Why Wind Power Won't Work

Wind Wake Turbulence

---

Scroll down for more photos

Guest post from 'Earth, Wind and Fire John'

The photo demonstrates turbine wake turbulence in large wind farm arrays and why the potential for wind energy is substantially overestimated by most sources. The first turbine to catch the wind will produce appreciable energy, while turbines in its wake, down wind of that unit, produce exponentially less energy due to air turbulence. The low level fog, known as sea smoke, clearly shows this and is one of the best photographs ever taken that demonstrates this effect.

The first 4 articles below pertain to how Independent System Operators (ISOs) and Independent System Administrators (ISAs) attempt to incorporate intermittent electrical sources onto the grid. Pacificorp was purchased by Warren Buffet and several stories are included regarding Buffett's energy ventures. I have also included a document from an ISO which defines Spinning and Non-Spinning Reserve, and a good piece from the LA Times explaining how renewable energy cannot reduce carbon or other emissions, and actually makes them worse.

Energy Imbalance Markets will raise prices in the West

Some western energy markets are currently challenged by the increased development of variable renewable energy resources (i.e., wind and solar that vary depending on the availability of the resource and therefore must be integrated onto the electric grid whenever they are available, day or night) promoted through federal tax incentives and renewable portfolio standards in some states. Many of these resources are under development even though the economic recession has reduced the need for electric generation in many areas in the West.

While there are several efforts underway in the West to address integration of these variable resources at reasonable and affordable cost to consumers, creation of an “energy imbalance market” (EIM) is being touted by wind developers and the U.S. Department of Energy (DOE) as the only way to handle renewable energy integration, and is being fast-tracked by DOE through its oversight of the federal Power Marketing Administrations (PMAs) that own significant transmission and generation assets in the West (see APPA issue brief on March 16, 2012, memo from DOE Secretary Chu on his priorities for the PMAs).

As proposed, such an EIM would be a sub-hourly, real-time, centrally dispatched energy market intended to improve the integration of increasing levels of variable generation from renewable resources. The theoretical benefit of an EIM is that the larger array of generation available for dispatch would provide a greater balance of intermittent resources and reduce the need for backup power. For example, if the wind or sunlight is low in one region of the EIM it might be greater in another area, thus reducing the total variability. But this benefit can only be fully achieved if there is adequate transmission capacity from the sources of generation to the demand for power.

California ISO and Pacificorp enter MOU on Energy Imbalance Markets

On February 12, 2013, the California Independent System Operator Corporation (CAISO) and neighboring utility, PacifiCorp, entered a Memorandum of Understanding to cooperate on the development of an energy imbalance market (EIM) in each entity’s respective balancing authority areas, in the hopes of laying groundwork for a broader effort across the western region. Hailed by the CAISO as the “first step in bringing PacifiCorp and ultimately other Western balancing authorities into an automated real-time [five]-minute dispatch system” the CAISO and PacifiCorp agreed in the MOU to work towards implementing the EIM by October 2014.

In statements issued with the release of the MOU, the parties noted their hope that the EIM will integrate resources efficiently and reliably, including, in particular, the significant renewable resources that have come online in the West in recent years.

Spinning and non-spinning reserve (California ISO)

Spinning Reserve is the on-line reserve capacity that is synchronized to the grid system and ready to meet electric demand within 10 minutes of a dispatch instruction by the ISO. Spinning Reserve is needed to maintain system frequency stability during emergency operating conditions and unforeseen load swings.

Non-Spinning Reserve is off-line generation capacity that can be ramped to capacity and synchronized to the grid within 10 minutes of a dispatch instruction by the ISO, and that is capable of maintaining that output for at least two hours. Non-Spinning Reserve is needed to maintain system frequency stability during emergency conditions.

Rise in renewable energy will require use of more fossil fuels - LA Times

The Delta Energy Center, a power plant about an hour outside San Francisco, was roaring at nearly full bore one day last month, its four gas and steam turbines churning out 880 megawatts of electricity to the California grid. On the horizon, across an industrial shipping channel on the Sacramento-San Joaquin River Delta, scores of wind turbines stood dead still. The air was too calm to turn their blades — or many others across the state that day. Wind provided just 33 megawatts of power statewide in the midafternoon, less than 1% of the potential from wind farms capable of producing 4,000 megawatts of electricity.

One of the hidden costs of solar and wind power — and a problem the state is not yet prepared to meet — is that wind and solar energy must be backed up by other sources, typically gas-fired generators. As more solar and wind energy generators come online, fulfilling a legal mandate to produce one-third of California's electricity by 2020, the demand will rise for more backup power from fossil fuel plants.

"The public hears solar is free, wind is free," said Mitchell Weinberg, director of strategic development for Calpine Corp., which owns Delta Energy Center. "But it is a lot more complicated than that." Wind and solar energy are called intermittent sources, because the power they produce can suddenly disappear when a cloud bank moves across the Mojave Desert or wind stops blowing through the Tehachapi Mountains. In just half an hour, a thousand megawatts of electricity — the output of a nuclear reactor — can disappear and threaten stability of the grid.

