Wind Wake Turbulence

---

Scroll down for more photos

Guest post from 'Earth, Wind and Fire John'

The photo demonstrates turbine wake turbulence in large wind farm arrays and why the potential for wind energy is substantially overestimated by most sources. The first turbine to catch the wind will produce appreciable energy, while turbines in its wake, down wind of that unit, produce exponentially less energy due to air turbulence. The low level fog, known as sea smoke, clearly shows this and is one of the best photographs ever taken that demonstrates this effect.

The first 4 articles below pertain to how Independent System Operators (ISOs) and Independent System Administrators (ISAs) attempt to incorporate intermittent electrical sources onto the grid. Pacificorp was purchased by Warren Buffet and several stories are included regarding Buffett's energy ventures. I have also included a document from an ISO which defines Spinning and Non-Spinning Reserve, and a good piece from the LA Times explaining how renewable energy cannot reduce carbon or other emissions, and actually makes them worse.

Energy Imbalance Markets will raise prices in the West

Some western energy markets are currently challenged by the increased development of variable renewable energy resources (i.e., wind and solar that vary depending on the availability of the resource and therefore must be integrated onto the electric grid whenever they are available, day or night) promoted through federal tax incentives and renewable portfolio standards in some states. Many of these resources are under development even though the economic recession has reduced the need for electric generation in many areas in the West.

While there are several efforts underway in the West to address integration of these variable resources at reasonable and affordable cost to consumers, creation of an “energy imbalance market” (EIM) is being touted by wind developers and the U.S. Department of Energy (DOE) as the only way to handle renewable energy integration, and is being fast-tracked by DOE through its oversight of the federal Power Marketing Administrations (PMAs) that own significant transmission and generation assets in the West (see APPA issue brief on March 16, 2012, memo from DOE Secretary Chu on his priorities for the PMAs).

As proposed, such an EIM would be a sub-hourly, real-time, centrally dispatched energy market intended to improve the integration of increasing levels of variable generation from renewable resources. The theoretical benefit of an EIM is that the larger array of generation available for dispatch would provide a greater balance of intermittent resources and reduce the need for backup power. For example, if the wind or sunlight is low in one region of the EIM it might be greater in another area, thus reducing the total variability. But this benefit can only be fully achieved if there is adequate transmission capacity from the sources of generation to the demand for power.

California ISO and Pacificorp enter MOU on Energy Imbalance Markets

On February 12, 2013, the California Independent System Operator Corporation (CAISO) and neighboring utility, PacifiCorp, entered a Memorandum of Understanding to cooperate on the development of an energy imbalance market (EIM) in each entity’s respective balancing authority areas, in the hopes of laying groundwork for a broader effort across the western region. Hailed by the CAISO as the “first step in bringing PacifiCorp and ultimately other Western balancing authorities into an automated real-time [five]-minute dispatch system” the CAISO and PacifiCorp agreed in the MOU to work towards implementing the EIM by October 2014.

In statements issued with the release of the MOU, the parties noted their hope that the EIM will integrate resources efficiently and reliably, including, in particular, the significant renewable resources that have come online in the West in recent years.

Spinning and non-spinning reserve (California ISO)

Spinning Reserve is the on-line reserve capacity that is synchronized to the grid system and ready to meet electric demand within 10 minutes of a dispatch instruction by the ISO. Spinning Reserve is needed to maintain system frequency stability during emergency operating conditions and unforeseen load swings.

Non-Spinning Reserve is off-line generation capacity that can be ramped to capacity and synchronized to the grid within 10 minutes of a dispatch instruction by the ISO, and that is capable of maintaining that output for at least two hours. Non-Spinning Reserve is needed to maintain system frequency stability during emergency conditions.

Rise in renewable energy will require use of more fossil fuels - LA Times

The Delta Energy Center, a power plant about an hour outside San Francisco, was roaring at nearly full bore one day last month, its four gas and steam turbines churning out 880 megawatts of electricity to the California grid. On the horizon, across an industrial shipping channel on the Sacramento-San Joaquin River Delta, scores of wind turbines stood dead still. The air was too calm to turn their blades — or many others across the state that day. Wind provided just 33 megawatts of power statewide in the midafternoon, less than 1% of the potential from wind farms capable of producing 4,000 megawatts of electricity.

