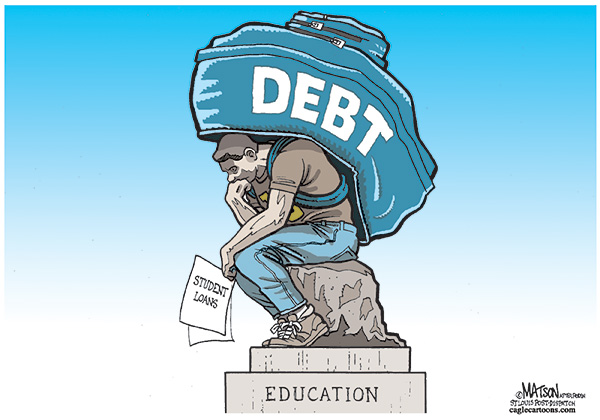

Chris Whalen: United States Risks Credit Rating Downgrade With Continued Support Of AIG And Citigroup

AIG is a dead duck.

As most of you know, embattled AIG interim CEO Frank Liddy resigned last week. Likely having realized AIG would need to ask for billions more in taxpayer subsidies, Liddy made the intelligent personal decision to step away quietly. He was unqualified for the position from the outset (he ran Allstate, a quiet domestic insurer) and was already heavily conflicted with his service on the board of Goldman Sachs, the largest recipient of AIG counterparty payouts.

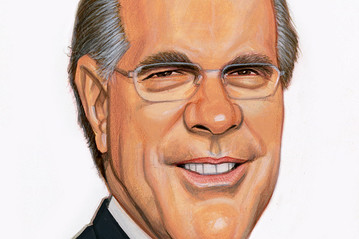

Site favorite, Chris Whalen of Institutional Risk Analytics, weighed in recently on AIG, Liddy, Citigroup and the entire sordid mess of government-sponsored zombie corporations. The most interesting observation from the short clip is Whalen's contention that Treasury risks a sovereign debt ratings downgrade with continued support of the aforementioned failing GSEs.

Tip to James for finding this video; an outstanding clip from Bloomberg is after the loop.

Jun 4, 2009 at 2:46 PM

Jun 4, 2009 at 2:46 PM