The Blinder-Zandi Paper (LINK)

Authored by Dr. Pitchfork.

---

The ruling class just can’t let it go. They bailed out the banksters and their bondholders; they bailed out the UAW and state bureaucracies; they made us perpetual cash cows for Big Pharma and Big Insurance; and yet...you still complain about bailouts and deficits. What’s your problem? Our wise and benevolent rulers saved us from fighting in the streets over scraps of rat meat, but you’re still not grateful. What gives?

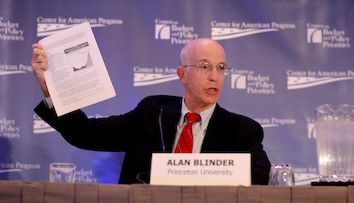

Not to worry. Now we know (if there were ever any doubt), that TARP and the “stimulus” and all the various bailouts helped prevent a "Second Great Depression." According to an article from the NY Times, Alan Blinder of Princeton and Mark Zandi, Chief Economist at Moody’s, have proven “empirically” that the bailouts worked. Even though the bailouts were politically unpopular, and even though there is still a great deal of “populist” anger about them, Blinder and Zandi have shown us the “wisdom” of the bailouts, and proved conclusively that our rulers saved us all from financial and economic armageddon. Of course, there’s just one little problem with this narrative: Blinder and Zandi have done no such thing. For all their charts, appendices and footnotes, they’ve proven nothing whatsoever. Nada. Zip. What they have done, however, is puke up a pretty little piece of bailout propaganda when the ruling class needed it most.

All the more galling, the Blinder-Zandi paper was originally titled "How We Ended the Great Recession." Given such hubris, I was fully prepared to delve deep into their methodology, examine carefully all their assumptions, and offer a full critique of the arguments implicit therein. Alas, no such critique will be forthcoming. I've read the "paper" from beginning to end, from cover page to footnotes to appendices. Everything. But I still have no idea how they arrived at any of the results laid out ever so neatly in their ostentatiously detailed charts. That's because their model, and the assumptions they used, are nowhere to be found. If these were third graders, they'd get a zero for not showing their work.

What’s in the Model?

Although they don't give any specifics, the authors nonetheless offer a few hints about their model and some of its components. According to "Appendix B: Methodological Considerations," the economic effects of the financial interventions (i.e. the bailouts) were modeled in terms of their effects on interest-rate spreads (e.g. the TED spread).

[The] so-called TED spread is one of the two key credit spreads in the Moody's model, and thus one main channel via which the unconventional financial policies operated. (18)

Moreover, changes in consumer spending and capital investment were modeled in terms of various interest-rate spreads (like the TED spread).

The investment equations in the model are specified as a function of changes in output and the cost of capital. The cost of capital is equal to the implicit cost of leasing a capital asset, and therefore reflects the real after-tax cost of funds, .... More explicitly, the cost of funds is defined as the weighted-average after-tax cost of debt and equity capital. The cost of debt capital is proxied by the "junk" (below investment grade) corporate bond yield, which is the second of the two key credit spreads in the Moody's model. The cost of equity capital is the sum of the 10-year Treasury bond yield plus an exoenously set equity risk premium. Changes in the cost of capital, which have a significant impact on investment, reflect...the policy efforts to stabilize the financial system. (18)

Sound convoluted? “You betcha.” In a nutshell, the Blinder-Zandi model assumes that:

- interest-rate spreads have large, significant effects on economic activity;

- financial interventions (such as TARP) are best modeled in terms of credit spreads;

- these financial interventions, in fact, significantly reduced the various credit spreads;

- (and finally) without financial interventions like TARP these spreads would have remained elevated for a much longer period of time.

Is it any wonder then, that the model shows a massive difference between the bailout scenario and the non-bailout scenario? After all, that’s what the model has been designed to do. Based on the assumptions Blinder and Zandi made at the very start, there could be no other possible outcome than one that shows a large, signficant deviation between the bailout scenario and the non-bailout scenario. It's already baked in. The precise “results” are just numerical icing on the bailout cake.

Excellent Penmanship, No Argument: D-

Still, are the assumptions they make about credit spreads and economic activity realistic? Are the assumptions they make about how the financial interventions (TARP, MBS purchases, e.g.) affected these credit spreads plausible? And what about the assumptions they make about these spreads in the absence of any intervention – are those assumptions credible?

The short answer is, we have no idea – because Blinder and Zandi don’t tell us. They don't tell us exactly what their assumptions are, or how they were derived. Their assumptions, we are told, are based on certain "historical relationships" between various data sets.

The slightly longer answer is, regardless of the precise formulation of their assumptions, regardless of the source of their figures and coefficients, and regardless of the methodology used to obtain them, we still have no sustained, detailed and credible argument – whatsoever – about what would have happened in the absence of various bailout measures. No argument. None. All we have, ultimately, is a gut feeling that things would have been very, very bad without them. But how bad? For how long? And why? Neither Blinder nor Zandi, nor indeed the entire pro-bailout establishment, have put forward anything other than sound bites and scare tactics to describe the likely outcome had market forces been allowed to work.

