Why Is The Wall St. Journal So Afraid Of Elizabeth Warren?

Video - Mary Kissel on the John Batchelor Show - Mar. 17, 2011

--

Audio - Kissel on the John Batchelor Show (separate interview) - Mar. 16, 2011

--

The Daily Bail awaits comment from Mary Kissel.

Zack Carter started a bit of a commotion recently, when he identified the Wall St. Journal's Mary Kissel - a former Goldman Sachs executive - as one of the people behind the recent attacks on Elizabeth Warren and the Consumer Financial Protection Bureau (CFPB). It would be one thing to attack Warren on ideological grounds, or even for partisan political reasons, but Ms. Kissel and the WSJ are simply making things up.

They claim, for example, that the CFPB, under Warren's command, "is trying to extend its reach by extorting billions of dollars from private mortgage servicers, regulating their business by fiat, and stalling a U.S. housing market recovery."

The reality is, that neither Warren herself, nor the CFPB, is "extorting" anyone. Nor, as Warren testified to Congress this week, does she or anyone from the Bureau have anything whatsoever to do with any direct negotiations with the banks and mortgage servicers regarding any kind of settlement. The DOJ and Treasury have asked people who are involved in setting up the Bureau, including Warren herself, for advice, but there is no evidence that anyone associated with the CFPB has done anything more than that. If the WSJ had evidence to the contrary, they would produce it, because it would be one of the biggest scoops of the year. But there is no such evidence.

Furthermore, the CFPB, once it's up and running, will not regulate anyone or anything, including mortgage servicers, "by fiat." Unless, of course, "by fiat" means enforcing the actual laws, already on the books, pertaining to mortgages and mortgage servicing -- something which the Fed, the OCC and the OTS spectacularly failed to do in the years leading up to the financial crisis. Earth to the WSJ, that's why they came up with the CFPB in the first place -- the existing agencies were too captured by Wall St., or simply incompetent, to enforce the law and so enforcement of consumer protections is now being consilidated under the jurisdiction of the Bureau. Now, just to be sure, let's make this clear, so that even someone from the WSJ editorial board can understand it: the CFPB is charged with enforcing the law, the existing laws which are already on the books, not new laws that Elizabeth Warren makes up ex nihilo.

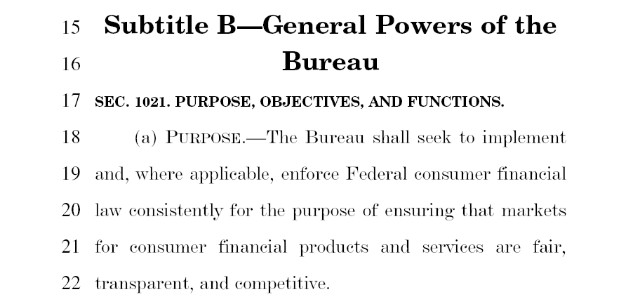

And don't take our word for it, here it is in black and white from the actual Dodd-Frank bill:

Notice that the Bureau shall implement and enforce "Federal consumer financial law." There is no ambiguity on what the purpose of the Bureau is, and if you continue reading the bill, you will also notice that every power and authority granted to the CFPB references already existing Federal law and the enforcement thereof.

Notice that the Bureau shall implement and enforce "Federal consumer financial law." There is no ambiguity on what the purpose of the Bureau is, and if you continue reading the bill, you will also notice that every power and authority granted to the CFPB references already existing Federal law and the enforcement thereof.

Warren's critics at the WSJ also contend that the scandal over mortgage processing and title registration is just a mere paperwork problem and that Elizabeth Warren and her myrmidons over at the CFPB are using their vast, new powers (which they don't in reality have -- again, these are just made up) to extort the banks out of $20-30B. They write: "The feds have been investigating, and it turns out that most of the infractions were technical while very few borrowers lost their homes without cause."

Perhaps the WSJ editorial board is blocked from reading certain financial websites while at work, but this issue has been covered extensively by almost all the leading financial blogs. First of all, there is no evidence to date that the feds have been investigating anything. Nor, unfortunately, have the state AG's. The AG's and the federal agencies claim to already understand the problems with mortgage servicing and title registration, and they have, it seems, listened to some of the complaints coming in from borrowers across the country who have experienced these problems first-hand. But the Federal regulators, the AG's and the DOJ have so far avoided doing any kind of forensic investigation to find out where fraud and criminal activity have taken place. See here. And yet, there are reams of evidence, including some fairly well documented cases, in which mortgage servicers were consciously mishandling mortgage and insurance payments, fraudulently purchasing force-placed insurance policies, and in many cases skimming off the proceeds of foreclosure sales ahead of the MBS investors they were supposed to be serving. In addition to any criminal liability associated with those issues, there may be many billions of dollars in liability at the state and county level for unpaid land record fees that stem from the way that MERS had been used to avoid paying those fees. Anyone who tries to claim that the fraudclosure scandal is just a problem with "paperwork" is simply not credible. For starters, see here, here, here, here, here and here.

