Kansas City Fed Head Thomas Hoenig Discusses The Federal Reserve's Exit Strategy (Video)

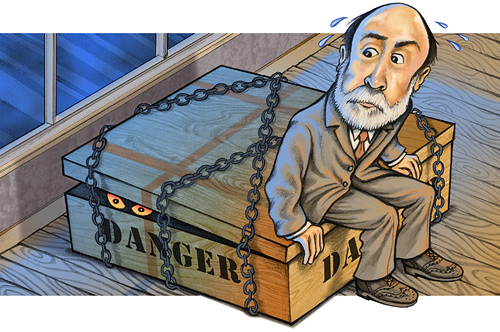

Still waiting on my flight, so here's another clip from CNBC's surprisingly excellent, morning broadcast. Readers know that we've come to appreciate regional Federal Reserve President Thomas Hoenig's predilection for candor. Though he was late to dissent, Hoenig has recently been showing his independence from B-52 in his continuing call to allow large banks to fail and fall into government receivership.

I'm comfortable with giving up the charade anytime now. We're going to have to deal with Citigroup in an adult manner sometime in the next 12 months when they return looking for capital. Their off-balance sheet issues alone are enough to kill them, let alone the morass they do keep on the books.

So, it's refreshing to hear voices from Washington (Kansas City in reality, which could explain his forthrightness) that echo our belief (and yours) that certain failed institutions should actually be allowed to fail and their bondholders be asked to take the losses instead of taxpayers. But that's an old rant which you've read many times before. If only Bernanke, Geithner, Summers and Obama would listen. Fat chance to expect those beholden to the banking oligarchy to change their stripes, yet I remain optimistic, almost every day.

FDIC Chair Sheila Bair On The Regulatory Power Grab (Video)

FDIC Chief Sheila Bair made an appearance on Squawk Box this morning. Sheila was shut out in the recent All Star Washington Power Grab For Financial Regulatory Pre-Eminence. In other words, Geithner made sure Sheila was kept in the corner, while he, Summers and especially Bernanke raided the pantry.

(Editor's Note: still travelling and will resume normal posting this afternoon...there are photos and a few new cartoons inside.)

And before I am flailed by both sides, remember, I have no dog in this race. I have zero tolerance for the leadership of both parties. Outside of a few outstanding members from both sides (Brad Sherman, Grayson, Issa, Capuano, Ron Paul), I have no positive feelings toward any of the corrupted.

CNBC Videorama: Richard Bove, Tiger Woods, Fannie & Freddie, US Bancorp, The FDIC And The Governator (6 Videos)

More diversion from CNBC while I travel. There's something for everyone in here, hopefully.

Star Trek And The Auto Bailouts

Barry Ritholtz is a Trekkie apparently and within that context offers a different take on the bailouts of Chrysler and GM. His point is actually very solid; had we not bailed out Chrysler in 1979, things might have turned out very differently for Detroit and General Motors in 2009.

Lloyd Blankfein: "Sorry Seems To Be The Hardest Word"

Goldman Sachs CEO Lloyd Blankfein, the only non-government employee at the 4-man meeting to decide the fate of AIG, sent a letter of apology and appreciation to various officials yesterday (Frank, Bachus, Shelby and Dodd) for the government's support during the financial crisis. There was no word on his thank you to former CEO of Goldman and Treasury, Hank Paulson.

What about a letter to taxpayers, Lloyd? The stooges in Washington gave the go-ahead, we gave the cash. A press release thanking us might be something to think about.

As long as we are discussing TARP repayment (I'll get into it more deeply this weekend), don't be fooled. Goldman and all the others have FDIC-backed debt still floating; Goldman got at least $13 billion from AIG payouts at par (some have said $20 billion); Goldman will benefit from the TALF and the remaining components of Geithner's P-PIP plus the myriad other Fed-Treasury-FDIC programs.

Still waiting on 'thank-yous' from the other CEOs.

From Dealbook we have the following quotes:

Lloyd C. Blankfein, told leading Congressional lawmakers on Tuesday that he regretted Goldman had “participated in the market euphoria” that led to the financial crisis.

Mr. Blankfein said Goldman was “grateful for the government’s extraordinary efforts and the taxpayers’ patience” during the crisis. And he acknowledged in letters obtained by DealBook that “certain practices were unhealthy” for the banking system.

In his letters to lawmakers, Mr. Blankfein wrote that Goldman had “an explicit contract with our shareholders to be responsible stewards of their capital.”

“While we regret that we participated in the market euphoria and failed to raise a responsible voice, we are proud of the way our firm managed the risk it assumed on behalf of our client before and during the financial crisis,” he said.

Mr. Blankfein added: “We believe that repayment of the government’s investment is a strong sign of progress and one measure of the ability to recover from the crisis. But real stability can return only if our industry accepts that certain practices were unhealthy and not in the long-term interests of individual institutions and the financial system, as a whole.”

Mr. Blankfein did not specifically identify the unhealthy “certain practices” in his letter, although he committed Goldman “to working constructively with regulators and policymakers to address systemic weaknesses and gaps that may have contributed to the financial crisis.”

Sorry Seems To Be The Hardest Word (Elton John 1976 LIVE)

Presidential Fly By: A Swat For The Ages

In a lighter moment, Obama nails a fly that is buzzing him repeatedly during his CNBC interview Tuesday with John Harwood. Video runs 45 seconds.

In a lighter moment, Obama nails a fly that is buzzing him repeatedly during his CNBC interview Tuesday with John Harwood. Video runs 45 seconds.

Ritholtz: TARP Was An Elaborate Ruse To Bailout Citigroup (Video)

Barry Ritholtz presents an interesting theory in Bailout Nation, which he discussed in more detail recently. Briefly, he suggests the possibility that Paulson forced all the banks to take TARP funds to provide cover for Citigroup, whom he contends was the only bank that needed immediate assistance.

While he's correct that Citigroup was (and remains) the least stable and most insolvent of all the recipients, every bank needed a psychological pop that only fresh and government-cheap capital could provide. The dominoes were falling quickly and the grim perception was that all could be brought down by insolvency fears.

Was Lehman any more insolvent than Morgan Stanley or Goldman, if all firms were forced to consider level 2 & 3 assets? Of course not. You see the reasoning and can imagine the fear it instilled in government officials. I believe Paulson was acting to boost the perception of solvency for the entire group. Months later, with changes to fair-value accounting, the insolvency perception remains paramount in the minds of certain analysts and bloggers, though the green-shoot camp seems happily content with 'whistling by the graveyard.'

And for the record, Citigroup has received $45 billion in TARP funds, a $306 billion taxpayer guarantee of assets, billions in recently-issued, FDIC-backed debt, access to TALF and other Fed programs PLUS at least $5 billion in payouts from AIG. Is there anything I've missed?

Jun 20, 2009 at 3:34 AM

Jun 20, 2009 at 3:34 AM