True Cost Of The Wall Street Bailout - PBS VIDEO

Watch just a few minutes of this clip. It is outstanding.

---

Special report from Bloomberg -- Adding It All Up

Allison Stewart from Need to Know with Bloomberg reporter Bob Ivry. None of this is new to Bail readers, though the details might surprise you. The Bloomberg total is $12.8 trillion.

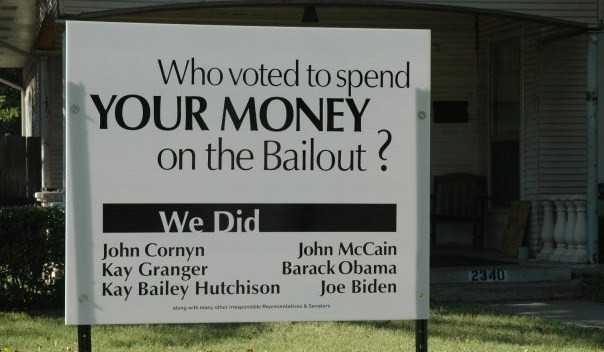

We all know about TARP, the Troubled Asset Relief Program, which spent $700 billion in taxpayers’ money to bail out banks after the financial crisis. That money was scrutinized by Congress and the media.

But it turns out that that $700 billion is just a small part of a much larger pool of money that has gone into propping up our nation’s financial system. And most of that taxpayer money hasn’t had much public scrutiny at all.

According to a team at Bloomberg News, at one point last year the U.S. had lent, spent or guaranteed as much as $12.8 trillion to rescue the economy. The Bloomberg reporters have been following that money. Alison Stewart spoke with one, Bob Ivry, to talk about the true cost to the taxpayer of the Wall Street bailout.

##

Oct 1, 2011 at 4:25 PM

Oct 1, 2011 at 4:25 PM

Reader Comments (43)

http://www.youtube.com/watch?v=0-7XNfZDczs

Why a dog??? Was it a shout-out?

[...]

Let me know what you think??? I find it interesting.

[...]

What is that??? I put a paragraph there.

I thought at first you said, you were a level-3 drinker...that would certainly explain a lot...

I missed your comment...were you being racist?

check out his site...

http://blogs.telegraph.co.uk/news/tobyharnden/100052622/self-described-mutt-barack-obama-dont-talk-about-me-like-a-dog/

"The comment makes him look ridiculous. First off, there are inevitable racial overtones to it. To be treated “like a dog” is to be treated as something less than human. In the Muslim world, to call someone a dog is a pretty serious insult (and no, I’m not suggesting Obama is a Muslim)."

http://www.youtube.com/watch?v=IlUsV-1_lVQ

Hahahaha, like I am not an American that paid taxes to fund their silly asses. Like where I am now is "my country", and not America. Like anyone would want to PIRATE PBS!!! Bwahahahahaha.

Whatever, they've been a shill for Zionists/Neocons the last 15 years anyway.

Good thing everyone ridiculed farang in the early 80s when I stated in newspaper comments sections Reagan's insane tax cuts and borrowing, along with his huge increase in S.S. benefits to people that NEVER PAID INTO the Trust fund would lead us to oblivion....how's it feelin' now, America? Still feeling "good about yourself" again???

Obama said his critics talk about him like a dog: that's right, boy. Here boy, here boy.......go find gay little male cheerleader Dubya, atta BOY!!!

Half of ALL home loans (27 Million) were forced on lenders by government to redistribute wealth and racial “reparations” behind America’s back": http://bit.ly/fHJFVZ Don’t sign off before you see part 2 which plays after a commercial.

This whole fake controversy between D's and R's on the FCIC is a smokescreen. People on Wall St. committed crimes, including fraud. Yves Smith wrote a book about how one hedge fund, Magnetar, deliberately constructed mortgage-backed securities that would fail, so that they could then bet on that failure by shorting them / buying credit default swap protection on them.

That FCIC guy on Fox news clearly doesn't understand what he's even talking about. Notice how he lumps Alt-A in with sub-prime. Most sub-prime wasn't even written by banks covered under the CRA, and CRA wasn't about sub-prime anyway.

The crux here, imho, is the Fed and Treasury guaranty. The Fed has allowed greater and more dangerous TBTF (just ask TARP cop Barofsky, or read his report), created a greater concentration of bank power, and institutionalized moral hazard. The banksters must be laughing their asses off, with over-stuffed wallets. Gamble, gamble, gamble. It matters not. The Fed has your back. You lost how much, Mr. TBTF Banker? No worries. We'll just lend you more at 0% interest so you can do it again...and again...and again...

