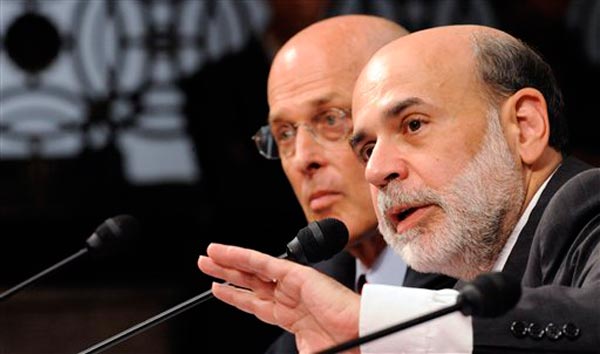

You Won't Believe What Bernanke Said About Bailouts At His 2005 Confirmation Hearings

In honor of today's Supreme Court forced data dump from the Fed.

Jim Bunning was the only Senator who had the courage to vote 'no' in the 99-1 shellacking that officially seated Bernanke in 2005.

In response to a question from Sen. Jim Bunning in November of '05, Bernanke said the following:

- “I believe that the tools available to the banking agencies, including the ability to require adequate capital and an effective bank receivership process are sufficient to allow the agencies to minimize the systemic risks associated with large banks."

- "Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.”

Bunning entered the '05 quotes into the official record for Bernanke's 2009 reconfirmation hearings:

- "That should sound familiar Mr. Chairman, since it was part of your response to a question I asked about the systemic risk of large financial institutions at your last confirmation hearing in 2005. I’m going to ask that the full question and answer be included in today’s hearing record."

- "Now, if that statement was true and you had acted according to it, I might be supporting your nomination today. But since then, you have decided that just about every large bank, investment bank, insurance company, and even some industrial companies are too big to fail. Rather than making management, shareholders, and debt holders feel the consequences of their risk-taking, you bailed them out. In short, you are the definition of moral hazard."

Bernanke's denial in 2005 of what came to pass just 24 months later, and the fact that the Fed's response to the crisis turned out to be the polar opposite of what he promised, is substantial, and in a world where Congress were not so beholden to Wall Street, it would be sufficient grounds for any Senator to vote 'no' on Bernanke's re-confirmation.

But there is no doubt about this battle of transcripts -- Bunning wins; Bernanke loses. B-52's laughable words are now repeated for emphasis:

- Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.”

Ouch. Bondholders were made whole in every case except Lehman, and we learned that several banks were judged too big to fail. The Chairman's words have never been cheaper.

We deserve better.

---

Now sit back and enjoy the beatdown...

Video - Bunning destroys Bernanke

Mar 31, 2011 at 8:53 PM

Mar 31, 2011 at 8:53 PM

Reader Comments (13)

The Ongoing Carnage In Ireland And Spain Shows What Life Is Like For Countries That Can't Print Like Crazy

Greece Finance Minister Says No Risk of Default

AIG General Counsel Who Protested Meager $500K To Have Her Bluff Called, Get Sacked

Clusterstock has published my story this morning...you might want to leave comments there...

how many times have were heard from Treasury ... We support a strong dollar policy ...

I agree with Bunning ...based on that statement alone ...Moreover, the agencies have made clear that no bank is too-big-too-fail ...having said one thing and done another is reason enough not to reconfirm let alone audit or do away with our owners ...er I mean the Fed.

I lived in Argentina and have seen this all before. I always wondered how such a great country as that could become such a den of backwardness and incompetence. Now, like in one of those Hollywood movies that start at the end and work their way back to the beginning, I see in our own actions here in America the explanation for how a country goes about shooting itself in the foot. Over & over & over again. Now I understand how a country can devolve into a vile shithole, because I'm living thru it every day on a firsthand witness basis.

And the moral collapse of this country is as greater -if not greater- than the economic one. Fraud, theft, lies, torture, scams ...you name it, we do it. Our media ignores these facts and instead gives us articles about Tiger Woods infidelities or bombards us with pics of guys kissing guys, girls kissing girls, and other inane bullshit.

Meanwhile I was just reading that the Chinese have proposed that only the most advanced nations should be required to comply with emissions controls. What a wonderfully fair, practical & and good idea! Much better than the Americans who want to impose such controls on EVERYONE.

