Mike Mayo: Send Citigroup And Bank Of America To 'Minor Leagues' For Breakup: "We Don't Have Capitalism, We Have Entitlement"

Big banks that haven't been performing should be broken up before they become a threat to the entire financial system, banking analyst and author Mike Mayo told CNBC.

"Let's go bank by bank, company by company, CEO by CEO, chairman by chairman, let's just go down the list...and start cleaning house," he said.

Looking at specific institutions, Mayo pointed to Citigroup Chairman Dick Parsons and said, "I don't know how he still has a job."

Full write-up inside. This is a great interview.

Former NYSE Chairman Dick Grasso On High Frequency Trading: "Throw The Scalpers Out The Door"

CNBC Video - Grasso with Kernen on Squawk Box - Oct. 28, 2011

Clip runs 1 minute. Grasso is wrong. The entire practice should be banned. He tries to make a distinction that doesn't exist. Market makers are now and have always been scalpers, by the nature of their business. I've been around long enough to remember 50-cent spreads on $10 dollar stocks, with Knight Trading sitting on the bid and ask all day long, fat and happy. And a world without HFT will not revert to dramatically wider spreads as some argue with the proliferation of independent exchanges.

Harkin, Defazio To Propose Financial Transaction Tax

This will never pass, not with high-frequency trading being so lucrative for investment banks and hedge funds.

Watch Herman Cain Randomly Break Out Into Song During Press Conference At The NPC (Video)

Hours after Politico’s story broke about the sexual harassment allegations against GOP presidential candidate Herman Cain, the former Chairman of the Kansas City Federal Reserve appeared at The National Press Club to confront questions about the scandal, and decided to sing about his faith.

I honestly don't know what to say about this one. Maybe he expected Bernanke to join him on stage, for a money-printing duet.

---

Dick Grasso With Joe Kernen On Occupy Wall Street: "I Understand The Anger, Banks Gave Capitalism A Bad Name"

CNBC Video - Oct. 28, 2011

Kernen has gotten religion. Grasso, the former head of the NYSE who left with more than $100 million, not so much. This is a very revealing interview. Kernen stands up for the anti-bailout complaints of Wall Street protesters, and attacks the bonus culture and lack of clawbacks. Don't skip this.

Lawyer Tells Bankruptcy Judge: All MF Global Funds Accounted For, Held by Brokerage

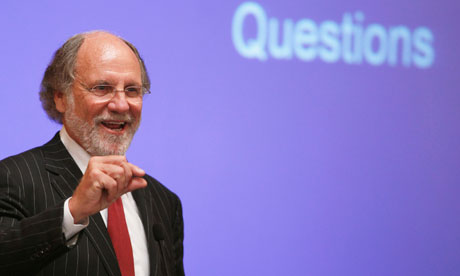

MF Global Holdings Ltd. (MF), run by former New Jersey governor and Goldman Sachs Group Inc. (GS) co- chairman Jon Corzine, has accounted for all its customer funds, said Kenneth Ziman, a lawyer for MF Global, citing the company’s management.

“To the best knowledge of management, there is no shortfall,” Ziman told U.S. Bankruptcy judge Martin Glenn in Manhattan, who inquired about whether a shortfall in customer accounts would affect the case, citing media reports that hundreds of millions of dollars were missing. Most of MF Global’s U.S. assets are held at its brokerage unit, Ziman said.

JPMorgan: MF Global’s Bankruptcy Filing Is Wrong

According to the bankruptcy filing, here are the top unsecured creditors and investors in MF Global. Notice CNBC on the list for advertising on Bubblevision.

CNBC Update - Tracking The Missing Funds From MF Global

Runs 2 minutes. Update from about an hour ago. Comments from the CME and CFTC.

Nov 2, 2011 at 1:06 PM

Nov 2, 2011 at 1:06 PM