, German wind turbines operated at a capacity factor (actual output vs. rated output) of only 17 percent in 2012.

The low capacity factor of German wind turbines makes wind electricity expensive. Driven by increased costs from renewables, household electricity rates almost doubled from 13.9 eurocents per kilowatt-hour to 26.0 eurocents per kilowatt-hour from 2000 to 2013. Today, Germany has the second highest electricity rates in Europe, more than triple U.S. electricity prices.

http://www.washingtonpost.com/local/dominion-virginia-power-wont-build-offshore-wind-farm-on-tract-it-leased-unless-cost-drops/2013/09/14/4b11661e-1cc8-11e3-82ef-a059e54c49d0_story.html

http://www.zerohedge.com/news/2013-09-17/largest-lbo-ever-prepares-largest-non-financial-bankruptcy-30-years

HA HA HA ...HA HA HA LOL ROFL......holy fuck this is funny.....

http://www.treehugger.com/corporate-responsibility/txu-to-add-3000-mw-of-wind-energy-with-compressed-air-storage.html

http://minnesota.publicradio.org/display/web/2013/09/17/goodhue-wind-farm

http://www.nytimes.com/2013/09/19/world/europe/germanys-effort-at-clean-energy-proves-complex.html?pagewanted=all&_r=0

German families are being hit by rapidly increasing electricity rates, to the point where growing numbers of them can no longer afford to pay the bill. Businesses are more and more worried that their energy costs will put them at a disadvantage to competitors in nations with lower energy costs, and some energy-intensive industries have begun to shun the country because they fear steeper costs ahead.

Newly constructed offshore wind farms churn unconnected to an energy grid still in need of expansion. And despite all the costs, carbon emissions actually rose last year as reserve coal-burning plants were fired up to close gaps in energy supplies.

A new phrase, “energy poverty,” has entered the lexicon.

“Often, I don’t go into my living room in order to save electricity,” said Olaf Taeuber, 55, who manages a fleet of vehicles for a social services provider in Berlin. “You feel the pain in your pocketbook.”

Mr. Taeuber relies on just a single five-watt bulb that gives off what he calls a “cozy” glow to light his kitchen when he comes home at night. If in real need, he switches on a neon tube, which uses all of 25 watts.

Even so, with his bill growing rapidly, he found himself seeking help last week to fend off a threat from Berlin’s main power company to cut off his electricity. He is one of a growing number of Germans confronting the realities of trying to carry out Ms. Merkel’s most ambitious domestic project and one of the most sweeping energy transformation efforts undertaken by an industrialized country....

http://thehill.com/blogs/e2-wire/e2-wire/324867-white-house-said-to-seek-replacement-for-faltering-energy-nominee

The White House nomination of Ron Binz to chair the Federal Energy Regulatory Commission appears to be collapsing.

Binz has faced strong opposition from Republicans, and Democratic Sen. Joe Manchin (W.Va.) also opposes his nomination, endangering his path to confirmation.

On Thursday, a Democratic spokesman on the Senate Energy and Natural Resources Committee said other candidates are being considered for the post.

“The [Senate Energy and Natural Resources] Committee is aware that other candidates are being considered to lead FERC,” said Keith Chu, a spokesman for the committee’s Democratic leadership.

http://wattsupwiththat.com/2013/09/27/expensive-energy-kills-poor-people/

...Yes, kills. People die from the cold. If the women of Maseru have to pay more for coal, they have less money to pay for food. So they will buy a bit less coal and a bit less food, and somewhere in there, in the hidden part that far too many people don’t want to think about, kids are dying. It’s already happening...

Note: They pay more, get less and who gets the money?

http://www.globalwarming.org/2013/09/27/legal-analysis-of-epas-proposed-carbon-pollution-standard/

The analysis below subjects EPA’s proposed Carbon Pollution Standard to the D.C. Circuit Court’s rigorous standard of review under Clean Air Act Section 111. Previously, I explained how EPA’s proposed standard, whose purpose is to reduce greenhouse gases, is likely to increase greenhouse gas emissions in practice.

http://online.wsj.com/news/articles/SB10001424052702303382004579129182510803694

BRUSSELS—Top executives of companies that provide half of Europe's electricity production capacity on Friday called on politicians to end "distorting" subsidies for wind and solar power, saying the incentives have led to whopping bills for households and businesses and could cause continent-wide blackouts.

Speaking at a news conference here, chief executives of 10 energy producers also urged European Union authorities to compensate electricity companies that agree to maintain spare capacity on standby—a practice that helps increase the security of Europe's highly interconnected power grid.

http://www.latimes.com/local/la-me-energy-subsidies-20131014,0,1024399.story

"We are on a mission to deal with climate change," said Peevey, who oversees most of the spending. "It is considered a great success story."

Not everybody is convinced that the investments are doing any good for ratepayers.

"Suddenly, you look up and there are literally hundreds of millions of dollars going into investments that produce marginal benefits," said state Sen. Rod Wright (D-Inglewood), a member of the Energy, Utilities and Communications Committee.