Further, both the WSJ and Ms. Kissel in her radio interview with John Batchelor explicitly conflate the leaked 27-page settlement docs put together by the state AG's with the activities of Elizabeth Warren and the CFPB. The Journal writes:

They've sent a proposed 27-page "settlement" to the banks that would, among other things, force mortgage servicers to submit to the bureau's permanent regulatory oversight; impose vast new reporting and administrative burdens; mandate the reduction of borrowers' mortgage principal amounts in certain circumstances; and force servicers to perform "duties to communities," such as preventing urban blight. We warned during the Dodd-Frank debate that the new consumer bureau would become a political tool for credit allocation, and here we already are.

In the radio interview, Ms. Kissel and John Batchelor further suggest that the "settlement" is being worked out by Warren herself with the aim of shaking down the banks and servicers for money that they will then give away to poor people who are delinquent or underwater on their mortgages.

Whoever "they" is, it isn't the CFPB and Elizabeth Warren. A simple Google search could tell them this. Those who are negotiating some kind of "settlement" include the state AG's, the DOJ and the federal banking regulators, not Elizabeth Warren. This is simply a fact. Moreover, any regulatory oversight over mortgage servicers by the CFPB would be authorized by current Federal law and the Dodd-Frank bill, not by any "shakedown" by the state AG's and the DOJ. The outcome of the settlement talks is not driving future oversight by the CFPB. CFPB oversight of mortgage servicers will be determined by the law. The Journal's insinuations on this point are just nonsense.

Ironically, Kissel and Batchelor discuss the settlement proposal as if the mortgage modification elements of the settlement are damaging to the banks, when, in fact, the banks could make out like bandits. Showing very little understanding of the situation, the Journal scolds:

Homeowners and bank shareholders will ultimately pay for the compliance burden and the $20 billion to reward delinquent borrowers, as servicers pass on the costs. Never mind that these banks didn't originate many of those loans and typically don't own them now.

Here's why this should be embarrassing:

Beyond the criminal and civil fraud liabilities that the settlement appears to absolve the banks and servicers of, the treatment of second liens in the settlement is an outright gift. This is something that has been discussed extensively by others, that most mortgages are owned by Fannie and Freddie or other MBS investors, not by the banks. However, many second liens (like home equity loans) are held by the banks themselves. Batchelor and Kissel are just aghast that some dead-beat homeowner might get a mortgage mod, but what they don't seem to understand is that without the terms proposed in the settlement, the banks would be getting ZERO from most of those underwater and delinquent borrowers because the proceeds of any foreclosure sale would go first to pay off the first mortgage (which the banks don't own), leaving nothing for the second. Zip. Nada. Some analysts have even suggested that some of the large banks would be completely wiped out if they had to write down those second liens to what they are really worth. The proposed settlement represents an enormous boon to the banks on this score. Do the WSJ and Mary Kissel really not know any of this?

Mar 23, 2011 at 2:37 PM

Mar 23, 2011 at 2:37 PM

Reader Comments (5)

That's pure propaganda. As was pointed here, Adam Levitin sampled foreclosure filings in Allegheny County Pa. and found that the complaint failed to attach a copy of the promissory note in fully 3 out of every 5 cases.

Without a promissory note, the complaint should be dismissed because the court lacks jurisdiction over a case where the plaintiff can't show any injury.

By WSJ logic, it would be A-okay to proceed with the foreclosure case (and ultimate eviction) anyway because the homeowner's failure to pay gives the bank--which without the note cannot establish that it's entitled payment in the first instance--"cause."

Not long ago the WSJ stopped relaying the (astronomical) PE ratio of the S&P 500 as reported by Standard & Poor's. Instead it used the PE ratio as reported by well-known market shill Laszlo Birinyi, the author of puff pieces like this one...

http://www.cnbc.com/id/42228291

The only reason to eyeball a WSJ headline now and then is to pick up on the latest propaganda memes.

Did you see the hearings the other day with House Fin. Services? Most of the congressmen just made asses of themselves. Well, maybe I should be more specific. They showed that they had almost ZERO idea what the CFPB is or is supposed to do, and they seemed to have no idea that it hadn't actually done anything at all yet because it's not operational.

So yeah, I'm just going to go with stupid and ignorant on this one. If anyone wants to pipe up and admit to being a shameless liar, I'll promise to keep an open mind.

But when it comes to reporters, I think it's different. Most of the rah-rah Recovery reporters, I think, go to banking events whereat their heads are filled with poison that they repeat the next day on air in the ridiculous belief that their part of the Team.

Not one of them (that means you, Erin Burnett) will be invited back to the Hamptons once they're fired. But they don't think that far ahead. The shills are too busy partying like it's 1999.