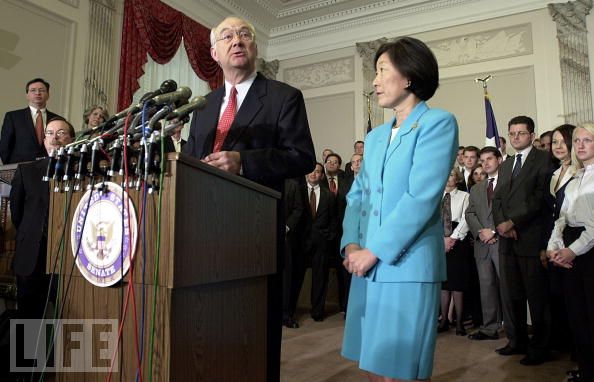

Wendy Gramm, Judge Bruce Levine & Criminal Behavior At The CFTC - Attention Eric Holder, Federal Prosecutors

If you haven't heard this story yet, be prepared for a new realm of outrage. When you read this keep in mind that the CFTC has only 2 judges.

Quietly last month, CFTC Case Judge, George H. Painter, issued a "Notice and Order" announcing his retirement from his position. In this notice Judge Painter wrote of a conspiracy at the highest levels of the CFTC (within the enforcement division), where a long time judge of 20 years has been working with past CFTC Chairs to rig the enforcement of the law by never (not once in 20 years) finding anyone guilty of market manipulation. We must be talking about tens of thousands of cases, to put the size of these crimes in scope.

Here are Judge Painter's words:

"There are two administrative law judges at the Commodity Futures Trading Commission: myself and the Honorable Bruce Levine. On Judge Levine's first week on the job, nearly twenty years ago, he came into my office and stated that he had promised Wendy Gramm, then Chairwoman of the Commission, that we would never rule in a complainant's favor. A review of his rulings will confirm that he has fulfilled his vow. Judge Levine, in the cynical guise of enforcing the rules, forces pro se complaints to run a hostile procedural gauntlet until they lose hope, and either withdraw their complaint or settle for a pittance, regardless of the merits of the case"

"In light of these unfortunate facts, if I simply announced my intention to retire, the seven reparation cases on my docket would be reassigned to the only other administrative law judge of the Commission, Judge Levine. This I cannot do in good conscience. Accordingly, I recommend that the Commission request the services of an administrative law judge to be detailed to the Commission from another agency."

His request was granted, and his cases were not assigned to Judge Levine.

Wendy Gramm is a former Enron board member, and former head of the CFTC (1988-1993), and the wife of deregulation neocon Phil Gramm. Here's what Barry Ritholtz said about Wendy Gramm:

A reminder to those of you who may be unfamiliar with this particular corporate harlot: Gramm was not only the former CFTC chair, but she was an Enron board member and wife of deregulation architect Phill Gramm, who for reasons unknown to decent society, is gainfully employed as a fluffer at UBS, helping to further besmirch the reputation of that bailed out firm.

Nice one, Barry!

Judge Painter Retirement Letter, WSJ Article on Judge Lynch

Sep 6, 2011 at 5:48 PM

Sep 6, 2011 at 5:48 PM

Reader Comments (27)

http://futuresmag.com/News/2010/10/Pages/CFTC-judge-claims-colleague-is-biased-.aspx

http://www.ritholtz.com/blog/2010/10/judge-cftc-corrupt-wendy-gramm-criminal/

By STEPHEN LABATON

Published: November 05, 1999

WASHINGTON, Nov. 4 — Congress approved landmark legislation today that opens the door for a new era on Wall Street in which commercial banks, securities houses and insurers will find it easier and cheaper to enter one another's businesses.

The measure, considered by many the most important banking legislation in 66 years, was approved in the Senate by a vote of 90 to 8 and in the House tonight by 362 to 57. The bill will now be sent to the president, who is expected to sign it, aides said. It would become one of the most significant achievements this year by the White House and the Republicans leading the 106th Congress.

''Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,'' Treasury Secretary Lawrence H. Summers said. ''This historic legislation will better enable American companies to compete in the new economy.''

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation's financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression.

http://www.nytimes.com/1999/11/05/business/congress-passes-wide-ranging-bill-easing-bank-laws.html

http://blogs.findlaw.com/greedy_associates/2010/10/boston-college-law-3l-i-want-my-money-back.html#more

http://www.nytimes.com/2008/11/17/business/economy/17gramm.html?pagewanted=all

Good read on Phil Gramm...

http://www.youtube.com/watch?v=K30siX8-9sU

If nothing else, watch the last two minute...