"You know the tale of Robin Hood? Well, this is robbing the 'hood," he said. "You are taking from poor people to give to rich people."

http://www.bloomberg.com/news/2013-10-13/clean-energy-investment-headed-for-second-annual-decline.html

Clean-energy investment fell 14 percent in the third quarter from the prior three months as Europe curbed subsidies and cheaper U.S. natural gas lured investment.

The $45.9 billion spent makes it “almost certain” that annual investment in renewables and energy-smart technologies will fall for the second consecutive year from $281 billion in 2012, Bloomberg New Energy Finance said in a statement.

Investment in the quarter was 20 percent lower than the same period last year as spending in China, the U.S. and Europe fell. The U.S. saw the largest decline, sliding 41 percent to $5.5 billion, according to the London-based research company.

Europe’s clean-energy industry is retrenching after subsidies were reduced in nations from Germany to Spain, which helped propel record growth in previous years. Cheap gas in the U.S. driven by a shale-drilling boom and a reduction in China’s spending on wind power wind power also contributed to the overall decline, the London-based consultant said.

“Governments accept that the world has a major problem with climate change but, for the moment, appear too engrossed in short-term domestic issues to take the decisive action needed,” Michael Liebreich, chief executive officer of Bloomberg New Energy Finance, said in the statement.

http://www.windaction.org/posts/38808-statoil-cancels-120-million-offshore-wind-project-in-maine#.Ul3NahafYQI

AUGUSTA — Norwegian company Statoil announced Tuesday that it was pulling the plug on its $120 million offshore wind pilot project in Maine, citing uncertainty about state regulations.

It will instead put its resources toward pursuing an offshore wind project it has been developing in Scotland.

----------

I have a shitload more coming up including a Goldman Sucks deal. Stay tuned.

http://bangordailynews.com/2013/10/08/business/proposal-to-build-major-wind-farm-in-aroostook-county-resurrected/

PORTLAND, Maine — A wind farm first proposed in southern Aroostook County in 2007 is back on the table.

EDP Renewables North America LLC, based in Houston, is pursuing development of a 250-megawatt wind farm roughly nine miles west of Bridgewater. The company calls it the Number Nine Wind Farm.

------

OK , I will stop right there. please read the rest but here is how Goldman Sachs comes into play...

In 2005, the company was purchased by investment bank Goldman Sachs for an undisclosed sum, and was acquired by Energias de Portugal in 2007 for $2.15 billion.[1] It became a part EDP Renewables which was listed in 2008.[2][3] On 1 July 2011, the company changed its name from Horizon Wind Energy to EDP Renewables North America LLC.

http://www.bloomberg.com/news/2013-10-15/germany-increases-fee-to-fund-renewable-energy-to-record.html

Germany’s power grid operators boosted the surcharge consumers pay for renewable energy by 18 percent to a record, adding to pressure on Chancellor Angela Merkel’s government to act against rising electricity bills.

The four grid companies set the fee paid through power bills at 6.24 euro cents (8.42 U.S. cents) a kilowatt-hour next year from 5.28 euro cents now, according to a statement on the website of TransnetBW. The charge has more than quintupled since 2009, helping to make German household power bills the third-highest in the European Union. Big industrial users are largely exempt from the fee.

http://bangordailynews.com/2013/10/24/business/connecticut-regulators-approve-contract-for-250-megawatt-wind-farm-in-aroostook-county/?ref=BusinessBox

Connecticut regulators approved more than $1 billion in state-directed power contracts on Wednesday, but not without expressing their doubts about whether some benefits of the clean, cheap electricity would accrue to the state.

The state Public Utilities Regulatory Authority, in approving plans for a 20-megawatt solar farm in Sprague and a 250-megawatt wind farm in northern Maine, said that the Maine power will be distributed locally, rather than delivered to southern New England.

And environmentally, the regulators said, the clean wind power will benefit the Atlantic Ocean and Maine more than Connecticut ratepayers, who are paying for the power.

“The environmental effects … will primarily accrue to the citizens of sparsely populated Aroostook County, certain parts of Canada’s Maritime Provinces, and the Atlantic Ocean,” regulators said in their decision to approve the contracts.

On the electricity from Maine, regulators said, “Because of transmission limitations, it appears that the electricity generated by this project will remain exclusively or largely in Maine and not be delivered to Connecticut or elsewhere outside of Maine.”…

…Connecticut Light & Power and United Illuminating negotiated agreements to buy power from the projects, which are being developed by Heliosage and EDP Renewables North America.

Though electrons from the project will likely not leave Maine, the projects still will help Connecticut, said William Dornbos, the Connecticut director of Environment Northeast, an advocacy group.

“It’s always important to remember that we participate in a regional electric grid,” he said. “More wind power helps lower electricity costs in our regional wholesale electricity market by pushing more expensive resources like oil-fired power plants, outside that market.”

The statute enabling the energy procurement, passed this summer by the General Assembly, gave the energy commissioner the authority to determine whether the contracts were in the interest of ratepayers, a question traditionally in the purview of state utility regulators.

