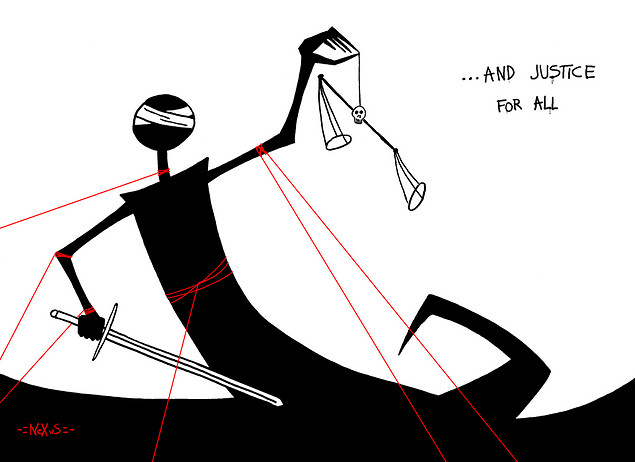

Lawyer Accuses Nevada Supreme Court Of 'Predetermining' Foreclosure Cases In Favor Of Banks

Source - Las Vegas Review Journal

A lawyer accuses Nevada District Judge Donald Mosley and other judges of predetermining the outcome in foreclosure disputes in favor of the lenders, according to an appeal filed with the Nevada Supreme Court.

In the process, they have made a "mockery" of a program designed to rescue distressed homeowners, attorney Jacob Hafter says in court papers.

A 2009 state law gives judges the authority to modify loans if lenders fail to abide by Nevada Foreclosure Mediation Program guidelines.

Hafter said Mosley -- and by implication the high court -- had previously discussed how Nevada courts would rule in these disputes. During a foreclosure hearing for Hafter client Carl Piazza, Mosley said he would never sanction a lender for bad faith by modifying a loan from the bench.

"That's something we resolved for, basically, since this program began, that the judges, and the Supreme Court was part of this discussion, are not going to, in this forum, start modifying loans; just would not do (it)," Mosley said during the October hearing.

--

Now take a look at a letter from the Hafter to Judge Mosley:

Analysis from Daily Bail resident Supreme Court licensed attorney 'Cheyenne':

Jesus H. Christ. This is unbelievable. That attorney is kicking the shit out of a judge in public, suggesting that a good part of the bar is behind him, adumbrating that there is collusion on the High Nevada Bench, and requesting recusal. In short, he has declared war on this judge and indeed the system itself.

That's the most incredible feckin' letter I've ever read from a member of the bar to his court, by far.

P.S. Note that the lawyer here is licensed before the U.S. PTO. Chances are he's got a background in science or engineering.

Feb 22, 2011 at 11:25 PM

Feb 22, 2011 at 11:25 PM

Reader Comments (16)

Mortgage Rule Could Exacerbate Housing Slump

Walmart Sales Fall For Seventh Straight Quarter In Q4, As U.S. Stores Struggle

Judge must have been fuming...it's an annihilation...

Fortunately it's not the ENTIRE government, just the executive branch, the legislature, and various courts like the one discussed here. (Taibbi's fantastic piece on Florida judges brought out of retirement to do the banks' fraudulent bidding is on point as well.) There are, despite what the media would have you believe, a growing number of jurists who are onto the banks' fraud.

The most comprehensive and practical site I've found online relating to foreclosure fraud is this one:

http://www.msfraud.org/

In particular, the law library tab, sub-tab lounge, provides a well-organized guide to navigating foreclosure law. It's not the most aesthetically pleasing site, but damn is it good.

I searched the site for "hafter" (the outraged Nevada attorney mentioned in DB's post), and nothing turned up.

Finally, a shout out to commenter john who recently linked the Jacob Hafter letter in the comments here.

Sounds like not much difference between the Nevada Supreme Court, and the Supreme Court of the United States.

When it comes to justice special interests go to the head of the line and win even if they comitted fraud to get there.

Sell Short--

Not the ENTIRE government are banking myrmidons. There is a growing pocket in the judiciary that is onto the banks' fraudulent ways. There are plenty of websites that track legal rulings that find against the banks in foreclosure cases, and on many different grounds The most comprehensive of these that I know of is this one:

http://www.msfraud.org/

In particular, go to the library tab, then to the lounge sub-tab, and you'll see entire categories of case law where the banks go down for the count. It's awesome.

Outside of foreclosures, who can forget Judge Rakoff's savage beat down of both Bank of America AND the S.E.C. itself for being complicit wrong-doers?

"In other words, the parties were proposing that the management of Bank of America—having allegedly hidden from the Bank's shareholders that as much as $5.8 billion of their money would be given as bonuses to the executives of Merrill who had run that company nearly into bankruptcy—would now settle the legal consequences of their lying by paying the S.E.C. $33 million more of their shareholders' money."

"This proposal to have the victims of the violation pay an additional penalty for their own victimization was enough to give the Court pause. The Court therefore heard oral argument on August 10, 2009 and received extensive written submissions on August 24, 2009 and September 9, 2009. Having now carefully reviewed all these materials, the Court concludes that the proposed Consent Judgment must be denied."

