Obama's Brand New Houseowner Bailout Means YOU Will Be Paying For All Those Deadbeat Home-Equity Loans (Call The White House @ 202-456-1414 & Pass It On)

Happy to pay for your home-equity loan, neighbor.

##

President Stimulus has unleashed the sound and the fury. Two-hundred billion for capital investment that's nothing more than cash for clunkers X 50. Also $50 billion for infrastructure. Listen Jackwagon, maybe you should have thought of that with your first stimulus. And just this afternoon, a brand new loan-mod program that has some distressing details. Ultimately it's a stealth bailout for banks and mortgage-debtors who borrowed to finance a luxury lifestyle, and now can't afford to pay it back.

Congratulations! You're going to be paying for your neighbor's home-equity loan.

The program must resolve a stubborn problem that has hindered every other modification program: how to deal with second mortgages. The program says second liens must be reduced so that the total mortgage debt is less than 115% of the home's current value. The government will make payments for banks to reduce those loans, but banks have been very reluctant to write down seconds that are current.

The big-picture aim of the program is to prevent walkaways, as it targets houseowners who are current on their payments but facing a negative equity situation where their house is worth less than the outstanding mortgage. It's essentially a government sponsored, taxpayer-funded mortgage program for principal writedown.

There are 2 problems. Mortgage holders don't deserve a writedown at the expense of everyone else, and 2nd, 3rd (4th and 5th -- see below) mortgages are being included.

This is an affront to taxpayers and must be stopped. The thought of borrowed dollars from the next generation being used to writedown deadbeat home-equity loans for the irresponsible, is not pleasant. Keith Jurow has an important piece on HELOCs this morning. Check out this example:

Although the average outstanding HELOC balance is roughly $49,000 now, this figure hides the real problem. The average HELOC written in California for residential purchase in 2004 was $150,000 and in 2005 was $139,000. Hundreds of thousands of Californians took out a HELOC and then refinanced it several times to pull cash out from their growing equity. Here is an example of how it worked from a recent post on IrvineHousingBlog:

"The original sales price is not clear from my records, but it looks as if the buyers paid about $1,200,000 in 1997. There was a $900,000 loan which I assume was 80% of the total purchase price. The original owners were a couple, and after the point where only the wife is on title in 2004 -- presumably after a divorce -- the HELOC abuse became truly remarkable.

- On 3/11/2004 the wife appears alone on title, and the first mortgage is $999,800.

- On 8/30/2004 she refinanced with a $1,000,000 first mortgage.

- On 12/28/2005 she refinanced with a $2,170,000 first mortgage.

- On 2/1/2006 she got a HELOC for $250,000.

- On 8/22/2006 she refinanced with an Option ARM for $2,500,000.

- On 11/15/2006 she opened a HELOC for $490,000.

- On 8/1/2007 she refinanced with another Option ARM for $3,225,000.

- On 10/22/2007 she opened a HELOC for $500,000.

- Total property debt is $3,725,000.

- Total mortgage equity withdrawal is $2,725,200 during a four-year stretch."

Of the 13.2 million outstanding HELOCs, it is not far-fetched to estimate that at least 95% of these borrowers are in "negative equity" when you add the first and second liens together. For California, the figure could be 98%.

DB here. A quick list of what you'll be paying for: Luxury cars and SUVs, swimming pools, vacation homes, boats, boob jobs, plastic surgeries, big fat diamonds for wives & girlfriends, European vacations, weeks at the beach in Bali, cars for the kids, country-club memberships, designer dresses, that fun weekend in Paris, the time in Mallorca when they saw Paris Hilton blow coke off a monkey's butt, tennis and golf lessons for the kids, a personal trainer for mom, a hair transplant for dad, and those really cute dog outfits -- in every color.

Pretty much anything you can imagine, that bill is coming to you. Multiple HELOCs were cash-flow rivers flowing through bubble states like honey down a grizzly bear's ass. Everybody who was anybody financed their lifestyle through house-ATM withdrawal machinations. And now, Obama wants you to pay for it.