I feel like Neo after he takes the red pill and sees that he's been living in The Matrix. Tumbling down the rabbit hole..."He's gonna pop!" PUKE...

Really? Really? I'm dumber for having read this statement.

1: They signed for the loan because they wanted to gamble and make money... GREED!

2: Many of these foreclosures are cash out refis where they bought/borrowed against other houses, and spent the money they stole.

3: They are NOT "home owners", they are home debtors.

Most of the people in this country knew not to borrow money they couldn't afford to pay back.

In fact, these criminals should be held responsible for paying back the money they gained. Their Mercedes SUV's should be repossessed, their pictures of their trips to Europe should be burned and they should have to work in a government job cleaning the National Parks until they pay the money back.

And yes, the bankers should just be executed.

Is this why we see these kinds of things going on in foreign & economic Relations that threaten USA sovereignty , but We the People get stuck with the DEBTS ??? The citizens of America are supposed to be protected from such people and groups by law. That law, titled the Logan Act, prohibits United States citizens, without the authority of their office, from interfering in relations between the United States and foreign governments .

That law, titled the Logan Act http://www.fas.org/sgp/crs/misc/RL33265.pdf

http://homelandsecurityus.com/archives/4583

United States has partnered with Canada to use biometric software to track North American citizens.

http://www.whitehouse.gov/the-press-office/2011/02/04/declaration-president-obama-and-prime-minister-harper-canada-beyond-bord

Do we the people even have a clue as to what we bailout and why ?? This is Important to price the fixed asset markets as well as the reflection on debt allocations and the relationship this accounting would have in dollar valuations allocations . We the people deserve to Know if this is what caused hank Paulson to demand the bailout TARP money , which he first said was for Toxic asset relief , and then switched the bailout to certain Financial Firms that I bet held Arabian Investors who Demanded their holdings be guaranteed 33 % equity solvency or they pull out of Wall Street ??

This is Why the FEDERAL RESERVE needs to be Audited .

Ok , heres another question for the Cronies Capitalism thats failing the US Economic Recovery , Did Hank Paulson switch gears with the TARP on who he bailed out due to these Shariah Law Compliance rules to keep this Fund invested in the US Dow Top 30 ??

http://dailybail.com/home/bloombergs-jonathan-weil-citis-vikram-pandit-may-have-violat.html . I bet the Citi Group and other widely held investments by Arab investors in Wall Street Demanded this 33 % solvency guarantee be put in place or they would pull out their Investments in Wall Street , and so this forced the Federal Reserve to start bailing out these positions up to the point that with fanny and Freddy holding Key asset investment that the Federal Reserve could not bailout without causing major conflicts of Interest in the securities and other asset classes that would have caused major conflicts to rise up in firms across the sector , this forced Bush and Paulson at the Treasury to come to Congress for the Bailout money to then bailout the Firms that held Arab investments and this was why Paulson baited Congress and then switched the bailout , is my opinion .

in your video The Goldman Ex CEO had a cozy relationship with the Arabs , so you got to wonder is this Shariah Law Compliance demand was what caused the economic crisis to unfold ;

http://dailybail.com/home/the-hammer-gets-hit-by-a-tree.html - this talks about Hank Paulson switching TARP funds Allocations .

and in your video here the Official dodges simple questions , is it because of this Arab bailout possibility that forced the Federal Reserve to Cash the Arab Investors a ## % guarantee or Wall Street Loses the Investors from Arabia ?? I bet this is what Happened .

http://dailybail.com/home/there-are-no-words-to-describe-the-following-part-ii.html - This is an interview where the Official responsible for finding out where the Federal Reserve Money is allocated towards has No Idea where any of the funds go , very strange , seems there could be some of the funds went to this Investor group to guarantee their Minimum required 33% solvency rate in any of their holdings don't you think ?? Read their requirements for Compliance page under

Screens for Shari´ah compliance

In this link Bernanke talks about bailout foreign investors starting in 2007 so maybe this Islamic Board demanded they be secured under Shariah rules they formulated , if so the US Investors have a right to know these things don't you think ???

http://www.youtube.com/watch?v=-RAugiQsTR0&feature=related

Overview The Dow Jones Islamic Market Index℠

http://www.djindexes.com/islamicmarket/

family includes thousands of broad-market, blue-chip, fixed-income and strategy and thematic indexes that have passed rules-based screens for Shari´ah compliance. The indexes are the most visible and widely-used set of Shari´ah-compliant benchmarks in the world.

