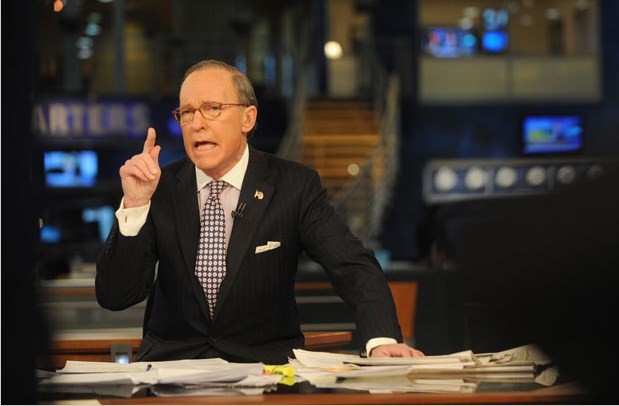

Goldman Treasury faces, from left: Steve Shafran, Kendrick Wilson III, Henry Paulson Jr., Edward Forst and Neel Kashkari .

Goldman Treasury faces, from left: Steve Shafran, Kendrick Wilson III, Henry Paulson Jr., Edward Forst and Neel Kashkari .

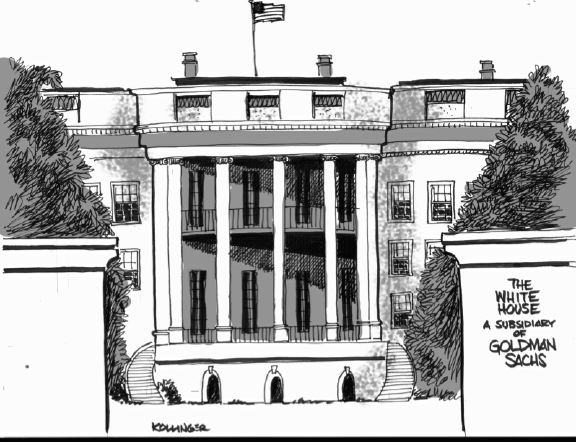

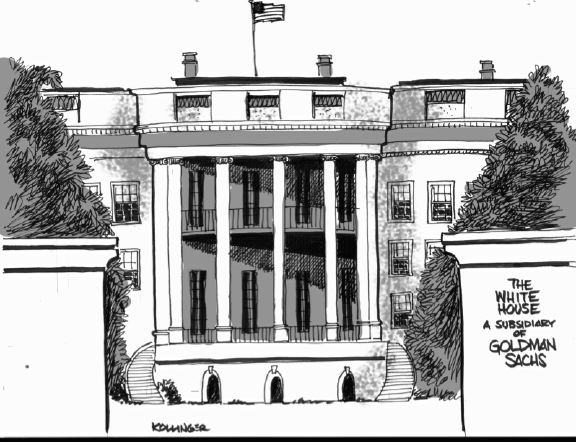

Hey suckers (myself included) check out where our tax dollars are headed: Goldman Sachs to Make Record Bonus Payout.

Government Sachs staff can look forward to the biggest bonus payouts in the firm's 140-year history after a spectacular first half of the year. Staff in London were briefed last week on the banking and securities company's prospects and told they could look forward to bumper bonuses if, as predicted, it completed its most profitable year ever.

In April, Goldman said it would set aside half of its £1.2bn first-quarter profit to reward staff, much of it in bonuses. It is believed to have paid 973 bankers $1m or more last year, while this year's payouts are on track to be the highest for most of the bank's 28,000 staff, including about 5,400 in London.

Why are they so profitable? Evaporating competition.

A lack of competition and a surge in revenues from trading foreign currency, bonds and fixed-income products has sent profits at Goldman Sachs soaring, according to insiders at the firm.

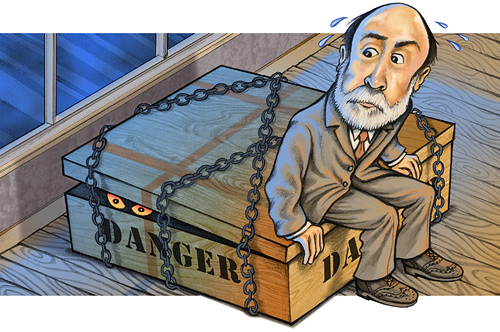

And don't forget the highly-corrupted AIG payouts to counterparties at PAR, that were ordered by B-52 and the Federal Reserve. At least $13 billion of your tax dollars have gone directly to Goldman (not including TARP) via this AIG conduit. And the AIG story is not yet finished.

And don't forget the highly-corrupted AIG payouts to counterparties at PAR, that were ordered by B-52 and the Federal Reserve. At least $13 billion of your tax dollars have gone directly to Goldman (not including TARP) via this AIG conduit. And the AIG story is not yet finished.

Also, the change to FASB 157 (mark-to-market- accounting) now allows them to fudge asset pricing on the balance sheet, thus eliminating pesky writedowns and improving earnings and therefore bonus payouts.

Then we have FDIC-backed debt issued by Goldman saving the company hundreds of millions in interest payments. Not to mention the TALF and the myriad other Fed and Treasury liquidity programs in which they participate. Have I forgotten anything? The list of taxpayer largesse is so long it's difficult to keep straight.

Click to read more ...

Jun 22, 2009 at 8:35 PM

Jun 22, 2009 at 8:35 PM