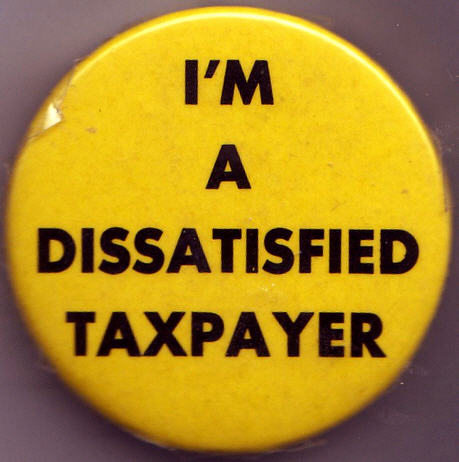

This should be the final straw for voter outrage. The frugal and wise are being asked to carry the bloated and profligate.

Call the White House now @ 202-456-1414 and tell the switchboard operator how you feel about the new houseowner bailout and especially the part about bailing out underwater home-equity loans.

Write off those 3 helocs Mr. Deadbeat, the taxpayer thinks you need a hand.

##

Just posted:

Related reading:

Please share this story. Facebook, Twitter, Digg, Reddit, anywhere and everywhere. Use your imagination. Thank you.

PLEASE email, facebook, re-tweet, share and take our stories with you when you leave. Our only weapon against the madness is GREATER AWARENESS. Just by sending this story to a few friends, you'll be contributing to the formation of an aggressive, educated voter base that understands the economic peril of our failed debt, deficit and spending policies. Thank you.

Sep 7, 2010 at 1:24 PM

Sep 7, 2010 at 1:24 PM

Reader Comments (31)

http://www.businessinsider.com/obama-set-to-launch-brand-new-homeowner-bailout-on-tuesday-2010-9#ixzz0yrnQmnVN

http://online.wsj.com/article/SB10001424052748704323704575461920164400014.html?mod=WSJ_hps_LEFTWhatsNews

Read this whole piece...there's much more to it than i showed in the story...

I draw the line on taxpayer bailouts of housing at 2nd mortgages...this is infuriating...i can't imagine how renters must feel about it...

http://dailybail.com/headlines/saving-us-water-and-sewer-systems-will-be-costly.html

http://dailybail.com/home/geithner-makes-shocking-hamp-admission-federal-loan-modifica.html

http://www.realestatechannel.com/us-markets/residential-real-estate-1/housing-bubble-home-equity-lines-of-credit-heloc-second-mortage-lien-holders-home-foreclosures-bank-failures-the-new-york-times-keith-jurow-3122.php

http://www.realestatechannel.com/us-markets/residential-real-estate-1/real-estate-news-mortage-refiancing-real-estate-bubble-fdic-financial-crisis-inquiry-commission-president-obama-home-equity-lines-of-credit-heloc-2633.php

Keith Jurow...

http://www.marketwatch.com/story/europe-stress-tests-understated-debt-report-2010-09-07

http://www.businessinsider.com/can-the-economy-even-recover-when-92-of-the-population-things-things-are-horrible-2010-9#ixzz0yrrxfTVe

http://tpmdc.talkingpointsmemo.com/2010/09/how-blanche-lincoln-fell-so-so-far-behind-in-arkansas.php

She's getting her ass kicked by 30 pts...

http://tpmdc.talkingpointsmemo.com/2010/09/odonnells-greatest-hits.php

http://tpmmuckraker.talkingpointsmemo.com/2010/09/georgia_man_wants_tea_partiers_to_join_his_patriotic_pyramid_scheme.php

http://www.huffingtonpost.com/2010/09/01/dirty-sexy-politics-meghan-mccain_n_701835.html

http://www.irishtimes.com/newspaper/breaking/2010/0907/breaking33.html

As with PPIP, does Treasury/FHA think we're stoopid?

Also, the WSJ article mentioned "other incentives" for lenders to take write-downs, but it doesn't say what these are. I searched Treasury and FHA's websites, but I got nothing.

