The Blind Leading The Blinder -- FED Propaganda Machine Credits Bernanke Bailouts For Ending The Great Recession

The Blinder-Zandi Paper (LINK)

Authored by Dr. Pitchfork.

---

The ruling class just can’t let it go. They bailed out the banksters and their bondholders; they bailed out the UAW and state bureaucracies; they made us perpetual cash cows for Big Pharma and Big Insurance; and yet...you still complain about bailouts and deficits. What’s your problem? Our wise and benevolent rulers saved us from fighting in the streets over scraps of rat meat, but you’re still not grateful. What gives?

Not to worry. Now we know (if there were ever any doubt), that TARP and the “stimulus” and all the various bailouts helped prevent a "Second Great Depression." According to an article from the NY Times, Alan Blinder of Princeton and Mark Zandi, Chief Economist at Moody’s, have proven “empirically” that the bailouts worked. Even though the bailouts were politically unpopular, and even though there is still a great deal of “populist” anger about them, Blinder and Zandi have shown us the “wisdom” of the bailouts, and proved conclusively that our rulers saved us all from financial and economic armageddon. Of course, there’s just one little problem with this narrative: Blinder and Zandi have done no such thing. For all their charts, appendices and footnotes, they’ve proven nothing whatsoever. Nada. Zip. What they have done, however, is puke up a pretty little piece of bailout propaganda when the ruling class needed it most.

All the more galling, the Blinder-Zandi paper was originally titled "How We Ended the Great Recession." Given such hubris, I was fully prepared to delve deep into their methodology, examine carefully all their assumptions, and offer a full critique of the arguments implicit therein. Alas, no such critique will be forthcoming. I've read the "paper" from beginning to end, from cover page to footnotes to appendices. Everything. But I still have no idea how they arrived at any of the results laid out ever so neatly in their ostentatiously detailed charts. That's because their model, and the assumptions they used, are nowhere to be found. If these were third graders, they'd get a zero for not showing their work.

What’s in the Model?

Although they don't give any specifics, the authors nonetheless offer a few hints about their model and some of its components. According to "Appendix B: Methodological Considerations," the economic effects of the financial interventions (i.e. the bailouts) were modeled in terms of their effects on interest-rate spreads (e.g. the TED spread).

[The] so-called TED spread is one of the two key credit spreads in the Moody's model, and thus one main channel via which the unconventional financial policies operated. (18)

Moreover, changes in consumer spending and capital investment were modeled in terms of various interest-rate spreads (like the TED spread).

The investment equations in the model are specified as a function of changes in output and the cost of capital. The cost of capital is equal to the implicit cost of leasing a capital asset, and therefore reflects the real after-tax cost of funds, .... More explicitly, the cost of funds is defined as the weighted-average after-tax cost of debt and equity capital. The cost of debt capital is proxied by the "junk" (below investment grade) corporate bond yield, which is the second of the two key credit spreads in the Moody's model. The cost of equity capital is the sum of the 10-year Treasury bond yield plus an exoenously set equity risk premium. Changes in the cost of capital, which have a significant impact on investment, reflect...the policy efforts to stabilize the financial system. (18)

Sound convoluted? “You betcha.” In a nutshell, the Blinder-Zandi model assumes that:

- interest-rate spreads have large, significant effects on economic activity;

- financial interventions (such as TARP) are best modeled in terms of credit spreads;

- these financial interventions, in fact, significantly reduced the various credit spreads;

- (and finally) without financial interventions like TARP these spreads would have remained elevated for a much longer period of time.

Is it any wonder then, that the model shows a massive difference between the bailout scenario and the non-bailout scenario? After all, that’s what the model has been designed to do. Based on the assumptions Blinder and Zandi made at the very start, there could be no other possible outcome than one that shows a large, signficant deviation between the bailout scenario and the non-bailout scenario. It's already baked in. The precise “results” are just numerical icing on the bailout cake.

Excellent Penmanship, No Argument: D-

Still, are the assumptions they make about credit spreads and economic activity realistic? Are the assumptions they make about how the financial interventions (TARP, MBS purchases, e.g.) affected these credit spreads plausible? And what about the assumptions they make about these spreads in the absence of any intervention – are those assumptions credible?

The short answer is, we have no idea – because Blinder and Zandi don’t tell us. They don't tell us exactly what their assumptions are, or how they were derived. Their assumptions, we are told, are based on certain "historical relationships" between various data sets.

The slightly longer answer is, regardless of the precise formulation of their assumptions, regardless of the source of their figures and coefficients, and regardless of the methodology used to obtain them, we still have no sustained, detailed and credible argument – whatsoever – about what would have happened in the absence of various bailout measures. No argument. None. All we have, ultimately, is a gut feeling that things would have been very, very bad without them. But how bad? For how long? And why? Neither Blinder nor Zandi, nor indeed the entire pro-bailout establishment, have put forward anything other than sound bites and scare tactics to describe the likely outcome had market forces been allowed to work.

