BREAKING - MF Global Admits Using Client Money

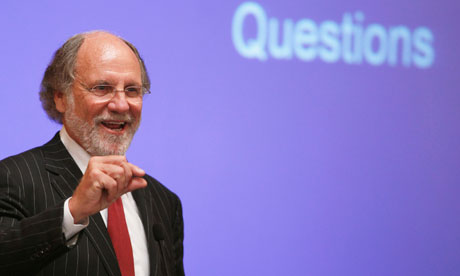

This is not looking good for former New Jersey Senator and Governor, and previously Goldman Sachs CEO Jon Corzine. More than $700 million of supposedly safeguarded client funds were stolen by MF Global to support besieged trading positions. Jon Corzine should go to prison. If Corzine escapes without a Federal ID number and associated orange jumpsuit due to fundraising ties with Obama and Eric Holder, then the game is over.

---

The admission is here:

WASHINGTON (AP) — MF Global, the failed securities firm led by Jon Corzine, admitted using clients' money as its financial troubles mounted, a federal official says.

An MF Global executive admitted that to federal regulators in a phone call early Monday after regulators discovered money missing from clients' accounts, according to an official familiar with the conversation.

The official spoke on condition of anonymity because he wasn't authorized to discuss an investigation by federal regulators.

Government rules require securities firms to keep clients' money and company money in separate accounts. Violations can result in civil penalties.

The investigation of MF Global Holdings Ltd. is preliminary. A formal investigation by the company's main regulator, the Commodity Futures Trading Commission, requires a vote by its five commissioners.

It isn't clear whether the violations could lead to criminal charges. At a news conference, Manhattan U.S. Attorney Preet Bharara would not comment on whether a criminal investigation is underway involving the revelations at MF Global.

---

1. Where were the regulators? By the time the Federal Reserve Bank of New York suspended MF Global, it was clear the firm was over leveraged, with some reports saying the ratio was 80-to-1. Client money is missing. At the very least, bookkeeping at MF Global was sloppy. Regulators and accountants should have stopped the madness before this point. The company was told to boost capital in August — but it’s clear the bank’s exposure was far greater than anticipated.

2. Where is the money? At least $700 million in client money is missing. This is a cardinal sin in the world of investment banking. Client money cannot be borrowed or mixed with house money. Should the suspicions prove true, this will be more embarrassment.

3. Why did Jon Corzine, MF Global’s CEO, claim everything was OK, in the company’s waning days? The former Goldman CEO was quoted less than a week ago saying “Reflecting the stressed markets in the quarter, we deliberately chose to reduce overall market exposure in most principal trading activities and focused on preserving capital and liquidity.”

http://www.marketwatch.com/story/3-big-questions-for-mf-global-fiasco-2011-11-01

---

Background:

Nov 1, 2011 at 3:09 PM

Nov 1, 2011 at 3:09 PM

Reader Comments (22)

http://www.marketwatch.com/story/mf-globals-risk-mismanagement-2011-11-01

http://www.bloomberg.com/news/2011-11-02/corzine-forgot-lessons-of-long-term-capital-roger-lowenstein.html

http://www.bloomberg.com/news/2011-11-01/others-pay-price-for-corzine-s-risky-revenge-william-d-cohan.html

http://www.chicagobusiness.com/article/20111108/NEWS01/111109753/harris-bank-emerges-as-starting-point-in-mf-global-investigation

http://uk.reuters.com/business/quotes/officerProfile?symbol=MFGLQ.PK&officerId=1481065

https://www.hedgefund.net/publicnews/default.aspx?story=13167

One of the e-mails referred to $200 million that MF Global owed JP Morgan Chase. Information from the e-mail chain indicates the transfer was made by Edith O’Brien, a treasurer for the firm.

Investigators believe the $200 million that JP Morgan Chase received is entirely customer money.

While O’ Brien has not been accused of any wrongdoing, she is now considered a person of interest in the ongoing investigation.