Buffett buys Pacificorp for $5.1 billion in cash - Background

Striking the second biggest deal of his career and making a major move in the energy industry, billionaire investor Warren Buffett agreed Tuesday to pay $5.1 billion in cash to acquire Western states electric utility PacifiCorp.

Buffett's MidAmerican starts wind projects before credits end

MidAmerican Energy Holdings Co., the power provider owned by Warren Buffett’s Berkshire Hathaway, completed 300 megawatts of wind farms in California ahead of the expiration of a tax credit at the end of this year.

MidAmerican Renewables LLC completed the 168-megawatt Pinyon Pines Wind I and the 132-megawatt Pinyon Pines Wind II projects near Tehachapi, the Des Moines-based company said today in a statement. The 100 Vestas Wind Systems 3-megawatt turbines will supply Southern California Edison with electricity under long-term contracts.

Western Wind acquires 4000 mw wind project pipeline

Western Wind Energy Corp. is pleased to announce it has executed a Term Sheet with Champlin/GEI Wind Holdings ("CGEI Wind") to acquire the rights and title to a 4,000 MW wind energy development pipeline, with near term projects in Hawaii and Utah. Additional large projects are in California and throughout the US in niche markets with strong Renewable Portfolio Standards and Power Purchase Agreement pricing.

Cost of the acquisition is $20 Million US, payable by the issuance of 8 Million common shares at a deemed value of $2.50 per share US. The term sheet will be subject to completion of due diligence, formal documentation, board approvals and approval of the TSX and the applicable securities regulatory agencies including applicable escrow provisions.

Brookfield renewable gains control of Western Wind

We are referring to one of the more unusual events in recent Canadian corporate history: the bid by Brookfield Renewable Energy Partners to acquire Western Wind for $2.60 a share. At the close of business Thursday Brookfield Renewable announced that it had acquired 59.7% of the shares held by the independent shareholders. Adding in the stake held by Brookfield – a stake it purchased last year – Brookfield said that it now has a 66.1% stake in Western Wind.

Apex buys right to wind energy project

Property intended for a wind farm south of the Hoopeston area has again changed hands. Development of the Hoopeston Wind farm has been ongoing since 2008. The most recent coordinator, GDF SUEZ Energy North America Inc in Houston, Texas, took over in 2011 when it purchased the previous wind farm developer, International Power.

Apex Wind Energy, Inc. is an independent renewable energy company based in Charlottesville, Va. Since its founding in 2009, Apex has completed 10 acquisitions and has project sites in 20 states, including Illinois, Indiana and Wisconsin.

Related:

Maersk Line and Apex partnership

Jim Trousdale relationship map

BP to buy back $8bn in stock after Russian sale

Offshore wind resource substantially overestimated

Estimates of the global wind power resource over land range from 56 to 400 TW. Most estimates have implicitly assumed that extraction of wind energy does not alter large-scale winds enough to significantly limit wind power production. Estimates that ignore the effect of wind turbine drag on local winds have assumed that wind power production of 2–4 W m−2 can be sustained over large areas.

New results from a mesoscale model suggest that wind power production is limited to about 1 W m−2 at wind farm scales larger than about 100 km2. We find that the mesoscale model results are quantitatively consistent with results from global models that simulated the climate response to much larger wind power capacities. Wind resource estimates that ignore the effect of wind turbines in slowing large-scale winds may therefore substantially overestimate the wind power resource.

These images are worth the click.

3-D images of wind turbine wake turbulence (very cool)

Senators back breaks for offshore wind

U.S. Sen. Susan Collins of Maine is co-sponsoring a bill to boost offshore wind energy generation, which is being aggressively pursued in the state. Collins, a Republican, joins Democratic Sen. Tom Carper of Delaware in introducing the Incentivizing Offshore Wind Power Act. A House version of the bill is also being introduced.

The proposals provide financial incentives for investment in offshore wind energy. They seek to extend investment tax credits for the first 3,000 megawatts of offshore wind facilities placed into service, or about 600 wind turbines. The sponsors say the tax credits are vital for wind energy technology because of the longer lead time for the permitting and construction of offshore wind turbines, compared to onshore wind energy.

Biden caught with hand in cookie jar (Must Read)

BrightSource Is “Sustained By An Impressive Array” Of Subsidies

Brightsource Is “Sustained By An Impressive Array Of Federal, State And Local Subsidies, Including A $1.6 Billion Loan Guarantee From The Department Of Energy.”“Fortunately for BrightSource, its efforts are sustained by an impressive array of federal, state and local subsidies, including a $1.6 billion loan guarantee from the Department of Energy, one of the largest solar guarantees on record. The company notes federal provisions providing solar projects with a 30% investment tax credit through 2016, as well as accelerated depreciations of capital costs for solar entities, among other goodies.” (Editorial, “Secretary Of Subsidy,” The Wall Street Journal, 6/2/11)

Sany Electric completes first wind farm in Texas

News of the self-funded project first emerged in December 2010. Sany has a development pipeline in the Texas Panhandle—in the north of the state--and in Central America. But it has no firm plans as yet to build a second US wind project, according to project development advisor Stacy Rowles.