There you have it: China is busily winning the hearts & minds of the global community while the USA wants to buttfuck everyone in order to have others pay for America's greed, fraud and corruption.

YOU do the math and tell me which of the two nations is headed staright for Shitsville ....

Great article Bob Herbert - Las Vegas Sun 10-21-09

Middle class can't afford to pay for wealthy's risks

The headlines that ran side by side on the front page of Saturday's New York Times summed up, inadvertently, the terrible fix that we've allowed our country to fall into. The lead headline, in the upper right-hand corner said: "U.S. Deficit Rises to $1.4 Trillion; Biggest since 45". The headline next to it said: "Bailout Helps Revive Banks and Bonuses".

We've spent the past few decades shoveling money at the rich like there was no tomorrow. We abandoned the poor, put an economic stranglehold on the middle class and all but bankrupted the federal government - while giving the banks and megacorporations and the rest of the swells at the top of the economic pyramid just about everything they've wanted.

And we still don't seem to have learned the proper lessons._ We've allowed so many people to fall into the terrible abyss of unemployment that no one - not the Obama administration, not the labor unions and most certainly no one in the Republican Party - has a clue about how to put them back to work.

Meanwhile, Wall Street is living it up. I'm amazed at how passive the population has remained in the face of this sustained outrage.

Even as tens of millions of working Americans are struggling to hang onto their jobs and keep a roof over their families' heads, the wise guys of Wall Street are licking their fat-cat chops over yet another round of obscene multibillion-dollar bonuses - this time thanks to the bailout billions that were sent their way by Uncle Sam, with very little in the way of strings attached.

Never mind that the economy remains deeply troubled. As the Times pointed out Saturday, much of Wall Street "is minting money."

Call it deejay voodoo. I wrote a column a few days before Christmas in 2007 that focused on the deeply disturbing disconnect between Wall Streeters harvesting a record crop of bonuses billions on top of billions - while working families were having a very hard time making ends meet.

We would later learn that December 2007 was the very month that the Great Recession began. I wrote in that column: "Even as the Wall Streeters are high-fiving and ordering up record shipments of Champagne and caviar, the American dream is on life support."

So we had an orgy of bonuses just as the recession was taking hold and now another orgy (with taxpayers as the enablers) that is nothing short of an arrogantly pointed finger in the eye of everyone who suffered, and continues to suffer, in this downturn.

Whether P.T. Barnum actually said it or not, there is a sucker born every minute. American taxpayers might want to take a look in the mirror. If the epithet fits ...

We need to make some fundamental changes in the way we do things in this country. The gamblers and can artists of the financial sector, the very same clowns who did so much to bring the economy down in the first place, are howling self-righteously over the prospect of regulations aimed at curbing the worst aspects of their excessively risky behavior and preventing them from causing yet another economic meltdown.

We should be going even further. We've institutionalized the idea that there are firms that are too big to fail and, therefore, "we, the people" are obliged to see that they don't - even if that means bankrupting the national treasury and undermining the living standards of ordinary people. What sense does that make?

If some company is too big to fail, then it's too big to exist. Break it up.

Why should the general public have to constantly worry that a misstep by the high-wire artists at Goldman Sachs (to take the most obvious example) would put the entire economy in peril? These financial acrobats get the extraordinary benefits of their outlandish risk-taking - multimillion-dollar paychecks, homes the size of castles - but the public has to be there to absorb the worst of the pain when they take a terrible fall.

Enough! Goldman Sachs is thriving while the combined rates of unemployment and underemployment are creeping toward a mind-boggling 20 percent: Two- thirds of all the income gains from the years 2002 to 2007 - two-thirds! - went to the top 1 percent of Americans.

We cannot continue transferring the nation's wealth to those at the apex of the Economic pyramid - which is what we have been doing for the past three decades or so while hoping that someday, maybe, the benefits of that transfer will trickle down in the form of steady employment and improved living standards for the many millions of families struggling to make it from day to day.

That money is never going to trickle down. It's a fairy tale. We're crazy to continue believing it.

the confirmation hearing is slated for December 17....we have 7 days to make a lot of noise...