In their decision Wednesday, the three commissioners — Arthur H. House, John W. Betkoski III and Michael A. Caron — explained that they were not asked to determine whether the contracts were in the best interest of ratepayers.

http://www.epaw.org/multimedia.php?lang=en&article=a19

From our correspondent from The Netherlands: two wind turbine mechanics, respectively 19 and 21 years old, died because of the fire. One fell to his death and was found on the ground underneath the turbine, the other died from his burns and was found inside the charred remains of the turbine.

A surprinsingly large number of wind turbines are involved in accidents around the world. Most of them are blades falling off, turbines collapsing, or nacelles burning down to a skeleton (400 - 800 litres of burning oil are not easy to extinguish, especially as firemen rarely have ladders long enough for these >100-meter long contraptions). Some human deaths have been reported.

A record is being kept at Caithness Windfarm Information Forum.

http://www.reuters.com/article/2013/12/31/us-phillips66-berkshire-idUSBRE9BT0PQ20131231

(Reuters) - Warren Buffett's Berkshire Hathaway Inc struck a deal to buy a Phillips 66 business that makes chemicals to improve the flow potential of pipelines for around $1.4 billion of stock.

Phillips 66 said on Monday that Berkshire will pay for the unit, Phillips Specialty Products Inc, using about 19 million shares of Phillips 66 stock that it currently owns.

Note: see my stories (above) about Mid American and Pacificorp:

Buffett buys Pacificorp for $5.1 billion in cash - Background

Striking the second biggest deal of his career and making a major move in the energy industry, billionaire investor Warren Buffett agreed Tuesday to pay $5.1 billion in cash to acquire Western states electric utility PacifiCorp.

Buffet on Hydro

Buffett's MidAmerican starts wind projects before credits end

MidAmerican Energy Holdings Co., the power provider owned by Warren Buffett’s Berkshire Hathaway, completed 300 megawatts of wind farms in California ahead of the expiration of a tax credit at the end of this year.

MidAmerican Renewables LLC completed the 168-megawatt Pinyon Pines Wind I and the 132-megawatt Pinyon Pines Wind II projects near Tehachapi, the Des Moines-based company said today in a statement. The 100 Vestas Wind Systems 3-megawatt turbines will supply Southern California Edison with electricity under long-term contracts.

http://www.wtae.com/news/local/fayette/huge-wind-turbine-falls-in-fayette-county/-/10931844/23960988/-/5g461y/-/index.html?utm_source=hootsuite&utm_medium=facebook&utm_campaign=wtae-tv%2Bpittsburgh

http://wlfi.com/2014/02/21/wind-turbine-catches-fire-in-benton-county/

BENTON COUNTY, Ind. (WLFI) – A wind turbine in Fowler catches fire in Benton County Friday morning. Witnesses report seeing the turbine shooting flames and sparks from its motor.

The turbine is just off U.S. 52 and County Road 100 South in Benton County. At 6:30 a.m., the Fowler Fire Department dispatched a crew to create a perimeter around the tower.

BP Wind Energy owns the turbine. Fowler Fire Chief Bill Burton said BP told him, whenever this happens, crews should secure the area and not attempt to put the fire out. He said this is something crews are prepared for, but never thought they would see.

——————–

This is the same farm that is suing a utility over a PPA.

http://www.newsbug.info/williamsport_review_republican/article_53dc4d8a-722d-11e3-97c2-0019bb2963f4.html

http://www.unionleader.com/article/20140220/NEWS02/140229973

MANCHESTER — An effort by the Federal Energy Regulatory Commission to levy $8.75 million in fines against Manchester’s energy consultant is moving to federal court, with a jury trial requested by FERC lawyers.

The fines against Competitive Energy Services of Maine, which arranges energy purchase deals for the city of Manchester, were first announced in July of 2012.

The parties have been unable to settle the case, and in December FERC lawyers petitioned the U.S. District Court in Massachusetts for a jury trial affirming the civil penalties against CES and its owner, Richard Silkman.

Silkman is accused of colluding with large-scale energy users in Maine to overstate their baseline energy use so as to qualify for incentives designed to encourage conservation during periods of peak use, making it appear that the users were conserving power when they weren’t.

Silkman has denied the charges and his attorneys are attempting to have them dismissed, claiming that the statute of limitations has expired and that FERC’s anti-manipulation statute does not apply to consultants…

———

FERC/CES

http://www.cov.com/files/Publication/cfeffdbb-2b1a-461e-8817-15c824ed38df/Presentation/PublicationAttachment/f3f4a12a-4c70-4b7f-83ba-23fea2a4e52a/FERC_Imposes_Civil_Penalties_for_Demand_Response_Manipulation.pdf

http://www.wind-watch.org/news/2011/02/17/freedom-wind-developers-subject-of-federal-investigation/

[snip]

Competitive Energy Services of Portland, the original parent company of the Beaver Ridge Wind development, and Richard Silkman, a co-managing partner of CES, are each named in separate staff notices of alleged violations released Jan. 25, by FERC.

http://www.energymaine.com/mrepress/pressRelease.asp

[snip]

Competitive Energy Services, LLC ("CES"), of Portland, Maine, announced today that it is now selling "Green Power" to Maine residential and small businesses consumers. The product is being sold through Maine Renewable Energy ("MRE"), an affiliate of Competitive Energy Services and in partnership with Maine Interfaith Power and Light ("MeIPL").