Cross Your i's and Dot Your t's?

Aside from the claim that the bailouts were instrumental in saving our bacon, the authors also conclude that the financial interventions (i.e. the bailouts) and the “stimulus” spending worked in concert, each reinforcing the effects of the other. But this raises a particularly thorny question concerning the 'historical relationship" between interest-rate spreads and spending and investment. What “historical relationships” are we talking about here? If Blinder and Zandi are talking about the very recent past alone, or if they give significant weight to the very recent past, then how are the effects of interest-rate spreads on consumption and investment distinguished from the effects of “stimulus” spending? Here’s what I mean: between the fall of 2008 and the present, the TED spread, for example, has dropped from an all-time high to its historically low trend.

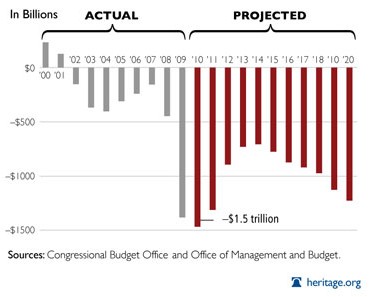

During this same time period, government deficit spending (“stimulus”) has gone through the roof.

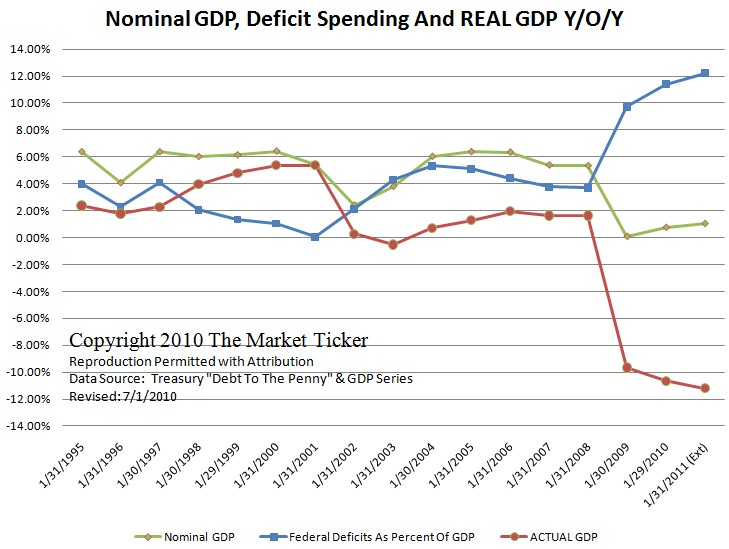

In macro-tard terms, GDP has gone up at the same time that credit spreads have come down. Feel free to model that "historical relationship." But if you back out deficit spending from total reported GDP, as Karl Denninger delights in pointing out, we’re still in a DEPRESSION. Credit spreads have shrunk, but so has real, organic GDP -- and aside from government spending, it's still shrinking!

That is to say, depending on how (or if) you separate the GDP effects of government spending from the GDP effects of the compression of credit spreads, you could just as plausibly argue that a reduction in these spreads has had NEGATIVE effects on GDP! Absurd? Obviously. But this is what happens when economists confuse symptoms with underlying realities, confusing effects with causes. To be fair, without access to their model, there is no direct evidence to suggest that Zandi and Blinder do anything like what I describe, but there is also no evidence to suggest that they don’t. Indeed, their results would make very little sense unless they do, in fact, conflate the effects of “stimulus” spending with the relationship between credit spreads and consumption and investment.*

E for Effort, P for Propaganda

But whether Blinder and Zandi realize it or not, all they have shown with their modeling exercise is that they believe in bailouts, that they believe (very much so) in Bernanke, and that their belief extends to two decimal places. Their paper represents nothing more than a high-level guessing game which has been given a veneer of empiricism and mathematical rigour. And they don’t even tell us exactly what their guesses are, or why they make them. They just give us the results and stamp them with their ostensible authority – which is all the ruling class really needs or desires, anyway: Princeton, “chief economist,” two decimal places. That is to say, “Fall in line, plebs; do as you’re told; forget what has been done to you. THE BAILOUTS WORKED." Economist Arnold Kling is right, the Blinder-Zandi paper is little more than "propaganda dressed up as research."

*The only caveat I can offer here is that not all of the deficit spending is, of course, due to fiscal "stimulus," and Blinder and Zandi include a good portion of deficit spending is included in their "baseline" scenario. This much is standard practice. But if we follow Denninger's analysis, the financial interventions, on their own, merely kept GDP from shrinking more than it in fact did. The methodological difficulties in accounting for the effectiveness of TARP, e.g. still stand, however.

Having already taken the Bailout Stakes, insider favorite "Macro-Model" gets ready for the Propaganda Derby.