One of the hidden costs of solar and wind power — and a problem the state is not yet prepared to meet — is that wind and solar energy must be backed up by other sources, typically gas-fired generators. As more solar and wind energy generators come online, fulfilling a legal mandate to produce one-third of California's electricity by 2020, the demand will rise for more backup power from fossil fuel plants.

"The public hears solar is free, wind is free," said Mitchell Weinberg, director of strategic development for Calpine Corp., which owns Delta Energy Center. "But it is a lot more complicated than that." Wind and solar energy are called intermittent sources, because the power they produce can suddenly disappear when a cloud bank moves across the Mojave Desert or wind stops blowing through the Tehachapi Mountains. In just half an hour, a thousand megawatts of electricity — the output of a nuclear reactor — can disappear and threaten stability of the grid.

Buffett buys Pacificorp for $5.1 billion in cash - Background

Striking the second biggest deal of his career and making a major move in the energy industry, billionaire investor Warren Buffett agreed Tuesday to pay $5.1 billion in cash to acquire Western states electric utility PacifiCorp.

Buffett's MidAmerican starts wind projects before credits end

MidAmerican Energy Holdings Co., the power provider owned by Warren Buffett’s Berkshire Hathaway, completed 300 megawatts of wind farms in California ahead of the expiration of a tax credit at the end of this year.

MidAmerican Renewables LLC completed the 168-megawatt Pinyon Pines Wind I and the 132-megawatt Pinyon Pines Wind II projects near Tehachapi, the Des Moines-based company said today in a statement. The 100 Vestas Wind Systems 3-megawatt turbines will supply Southern California Edison with electricity under long-term contracts.

Western Wind acquires 4000 mw wind project pipeline

Western Wind Energy Corp. is pleased to announce it has executed a Term Sheet with Champlin/GEI Wind Holdings ("CGEI Wind") to acquire the rights and title to a 4,000 MW wind energy development pipeline, with near term projects in Hawaii and Utah. Additional large projects are in California and throughout the US in niche markets with strong Renewable Portfolio Standards and Power Purchase Agreement pricing.

Cost of the acquisition is $20 Million US, payable by the issuance of 8 Million common shares at a deemed value of $2.50 per share US. The term sheet will be subject to completion of due diligence, formal documentation, board approvals and approval of the TSX and the applicable securities regulatory agencies including applicable escrow provisions.

Brookfield renewable gains control of Western Wind

We are referring to one of the more unusual events in recent Canadian corporate history: the bid by Brookfield Renewable Energy Partners to acquire Western Wind for $2.60 a share. At the close of business Thursday Brookfield Renewable announced that it had acquired 59.7% of the shares held by the independent shareholders. Adding in the stake held by Brookfield – a stake it purchased last year – Brookfield said that it now has a 66.1% stake in Western Wind.

Apex buys right to wind energy project

Property intended for a wind farm south of the Hoopeston area has again changed hands. Development of the Hoopeston Wind farm has been ongoing since 2008. The most recent coordinator, GDF SUEZ Energy North America Inc in Houston, Texas, took over in 2011 when it purchased the previous wind farm developer, International Power.

Apex Wind Energy, Inc. is an independent renewable energy company based in Charlottesville, Va. Since its founding in 2009, Apex has completed 10 acquisitions and has project sites in 20 states, including Illinois, Indiana and Wisconsin.

Related:

Maersk Line and Apex partnership

Jim Trousdale relationship map

BP to buy back $8bn in stock after Russian sale

Offshore wind resource substantially overestimated

Estimates of the global wind power resource over land range from 56 to 400 TW. Most estimates have implicitly assumed that extraction of wind energy does not alter large-scale winds enough to significantly limit wind power production. Estimates that ignore the effect of wind turbine drag on local winds have assumed that wind power production of 2–4 W m−2 can be sustained over large areas.