Richard Silkman, Managing Partner of Competitive Energy Services, said, "Today, we are helping to bring the promise of competitive electricity markets to Maine homes and small businesses by offering Mainers a choice of where their electricity comes from. Our product is 100% renewable and 100% generated within the State of Maine.

http://www.bloomberg.com/news/2014-02-18/shaw-joins-kkr-buying-cleaner-energy-rivals-won-t-touch-energy.html

Hedge funds and private equity firms from D.E. Shaw & Co. to KKR & Co. (KKR) are ramping up their investments in renewable energy projects.

D.E. Shaw, the $30 billion hedge fund manager, bought stakes in five California solar plants in July and is co-developing a wind farm off Rhode Island’s coast. KKR has completed five clean-energy deals in three years, and Altus Power America Management LLC announced a joint venture Feb. 4 to develop $150 million of commercial solar projects.

What’s driving this are projections of stable yields of 8 percent to 10 percent in the next few years -- better than most corporate bonds. Wind farms and industrial-scale solar plants typically have decades-long deals, known as power-purchase agreements, to sell electricity to utilities. D.E. Shaw is betting those contracts make renewable energy as safe and reliable as, say, conventional utility bonds have always been regarded, said Bryan Martin, a managing director at the New York-based firm.

Only a minority of investors understand that such contracts with investment-grade utilities or cities “are capable of providing a steady income stream comparable to high-quality corporate bonds,” Martin said by e-mail.

Investment-grade corporate bonds returned an annualized 5.8 percent since the end of 2010 through Feb. 14 of this year, according to the Bank of America Merrill Lynch U.S. Corporate Index.

David E. Shaw, a researcher in computational biochemistry who founded the firm bearing his name in 1988, was appointed to the President’s Council of Advisors on Science and Technology by Bill Clinton and later by Barack Obama.

http://www.forbes.com/sites/jamestaylor/2014/02/27/wind-industry-study-electricity-prices-skyrocketing-in-largest-wind-power-states/

A newly published paper by the American Wind Energy Association illustrates that electricity prices are rising more than four times the national average in nine of the 11 states with the most wind power consumption. In Texas, the only one of the 11 states with significantly declining electricity prices, deregulation rather than wind power is causing the decline in electricity prices. The findings are a huge blow to advocates of renewable power mandates and wind power subsidies…

...AWEA Shoots Self in Foot

In its attempt to rebut the common-sense, objectively documented fact that forcing people to purchase electricity from expensive sources raises electricity prices, AWEA merely shot itself in the foot regarding its bogus economic claims. AWEA also put state legislators on notice to be very careful regarding any self-serving claims AWEA might present in the future. Thank you for making my point for me, AWEA!

Warren Buffett says climate change made no difference to insurance on catastrophes

http://joannenova.com.au/2014/03/warren-buffett-says-climate-change-made...

A CNBC show interviewed Warren Buffett — and in the context of talking about insurance shares — the billionaire (and Bershire Hathaway shareholders) are smiling all the way to the bank. Climate scientists may be predicting disasters, but as far as insurance goes, nothing much had changed.

Interviewer: How has the latest rise of extreme weather events changed the calculus on Ajit Jain in reinsurance?

Warren Buffett: “The public has the impression, because there has been so much talk about climate, that the events of the last ten years have been unusual. …They haven’t. We’ve been remarkably free of hurricanes in the last five years. If you’ve been writing hurricane insurance it’s been all profit.”

Warren Buffett: “So far the effects of climate change, if any, have not affected… the insurance market.

It has made no difference. I calculate the probabilities in terms of catastrophes no differently than a few years ago… that may change in ten years.”

Warren Buffett: “I love apocalyptic predictions, because … they probably do affect rates…”

Warren Buffett: “Writing US hurricane insurance has been very profitable in the last five or six years… now the rates have come down and we’re not writing much, if anything, on Hurricanes in the US at all. The biggest cat risk right now.. I think is earthquakes in New Zealand.”

http://bangordailynews.com/2014/03/04/business/high-court-overrules-state-approval-of-multimillion-dollar-wind-energy-deal/?ref=regionstate

HALLOWELL, Maine — A 2012 deal worth hundreds of millions of dollars to expand wind energy projects across the Northeast was dealt a blow Tuesday by the Maine Supreme Judicial Court, which ruled that a state agency’s approval of the complex deal was invalid.

The transaction included prominent wind developer First Wind, Maine utility companies Bangor Hydro and Maine Public Service, and Nova Scotia-based electric utilities owner Emera Inc.

The Public Utilities Commission had approved the proposed transaction in April 2012. In June 2012, the companies announced they had closed the multipart deal to affiliate, which would provide First Wind with the cash to build wind turbines across the region.

A press release stated the joint venture amounted to $361 million in loans and investments, adding that “the completion of the joint venture could lead to up to $3 billion in future economic investment in the region in the coming years.”

But between the PUC’s approval and the companies’ announcement of the closing, three parties appealed the approval to the state’s highest court. The appeals were made by the state public advocate, Houlton Water Co. and the Industrial Energy Consumers’ Group, which represents large energy users and advocates for lower electricity prices.