Aug 5, 2010 at 8:13 AM

Aug 5, 2010 at 8:13 AM

Reader Comments (28)

http://economicsofcontempt.blogspot.com/2010/08/why-fed-isnt-doing-more.html

Advocates more Fed action...of course...

http://www.econbrowser.com/archives/2010/08/options_for_mon.html

More Keynesian muttering...

http://www.ft.com/cms/s/0/4768a892-9d8c-11df-a37c-00144feab49a.html

I found this amusing because it highlights that journalists grab whatever science supports their ends. The details are not important, you have a professor with lots of publications, he has a complicated scientific argument, it makes you an objective, rational journalist. He even quotes Narayana Kocherlakota saying macro models work, not realizing the Kocherlakota was actually talking about a very different class of models than the one Blinder and Zandi use, and forgetting that of course a macroeconomist would say macro theory works.

http://falkenblog.blogspot.com/2010/07/chief-economists-are-for-pr.html

B – A – I L O – U T S – Bailouts!

Such is the bailout cheer, here at the University of Failure. These guys appear to have graduated at the head of the (cl)ass.

http://letthemfail.us/archives/5002

http://www.businessinsider.com/propaganda-second-great-depression-2010-8

All This Stuff About Bailouts Preventing The Second Great Depression Is Just Propaganda

http://www.youtube.com/watch?v=umeXaGb6Xco

http://www.youtube.com/watch?v=-ClwicFzAcM

Level three assets - which often include some types of mortgage-backed securities, as well as private equity investments - are the least liquid, but level two assets, which make up by far the majority of brokerage's financial assets, are also valued using arbitrary inputs because they don't trade in highly liquid markets. Only level one assets trade with dependable market prices, and they make up no more than a fourth of financial assets at most Wall Street firms.

This reliance on illiquid assets will only stoke fears that, during the credit boom of the last five years, the brokerages became too exposed to complex securities and financial instruments that will be worth less, and trade even more infrequently, in a more sober market environment. Referring to financial firms, Warren Buffett told Fortune last month, "They are marking to model rather than marking to market. The recent meltdown in much of the debt market, moreover, has transformed this process into marking to myth."

http://money.cnn.com/2007/09/06/magazines/fortune/eavis_level3.fortune/index.htm

NEW YORK (CNNMoney.com) -- Stocks skidded Monday, with the Dow slumping nearly 778 points, in the biggest single-day point loss ever, after the House rejected the government's $700 billion bank bailout plan.

The day's loss knocked out approximately $1.2 trillion in market value, the first post-$1 trillion day ever, according to a drop in the Dow Jones Wilshire 5000, the broadest measure of the stock market.

http://money.cnn.com/2008/09/29/markets/markets_newyork/index.htm

This is SOOOooo Third Worldish. It completely reminds me of some of the headlines I used to read in Argentina when they were at war with England in '82:

"Argentine air force sinks destroyer!"

next day;

"Argentine Troops Rout Brits"

next day;

"Argentine air strike sinks another ship!"

next day;

"Argentine army pushes back invaders"

next day;

"Argentine forces cut-off English beachhead!"

next day:

"ARGENTINA SURRENDERS!"

This Jim Rogers clip is a great find. Thanks. More evidence that Bernanke and the FED, as an institution, are clueless.

http://www.youtube.com/watch?v=umeXaGb6Xco

BTW, Obama keeps talking about who "drove the economy into a ditch," but he hired the very same bus drivers (Bernanke, Geithner, Kohn, Kashkari...).

http://www.cbsnews.com/elements/2008/03/31/in_depth_business/timeline3983629.shtml

The sad part is that here we are today still trying to work our way out of it with more trouble on the horizon.

Sorry DB, just depressed today I guess.

I miss the good old days...

http://www.youtube.com/watch?v=-pCZ5E5tn4I

That's all it is too...

Don't ya see, Doc? These guys have to take their victory lap NOW, before reality takes hold. Shame on you, Doc for spoilnig their moment.

Ben's still not feeling a double-dip either, I hear.

That's because Ben's on VICODIN and can't feel SHIT.

Hmm. Just like California, only WITH olive trees.

---

These guys have impeccable timing. Like how they spotted the financial crisis just a few days after the collapse of Lehman Brothers, or when Zandi had this to say in the fall of 2008: "I would expect unemployment rates to peak at 8% by early 2010."

I don't think "reality" concerns them too much. They ARE macro-modelers after all.

BIGGEST CRIMINAL THUGS EVER ON PLANET EARTH

Who’s Afraid of Bradley Manning?

http://www.lewrockwell.com/kwiatkowski/kwiatkowski253.html

WikiGate

http://www.lewrockwell.com/margolis/margolis198.html

Some say you cannot take it with you, but I heard a man is working on a coffin with a cash drawer. Some might need it where they are sure to go, I heard Lucifer does not accept corporate American Express...

What would you call a serial killer that wiped out an entire planet? As An EMT, I can tell you that going up in a fireball is going to hurt.

I hope it is not true as well, but what is the real deal about keeping the press away, etc.?

...it's just the end of the UNITED STATES!