Cross Your i's and Dot Your t's?

Aside from the claim that the bailouts were instrumental in saving our bacon, the authors also conclude that the financial interventions (i.e. the bailouts) and the “stimulus” spending worked in concert, each reinforcing the effects of the other. But this raises a particularly thorny question concerning the 'historical relationship" between interest-rate spreads and spending and investment. What “historical relationships” are we talking about here? If Blinder and Zandi are talking about the very recent past alone, or if they give significant weight to the very recent past, then how are the effects of interest-rate spreads on consumption and investment distinguished from the effects of “stimulus” spending? Here’s what I mean: between the fall of 2008 and the present, the TED spread, for example, has dropped from an all-time high to its historically low trend.

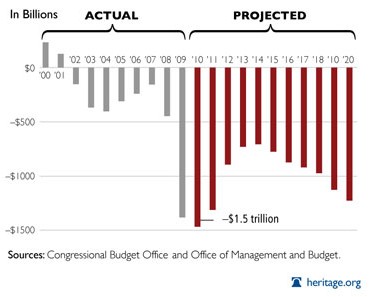

During this same time period, government deficit spending (“stimulus”) has gone through the roof.

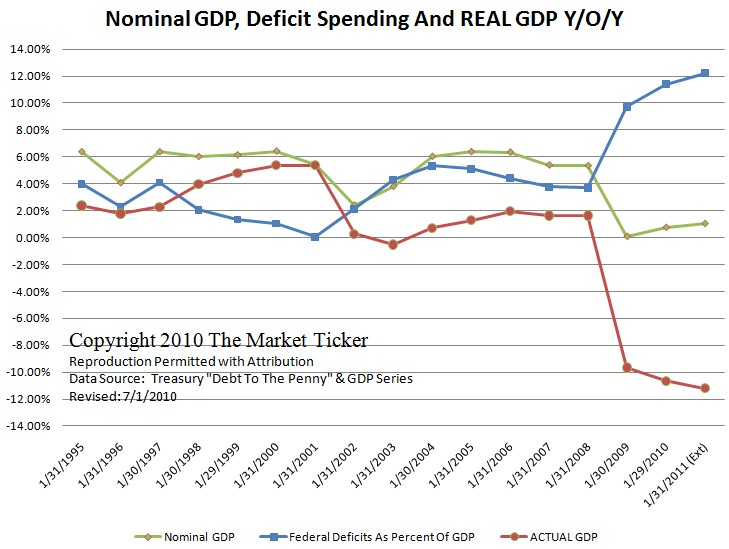

In macro-tard terms, GDP has gone up at the same time that credit spreads have come down. Feel free to model that "historical relationship." But if you back out deficit spending from total reported GDP, as Karl Denninger delights in pointing out, we’re still in a DEPRESSION. Credit spreads have shrunk, but so has real, organic GDP -- and aside from government spending, it's still shrinking!

That is to say, depending on how (or if) you separate the GDP effects of government spending from the GDP effects of the compression of credit spreads, you could just as plausibly argue that a reduction in these spreads has had NEGATIVE effects on GDP! Absurd? Obviously. But this is what happens when economists confuse symptoms with underlying realities, confusing effects with causes. To be fair, without access to their model, there is no direct evidence to suggest that Zandi and Blinder do anything like what I describe, but there is also no evidence to suggest that they don’t. Indeed, their results would make very little sense unless they do, in fact, conflate the effects of “stimulus” spending with the relationship between credit spreads and consumption and investment.*

E for Effort, P for Propaganda

But whether Blinder and Zandi realize it or not, all they have shown with their modeling exercise is that they believe in bailouts, that they believe (very much so) in Bernanke, and that their belief extends to two decimal places. Their paper represents nothing more than a high-level guessing game which has been given a veneer of empiricism and mathematical rigour. And they don’t even tell us exactly what their guesses are, or why they make them. They just give us the results and stamp them with their ostensible authority – which is all the ruling class really needs or desires, anyway: Princeton, “chief economist,” two decimal places. That is to say, “Fall in line, plebs; do as you’re told; forget what has been done to you. THE BAILOUTS WORKED." Economist Arnold Kling is right, the Blinder-Zandi paper is little more than "propaganda dressed up as research."

*The only caveat I can offer here is that not all of the deficit spending is, of course, due to fiscal "stimulus," and Blinder and Zandi include a good portion of deficit spending is included in their "baseline" scenario. This much is standard practice. But if we follow Denninger's analysis, the financial interventions, on their own, merely kept GDP from shrinking more than it in fact did. The methodological difficulties in accounting for the effectiveness of TARP, e.g. still stand, however.

Having already taken the Bailout Stakes, insider favorite "Macro-Model" gets ready for the Propaganda Derby.