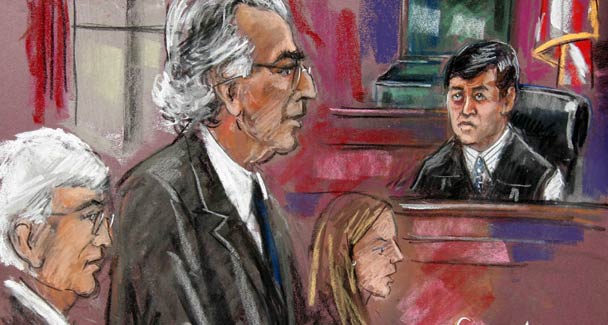

Citigroup Saw Warning Signs, Knew Of Madoff Fraud; Picard Suit Wants $430M In Damages

Citigroup ignored warning signs of Bernard L. Madoff’s Ponzi scheme, and a bank executive knew the con man’s stated trading strategy couldn’t generate the reported returns, the trustee liquidating Madoff’s firm said in a lawsuit.

The unidentified Citibank executive, who was responsible for making recommendations to clients on derivatives, “concluded” by June 2007 that returns reported by a Madoff feeder fund, Fairfield Sentry Ltd., couldn’t have come from the strategy, trustee Irving Picard said in a complaint unsealed yesterday. The executive reached his conclusion after meeting with analyst Harry Markopolos, a whistleblower who also alerted U.S. regulators to the fraud, Picard said.

The Citibank official later communicated with Markopolos orally and in writing, specifically discussing the fraud before the Ponzi scheme was exposed in December 2008, Picard alleged.

“Citi knew, and was on notice of, irregularities and problems concerning the trades reported by BLMIS, and strategically chose to ignore these concerns in order to continue to enrich themselves,” Picard said in the complaint, referring to Madoff’s firm, Bernard L. Madoff Investment Securities LLC.

Picard laid out in the complaint details of a lawsuit he filed under seal in December against New York-based Citigroup and other banks. He is demanding $425 million from Citigroup - money it received “in connection with” a loan to a Madoff feeder fund and a swap transaction with a Swiss hedge fund linked to a second feeder fund, Picard said.

Continue reading at Bloomberg...

--

We first got an inkling of Picard's filing from this Bloomberg story in December.

Citigroup, Bank of America Sued by Madoff Trustee

Citigroup Inc.’s Citibank, Bank of America Corp.’s Merrill Lynch unit and five other banks were sued by the trustee liquidating Bernard Madoff’s firm to recover more than $1 billion for the con man’s defrauded customers.

The banks, which include Natixis SA, Fortis Prime Fund Solutions Bank (Ireland) Ltd., ABN Amro Bank NV, Nomura Bank International Plc. and Banco Bilbao Vizcaya Argentaria SA, received money through Madoff feeder funds when they knew, or should have known, that Madoff’s investments were a fraud, the trustee, Irving Picard, said yesterday in a statement.

Picard, who faces a two-year legal deadline that runs out Dec. 11, has filed hundreds of suits in the past month, seeking more than $34 billion from banks, feeder funds, investors and others alleged to have profited from Madoff’s decades-long Ponzi scheme, the biggest in history. So far, Picard has recovered about $2.5 billion for victims of the fraud.

http://www.bloomberg.com/news/2010-12-09/madoff-trustee-picard-sues-citibank-merrill-nomura-banco-bilbao-vizcaya.html

---

We have been unable to locate a copy of Picard's Citigroup suit, but did find the J.P. Morgan lawsuit.

Madoff Trustee Irving Picard's suit against J. P. Morgan...

Meanwhile, back in the joint, CNBC reports:

Allen Stanford and Bernie Madoff In Same Prison

Accused Ponzi schemer Allen Stanford has joined convicted Ponzi schemer Bernard Madoff at the federal prison complex in Butner, North Carolina.

CNBC first reported Tuesday week that Stanford would be transferred to the facility for drug treatment. In January, U.S. District Judge David Hittner ruled that Stanford was incompetent to stand trial and ordered the drug treatment. Hittner suggested it take place in Butner, which has a well-regarded prison hospital, and federal officials agreed.

Stanford and Madoff will likely never encounter each other. Madoff is serving a 150-year sentence in the complex's medium security unit.

---

From last week...

Feb 23, 2011 at 1:41 AM

Feb 23, 2011 at 1:41 AM

Reader Comments (6)

The trustee for jailed fraudster Bernard Madoff has claimed in a lawsuit that Citigroup ignored warning signs of the multi-billion dollar Ponzi scheme, it was reported on Tuesday night.

http://www.telegraph.co.uk/finance/financetopics/bernard-madoff/8342034/Bernard-Madoff-Citigroup-ignored-Ponzi-scheme-warning-signs-claims-trustee-Irving-Picard.html

Citigroup Inc.’s Citibank, Bank of America Corp.’s Merrill Lynch unit and five other banks were sued by the trustee liquidating Bernard Madoff’s firm to recover more than $1 billion for the con man’s defrauded customers.

The banks, which include Natixis SA, Fortis Prime Fund Solutions Bank (Ireland) Ltd., ABN Amro Bank NV, Nomura Bank International Plc. and Banco Bilbao Vizcaya Argentaria SA, received money through Madoff feeder funds when they knew, or should have known, that Madoff’s investments were a fraud, the trustee, Irving Picard, said yesterday in a statement.

Picard, who faces a two-year legal deadline that runs out Dec. 11, has filed hundreds of suits in the past month, seeking more than $34 billion from banks, feeder funds, investors and others alleged to have profited from Madoff’s decades-long Ponzi scheme, the biggest in history. So far, Picard has recovered about $2.5 billion for victims of the fraud.

http://www.bloomberg.com/news/2010-12-09/madoff-trustee-picard-sues-citibank-merrill-nomura-banco-bilbao-vizcaya.html

Accused Ponzi schemer Allen Stanford has joined convicted Ponzi schemer Bernard Madoff at the federal prison complex in Butner, North Carolina.

http://www.cnbc.com/id/41679265

I emailed you Picard's Citigroup-Madoff complaint. Like the JPM complaint here (it was filed by the same firm and lead counsel), the names of bankers and bank officials have been redacted. But whereas the complaint here seeks more than $5 billion in damages, the complaint against C seeks less than $500 million.