Fellow Chinese manufacturers Goldwind and Guodian have recently built or are developing US projects in an to forge a track record in the country's market. In March, Guodian United Power signed a deal to supply six 1.5MW turbines to a small ‘distributed power’ project in Corpus Christi in south Texas. Last year, Goldwind completed a 4.5MW pilot project in Pipestone, Minnesota - its first US project.

Congressional oversight needed for wind rulemaking

After 20 years and many extensions, the federal Production Tax Credit (PTC) was scheduled to expire at the end of 2012. Neither the House nor the Senate saw fit to extend this overly generous corporate benefit when it was considered on its own merits, and the PTC did, in fact, expire.

But in the final hours of the fiscal cliff negotiations, a provision in the American Taxpayer Relief Act surreptitiously added a $12 billion, 1-year extension of the PTC. This move was done behind closed doors, without debate, any opportunity for amendment, or obligation of the Congress to find a way to pay for it.

The abuse of the Public Trust did not end there. With this extension, a critical change to the PTC was introduced that relaxed the eligibility requirements for the credit. Renewable energy projects now need only ‘commence construction’ by January 1, 2014, to qualify for the credit, instead of the projects being ‘placed-in-service’ by that date.

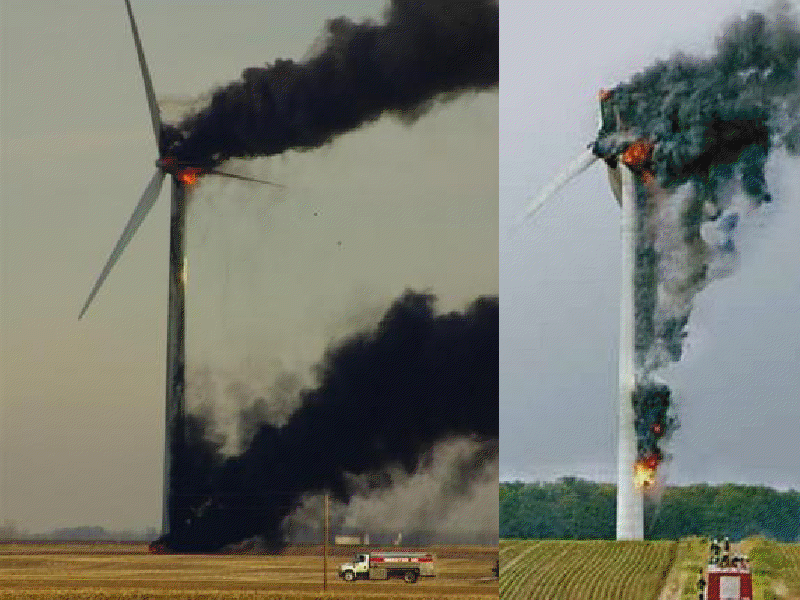

Wind Turbine Fires

Forest fires and wind turbines; the danger no one talks about

Despite all that has been written about wind power, a vitally important issue has barely been mentioned. When turbines fail, blades may fall to the ground or send fragments that land up to a mile away. Turbines often catch fire, and when they do they often send flaming shards into fields and forests.

In California, one such fire burned 68 acres, another 220 acres, and in Palm Springs several “spot fires” had been generated in surrounding areas. In Hawaii, 95 acres were burned. Australia lost 80,000 acres of forests located mostly in a national park. Spain lost nearly 200 acres from one fire. A comment on a German fire mentioned that “burning debris” from a turbine had traveled several hundred meters from the site. In Holland, three burning blades from a mere 270-foot tower cast a 50-foot flaming shard 220 feet from the site.

The most dramatic report emanated from Wales where “great balls of fire” landed more than 150 yards away, causing a hillside to burn. Fearing more forest fires, an Australian province enacted a law banning placements of wind towers near wooded areas. Yet, in heavily forested Maine, all of our wind power sites have been approved without even considering that turbines have often caused forest fires.

That 220-acre California fire had been contained by 45 firefighters, two helicopters and two bulldozers. The 69-acre fire was contained with the help of 15 fire engines, four hand crews and four planes. A 5-acre California fire was extinguished by six fire engines, three water trucks, two helicopters, two tanker planes, a bulldozer and three hand crews.

Here are some photos of wind turbine fires and failures.

Wind turbine fires and failures - Must See Photos

The coming US carbon tax via the US Treasury (Must Read)

I sought emails and other documents from two offices: Environment and Energy (really), and Legislative Affairs. This action after the administration first ignored us, which they followed with an unfortunate stumble, trying to delay us with fees — even absurd and surely anti-’green’ ones, like $1,800 to photocopy electronic mail, typically copied on a disc for no charge — which fees, even when they’re not mindlessly trumped up like that one, not-for-profit groups which disseminate government information are exempt by statute from paying.