Do they even know what the hell they're doing? Maybe someone should do a Mark McHugh and write the geniuses at FHA. This is eerily reminiscent of the PPIP trial balloon (which crashed and burned like a lead zeppelin). Maybe if we make enough noise we can crash this one, too.

http://www.businessinsider.com/obama-200-billion-tax-break-for-business-2010-9#ixzz0yrt3QQ7Z

http://www.bloomberg.com/news/2010-09-07/hungary-romania-serbia-struggle-to-sell-debt-after-receiving-imf-funds.html

http://ftalphaville.ft.com/blog/2010/09/07/335821/goldman-still-expects-a-further-1-trillion-of-qe/

By PETER ORSZAG

http://www.nytimes.com/2010/09/07/opinion/07orszag.html?_r=2&adxnnl=1&ref=opinion&adxnnlx=1283854975-KzXmTlEVkPr6zznIS9xN4A

“Clearly there are signs of a softening labor market, but when we consider what we are hearing from our clients and by looking at our own business, there is reason to be cautiously optimistic,” said. Manpower Inc. Chairman and CEO Jeff Joerres. “The hiring intentions for the fourth quarter are not enough to break through the labor market sound barrier that we’re all eagerly anticipating, as 71 percent of employers indicate no change in hiring.”

Of the more than 18,000 employers surveyed, 15% anticipate an increase in staff levels in their Quarter 4 2010 hiring plans, while 11% expect a decrease in payrolls, resulting in a Net Employment Outlook of +4%. When seasonally adjusted, the Net Employment Outlook improves slightly to +5%. Seventy-one percent of employers expect no change in their hiring plans. The final 3% of employers indicate they are undecided about their hiring intentions

Krugman whines that the stimulus from Obama is too small...punk...

--

Me, too. I'm hoping for another Santelli moment.

http://www.cnbc.com/id/39037554/

Now, the White House proposes that for homeowners, up-to-date on payments but whose mortgages exceed value of their homes, banks and investors forgive the equity gap and the Federal Housing Administration back up new mortgages on the market values of those homes.

Wisely, banks and investors are reluctant to write-off debt on performing loans—they may actually get out what they are owed in the long run. Banks are likely to hoist on to the FHA—and the taxpayer—homeowners they believe are likely to fall behind on payments soon.

It’s another election year ploy that will blow up later, because those new loans will fail and require much higher fees for honest FHA mortgages.

When Republicans point out the shortcomings of those proposed jobs and mortgage initiatives, President Obama will cast them as cynical defenders of the rich.

http://www.youtube.com/user/fiercefreeleancer

How The FDIC Is Killing Short Sales: The Story Of OneWest, IndyMac & Taxpayer Funded Sweetheart Deals (VIDEO)

http://dailybail.com/home/how-the-fdic-is-killing-short-sales-the-story-of-onewest-ind.html

I'm beginning to think nationalizing the banks is a good idea. The greedy bastards have outsmarted, outmaneuvered, and screwed everybody. Hell we probably should start sending out taxes to the big Wall Street Banks. It appears they're going to get most of it anyway if our incompetent government has anything to with it.

Jefferson was right!

We pointed out the long term ramifications of bailing out failure in September of 2008. You have to let the profligate go bankrupt. LET THEM FAIL and stop forcing taxpayers to BAILOUT the debt peddlers, or face the coming TAX REVOLT.

Why does anyone pay taxes at all?

Because you have property, and STUFF, that the government will seize, if you don't.

And you don't want to lose all that STUFF. But the people who can't pay taxes cause they're up to their asses in debt have STUFF too, STUFF that they BORROWED on credit. And you're being forced to BAIL OUT their creditors (1) because you are frugal, and made the sacrifices today to have a secure financial future, and (2) others chose to borrow a fantasy lifestyle today.

When government steals from the prudent to pay the creditors of the profligate, you create a TAX REVOLT!!! (it'll be a future post at letthemfail.us)