And that's just on page one, the appetizer. Check out the whole enchilada:

http://scholar.google.com/scholar_case?case=14424144582837922601&q=rakoff+bank+america+s.e.c.&hl=en&as_sdt=800003

Let's face it: the president is owned by the banks, so is the functional entirety of congress. But Article III courts, not so much. And that's a bad thing for defendants on the wrong side of the law in a litigious, not to mention gun-owning, society. I don't care how big the defendant is, or how many media outlets he controls. If he doesn't control all the judges--and it sure doesn't look like it--eventually he's gonna bump into a jury the wrong way.

They are going to mess with everything and everyone until someone puts a bump on their head.

just a lil' joke...I'm with the "patent" lawyer here, as I am a member of the patent bar as well...and my guess is the judge in this letter had not read the judicial code of conduct in while, if ever...now he does not have to...

Where do you practice? I worked in a couple of Chicago firms with significant patent litigation books. It's a job that if done right sharpens the mind. You just can't do it forever, it's too much.

http://www.msnbc.msn.com/id/26760673/ns/politics-decision_08/

McCain has been in the pocket since the Keating 5 days. You will never see a candidate make it through the primaries of either party that is not firmly in the pocket.

Hence my favorite quote for all times;

“Sometimes the law defends plunder and participates in it. Sometimes the law places the whole apparatus of judges, police, prisons and gendarmes at the service of the plunderers, and treats the victim - when he defends himself - as a criminal.”

Frederic Bastiat

Gendarmes, get your Gendarmes here! they ain't cheap but they are loyal... The whole establishment is for sale at fire sale prices.

http://esrati.com/supreme-stupidity-best-politicians-money-can-buy/4165/

“We have the best government that money can buy.”

Mark Twain

Ga, although I did and do mostly transactional and patent prosecution work (arcane area most general lawyers do not know about, understand, or care to...Kathy Bates' character in Harry's Law calls it "boring as shit"...)

...and define "forever"--my Dad has been at patent law (prosecution and litigation) for 50 years, everyday...he says it keeps his mind sharp. That, and crossword puzzles...

The tides are turning whereby people without legal knowledge will always be disadvantaged about recognizing things such as foreclosures that become filed in names of defunct mortgage companies, filed with fees beyond “Acceleration Clauses,” and filed in Bankruptcy Courts with falsified “Lift Stay,” motions and false “Proof of Claims” documents by some foreclosure mill lawyers, for express purposes of achieving “simulated” foreclosure auctions via “straw buyers.”

DEBT COLLECTION Lawyers are officers of the court; knowledge of applicable laws and civil procedure is not required from mortgage lenders. In states that require judicial foreclosures, lawyers are the ones who file lawsuits to seize and sell property; and lawyers are responsible for filing and recording foreclosure property deeds.

Aside from property owners not having adequate legal knowledge so they can challenge unlawful foreclosures, there is the additional, unfortunate matter of property owners being instructed that they need to bring to foreclosure AUCTIONS the entire amount of the “accelerated” loan debt. Since they don’t have such $$$$$$$ to redeem their homes, they stay away from the foreclosure auctions; and they don’t poke into whether recorded property deeds or conveyances after foreclosure auctions, were legitimate and enforceable! When property owners are absent from foreclosure auctions, it is easier for foreclosure fraud to culminate. Even in property owners’ presence, illegal auctions can happen when there is limited awareness as to what constitutes a completed LAWFUL foreclosure.

It would not be easily detectable to the average person when an illegal “CREDIT BID” has been made on a foreclosed home. When people are absent from purported foreclosure auctions, they have little chance of preventing unlawful “credit bid” by third party home buyers, “straw purchasing”, illegal recorded property deeds, and so on.

Equally unfair to people who are oblivious about untoward foreclosures, is the reality that foreclosure frauds are carried out, NOT by bankers and lenders, but by lawyers / members of the bar. The foreclosure lawyers who deliberate engage in fraud are the reason why people become ILLEGALLY assessed with “Deficiency Judgments”! (and THUS DEBT COLLECTORS, wrongfully / unfairly enter the picture and EXPLOIT people!)

**Request for fraudulent foreclosure investigation @ http://www.change.org/petitions/view/request_for_congressional_foreclosure_panel_to_examine_foreclosure_lawyers#

**and see:

Open Letter to President Obama on Foreclosure Crisis (re: Wells Fargo) @ http://bit.ly/cyGXs0

LEHMAN BROTHERS; Foreclosure Fraud, Conspiracy, Wells Fargo; Deceptive Judicial Filings @ http://bit.ly/e2fYoE

Foreclosure Fraud Assault -A Cry For Help by Alan Gray @ http://bit.ly/9KVcNw (re: Wells Fargo)

Foreclosure fraud, Wells Fargo and the Massachusetts S. Ct; and State Attorneys General @ http://bit.ly/dI0ySo

What Are Those Mortgage Servicers Doing? SUPER FUTURE EQUITIES v WELLS FARGO @ http://www.bankruptcylawnetwork.com/wp-content/uploads/2007/05/super-future-v-wells-fargo-et-al-complaint.pdf