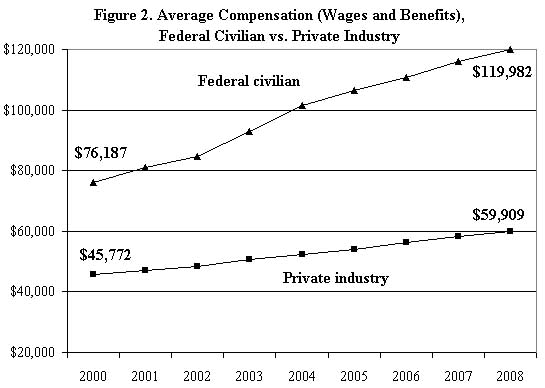

Rethinking Salary Constructs, Federal Pay Continues To Skyrocket (CHART)

In 2008 the average federal worker earned twice that of his private-industry counterpart in wages and benefits: $120,000 per year versus $60,000.

Check out the difference in slope of the two lines. Yowza. Federal pay and benefits are up 58% since 2000 compared to just 28% in the private sector.

Of course, when you consider the massive productivity advantage government workers enjoy over their private counterparts, it all makes sense. WTF?

Well, it's all the Democrats fault undoubtedly. Wait, looks like it was Bush.

Oct 26, 2009 at 4:46 PM

Oct 26, 2009 at 4:46 PM