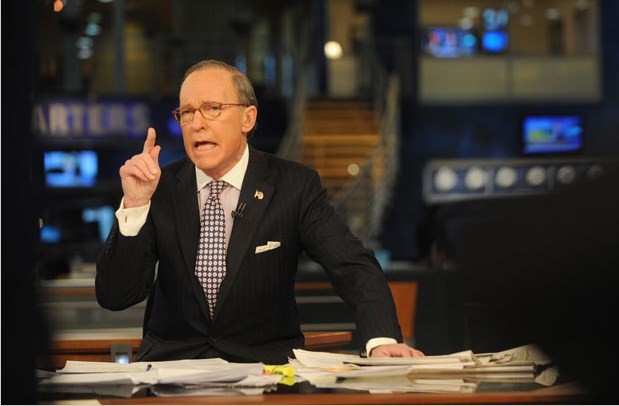

A Federal Reserve Dictatorship: A Few Words From Larry Kudlow

I will admit to growing uneasy lately watching CNBC's Larry Kudlow blather endlessly about green shoots. But occasionally his opinions re-enter the reality stratosphere, and even less frequently, he nails it. Today, he had a hammer.

In a blistering CNBC editorial "An Imperial Fed" Kudlow shredded the Federal Reserve quite nicely:

A host of factors contributed to the credit crisis. But it was ultimately the Federal Reserve — with its bubblehead policy of ultra-cheap rates, monetary explosion, and a sinking dollar — that created it. The Fed was the chief culprit, just as it was ten years ago when it unleashed the tech bubble. It not only created this current crisis, it totally missed it as well. So why would anyone think it has the right stuff to fix it?

Kudlow supports Sheila while ripping the Fed again:

I say put Sheila Bair and the FDIC in charge of systemic-risk regulation. Make them totally independent from the Treasury. And while we’re at it, let’s get the Fed to return to a market-price rule for money, including gold, the dollar, bond rates, and commodities. This would mark a sorely needed return to the stable-money period that stretched from the early 1980s to the late 1990s. That was before the central bank embarked on this crazy pillar-to-post stop-go-stop-go monetary-meddling insanity that completely destabilized the economy and undermined the stock market.

Once more for good measure with some laudable comments on our out-of-control deficit spending:

And by the way, speaking of limits to reckless borrowing and debt, the Treasury is going to auction $104 billion in debt this week. That’s yet another record. The previous record was set a few weeks ago, which came a week after another record. Talk about the need for limits. This is total fiscal insanity. It needs to stop now.

But this Fed-dictatorship proposal is a terrible idea. The Fed needs to stick to its knitting and focus on stable money. That’s what’s been missing for ten years under Alan Greenspan and Ben Bernanke. That’s why we experienced two nasty recessions. And that’s why the stock market has gone nowhere.

Read the entire truth-telling, Bernanke-Greenspan destroying, little-bit-of Kudlow's anger HERE.

Jun 22, 2009 at 1:57 PM

Jun 22, 2009 at 1:57 PM

Reader Comments (4)

“I am not particularly of the green shoots group yet,” Rice said today to the Atlanta Press Club, referring to a phrase used by Federal Reserve Chairman Ben S. Bernanke that described signs of a nascent recovery. “I have not seen it in our order patterns yet. At the macro level, there may be statistics suggesting the economy is starting to turn. I am not seeing it yet.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=ayc5BDPO_GGs

In Britain, for all their other foibles, people like Bernanke and Geithner would have already RESIGNED out of a sense of honor (or "honour"). In America, they just lie, fib, obfuscate and collect their check.

We have no public honor. No sense of obligation and fair behavior from politicians. You can do anything and get away with it if you are crafty enough.