Delay can only work only so well once we file suit, and recently Treasury turned over a first production of approximately 770 pages of reports. Despite its better efforts Treasury managed to hand over some docs that in an attentive world should prove extremely useful, offering fantastic language if often buried in pointy-headed advice they received in Power Points and papers from the IMF, G-20 and, in graphic terms, an analysis from the World Bank on how to bring a carbon tax about.

These documents represent thoughtful advice on how to mug the American taxpayer and coerce them out of unacceptable and anti-social behavior, diverting at least 10% of the spoils to overseas wealth transfers. The major focus is language, how to sell it to the poor saps not by noting the cost or that it is a tax but as, for example, the way to be the leader in something like solar technology.

***

Read last week's story:

The Mafia Is Moving Into Green Energy

Note to readers

I have very serious reservations regarding financial and transparency issues surrounding the renewable industry. These issues need to be addressed fully before permits are issued, offshore tracts are auctioned, and projects on federal/state lands, or any other project using taxpayer assistance (financial incentives, grants, etc) are given. We must have full public disclosure of true ownership of developers and their partners and affiliates, with a particular focus on government agencies and employees.

john

May 3, 2013 at 1:47 PM

May 3, 2013 at 1:47 PM

Reader Comments (121)

Is Excelon the T&D provider (wires company) or do they own generation and sell electricity in the State you live in?

Is you domestic hot water electric or oil? Sometimes the element starts to, or goes bad in electric hot water heaters and causes electricity usage to skyrocket. Just a thought but we can skin (pardon the pun) this cat in several different directions and get your bill down.

john

Warren Buffett can do without a tax break for wind energy.

http://www.usnews.com/opinion/blogs/peter-roff/2014/05/20/warren-buffet-doesnt-need-a-wind-energy-tax-break

Does the “Oracle of Omaha” really need another tax break? It’s a fair question, given the way billionaire Warren Buffet made headlines several years ago with his complaints that his secretary paid more in taxes to the federal government than he did.

Of course, that was back when he was campaigning in support of higher taxes on the so-called “wealthiest Americans” in furtherance of the class envy strategy Democrats like himself, President Barack Obama and their allies in Washington have honed to a razor sharp edge. But now he’s got his hand out for corporate tax breaks that improve the bottom line for his Berkshire Hathaway company and the stock price of all the companies he’s invested in.

Buffet is one of many who is pushing for the reintroduction of the federal Wind Production Tax Credit that expired at the end of 2013. Senate Democrats made sure to add it to the “extenders” package of tax break renewals, but that effort just hit the rocks because Senate Majority Leader Harry Reid “filled the tree” and wouldn’t let the Republicans offer any amendments. So the credit remains dead, for the moment at least, but it’s sure to come up again. Without it, nothing about wind energy makes any sense.

[READ: The Rules According to Harry]…

There are very few people in the environmental movement that seem to care about the number of birds and other species of flying animals who are being decapitated in mid-flight by giant turbines spinning in the breeze. They also don’t seem to care that wind, which is already unreliable because it doesn’t blow all the time, is also more costly to generate than electricity produced though already proven means, such as natural gas and nuclear power. What they care about is the way the Wind Production Tax Credit makes wind energy attractive on the bottom line, not because it is profitable but because of the way the profits and losses line up against the tax credits.

As my TJS bloleague Nancy Pfotenhauer recently pointed out, Buffet is big on big wind because it helps reduce the corporate tax liability of some companies. “On wind energy we get a tax credit if we build a lot of wind farms,” the billionaire Democrat recently told a Nebraska audience. “That’s the only reason to build them. They don’t make sense without the tax credit.”

That’s quite an admission. We don’t build wind farms because they reduce America’s reliance on energy being imported from unstable regions of the world or because they produce fewer carbon emissions than natural gas or coal-fired electricity plants. And we don’t build them because it’s good public policy leading to the creation of good jobs in America at good wages. The only reason to build them, Buffet said, is the tax breaks given to folks in the business of producing big wind.

[ READ: Big Wind's Bogus Subsidies]

...The whole business isn’t so much a gamble as it is a proven sucker’s bet for anyone putting up the money – in this case you and I. Wind technology is just not sufficiently developed to allow it to take over anything close to base-load power requirements. Instead of trying to pretend it is, and using very expensive examples to do it, why not put the same resources toward producing gains in efficiency in proven power sources? Or, frankly, just not do anything at all?

America is or will soon be, depending on whose analysis you read, a net energy exporter for the first time in decades. There’s no need anymore for subsidies or special tax breaks for any kind of energy, be it wind, solar, natural gas, coal or oil. Warren Buffet doesn’t need another tax break, which is what a restored Wind Production Tax Credit would be to him. If he believes in big wind, let him spend his money and put his capital at risk without you and I having to back his play through tax credits and subsidies.

http://www.cleveland.com/opinion/index.ssf/2014/05/energy_dept_decision_takes_win.html

There may come a time when it’s a good idea to produce electricity by putting windmills in Lake Erie a few miles northwest of downtown.