New results from a mesoscale model suggest that wind power production is limited to about 1 W m−2 at wind farm scales larger than about 100 km2. We find that the mesoscale model results are quantitatively consistent with results from global models that simulated the climate response to much larger wind power capacities. Wind resource estimates that ignore the effect of wind turbines in slowing large-scale winds may therefore substantially overestimate the wind power resource.

These images are worth the click.

3-D images of wind turbine wake turbulence (very cool)

Senators back breaks for offshore wind

U.S. Sen. Susan Collins of Maine is co-sponsoring a bill to boost offshore wind energy generation, which is being aggressively pursued in the state. Collins, a Republican, joins Democratic Sen. Tom Carper of Delaware in introducing the Incentivizing Offshore Wind Power Act. A House version of the bill is also being introduced.

The proposals provide financial incentives for investment in offshore wind energy. They seek to extend investment tax credits for the first 3,000 megawatts of offshore wind facilities placed into service, or about 600 wind turbines. The sponsors say the tax credits are vital for wind energy technology because of the longer lead time for the permitting and construction of offshore wind turbines, compared to onshore wind energy.

Biden caught with hand in cookie jar (Must Read)

BrightSource Is “Sustained By An Impressive Array” Of Subsidies

Brightsource Is “Sustained By An Impressive Array Of Federal, State And Local Subsidies, Including A $1.6 Billion Loan Guarantee From The Department Of Energy.”“Fortunately for BrightSource, its efforts are sustained by an impressive array of federal, state and local subsidies, including a $1.6 billion loan guarantee from the Department of Energy, one of the largest solar guarantees on record. The company notes federal provisions providing solar projects with a 30% investment tax credit through 2016, as well as accelerated depreciations of capital costs for solar entities, among other goodies.” (Editorial, “Secretary Of Subsidy,” The Wall Street Journal, 6/2/11)

Sany Electric completes first wind farm in Texas

News of the self-funded project first emerged in December 2010. Sany has a development pipeline in the Texas Panhandle—in the north of the state--and in Central America. But it has no firm plans as yet to build a second US wind project, according to project development advisor Stacy Rowles.

Fellow Chinese manufacturers Goldwind and Guodian have recently built or are developing US projects in an to forge a track record in the country's market. In March, Guodian United Power signed a deal to supply six 1.5MW turbines to a small ‘distributed power’ project in Corpus Christi in south Texas. Last year, Goldwind completed a 4.5MW pilot project in Pipestone, Minnesota - its first US project.

Congressional oversight needed for wind rulemaking

After 20 years and many extensions, the federal Production Tax Credit (PTC) was scheduled to expire at the end of 2012. Neither the House nor the Senate saw fit to extend this overly generous corporate benefit when it was considered on its own merits, and the PTC did, in fact, expire.

But in the final hours of the fiscal cliff negotiations, a provision in the American Taxpayer Relief Act surreptitiously added a $12 billion, 1-year extension of the PTC. This move was done behind closed doors, without debate, any opportunity for amendment, or obligation of the Congress to find a way to pay for it.

The abuse of the Public Trust did not end there. With this extension, a critical change to the PTC was introduced that relaxed the eligibility requirements for the credit. Renewable energy projects now need only ‘commence construction’ by January 1, 2014, to qualify for the credit, instead of the projects being ‘placed-in-service’ by that date.