Their primary argument was that the deal would violate the state’s landmark electricity restructuring act. That law barred electricity transmission companies such as Bangor Hydro from owning electricity generation because it was seen as anti-competitive and contributing to high electricity prices.

Committee passes bill requiring wind projects to lower rates, create jobs

http://bangordailynews.com/2014/03/07/politics/state-house/committee-passes-bill-requiring-wind-projects-to-lower-rates-create-jobs/?ref=regionstate

AUGUSTA, Maine – A Gov. Paul LePage initiative meant to overhaul Maine’s wind energy production goals to require ratepayer benefits and manufacturing jobs, gained tentative approval in the Legislature’s Energy Committee on Friday.

But the bill, LD 1791, sponsored by state Rep. Lance Harvell, R-Farmington, saw a significant revisions including allowing a section of current law to stand, prior to the 6-2 vote to approve the measure.

Initially, the bill would have erased from Maine law specific goals by year for installed wind energy capacity, but an amendment by Harvell Friday left those goals intact, including one for 2015 that state isn’t even halfway toward reaching.

Under current law, the state’s goal is to have 2,000 megawatts of installed wind energy by the end of next year. But, according to industry officials, so far the state has only 676 megawatts of operating wind turbines with another 150 megawatts under construction.

The bill, as amended, still adds new criteria to the state’s wind energy goals including one that says new grid-scale wind power projects in Maine need to show how they will reduce the price of electricity for Maine ratepayers, create jobs and bolster the state’s manufacturing industries prior to approval for construction by the state’s Department of Environmental Protection.

http://www.brama.com/survey/messages/12817.html

Posted by RomanG on July 02, 2001 at 16:52:34:

In Reply to: Any Ukrainian Producers for Wind Energy posted by Orest on July 02, 2001 at 13:17:47:

http://www.environmental-expert.com/magazine/ukraine/vol5/

HOME - Business Center - Publications - Aticles - News - Magazines - Upcoming Events

Job Search - Training - Software House - Technology Providers - Tools - Directory

View more issues Vol. 5 December, 1999

Constructive Ecology

& Business Journal

--------------------------------------------------------------------------------

--------------------------------------------------------------------------------

Wind power to serve Ukrainian power economy

Dr. Lev Dul'nev, Windenergo Ltd

It is well-known that Ukraine is currently facing a most acute energy crisis which makes the country heavily dependent on supplies of energy from Russia etc. The interest of the Government and the industrialists to alternative energy is therefore quite understandable. Wind power is in the focus now because wide areas near the Azov Sea, the Black Sea and the Carpathians have vast resources of that. No domestically made windmills of sufficient reliability were available to Ukraine, and the ambitious projects to develop, for example, 1,000 kW units failed both here and in Russia. The task turned out to be unexpectedly challenging while the funding was progressively cut since the collapse of the USSR. The idea to combine Western technologies and Ukrainian military industrial capacities eventually lead to setting up Windenergo Ltd., a joint venture between KENETEC Windpower Inc. of the US and Yuzhnyi Engineering Plant (YuMZ) in Dnepropetrovsk, Ukraine. Windenergo received from KENETEC a license, and capacities for making 400 USW 56-100 windmills - a total of 50 MW - annually are now in preparation at YuMZ.

The making of the initial wind turbines necessitated a revision of some deep-ingrained views. During the long years of failures to develop domestic turbines, many became skeptic about their usefulness. The new technology, however, includes an on-board computer system and connections to a power pool that is controlled similarly to any state-of-the-art power plant.

Initially, the US party constructed a pilot wind farm of 3 mills commissioned near Donuzlav Bay in the Crimea in May 1993. The farm was a tremendous success, and the turbines have displayed high reliability and efficiency. By now, 64 similar domestically made units have been added to the pool. The final capacity of Donuzlav Wind Farm is planned at 500 MW. The wind electric power cost here is 2.38 to 2.90 cents/kWh compared to 5 cents in the US and to 4 cents at steam power plants that burn gas and fuel oil in Ukraine.

The machines themselves used to be 1.5 to 2 times less expensive than their Western counterparts and until recently seemed to be highly competitive at the markets of NIS, like Russia and Kazakhstan. Yet gradually it turned out that the prices could not be contained, because the mastodon plants could not get enough military orders to keep them afloat. This lead to ever increasing overheads that burdened the wind power project. The only way out is to divide these enterprises to smaller units more capable of finding their own market niches. It is has been proved that restructuring will to a certain degree make the progress of the wind power project more stable.

The Cabinet of Ministers adopted a decision that the fledgling industry be funded by allocation of 0.75 % of the national utility proceeds for these purposes, an equivalent of about USD 26,000,000 per annum. This enabled transition to full-scale production and resulted in commissioning of 6 wind farms having a total of 98 units. Another 57 USW 56-100 windmills are now being assembled at YuMZ. The production facilities thus created will not only yield more machines of this type but also step up to a new generation of units having capacities of 400-600 kW.

The rise in wind power generation means a breakthrough to alternative energy and will help Ukraine cover part of the losses expected from the prospective shut-down of Chernobyl Nuclear Plant and raise international funding for global-scale energy projects involving this country.