But the U.S. government has concluded that time is not now.

Nor may it ever be. At least not in the lifetime of anyone reading this piece.

Using our abundance of fresh water in ways that secure Greater Cleveland’s economic survival should always be at or near the top of the region’s list of priorities. As should exploring ways for a cleaner, greener Cleveland.

But read the next three paragraphs very carefully.

There are 534,899 households in Cuyahoga County. Installing five or six wind turbines seven miles out would generate enough power to light a maximum of 6,100 of those households.

The cost is pegged at about $150 million. In Cleveland dollars, that means overruns would push the final figure past the $200 million mark. That doesn’t include annual maintenance costs of about $5 million.

Because businesses and manufacturers always use between 30 percent and 40 percent of the power produced, the wind turbine pilot project would produce about 0.5 percent of the county’s required electricity.

Given the enormity of the region’s problems, it’s tough to justify that expenditure – even taking the long view.

Nevertheless, windmill supporters haven’t given up the chase. Even as business leaders who know how to read a bottom line have quietly backed away, proponents – led by the Cleveland Foundation – have refused to follow the lead of other Great Lakes cities and scale back their grandiose plans.

So, on May 7, the U.S. Department of Energy did it for them.

In a stinging rebuke, the government rejected Cleveland’s application for a huge pot of federal money essential to help pay for the wildly expensive idea. Instead, the Energy Department awarded up to $47 million each to three projects off the coasts of New Jersey, Oregon and Virginia.

Cleveland received a booby prize of about $3 million for more design work.

When the wind turbine planning turned serious nearly a decade ago, the initial goal was to have them up and spinning by the end of 2011. But the warning signs about this project have been out there for years – signs many of the project's boosters conveniently chose to ignore.

A $1 million feasibility study released five years ago this month and paid for, in part, by local taxpayers, warned that the high capital and operating costs of offshore wind would require significant funding from the Energy Department and philanthropic organizations. Former County Prosecutor Bill Mason, a prominent proponent of the idea at the time, admitted being staggered by the cost estimates.

The study, conducted by Juwi GmbH, a German company that develops wind energy projects, also warned, “In general the ice coverage on Lake Erie has a significant influence on the ability to perform major corrective maintenance. . . . Limited accessibility by service vessels during the ice season reduces turbine availability to produce electricity.”

http://www.torontosun.com/2014/05/31/sun-news-network-documentary-down-wind-exposes-the-wynne-mcguinty-green-energy-disaster

TORONTO - Anyone who has studied the Ontario Liberal government’s failed experiment with wind power knows what a financial and social catastrophe it has been.

How billions of taxpayers’ and hydro customers’ dollars are being wasted, and will continue to be wasted for decades to come, because of former Liberal premier Dalton McGuinty’s naive blunder into wind energy, now fully supported by Premier Kathleen Wynne.

How it has contributed to skyrocketing hydro bills and to the loss of 300,000 manufacturing jobs in Ontario.

A 2011 report by then auditor general Jim McCarter documented how the government rushed into wind energy without any business plan, ignoring even the advice of its own experts that could have substantially reduced costs.

As a result, Ontarians are now locked into 20 years of paying absurdly inflated prices for inefficient and unreliable wind power, which, ironically, still has to be backed up by fossil fuel energy, meaning natural gas.

That means the Liberals’ gas plants scandal, costing taxpayers and hydro ratepayers up to $1.1 billion — according to reports by McCarter and current Auditor General Bonnie Lysyk — is also part of the Liberals’ legacy of wind power waste.

Indeed, while the Liberals were telling us they were replacing coal power with wind and solar energy, they were actually doing it with nuclear power and natural gas…

...A new documentary, Down Wind: How Ontario’s Green Dream Turned into a Nightmare, by Sun News Network’s Rebecca Thompson — airing Wednesday, June 4 at 8 p.m. and 11 p.m. — powerfully and succinctly explains the enormity of the Liberals’ wind power catastrophe.

http://blog.aimnet.org/aim-issueconnect/nu-national-grid-terminate-cape-wind-contracts?utm_source=hs_email&utm_medium=email&utm_content=15484324&_hsenc=p2ANqtz-8oxYWQXGLr_OSP1i2HR56As_qqXtgNN9123xYCU7wrQxOvz5Gn-gADVqf2b66gi27_PaCql6wYa2BIZp_o9ght4A8fig&_hsmi=15484324

“Very bad news for Cape Wind. Very good news for Massachusetts ratepayers.”

That’s how one opponent of the proposed Nantucket Sound wind farm characterized the decisions by Northeast Utilities and National Grid yesterday to terminate their long-term contracts with the offshore wind farm. The two companies cited the fact that Cape Wind missed a December 31 deadline to obtain financing and begin construction, and chose not to put up financial collateral to extend the deadline.

This is one case of buyer’s remorse that will benefit virtually every Massachusetts employer and homeowner who buys electricity – the contracts would have placed ratepayers on the hook to buy Cape Wind power at an average of 25 cents per kilowatt hour over 15 years, more than twice the rate of power generated by on-shore wind facilities.

