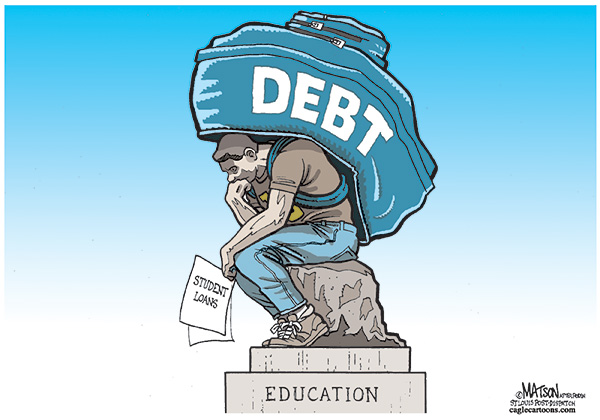

Student Loan Forgiveness: Shrinking Along With State Budgets

Here come the caveats. In a general sense, as long as we're in the mood to reward certain groups, we have a question. Who deserves a bailout?

Here come the caveats. In a general sense, as long as we're in the mood to reward certain groups, we have a question. Who deserves a bailout?

I'll take a stab at an answer: a select group of student-loan debtors and an equally select group with staggering health-care debt. Social workers, non-profit employees, teachers, nurses and home-health care employees (and others?) would all qualify. Wipe it away and watch them spend. Individual health care debt is another daunting problem for millions of families. The Feds can make it disappear with a few checks. Problem solved and millions are unleashed anew to consume mightily.

Sure, it's simplistic. And we understand the inherent injustice in bailing out anyone at the exclusion of others. But we would rather help these folks than the over-leveraged, bonus-chasing bastards of Wall Street. And so it was with interest that I read yesterday that while the Money Store remains open to inglorious banksters and failed automotive asshats, it is shutting down quickly for teachers and social workers. Nice. Our various governments are an embarrassment.

Here's the piece from Jonathon Glater of the New York Times.

May 27, 2009 at 2:49 PM

May 27, 2009 at 2:49 PM

Reader Comments (11)

http://www.usatoday.com/money/perfi/taxes/2009-05-26-irs-tax-revenue-down_N.htm

http://www.ritholtz.com/blog/2009/05/finally-bailout-nation-publishes-today/

This is what makes me the angriest -- not just the sheer injustice of the banker bailouts, but the huge disparity in how different people are affected by them. Remember, if it weren't for people like us, the asshats on Wall Street would be looking for new jobs and their bondholders would have to find new victims. I can't complain. I have plenty. But I don't have a mansion or a cappucino machine. Fucking welfare queens.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aE_j_CA8fCao&refer=worldwide

http://www.reuters.com/article/bondsNews/idUSN2832609020090528

http://online.wsj.com/article/SB124346998818460615.html

In a move with only one modern-day precedent, California Gov. Arnold Schwarzenegger and Democratic lawmakers are pressing the Obama administration and members of Congress for federal loan guarantees to help the state out of a desperate, multibillion-dollar jam.

http://apnews.myway.com/article/20090527/D98EPK2O1.html

Job Losses Push Safer Mortgages to Foreclosure

http://www.nytimes.com/2009/05/25/business/economy/25foreclose.html?_r=4&ref=global-home

You are not alone. Someone very close to me has 50k in student loan debt from getting a Masters in Social Work. And she makes 35k per year currently with 10 years of experience. She deserves a bailout of this debt certainly more than any banker.