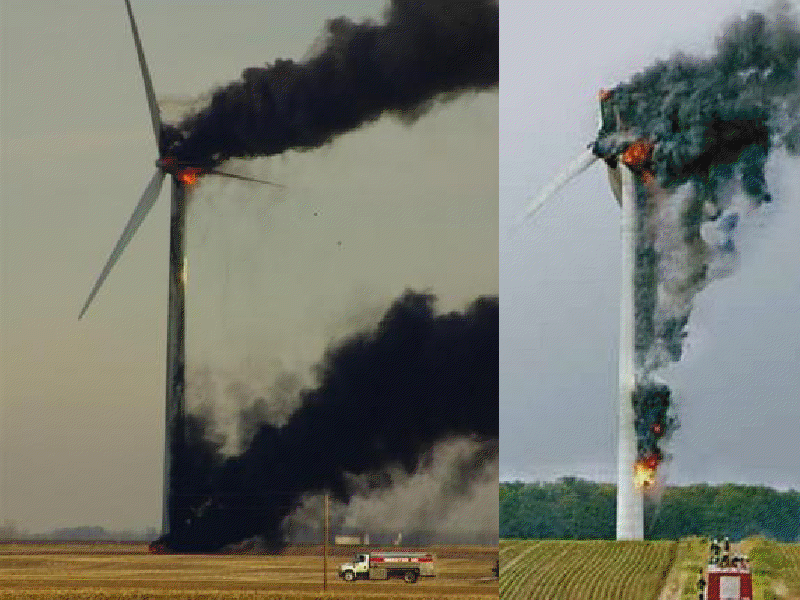

Wind Turbine Fires

Forest fires and wind turbines; the danger no one talks about

Despite all that has been written about wind power, a vitally important issue has barely been mentioned. When turbines fail, blades may fall to the ground or send fragments that land up to a mile away. Turbines often catch fire, and when they do they often send flaming shards into fields and forests.

In California, one such fire burned 68 acres, another 220 acres, and in Palm Springs several “spot fires” had been generated in surrounding areas. In Hawaii, 95 acres were burned. Australia lost 80,000 acres of forests located mostly in a national park. Spain lost nearly 200 acres from one fire. A comment on a German fire mentioned that “burning debris” from a turbine had traveled several hundred meters from the site. In Holland, three burning blades from a mere 270-foot tower cast a 50-foot flaming shard 220 feet from the site.

The most dramatic report emanated from Wales where “great balls of fire” landed more than 150 yards away, causing a hillside to burn. Fearing more forest fires, an Australian province enacted a law banning placements of wind towers near wooded areas. Yet, in heavily forested Maine, all of our wind power sites have been approved without even considering that turbines have often caused forest fires.

That 220-acre California fire had been contained by 45 firefighters, two helicopters and two bulldozers. The 69-acre fire was contained with the help of 15 fire engines, four hand crews and four planes. A 5-acre California fire was extinguished by six fire engines, three water trucks, two helicopters, two tanker planes, a bulldozer and three hand crews.

Here are some photos of wind turbine fires and failures.

Wind turbine fires and failures - Must See Photos

The coming US carbon tax via the US Treasury (Must Read)

I sought emails and other documents from two offices: Environment and Energy (really), and Legislative Affairs. This action after the administration first ignored us, which they followed with an unfortunate stumble, trying to delay us with fees — even absurd and surely anti-’green’ ones, like $1,800 to photocopy electronic mail, typically copied on a disc for no charge — which fees, even when they’re not mindlessly trumped up like that one, not-for-profit groups which disseminate government information are exempt by statute from paying.

Delay can only work only so well once we file suit, and recently Treasury turned over a first production of approximately 770 pages of reports. Despite its better efforts Treasury managed to hand over some docs that in an attentive world should prove extremely useful, offering fantastic language if often buried in pointy-headed advice they received in Power Points and papers from the IMF, G-20 and, in graphic terms, an analysis from the World Bank on how to bring a carbon tax about.

These documents represent thoughtful advice on how to mug the American taxpayer and coerce them out of unacceptable and anti-social behavior, diverting at least 10% of the spoils to overseas wealth transfers. The major focus is language, how to sell it to the poor saps not by noting the cost or that it is a tax but as, for example, the way to be the leader in something like solar technology.

***

Read last week's story:

The Mafia Is Moving Into Green Energy

Note to readers

I have very serious reservations regarding financial and transparency issues surrounding the renewable industry. These issues need to be addressed fully before permits are issued, offshore tracts are auctioned, and projects on federal/state lands, or any other project using taxpayer assistance (financial incentives, grants, etc) are given. We must have full public disclosure of true ownership of developers and their partners and affiliates, with a particular focus on government agencies and employees.

john