AIM and its 4,500 member employers, who have long opposed the contracts, strongly endorse the decisions by the two power companies to terminate their Cape Wind deals.

“Northeast Utilities and National Grid deserve tremendous credit for taking actions that will save customers billions of dollars that would otherwise have been spent buying electricity at the highest power price ever negotiated in Massachusetts,” said John Regan, Executive Vice President/Government Affairs at AIM.

“AIM has consistently supported economically beneficial renewable power projects that provide energy to commercial, industrial and residential customers at reasonable rates. The association opposed the Northeast Utilities and National Grid deals with Cape Wind - and challenged one in court – because the staggering costs of the project would have saddled ratepayers for decades to come.

“AIM thanks both Northeast Utilities and National Grid for their leadership in protecting the interest of ratepayers while committing to vibrant clean energy programs. “

------------------------------

MUST READ:

Two Big White House 'Green' Cronies Unite: First Wind scored over $700 million of stimulus funds, now being acquired by SunEdison

http://greencorruption.blogspot.ca/2015/01/two-big-white-house-green-cronies-unite.html?m=1#.VKY9yCvF9uK

Did you catch "big" news in the wind industry this past November? Yep, "SunEdison & TerraForm Power to acquire First Wind For $2.4 Billion!" And, most are predicting that this transaction makes SunEdison "one of the world's largest, if not the largest, renewable energy developers."

TerraForm, on the other hand, a SunEdison Co., is "a global renewable energy company" that is helping "change the way renewable energy is generated, distributed, used and owned."

Meanwhile, founded in 2002, the Boston-based First Wind "is an independent renewable energy company exclusively focused on the development, financing, construction, ownership and operation of utility-scale renewable energy projects in the United States."

Sounds terrific.

Well, until you read the fine print, as reported by James Hall, directly following this wind development: "Sun Edison Buying First Wind Scam."….

Well, until you read the fine print, as reported by James Hall, directly following this wind development: "Sun Edison Buying First Wind Scam."

=============

Maine set to double wind power capacity by 2018 as political challenges mount

https://bangordailynews.com/2015/01/06/business/maine-set-to-double-wind-power-capacity-by-2018-as-political-challenges-mount/

PORTLAND, Maine — After unveiling a report touting the broader economic benefits of wind power projects in Maine, the head of the Maine Renewable Energy Association on Tuesday afternoon headed to a hearing about a 9-megawatt wind project in Orland.

So did the lobbyist for the statewide anti-wind energy development group, Friends of Maine Mountains.

In light of projections that Maine’s wind power capacity will double by 2018 — adding nearly 700 megawatts — the project in Orland is small. But the size of the project doesn’t necessarily correspond to the size of the conflict.

Local battles, however, were not a part of the study released Tuesday, which came out a day before Republican Gov. Paul LePage, a regular critic of wind energy, is sworn in for a second term and before expected fights over energy policy in the Legislature.

Jeremy Payne, executive director of the Maine Renewable Energy Association, said he expects challenges this year — some old and some new.

“We expect to see a dozen or so bills attacking the industry,” Payne said, including changes to the visual impact standards, sitting concerns and the areas of the state designated for expedited permitting. “To use one of the governor’s favorite lines, I think the concern for the industry is that capital goes where it’s welcome and stays where it’s appreciated. I think there’s a very real risk right now of this investment capital we’re talking about not feeling that appreciation.”

After existing wind farms began producing energy, much of that appreciation has come from other parts of New England and the federal government.

Most Maine wind projects sell their power to markets southern New England that pay more for renewable energy produced here. And the federal government has provided tax credits for wind farms, based on their output, to help support development in the relatively young industry. That program lapsed Dec. 31, 2014, but the projects expected to double Maine’s capacity already have cleared that hurdle for qualifying.

========

Stay tuned.

http://rt.com/business/239765-eon-biggest-annual-loss/

Germany’s biggest power supplier, E.ON, saw its worst annual net loss of €3.2 billion in 2014. Profits were wiped out by the company’s transition to renewables, as well as low oil prices and volatile currencies.

“The earnings situation reflects the persistently difficult situation on energy markets in Germany and Europe,” E.ON said in its 2014 Annual Report, published Wednesday.

By comparison in 2013 the company recorded a €2.14 billion profit.

In December, E.ON announced it will split into two companies – one focused on renewables and the other on fossil fuels. The company said in December it expected the spin-off, which required divesting several power generation assets in Europe, would cost the company $4.5 billion and lead to an overall loss in 2014.

http://www.telegraph.co.uk/news/earth/energy/windpower/11595543/Wind-farm-bosses-object-to-rival-turbines-nearby.html

Wind farm bosses have objected to a rival operation built next door in case it steals their wind.

The owners of Westnewton wind farm in Cumbria have objected to rivals building three 360ft tall turbines nearby.

They claim the plans could take the wind out of their sails, hampering electricity output.