The Times also reported that authorities suspect the firm also used customer funds to settle payments with trading partners, which accounts for the remaining $1 billion that's missing.

http://www.canadafreepress.com/index.php/article/43553

Note: this article is in The Washington Times but is difficult to access.

http://mba.yale.edu/alumni/alumni_profiles/abelowb.shtml

Prior to joining MF, Brad was a founding partner of NewWorld Capital Group, a private equity firm investing in businesses active in environmental opportunities (alternative energy, energy efficiency, waste and water treatment, and environmental services).

Utilization of clients' accounts as a 'resource of fiduciary exploitation' is now the norm in the age of deregulation. Look who sits on the SCOTUS. It would cost the affected clients millions to have the black robed soldiers of the Vatican and The City of London tell them all to 'shut up and go home' and call it the 'Acme of American Jurisprudence'. I call it money in the bank for a judicial system corrupted by a foreign entity. These clients ripped off by Corzine have been doing it to others through a proxy using the 'esoteric investment skills' of this Corzine financial disease. My guess is that the chickens have come home to roost.

Bradley Abelow Relationship map:

http://www.muckety.com/5C23BED9E488BD1BF69C9C0F1E9CFF81.map

=============================

Bradley Abelow is a trustee of Century Foundation. John Podesta, the Director of the Soros Funded Center for American Progress is also a trustee.

http://www.muckety.com/510F0554BA6E714B39CE561E4DE4F745.map

===============================

Recap:

1. Bradley Abelow, an EPA financial advisory board member and Lisa Jackson the EPA Director have ties to John Corzine (who while CEO of MF Global…now bankrupt with a loss of 2,500 jobs). Each served at different times as the governor’s chief of staff.

2. Bradley Abelow also has ties to the Century Foundation (claims to be non-partisan) of which their are 22 trustees including John Podesta, the President and CEO of the Soros funded Center for American Progress.

Century Foundation website

“Progressive Ideas that Advance Security, Opportunity and Equality”

Board of Directors and Trustees

3. Mr. Abelow’s role as a financial adviser for the Environmental Protection Agency, which as of Tuesday listed him as the chairman of its financial advisory board.

It’s unclear how Mr. Abelow landed the chairmanship of the EPA financial panel, a position he noted in his biography on the MF Global website, which has since been removed.

http://uk.reuters.com/article/2012/01/04/us-mfglobal-goldman-idUKTRE8030UT20120104

[snip]

MF Global unloaded hundreds of millions of dollars' worth of securities to Goldman Sachs in the days leading up to its collapse, according to two former MF Global employees with direct knowledge of the transactions. But it did not immediately receive payment from its clearing firm and lender, JPMorgan Chase & Co (JPM.N), one of the sources said.

http://news.muckety.com/2012/01/06/freeh-blocks-regulators-request-in-mf-global-case/35741

http://www.zerohedge.com/news/40-wall-street-john-corzines-latest-office-space

40 Wall Street: John Corzine's Latest Office Space?

[snip]

It appears the Corzine-Carris ties may not be just office-space deep:

Joseph Principe, senior managing director at John Carris, declined to comment. Mr. Corzine hasn't made a decision, but he knows at least one of the securities firm's executives from earlier in his career, said a person familiar with Mr. Corzine's thinking.

One more connection between Mr. Corzine and John Carris: A list of recent transactions on the securities firm's website includes securities offerings for AMP Holding Inc., a Loveland, Ohio, designer of electric-vehicle conversion systems.

NOTE: Remember Mr.Abelow (Jon Corzine's right hand man) is the Chairman of the EPA financial panel and has interests here:

Prior to joining MF, Brad was a founding partner of NewWorld Capital Group, a private equity firm investing in businesses active in environmental opportunities (alternative energy, energy efficiency, waste and water treatment, and environmental services).

http://abcnews.go.com/Blotter/farmers-sue-jon-corzine-missing-millions/story?id=15321298#.Tw3rO5iRi5Q

[snip]

MF Global's clients included 38,000 wheat farmers, cattle ranchers and others who "hedged" their crop prices by placing millions in MF Global accounts. Those accounts were supposed to be "segregated and secure," according to the federal suit, meaning MF Global could not draw on those funds.