Get to power and build your cocoon with the the others. Protect your power, manage your career. Nothing else matters.

It will be so interesting to watch Elizabeth, can she actually withstand the enormity of the pressure to conform?

Make no mistake, Judge Painter's letter is a gauntlet in the face of TPTB. Let's see what they do.

I'm out in front of my office building in Chicago smoking a cigarette and get into it with a new guy on the help line (lots of cpu issues where I work).

C: Can you believe this mortgage shit, these bankers are criminals the way they fuck people out of their homes?

NG: That's right. They made bets on top of bets. They made bets on top of those bets and then made more bets on top of them. I hear it's up to $700 trillion.

Yeah, so awareness is spreading. Like wildfire, in my estimation.

If you think a collapse is on its way, you're right. Question 1 is, slow or fast. I'm betting fast.

Meantime, check this Ennio masterpiece...

http://www.youtube.com/watch?v=oE4MW2HNluw

The other thing to note is this: in the Great Depression, 2 out of 5 banks failed. Now that we know banks are more important than people, it's not difficult to ascertain the outcome here. Wipe out food stamps and we're well on our way. Hmmm.

Your prediction is sage. Painter's "order" will receive zero attention on MSM, and thus vanish. However, the trial bar has taken note. It is only a matter of time before the full implications of what lack of standing truly means seeps into the right heads. Attorneys aren't trained to leave money on tables.

Congress is retarded and will do nothing significant--unless to the downside. Ditto the Exec. Wading into Article III judges is another matter altogether, as our Founders had the foresight to give those dudes lifetime appointments. As such, they are on sale far less often.

This game's just gettin started, my man.

In any case, I nominate Mark McHugh in absentia. He's a pro at this kind of stuff.

http://acrossthestreetnet.wordpress.com/2010/10/21/trick-or-treating-at-the-sec/

http://acrossthestreetnet.wordpress.com/2010/08/27/update-turbo-doesnt-pick-up-his-mail/

http://acrossthestreetnet.wordpress.com/2010/08/22/a-letter-to-tim-geithner-cause-this-is-no-ordinary-bubble/

Read Judge Painter's words carefully. He says nothing actionable about W. Gramm. He just raises any number of questions about her.

Levine probably remains unscathed. In that respect, you are correct. This outburst, however, will permeate various bar organizations. I'm not disagreeing with you or anyone else here.

I'm merely pointing out that this is such an egregious outburst that either Groton responds or is proved a coward. Place your bets.

When we find out the latter, it is game on in the courts. We're in a depression. Think it doesn't touch lawyers? Think again. This clusterfuck is just what the doctor ordered.

Here is a website (linked by Lexus Nexis) detailing all of the legitimate subprime cases erroneously tossed out by judges (not even a chance to be heard by a jury)

Special thanks to Jon Eisenberg for providing a copy of his article.

http://www.dandodiary.com/2010/06/articles/subprime-litigation/an-updated-analysis-of-subprime-securities-suit-dismissal-motions/

http://www.dandodiary.com/2008/06/articles/subprime-litigation/the-list-subprime-lawsuit-dismissals-and-denials/index.html

http://www.skadden.com/content/Publications/Publications1962_0.pdf

Wendy Gramm and the CFTC are in violation of Title 18 U.S.C. 1501-1525

Obstruction of justice is the impediment of governmental activities. There are a host of federal criminal laws that prohibit obstructions of justice. The six most general outlaw obstruction of judicial proceedings (18 U.S.C. 1503), witness tampering (18 U.S.C. 1512), witness retaliation (18 U.S.C. 1513), obstruction of Congressional or administrative proceedings (18 U.S.C. 1505), conspiracy to defraud the United States (18 U.S.C. 371), and contempt (a creature of statute, rule and

common law)."

http://www.fas.org/sgp/crs/misc/RL34303.pdf

Traditionally, obtaining or extorting money illegally or carrying on illegal business activities, usually by Organized Crime . A pattern of illegal activity carried out as part of an enterprise that is owned or controlled by those who are engaged in the illegal activity. The latter definition derives from the federal Racketeer Influenced and Corruption Organizations Act (RICO), a set of laws (18 U.S.C.A. § 1961 et seq. [1970]) specifically designed to punish racketeering by business enterprises.

http://legal-dictionary.thefreedictionary.com/Racketeering

I KNOW hedgefund managersthat tried to report the sale of UNCOLLATERALIZED "collateralized" debt obligations by subprime dealers to the Commodities Futures Trading Commission (CFTC). They "never picked up their phone" to take the complaints. Financial institutions are competative, they need to make their clients money as well as protect it; and their business. So it is in the best interest of institutions to report grievances if they want to retain their clients.

http://www.washingtonpost.com/wp-dyn/content/article/2010/10/19/AR2010101907216.html

per a 2000 WSJ article...

