BofA Leak Exposes Possible Force-Placed Insurance Fraud

OperationLeakS has now released the first batch of Bank of America fraud documents. What has been disseminated so far consists mostly of emails between the hacker group Anonymous and a former employee at Balboa Insurance Co. which was acquired by BofA with their acquisition of Countrywide.

Operation #BlackMonday

One thing to clear up about these documents is that they are NOT the same documents held by Wikileaks. The documents just released by OperationLeakS Anonymous are mostly very recent emails and have nothing to do with the executive hard drive held by Wikileaks. In fact, the Anonymous leaker says he would love to see what Wikileaks has and says he could probably get "all the dirt" within a week of gaining access to it.

So, what do the latest leaked emails reveal? The most obvious thing is that Balboa/BofA employees were engaged in trying to hide original loan documents by erasing Document Tracking Numbers from scanned documents. See here.

But the Balboa employee also appears to have information that would blow the lid off a number of Force-Placed Insurance scams that are highly questionable, probably illegal and most likely would expose companies like Bank of America to more suits by mortgage-backed securities investors.

When someone holds a mortgage, they are required to have adequate insurance for the property, but if they stop making the payments on their insurance policy, the lender may purchase insurance on the property on behalf of the borrower (to protect the lender) and are then allowed to charge the mortgage holder for that insurance. This is called Force-Placed Insurance and usually it costs a great deal more than ordinary homeowners insurance because of the greater risks involved. The forced insurance, it should be noted, protects the lender, but not the borrower. This is standard practice in the mortgage industry, but sometimes things get a little murky. In fact, they sometimes get downright dirty.

In many cases, when homeowners begin missing payments on their mortgage, servicers will stop forwarding insurance payments (which have been held in escrow) to the insurance company on behalf of the borrower. This has occurred even when the borrower has paid enough into escrow to cover the insurance payment. Nonetheless, this automatically kicks in the Force-Placed Insurance process. The servicer will then purchase the insurance and charge the homeowner for it. The insurance so purchased is always several times more costly than ordinary insurance, thus putting even more stress on the delinquent borrower, often driving them even more quickly into foreclosure. American Banker discusses these problems here and here.

Moreover, there are many instances in which the force-placed insurance companies (like Balboa) have actually back-dated the insurance by up to 9 months and then charged the homeowner for insurance they didn't actually have and for which no claims will ever be filed because the covered period is in the past! These sorts of practices may explain the unexplained charges that show up on mortgages for people who have missed a payment or two, but then are unable to understand why their outstanding balance is more than their original mortgage. (There may be other explanations, but the force-placed insurance scam seems a likely candidate.)

It gets worse when you consider that many of these same insurance companies are known to give kickbacks to the servicer, or the servicing bank as the case may be, thereby incentivizing delinquencies (e.g. through HAMP), which can entail the lapse of homeowners insurance. It also becomes clear that the interests of the servicer and the insurance company are aligned against the interests of both homeowners and investors. This is because servicers in many cases are reimbursed for the insurance they purchase on behalf of borrowers out of the proceeds of forclosure sales, foreclosures which they helped bring about through overly expensive force-place insurance policies. That is, the servicers get paid before investors and by over-charging for the insurance in the first place the servicers are able to extract even more money from the investors they are supposed to be working for.

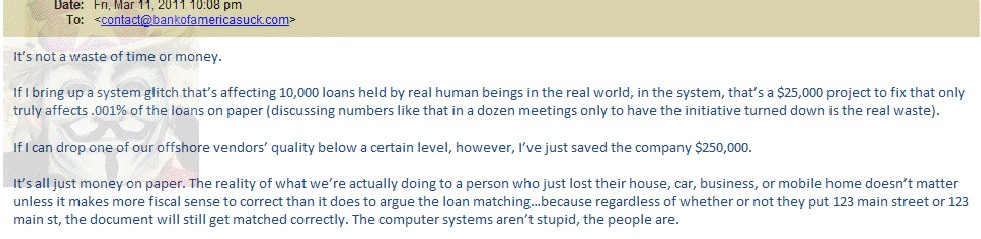

Where the situation gets really interesting is when a bank like BofA actually owns the insurance company, as in the case of Balboa. In this email, the Balboa employee appears to be saying that errors in tracking of mortgages were common, but that he had more incentive to blame outsourced clerical workers for errors, thereby reducing the fee Balboa paid to the other company for handling the paperwork, than he had incentive for actually preventing such errors in the first place:

It isn't clear what kind of "system glitch" the employee is referring to, but presumably it is a glitch related to lapsed insurance payments. If it is the case that Balboa/BofA was knowingly allowing servicing errors to occur, so that they could then force-place insurance policies on borrowers, then that in itself could be a huge blow to BofA -- in addition to the perhaps related issue of trying to erase DTN's on scanned documents.

It isn't clear what kind of "system glitch" the employee is referring to, but presumably it is a glitch related to lapsed insurance payments. If it is the case that Balboa/BofA was knowingly allowing servicing errors to occur, so that they could then force-place insurance policies on borrowers, then that in itself could be a huge blow to BofA -- in addition to the perhaps related issue of trying to erase DTN's on scanned documents.

More analysis to follow. Stay tuned.

Mar 19, 2011 at 1:05 PM

Mar 19, 2011 at 1:05 PM

Reader Comments (16)

http://www.lewrockwell.com/orig11/stockman5.1.1.html

First part reads like a Dr. Pitchfork highlight reel.

http://letthemfail.us/archives/6030

I knew it between 2003 and 2007 while they were force-placingme, and I knew it even more in October 2010 when I wrote the above. Now we see the proof, once again, in all its miserable shameful splendor...

This allows the bank to eliminate pesky claims that slow down the profit flow and still comply with directives not to destroy documents.

"They were just misplaced - the dog ate 'em. Gee, too bad we didn't find these sooner."

It's a scam and a fraud, clearly. The challenge will be to find 12 people who can understand the ramifications of these kinds of schemings.

It's a good thing I don't know any better.

Also, be sure to check out the last few comments on the thread -- three people corroborate exactly the type of double-dealing and "lost" insurance payments we discuss above. OperationLeakS needs to provide some context for the emails they posted, but if they are what they appear to be -- and especially if the leaker ever gets a chance to give evidence -- they are damning indeed.

Far better that this stuff is going somewhat mainstream as the electorate begins waking up.

And it is woke up and pissed off and waiting for a match...

James Andersen, Attorney says:

March 14, 2011 at 9:28 pm

If this person who leaked this story is interested in acting as an paid expert witness in a trial against Balboa and GMAC in Texas , please have them contact me at once.

281-488-2800

James Andersen Attorney at Law

Houston Texas

http://www.nakedcapitalism.com/2011/03/wikileaks-whistleblower-charges-bofa-of-engaging-in-large-scale-force-placed-insurance-scheme-with-cooperation-of-servicers.html#comment-350712

"I hope we shall crush in its birth the aristocracy of our moneyed corporations which dare already to challenge our government to a trial by strength, and bid defiance to the laws of our country." - Thomas Jefferson once said. How fitting, how prophetic! How alarming that we failed to accomplish that!

At http://www.WallStreetClassAction.com we organize a class action against the banks, the ratings agencies and other financial institutions involved in staging the colossal securitization fraud and subsequently crashing the economy and resulting in over $5 Trillion in asset losses in the US alone.

We realize that our own government is effectively a captured entity, so no criminal indictments will be forthcoming. But WE THE PEOPLE will hold the fraudsters accountable. United we stand.