The collaboration with KENETEC Windpower is a fine example of technology transfer in the context of economic reform in Ukraine. The US party invested USD 7,000,000, and the Ukrainian Government acts as another major investor. This offers good prospects for large-scale production of competitive windmills and for joint penetration to Ukrainian and other national markets.

With temperatures in the mid 60's today and expected

To fall to about 20 degrees tomorrow, I expect my porch to be full once again of those tightly compacted cellulose products, capable of throwing off enough BTU's to make my home warm enough to walk around in my undergarments. Hope all is well in DB land with John, Gomp, Cheyenne, tex, sagebrush, LL, Josie and more. Keep warm and enjoy the longer days. Won't be long now as the first flocks of robins passed this way a couple of weeks ago.

http://www.bloomberg.com/news/2011-04-03/china-buries-obama-sputnik-aim-for-clean-power-as-kissinger-advises-bank.html

China is beating the U.S. in the race to supply clean-energy technologies to the world, helped by a government bank whose advisers include Henry Kissinger.

China Development Bank Corp., which listed the former U.S. secretary of state as an advisory board member in a 2010 bond prospectus, agreed last year to lend 232 billion yuan ($35.4 billion) to Chinese wind and solar power companies. The U.S. gave about $4 billion to their American competitors in grants and offered about $16 billion of loan guarantees. Adding in private investment, China also led.

CDB, which has almost twice the assets of the World Bank, is matching U.S. expertise with Chinese financing and manufacturing prowess to dominate a market both nations say is critical to their future. Chinese solar-panel makers such as LDK Solar Co. Ltd. were the biggest loan recipients and for the first time last year supplied more than half the global market, according to Bloomberg New Energy Finance, which begins its annual conference today in New York.

“What China’s doing is really smart,” said Jon Anda, vice chairman of UBS AG’s securities unit in Stamford, Connecticut, who runs the Swiss bank’s environmental markets business. “Without a clear policy path, we’ll get crushed.”

http://www.nawindpower.com/e107_plugins/content/content.php?content.12735

During these past few weeks, there has been an ever-changing debate in Maine among the governor's administration, legislators, and renewable energy advocates over whether to do away with or add to language in the state's Wind Energy Act of 2008. L.D.1791, a bill proposed on behalf of Republican Gov. Paul LePage, could dictate the future of project development in the state.

When first introduced, the bill aimed to eliminate megawatt targets of the 2008 law and replace them with non-binding goals to increase economic benefits, especially manufacturing jobs, and to lower electricity prices for ratepayers. The megawatt goals include 2,000 MW by 2015 and 3,000 MW by 2020, and the governor’s administration has argued that they are far fetched and serve little purpose.

Patrick Woodcock, director of the Maine Governor’s Energy Office, says the megawatt goals were “perhaps a bit ambitious at the time of the 2008 law.” In fact, Maine currently only has about 450 MW of wind online and another 200 MW or so approved - a total much lower than the law’s 2 GW by 2015 goal.

Nonetheless, local wind energy advocates and stakeholders maintain that the megawatt targets help encourage investment and show that Maine is serious about wind development.

Jeremy Payne, executive director of the Maine Renewable Energy Association, says the law has created certainty for applicants. Although he admits that the state is unlikely to achieve the 2015 target, he notes, “The goals are just that: goals.”

In Maine, Massachusetts-based Patriot Renewables has two operating wind farms, one under construction and a few in stages of early development. Todd Presson, the developer’s chief operating officer, says the targets helped attract Patriot to the state…

--------------------

Good job Governor LePage. I've mention Patriot Renewables here a few times and there is much more to come.

http://www.reuters.com/article/2014/03/27/us-pipeline-irvings-special-report-idUSBREA2Q10A20140327

http://business.financialpost.com/2013/08/01/saint-john-transcanada-pipeline-energy-east/?__lsa=a048-4762

http://wattsupwiththat.com/2014/04/01/simulation-in-the-journal-of-renewable-and-sustainable-energy-provides-new-insight-into-best-arrangement-of-wind-turbines-on-large-installations/

-------------

One of the main problems with wind is turbulence Intensity (TI). This measurement had been used in wind studies for years and I cannot believe that these idiots have never considered it (I know they do what they do for money), and were dishonest enough to omit that very important aspect.

Factors that contribute to this (TI) would be areal terrain and other obstructions. For those who need to visualize this. You car is most efficient driving on nice paved, level ground. Then try this driving down railroad tracks. It will increase the fuel you use substantially (efficiency), AND more importantly, beat the hell out of you car.

That is what happens. I’ve measured it.

For you sports fans out there, Here is a gem I will never forget… This is when I was in the wind business.

http://www.youtube.com/watch?v=vJlCdIOWkYM

Now that is some golf!

The developer says its effort to raise money for power projects is unrelated to a court ruling setting aside its joint venture with Emera.

http://www.onlinesentinel.com/news/With_partnership_in_limbo__First_Wind_seeks_to_borrow__75_million_.html

Boston-based First Wind, Maine’s largest wind-power developer, is trying to raise $75 million to build projects this spring, a month after a court ruling struck down its critical financial partnership with a Canadian energy company.

