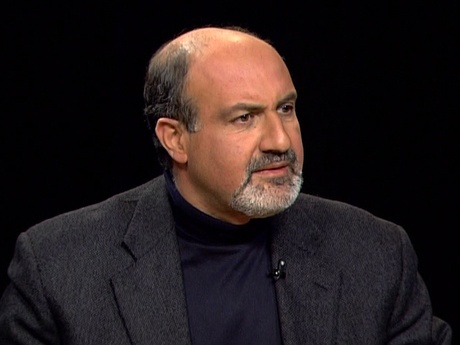

The Black Swan Doesn't Need A Bailout: Dr. Nassim Taleb Says "Bernanke Should Be Removed From Office" (CNBC Video March 31)

Nassim Taleb made an appearance on Squawk Box this morning with Arianna Huffington and the crew. The discussion of failed banks dominated. Taleb correctly demands that those in power who did not see foresee the crisis should be removed. Federal Reserve Chairman Ben Bernanke is singled out. How can we rely on failed leaders to extract us from a crisis they neither understood nor saw coming. The bank bailout crisis continues in his view because the same disgraced few are attempting to continue with the old order.

- "Myron Scholes should be in a retirement home doing Sudoku."

- "Remove people from office who oversaw and caused the build-up of hidden risk in the system. Bernanke and others."

- "The academic economics establishment failed us. Their econometric systems failed."

- "All but the least complex of derivatives should be eliminated."

- "Doing away with mark to market accounting equates to putting your head in the sand."

From CNBC:

Altering mark-to-market accounting rules would bring more opacity to the financial system, said Nassim Taleb, “The Black Swan” author.

“It’s exactly like how a thermometer makes a patient look more sick,” he said in a CNBC interview. “Eliminating the mark-to-market is exactly like putting your head in the sand.”

Rather than taxpayers propping up large banks, Taleb said, the hedge fund model should be followed.

“Some go bust, some do okay, some have problems,” he said. “We don’t care. It’s their problem. It’s not society’s problem.”

Fixing the financial crisis requires a financial system with less debt and less complex derivatives, he said. The solution is not to alter the current financial structure, said Taleb, but rather, to look for “robustness” in the system.

“Complexity causes fragility,” he said. “You’re no longer riding a horse—you’re flying a Concorde. A horse doesn’t explode but a Concorde can have a problem. We now have a Concorde in our hands.”

Mar 31, 2009 at 3:07 PM

Mar 31, 2009 at 3:07 PM

Reader Comments (19)

I'll be putting together something on this next.

http://abcnews.go.com/search?searchtext=cassano&type=

http://www.bloomberg.com/apps/news?pid=20601087&sid=armOzfkwtCA4&refer=home

http://www.bloomberg.com/apps/news?pid=20601087&sid=aNqa2y1RGKEA&refer=home

http://www.washingtonexaminer.com/politics/Beyond-AIG-A-Bill-to-let-Big-Government-Set-Your-Salary-42158597.html

http://www.cnbc.com/id/29971155

"Morgan Stanley's John Mack is honest."

No, he wants to be perceived as being honest. There is a difference. Suffice to say I am not a member of the John J. Mack fan club, nor of Philip Purcell, NASD, or FINRA.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aJX.sej6xrYE&refer=home

"Morgan Stanley, the second-largest securities firm, will pay $12.5 million to settle regulatory claims it wrongly withheld e-mails in arbitration cases by saying they were lost in the Sept. 11 attacks, the company's third sanction since 2002 for mishandling the records."

"Current CEO John Mack made improving the firm's standing with securities regulators a priority when he took the helm in June 2005. Today's accord resolves a claim filed in December by Finra's predecessor, NASD."

Albert Einstein

Doesn't the american media 'do' intelligent discussion programs any more?

Was the music played to wake up the hillbillies and get them dancing their way to economic prosperity?

What is wrong with just silence and human voices?

Absolutely yes. In our post apocalyptic, anti-narcoleptic, MTV driven culture, entertainment rules.

"Does he rock people? Is he a football player?"

"No, he's a banker, a trader."

"Oh, he's a bad guy?"

You know, doesn't that just about sum it up?

I did explain the difference...

Yeah, but it is not cool like back in the day. Music has really gone to hell...