Campaigners believe it is the first time wind theft has been cited as a reason not to build a new turbine farm.

http://www.zerohedge.com/news/2015-05-18/more-buffett-hypocrisy-eco-friendly-billionaire-seeks-squash-nevada-rooftop-solar

Billionaire hypocrisy has been in the news of late and it turns out the world’s ultra-rich don’t always practice what they preach. Take George Soros for instance, who publicly states that the wealthy should pay more taxes in order to promote a more stable society via the equitable distribution of wealth but who has for years used a tax loophole that allows him to avoid paying taxes on management fees, a practice that Bloomberg says has magnified his AUM exponentially and may ultimately mean Soros owes more than $6 billion in back taxes.

Then there’s Warren Buffett, the affable Omaha octogenarian whose railroad holdings and close ties with the President make the White House’s position on the Keystone Pipeline seem rather convenient, and who Dan Loeb recently blasted for being a habitual hypocrite on everything from taxes to hedge funds. As a reminder, here’s what Loeb said at the SALT conference earlier this month:

“I love reading Warren Buffett’s letters and I love contrasting his words with his actions. I love how he criticizes hedge funds, yet he had the first hedge fund,” Mr. Loeb said. “He criticizes activists, he was the first activist. He criticizes financial services companies, yet he loves to invest in them. He thinks that we should all pay taxes, yet he avoids them himself.”

Today, we get another example of what appears to be egregious Buffett belief bifurcation, this time in the form of green energy policy because as Bloomberg reports, when it comes to saving the environment, it’s a great idea — unless it eats into profit margins. Here’s more:

Warren Buffett highlights how his Berkshire Hathaway Inc. utilities make massive investments in renewable energy. Meanwhile, in Nevada, the company is fighting a plan that would encourage more residents to use green power.

Berkshire’s NV Energy, the state’s dominant utility, opposes the proposal to increase a cap on the amount of energy that can be generated with solar panels by residents who sell power back to the grid in a practice known as net metering.

While the billionaire’s famed holding company has reaped tax credits from investing in wind farms and solar arrays, net metering is often seen by utilities as a threat. Buffett wants his managers to protect competitive advantages, said Jeff Matthews, an investor and author of books about Berkshire…

In an April presentation to investors, NV Energy laid out its strategy for addressing the growth of home solar. The utility said it would “lobby to hold the subsidized net-metering cap at current 3 percent of peak demand"...

Sellers of rooftop-solar panels are pushing Nevada legislators to raise the cap, and one plan called for the ceiling to be lifted to 10 percent. Nevada State Senator Patricia Farleysaid she is proposing that Nevada’s utility regulator study the issue before lawmakers act.

“Across the country the utility industry is pressuring regulators and elected officials to limit solar energy’s growth, and the same thing is happening in Nevada,” said Gabe Elsner, executive director of the Energy & Policy Institute, a Washington, D.C.-based clean energy think tank. “NV Energy is trying to protect their monopoly by squashing competitors.”

============

Read the Buffett links I have in the main DB story above,

http://www.chadbourne.com/files/upload/Kogan-REITS-Solar-Presentation.pdf

Here is a case where REIT fraud was exposed in the RE sector.

http://www.zerohedge.com/news/2014-11-02/fbi-probe-accounting-fraud-multi-billion-reit

After getting guidance from the Treasury last year (I have to wonder if there were issues with one or more renewable company), and all that stimulus money they have received, a new method was started about a year ago. I am seeing many that have been mentioned here at the DB now scrambling to form Yieldco's.

https://financere.nrel.gov/finance/content/deeper-look-yieldco-structuring

http://www.sec.gov/Archives/edgar/data/1599947/000119312515010671/d827022dex11.htm

http://www.bidnessetc.com/53208-sunedison-inc-under-investigation-over-role-in-acquisitions-by-terraform-po/

http://www.zerohedge.com/news/2015-10-05/bad-news-piles-hedge-fund-hotel-sunedison-first-315mm-margin-call-now-mass-layoffs

http://www.pressherald.com/2015/10/05/former-puc-head-kurt-adams-to-take...

Kurt Adams, a former head of the Maine Public Utilities Commission, is leaving his job as chief development officer at wind developer SunEdison to become chief executive of Summit Utilities, Summit has announced.

The move comes as the CEO and board chairman of Colorado-based Summit, Michael Earnest, is retiring.

Earnest co-founded Colorado Natural Gas Inc., which became part of Summit Utilities Inc. in 1997.

Summit Utilities is the parent company of Summit Natural Gas of Maine, which has been expanding in the state.

Adams, who is currently a member of the Summit board, also will assume responsibility for the day-to-day leadership of Summit Natural Gas of Maine. Mike Tanchuk, who served as executive vice president of Summit Utilities and President of Summit Natural Gas of Maine, recently departed the company.

Adams who chaired the PUC from 2005 to 2008, was previously chief development officer at First Wind, which was acquired last year by a SunEdison subsidiary. First Wind/SunEdison are the largest wind developers in Maine.