At stake is progress on a $400 million wind farm that First Wind began last fall in the Aroostook County town of Oakfield, and money to advance projects in Bingham and remote sites in Hancock and Washington counties. Taken together, the ventures could represent an investment of more than $1 billion.

The company also needs cash for its first solar-electric project, which is under construction in Massachusetts.

First Wind was in better financial shape until last month, thanks to a $333 million joint venture with Halifax, Nova Scotia-based Emera Inc., the parent company of utilities in Bangor and Presque Isle. The legality of the partnership was left in doubt when the Maine Supreme Judicial Court ruled that the Maine Public Utilities Commission wrongly approved the deal in 2012.

The justices found that the approval violated the intent of Maine’s restructuring law to uncouple electricity generation and transmission. They sent the matter back for further review by the PUC. Parties in the case have been meeting to decide how to comply with the court ruling.

http://www.themainewire.com/2014/04/eyes-wind-puc-affair/

By Chris O’Neil - A few years ago First Wind had a brilliant scheme: form a joint venture with Nova Scotia utility giant Emera, then blitz Maine with an astonishingly aggressive wind power buildout.

This was actually Plan B, after an embarrassing failed attempt to go public in 2010.

In 2012 they got hitched with Emera even though Maine’s Supreme Judicial Court was still deciding whether the JV was legal. The Maine Public Utilities Commission (PUC) had to impose 50 conditions to the law so that the JV could proceed. Clearly motivating that special PUC treatment was a public desire to see First Wind succeed in its apparently benign pursuit of a cleaner planet.

Now, almost two years later First Wind has a problem.

The Court decided. It voided the deal because Maine law clearly says that utilities cannot own, control, or have interest in generation assets. Whether that law makes sense is a subject for another column, but its present effect is to send Maine’s biggest turbine installer into a tailspin. Anyone concerned about the economy and the environment should be paying close attention.

How First Wind Dug its Hole

With no more money from the Emera spigot, now First Wind is scampering in the Street like a drunkard desperately seeking a drink. The Boston developer, brainchild of former ENRON alumni Steve Vavrik, Paul Gaynor, and Michael Alvarez, this week announced that they have gotten consent from existing creditors to raise $75 million in junk bond financing from institutional high rollers (who might want to show a loss for the tax year). If they can raise it, that money is a fraction of what they need to stay afloat, but it restores a pulse for a few weeks or months.

Watching the Clock

First Wind’s relentless assault on Maine is driven by a loudly ticking clock. The hundreds of millions in tax giveaways they have received are growing unsustainable. Renewable Energy Credit values, and the popularity of state mandates that enable them, are both falling. The deficient gas infrastructure will be fixed. And big hydro is going to punch over the border from Newfoundland and Quebec, fulfilling state renewable mandates with high-quality electricity that can even perform base load and peak load functions. When all that happens, wind power goes the way of the pet rock. So they need to erect and contract now, but they can’t do it without money.

If the JV with Emera is killed — or even substantially stalled – First Wind’s days could be numbered. While we don’t like seeing any business fail, we will all be better off. As First Wind lobbies for continued sympathy and special treatment, let us remember that they deserve neither. The Emperor has no clothes. We hope our PUC sees it that way this time around.

http://www.onlinesentinel.com/news/Maine_DEP_asks_First_Wind_to_prove_financial_capacity_.html

The DEP’s request affects four wind-energy projects: Oakfield Wind in Aroostook County, Hancock Wind in Hancock County, Bingham Wind in Somerset County, and Bowers Wind in Penobscot and Washington counties. Taken together, the projects could cost about $1 billion to build.

“The Law Court’s decision on First Wind and Emera’s relationship throws into question the validity of financial capacity documents relating to four wind projects,” Jessie Logan, a DEP spokeswoman, told the Portland Press Herald on Tuesday. “The department is committed to working aggressively with First Wind to ensure all license conditions are met.”

The DEP is scheduled to release a statement Wednesday about its request to First Wind, she said.

The department is asking First Wind for the information because applicants for wind-energy projects must show that they have enough money for construction and maintenance, and for restoring sites after wind farms go off line. The proof can be in the form of a performance bond, a surety bond, a letter of credit or other financial assurance acceptable to the DEP.

Late last month, First Wind announced that it was seeking to raise $75 million through a bond offering to institutional investors. The company’s spokesman, John Lamontagne, said Tuesday that the deal has closed and the company received the money last week.

--------------------------

Watch out for the REPO 105 accounting trick...

http://blogs.wsj.com/marketbeat/2010/03/15/lehmans-repo-105-more-than-you-ever-wanted-to-know/

http://hotair.com/archives/2014/05/07/this-is-why-wind-energy-can-neither-have-nor-produce-nice-things/

That is a link to a stunning co-relationship between the timing of specific subsidies to the wind turbine industry and the start/stop timing of wind turbine projects based on those subsidies.

When subsidies were going to stop on Dec 31 2012, 1,600 megawatts of wind turbines were “constructed” in that last three months before the subsidies were due to end. But, only days later when subsidies were NOT allowed, only 1.6 MegWatts were built in the 3 months after the subsidies stopped. 1/1000 as many! (And those probably because they were late, NOT because the companies wanted to build them in January-February-March in the Great Plains.)

