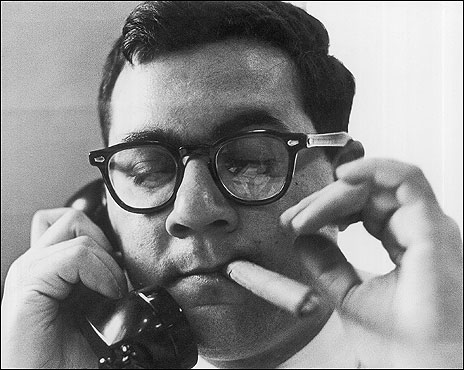

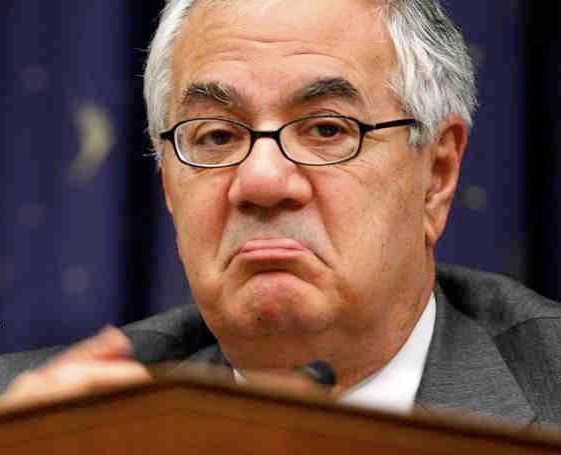

Bail Out Barney: Barney Frank On Mark To Market Accounting, The Financial Crisis And Market Regulation (CNBC Video March 31)

Lawmakers are considering an overhaul of financial services industry regulation. Insight on the process, with Rep. Barney Frank, Financial Services Committee chairman (D-MA).

For today's show, producers assembled one of the better Squawk Box casts of 2009. Roubini, Taleb, Huffington and Barney Frank. In this 16-minute clip Frank discusses AIG, bonuses, financial regulation, executive compensation, TARP, bank bailouts, GM, the auto bailout, and mark-to-market accounting with Huffington and the regular Squawk crew.

For the record and as I've written about extensively, changing MTM accounting rules is a mistake. Granting some form of regulatory leniency on capital requirements is a smarter idea, but it likely has no chance against the stampede of ignorance in Congress.

Not only does Barney Frank support the removal of FASB 157, he is quoted in this Marketwatch article supporting retroactive mark-ups on certain assets. The FASB vote is Thursday.

Mar 31, 2009 at 6:46 PM

Mar 31, 2009 at 6:46 PM

Reader Comments (7)

1) He has nothing to say about why FDIC hasn't done its job already, while at the same time he deflects any responsibility for AIG by saying "The Fed did it! If it were a bank, then FDIC would have..." Well, no they wouldn't have, because they didn't.

2) He doesn't want to "speculate" about how much of OUR TARP money will be given back. (I'm guessing not a whole lot, at least not until PPPIP has done its dirty job.) It's all about him, see -- it's all about the media picking on poor congress critters and setting them up for failure. Notice not one single iota of concern for the fact that we are getting ripped off.

3) Most astonishing of all, he still seems to think that this is a temporary "liquidity" problem, and that in a couple of months or years the CDO and other MBS prices will just magically re-inflate themselves. He seems to think that the banks actually are capable of giving the money back -- we are already nine degrees beyond insanity, why would anyone think the banks are just pretending to be terminally insolvent?

Unbelievable.

http://www.youtube.com/watch?v=aTpKQWNX8bE

I don't know who bought and paid for Jim Bunning, but tell us where we can buy some more!

Under the newly relaxed "mark-to-market" rules, I can actually claim to be John Holmes.

Thanks Paine Webber! <-- old skool