To determine their eligibility for the indexes, stocks are screened to ensure that they meet the standards set out in the published methodology. Companies must meet Shari´ah requirements for acceptable products, business activities, debt levels, and interest income and expenses. The screening methodology is subject to input from an independent Shari´ah supervisory board. By screening stocks for consistency with Shari´ah law, the indexes help to reduce research costs and compliance concerns Muslim investors would otherwise face in constructing Islamic investment portfolios.

Shari´ah supervisory board

Screens for Shari´ah compliance

The U.S. has been exposed as a kakistocracy. The Bailout Party crushed the Slave Party with television.

Carry on.

Good question! We'll never know, however. My guess is that our "Republic" survives and the parasitic "financial services" area dwindles to a resolute equilibrium, like all of us do at some point.

But, if you ask Sheila Bair, even though she had no real power in the fight, she would say, FINALLY, let them (I-banks) go...

http://www.ritholtz.com/blog/2011/07/fdics-sheila-bair-a-regulator-scorned/

That said, each man warned that the figure did not and could not reflect the future.

---

Less than you think...

Good question. Let's get down to brass tacks. The bailout involved the transfer of $700B from the Treasury and $2T from the Fed from Main Street to Wall Street. That means Wall Street gained and Main Street lost. Let's focus on the latter first, and particularly on jobs. Here's a graph of the labor force participation rate. The blue section is post-bailout:

http://www.google.com/imgres?q=number+people+labor+force&um=1&hl=en&sa=N&biw=1225&bih=604&tbm=isch&tbnid=LfZMd6gG1JQcEM:&imgrefurl=http://reflectionsofarationalrepublican.com/2011/05/07/bush-vs-obama-unemployment/&docid=102a5Ibr6oQgxM&w=482&h=290&ei=hD1QTvqwHevD0AHI98CrBA&zoom=1&iact=hc&vpx=904&vpy=270&dur=306&hovh=144&hovw=239&tx=155&ty=61&page=1&tbnh=118&tbnw=196&start=0&ndsp=15&ved=1t:429,r:9,s:0

So that's 2% down, which translates to 8.5 million jobs lost. That is, by the way, why the headline unemployment rate is 9.1 rather than 11.1%.

Other metrics include food stamps, which have risen from 34 million users to 46 million since the bailout. That's about 30% up. JP Morgan controls that program, so again: Wall Street wins, Main Street loses.Seeing the pattern yet, Hondo?

If not, take a look at real estate prices, food prices, energy prices, medicine prices, contemporary art prices, bankruptcy filings, foreclosure filings, insider stock sales vs. buys, taxes, municipal filing fees, toll-way charges, gas pump prices, pink slips, hours worked, wages per worker, Wall Street bonuses, Manhattan and D.C rents vs. everywhere else, credit card interest rates, credit card fees and surcharges, savings and checking account interest rates, retail banking fees, parking meter rates, metropolitan subway and bus fares, automobile accessory prices, and local taxes--to name but a few--and you'll see the same pattern that's emerged ever since TARP was passed, namely, that when Wall Street is rewarded for its degenerate gambling losses, you--my clueless friend--lose, and you lose big.

Are we clear?

http://www.prwatch.org/news/2011/08/10924/money-still-owed-federal-bailout-15-trillion-still-owed-treasury-federal-reserve

Self cost.

In so far al the practical experiments have been a posetiv one, for all the citisences of a comunety, and lesser caruse, ease the presure on the sorounding envirioment.

The second aspect is,

what is the suma sumarium, the total cost of a bailout.

In reality, what if the goverment of USA gave away to any breathing american(no matter where and who) a deasent housing, a deasent live, because housing(no dept at all, only practical maintenens and thats on you) was free. How can that be mutch wurse that pilipng money upon a litle click that controls everything, anyway.

And on topp of that they push a hugh financial burden(tax cuts and no regulations in either finnance and/or envirioment, poisoning, hugh wages,and even more from stock) on ordinary people by rising prices in every fu... consivable way.

Its only, just for now I belive, we breath for free.

Where will it end.

The sulotions a simple, just eraze the problem.

Alterantives are already there, thats not the problem.

Its the present world of finnaces that are.

The robberbarons.