"Seeking WSJ's Dec 2000 article: December 2000 Wall Street Journal story by Michael Schroeder titled, “If you got a beef with a futures broker, This Judge Isn’t for You—In Eight Years at the CFTC, Levine Has Never Ruled In Favor of an Investor” that details Levine’s penchant for favoring brokers over investors seeking reparations."

There have been perfectly legitimate cases against the subprime dealers of fraud by investors, etc. that were dismissed by the judges, erroneously citing the Securities Act of 1933 (which was enacted to protect investors).

Prevalence of Subprime Securities Class Actions Cornerstone Research's review of 2008 securities class actions reported that.

In 2008, nearly one-third of the companies in Although total new filings dropped in the first half of 2009, the rate of securities class actions against companies in the financial sector of the S&P 500 was over five times the rate for companies in the next highest sued sector. become an important source for information on securities class actions, reports that every subprime securities class action against a financial firm.

http://www.skadden.com/content/Publications/Publications1962_0.pdf

Kevin LaCroix, whose blog has approximately 200 subprime and other credit crisis-related securities class actions have been filed since February 2007.

Executives are named as defendants in almost "litigation against the firms closest to the ongoing subprime/liquidity crisis was the dominant force in federal class action securities litigation in 2008" and that financial firms represented 46% of the $856 billion maximum dollar loss attributed to securities class action filings in 2008. the financial sector of the S&P 500 were sued in securities class actions, which was nearly five times the rate for the next highest sued sector of the S&P 500.

EVIDENCE OF BANK/SUBPRIME FRAUD:

FRAUD IN SUBPRIMES- the writing is on the wall. Who are they kidding trying to cover it up? Are Americans THAT stupid or unaware? (you deserve the government you get)

Goldman Sachs pleaded innocence and the public officials pleaded ignorance. To sum up the subprime scandal, the subprimes were sold as naked positions and probably not disclosed that way to their investors.

REPO 105-EVIDENCE OF FRAUD

The subprime dealers wrote naked (uncollateralized) subprimes which is a very risky position, just like writing naked call options. The Repo 105 issue Lehman Brothers' trial proves that the collateral was not with the subprime dealers but at another bank when these subprimes were sold to investors. (the SFAS 140 made this legal, Sarbanes Oxley allowed this loophole to exist). If you don't understand what REPO 105 is, Paddy Hirsch from Market place videos does an excellent job of explaining it. http://www.youtube.com/watch?v=Tr8qPmyW5Yw

Here's another article on the REPO 105.

http://dealbook.blogs.nytimes.com/2010/03/12/in-lehmans-demise-some-shades-of-enron/

THE NUMBERS DON'T MAKE SENSE- EVIDENCE OF FRAUD

The subprime market is valued at $600 trillion. The PPP of the world is "only" $70 trillion? $600 trillion probably does not exist yet on the Planet Earth, there is definately not enough bonds to collateralize that many subprimes. Infact, to get this many subprimes, the subprime writer would have to sell several subprimes that were supposed to be collateralized by the same bond.

If someone wrote a "naked" (uncollateralized) call option, the CBOE and their respective brokerage would not allow this unless they had enough experience and net worth to cover themselves because this trade is considered high risk. And yes the lack of collateral is definately disclosed.

So why did I bother mentioning the block in court cases?

TARP WAS UNNECESSARY!!!

First, let's discuss what would've happened if the courts were to rule in the plaintiff's (subprime investor's) favor.

Since taxpayers will be gouged for TARP, we all need to understand the relationship between hedge fund investors, subprime dealers and ARM borrowers.

When these ARM borrowers foreclose, isn't the house the unintended property of these hedge fund investors?

Please allow me to elaborate. The Subprime Dealers (Countrywide, Wamu, Bear Stearns, etc..) sold subprime derivatives to subprime investors (most investors were at hedge funds) to come up with financial inventory/capital to sell ARMs with. These subprimes were known as "collateralized" debt obligations (CDO's), "collaterlized" mortgages obligations (CMO's) or Mortgage Backed Securities (MBS). Every financial instrument is a loan that is collateralized to secure the value of a loan. A mortgage is bank loan to borrower secured/collateralized with a house, an auto loan is a bank loan to borrower secured/collateralized with a car. A stock is an investor's loan to a company secured/collateralized by ownership of a company.