=========

Background:

First Wind - The Kurt Adams Story

http://www.windtaskforce.org/profiles/blog/show?id=4401701%3ABlogPost%3A...

Kurt Adams, chief counsel for expedited wind law pusher Gov John Baldacci becomes Baldacci's chair of the Maine Public Utilities Commission (MPUC). During his term there, the MPUC, overruling its own staff approves the Maine Power Reliability Project (aka the CMP upgrade) which mandates that ratepayers fund the $1.4 Billion transmission expansion in Maine. Baldacci administration proponents cite the reason to be a need for reliability due to "aging lines", completely downplaying the sole reason -- providing Adams' and Baldacci's friends in the wind industry with a free shipping system for their product - electrons, and the subsidies and renewable energy credits that go with them. They even alluded to population growth as a reason for more transmission, yet Maine's population was overall stagnant and predicted to be stagnant for 20 years to come, with all the while, appliances becoming more electricity-efficient. And then, after taking over $1 million in stock options from First Wind, Adams jumps from his PUC Chairman post to become Director of Transmission for First Wind.

Most of this is at the links below. This terribly important story was never carried in the Portland Press Herald or Maine Sunday Telegram, so most Mainers are still in the dark about this.

Maine Center for Public Interest Reporting - Select Articles in Chronological Order

PUC chairman took equity stake in wind company By: NAOMI SCHALIT, ©MAINE CENTER FOR PUBLIC INTEREST REPORTING | May 6, 2010 Group asks AG to probe official of First Wind By: NAOMI SCHALIT | July 18, 2010 First Wind SEC filing change questioned By: NAOMI SCHALIT | July 18, 2010 Adams Investigation Finds No Conflict By: NAOMI SCHALIT | July 18, 2010

This also extends to former Maine Governor Angus S King (Now Senator who's son just so happens to be a VP of acquisitions at Fisrt Wind (Now Sun Edison)...

http://www.themainewire.com/2012/03/developing-king-wind-project-cited-c...

http://www.businesswire.com/news/home/20151216006472/en/SHAREHOLDER-ALER...

LOS ANGELES--(BUSINESS WIRE)--Lundin Law PC announces it is investigating claims against SunEdison, Inc. (“SunEdison” or the “Company”) (NYSE: SUNE) concerning possible violations of federal securities laws. The investigation is related to allegations that certain statements issued by SunEdison were false and misleading and/or failed to disclose material information regarding the Company’s financial performance.

To participate in this class action lawsuit, please contact Brian Lundin, Esquire, of Lundin Law PC, at 888-713-1033, or via email atbrian@lundinlawpc.com.

No class has been certified in the above action. Until a class is certified, you are not considered represented by an attorney. You may also choose to do nothing and be an absent class member.

The investigation will focus on whether the Company made misleading statements and/or failed to disclose that it did not have the financial resources to keep acquiring companies. In addition, the Company announced that it was laying off 15% of its workforce on October 5, 2015.

Lundin Law PC was created by Brian Lundin, a securities litigator based in Los Angeles.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Lundin Law PC

Brian Lundin, Esq.

Telephone: 888-713-1033

Facsimile: 888-713-1125

brian@lundinlaw.com

Energy Jobs: SunEdison Boardroom Bloodletting Begins, Plus More CEO Moves

Executive and boardroom moves in cleantech, utilities, energy and VC

by Eric Wesoff

January 26, 2016

0

When SunEdison went through difficult layoffs in October 2015, hundreds were let go -- but the folks in the C-suite were mostly left unscathed. As GTM's Stephen Lacey reported, "The cuts have reached all the way to the VP level, but not the executive level. Sources within the company expressed worry and surprise that the cuts didn't impact the architects of the Vivint acquisition."

The other shoe has started to drop.

According to Julien Dumoulin-Smith at UBS, Steve Tesoriere, "an activist investor [who] played a key role in developing SunEdison’s YieldCo strategy," has resigned from the solar and wind developer's board. Tesoriere's Altai Capital Management owns approximately 2.3 percent of SunEdison, according to a proxy filing. UBS notes, "Tesoriere was also one of four to resign as a board member of SunEdison YieldCo TerraForm Power in November 2015."

SunEdison COO Francisco “Pancho” Perez Gundin left the company last week.

According to UBS, Paul Gaynor (former First Wind CEO) has also departed, although this was not disclosed in the 8K filing. "Given Paul's former role as CEO of First Wind, we continue to perceive growing risk to execution on guided targets, particularly on wind backlog," reported UBS.

When you point such things out, wind pushers invariably change the subject to older damage from coal mining, or blame cats for most bird deaths (ignoring species context). Or they'll flat out lie about noise issues. They go a bit silent when you point out that wind turbines kill more bats than any other technology, but they claim it can be fixed with yet another technology, wildly speculative. They just can't admit that these giant, ineffective totems are bone ugly.

Wind energy's main function has been to convince people that "something is being done about fossil fuels" without really proving it. The only thing it guarantees is a continued loss of natural aesthetics as the planet keeps warming.

http://bit.do/false_progress