Then, when liberal democrats resumed subsidies with a different rule, suddenly 1,600 Megawatts of wind turbines were suddenly resumed!

The wind lobby has yet to give up on their quest to renew the egregiously generous production tax credit that essentially keeps the wind industry afloat by providing 2.3 cents for every kilowatt-hour of energy output during the first ten years of a given project’s operation; that lucrative subsidy expired on January 1st of this year, but it wouldn’t be the first time — or the second, or the third – that Congress has belatedly bestowed a retroactive extension. Most recently, the wind industry was awarded a one-year extension of the credit at the start of 2013, with the new and convenient condition that any project that simply began construction in 2013 would receive the full benefits of the credit (whereas in the past, installations had to be completed) — and for a demonstration of just how precious that credit really is, here are a couple of handy visuals via The Atlantic:

According to the AWEA, a Washington, D.C.-based trade group, wind turbine installations hit a record 8,385 megawatts in the fourth quarter of 2012 only to crash in the first quarter of 2013 to 1.6 megawatts—and, yes, the decimal place is in the right place. In other words, thousands of wind turbines went online at the end of 2012 to power about 2.1 million American homes. Three months later, about one more turbine had been installed, generating just enough juice to supply about 405 homes.

The downdraft continued in the first quarter of this year, according to the AWEA, when 133 turbines producing 433 megawatts went online. …

Read: Installations skyrocketed in 2012 before dropping off like crazy when the credit expired, and then when the credit was renewed with the new and more flexible condition that projects only needed to have begun construction before it expired at the end of 2013, a bunch of projects got in just under the wire. Could the wind industry’s utter dependence on government taxpayer “help” (which actually discourages the price efficiency that could make wind viable in the long run) be any more apparent?

But rather than heeding my umpteenth rant on the mind-boggling perversity of supporting a technology that so clearly cannot survive in the free market based on its own competitive merits, let’s mix it up and look to — oh, I don’t know — how about billionaire Warren Buffet, noted supporter of hiking taxes on the wealthy, in Omaha this past weekend? Via the editors of the WSJ:

So it was fascinating to hear Mr. Buffett explain that his real tax rule is to pay as little as possible, both personally and at the corporate level. “I will not pay a dime more of individual taxes than I owe, and I won’t pay a dime more of corporate taxes than we owe. And that’s very simple,” Mr. Buffett told Fortune magazine in an interview last week.

The billionaire was even more explicit about his goal of reducing his company’s tax payments. “I will do anything that is basically covered by the law to reduce Berkshire’s tax rate,” he said. “For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

Think about that one. Mr. Buffett says it makes no economic sense to build wind farms without a tax credit, which he gladly uses to reduce his company’s tax payments to the Treasury. So political favors for the wind industry induce a leading U.S. company to misallocate its scarce investment dollars for an uneconomic purpose. Berkshire and its billionaire shareholder get a tax break and the feds get less revenue, which must be made up by raising tax rates on millions of other Americans who are much less well-heeled than Mr. Buffett.

Just take a moment and let that really wash over you, and then take a gander at the still other subsidy-goodies the Obama administration is doling out to its politically preferred pet projects. …Just today. Via The Hill:

The Department of Energy (DOE) Wednesday said it will give up to $47 million each to three offshore wind power projects over the next four years to pioneer “innovative” technology.

The planned projects are off the costs of New Jersey, Oregon and Virginia. DOE said the money will help speed the deployment of efficient wind power technologies as part of the government’s effort to expand the use of wind power.

http://www.reformer.com/news/ci_25803172/electricity-supplier-won-rsquo-t-buy-vermont-renewable

MONTPELIER -- One of the nation's top renewable power suppliers said it will no longer trade Vermont's renewable energy credits, which are also counted toward the state's clean electricity goals.

NextEra Energy announced last week that it will no longer take double-counted power in a letter to New England renewable energy credit brokers. The $15 billion North American company purchases and sells renewable energy credits (RECs).

"It is a fundamental principle of all renewable energy market sales that the environmental characteristics associated with the electric energy generated cannot be counted or claimed twice," NextEra Energy officials wrote.

Renewable power producers can sell RECs to other companies to meet state renewable energy standards. Vermont utilities often sell credits for renewable power generated in the state to out-of-state power suppliers. Under Vermont's clean energy development incentive program, this renewable power also counts toward the state's clean energy target.

On Jan. 1, Connecticut banned the purchase of Vermont credits that are also used to meet the state's renewable energy target. As a result, NextEra, which provides electricity in Connecticut, will no longer trade Vermont RECs in Connecticut.

Critics of Vermont's program say the state is claiming renewable energy credits that are sold to other states.

"The Connecticut Legislature did this because they knew that Vermont was trying to create the perception of being green without paying the full price of being green," said Kevin Jones, deputy director of the Institute for Energy and the Environment at Vermont Law School.

He said Vermont is selling its renewable energy to other states while importing fossil fuel-generated electricity. By claiming those credits to meet Vermont's renewable energy targets, Jones said, companies could be liable to pay penalties for purchasing fraudulent credits.