In honor of today's Supreme Court forced data dump from the Fed.

Jim Bunning was the only Senator who had the courage to vote 'no' in the 99-1 shellacking that officially seated Bernanke in 2005.

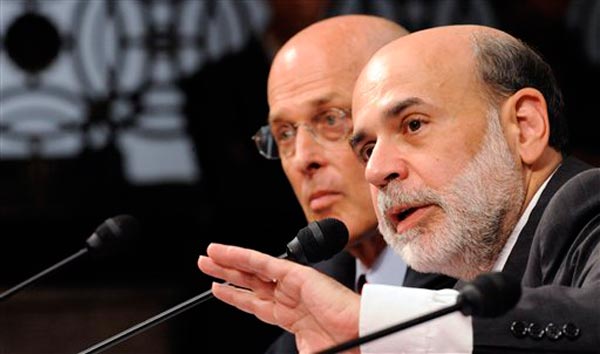

In response to a question from Sen. Jim Bunning in November of '05, Bernanke said the following:

- “I believe that the tools available to the banking agencies, including the ability to require adequate capital and an effective bank receivership process are sufficient to allow the agencies to minimize the systemic risks associated with large banks."

- "Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.”

Bunning entered the '05 quotes into the official record for Bernanke's 2009 reconfirmation hearings:

- "That should sound familiar Mr. Chairman, since it was part of your response to a question I asked about the systemic risk of large financial institutions at your last confirmation hearing in 2005. I’m going to ask that the full question and answer be included in today’s hearing record."

- "Now, if that statement was true and you had acted according to it, I might be supporting your nomination today. But since then, you have decided that just about every large bank, investment bank, insurance company, and even some industrial companies are too big to fail. Rather than making management, shareholders, and debt holders feel the consequences of their risk-taking, you bailed them out. In short, you are the definition of moral hazard."

Bernanke's denial in 2005 of what came to pass just 24 months later, and the fact that the Fed's response to the crisis turned out to be the polar opposite of what he promised, is substantial, and in a world where Congress were not so beholden to Wall Street, it would be sufficient grounds for any Senator to vote 'no' on Bernanke's re-confirmation.

But there is no doubt about this battle of transcripts -- Bunning wins; Bernanke loses. B-52's laughable words are now repeated for emphasis:

- Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.”

Ouch. Bondholders were made whole in every case except Lehman, and we learned that several banks were judged too big to fail. The Chairman's words have never been cheaper.

We deserve better.

---

Now sit back and enjoy the beatdown...

Video - Bunning destroys Bernanke