A DERIVATIVE is simply any financial instrument that is collateralized/secured by another financial instrument.

ie. Options are collatearlized by 100 shares of underlying stock. Subprimes are collateralized by a bond. Futures are collateralized by commodities.

-How derivatives work:

If any option seller writes a "naked" or uncollatearlized call option, according to the SEC/CBOE/Brokerage, it's considered risky(unlimited). They can't open the position unless they have $25,000 in net worth and the highest option approval rating. If the trade falls through, the buyer of the call can go after the writer for everything they have.

If a subprime dealer (ie. Countrywide) writes a "naked" or uncollateralized subprime, the same exact thing happens and they take the same unlimited risk.

Since they did not collateralize the subprime with a bond, THE SUBPRIME INVESTORS ARE ENTITLED TO GO AFTER THE SUBPRIME DEALERS FOR EVERYTHING THEY OWN (including the foreclosures). That's how the courts should have ruled, except that the courts are blocked thanks to the corruption that is the CFTC and Wendy Gramm. The subprime investors should have 100% control over the foreclosures. Period.

TARP wouldn't be necessary to make this exchange. The politicians/taxpayers/banks should not have a say in how these foreclosures are handled. This should be directly between the investor and the borrower (without the failed banks).

The subprime investor should be free to do as they please with that property...ie. use a property manager, rent it out, negotiate terms on how the borrower can keep the house, etc.

The banks purposely exposed themselves, they lose. If a call writer loses his shirt, nobody bails him/her out. Nobody should bail out the subprime dealers. They KNEW what they were doing.

This would eliminate the need for TARP.

Also TARP wasn't necessary to make the banks liquid.

http://www.heritage.org/research/reports/2008/11/tarp-and-the-treasury-time-to-allow-markets-to-work

http://mises.org/daily/4218

Now we all know that Goldman Sachs was behind Greece's debt troubles! The subprime scandal that could've been PREVENTED was the cause of Greece and other municipality defaults through trades of their interest rate swaps.

Back in March 2010, Gary Gensler (former Goldmanite and head of the CFTC) argued that "Derivative Reform would have dissuated Greece"

http://www.bloomberg.com/apps/news?pid=20601087&sid=a9hBzeyd2pLQ&pos=6.

http://www.nytimes.com/2010/02/14/business/global/14debt.html?hp

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aufmSRtDn0gg

TARP recipients/subprime dealers played the Interest Rate Swap game too, with munis in Los Angeles and Philadelphia:

http://online.wsj.com/article/SB10001424052748703775504575135930211329798.html

For those of us who understand, the collapse of the real estate market and the subprime market was inevitable. These bankers KNEW how the market was going to turn out (Goldman Sachs bet against itself). During foreclosures and high unemployment, municipalities lose revenue. Which makes their ratings go down. When the bond ratings go down, yields go up to give buyers incentive to hold onto that debt. How many city workers lost their jobs as a result of the subprime collapse?

So the banks created the problem, then banked on the rewards for tricking people out of their money.

Let's look at the figures.

To "liquidate" the banks:

-TARP=$700 BILLION

-Quantitative Easing= $30 TRILLION (The devaluation of the dollar is going to cost us in reduced tax brackets for real rates, oil imports and the cost of food.) http://www.investinganswers.com/education/primer-quantitative-easing-what-it-and-will-it-save-economy-1941

-Maiden Lane (to buy up these toxic assets)-$150 BILLION

Maiden Lane I=$30 billion

Maiden Lane II&III=$120 billion

-PPIP (to enable banks to make ARM loans to realtors to speculate in Real Estate Market)=$40 BILLON

Maiden Lane and PPIP cost us $200 billion? Plus whatever else we lose on TARP & QE.

This "bailout" and "economic recovery" is too expensive. Especially considering that we need to cut taxes and restrictions to enable investments in wealth creation and to balance trade in lieu of globalization. Nobody is batting on behalf of the U.S.

Are you kidding? Holder is likely to nominate Wendy Gramm for the position of "Special Czarina in charge of the Gulags".

Caveat: Have Gary Gensler and Tim Massad ever been in the same room together? Same guy? Hmmmm.