Trichet Says 'No Haircuts' For Billionaire Bondholders: "The Plan For Ireland Has Already Been Approved By The World"

Words, like body language, can be subtle.

But Jean-Claude Trichet has made very clear his opposition to haircuts for secured and unsecured bank creditors. In response to Fine Gael's plan to unilaterally restructure Ireland's debt, Trichet insisted today that the bailout plans for Ireland's banks have already been decided and that "the plans have to be executed."

Look forward to a bank bailout and bondholder showdown in the coming weeks.

--

Trichet Reiterates Opposition to Irish Debt Restructuring

EUROPEAN CENTRAL Bank (ECB) chief Jean-Claude Trichet has reiterated his opposition to any debt restructuring by Ireland, saying the terms of the EU-IMF bailout plan for the State have been approved by “the entire world.”

As top ECB officials closely observe the Irish election campaign, this was the second time in five days that Mr Trichet made the case against any restructuring of Ireland’s debt. He relayed the same message last Thursday immediately after the monthly meeting of the bank’s governing council.

In Brussels yesterday, Mr Trichet said the Irish rescue plan and that of Greece did “not comprehend” the notion of bondholders being compelled to take a “haircut” on their investments. Ireland entered an €85 billion EU-IMF programme last November and Greece was bailed out to the tune of €110 billion last May.

- “We have plans. The plans have to be executed, have to be implemented in the best fashion possible as has been the case the world over and it is very, very important in my opinion not to confuse things,” he said.

- “We have a programme, approved by the international community, approved by the IMF board, the entire world, approved by the European [Union], approved and financed by the IMF and the European [Union].

--

More...

See the rest of the pics...

Feb 8, 2011 at 5:39 AM

Feb 8, 2011 at 5:39 AM

Reader Comments (18)

http://www.irishtimes.com/newspaper/finance/2011/0208/1224289258019.html

source...

http://www.khou.com/news/texas-news/Super-Bowl-flyover-costs-taxpayers-450000-115109249.html

http://www1.albawaba.com/blunt-messages-people-fed-falling-back-their-egyptian-humor

http://thedailynewsonline.com/opinion/editorials/article_886768a8-32ea-11e0-a04d-001cc4c002e0.html?mode=story

[snip]

Of the $2.2 billion of stimulus money that went to renewables (mostly wind), 80 percent of that went overseas (See: Renewable energy money still going abroad, despite criticism from Congress: http://investigativereportingworkshop.org/investigations/wind-energy-funds-going-overseas/story/renewable-energy-money-still-going-abroad/).

[snip]

(For even more infuriating details, see: Wind Jammers at the White House: A Larry Summers memo exposes the high cost of energy corporate welfare: http://online.wsj.com/article/SB10001424052748704635704575604502103371986.html)

http://www.topix.com/forum/boston/T51BEUKAOJHK5IFKP

[snip]

But OMB and Treasury found severe problems with "the economic integrity of government support for renewables." Developers had almost no "skin in the game," meaning that their equity in projects was well below ordinary standards in the private market. They were also "double dipping," obtaining loan guarantees for projects that "would appear likely to move forward without the credit support" in the stimulus because of other subsidy programs. The reason for the roadblock was "an insufficient number of financially and technically viable projects."

Treasury and OMB singled out an 845-megawatt wind farm that the Energy Department had guaranteed in Oregon called Shepherds Flat, a $1.9 billion installation of 338 General Electric turbines. Combining the stimulus and other federal and state subsidies, the total taxpayer cost is about $1.2 billion, while sponsors GE and Caithness Energy LLC had invested equity of merely about 11%. The memo also notes the wind farm could sell power at "above-market rates" because of Oregon's renewable portfolio standard mandate, which requires utilities to buy a certain annual amount of wind, solar, etc.

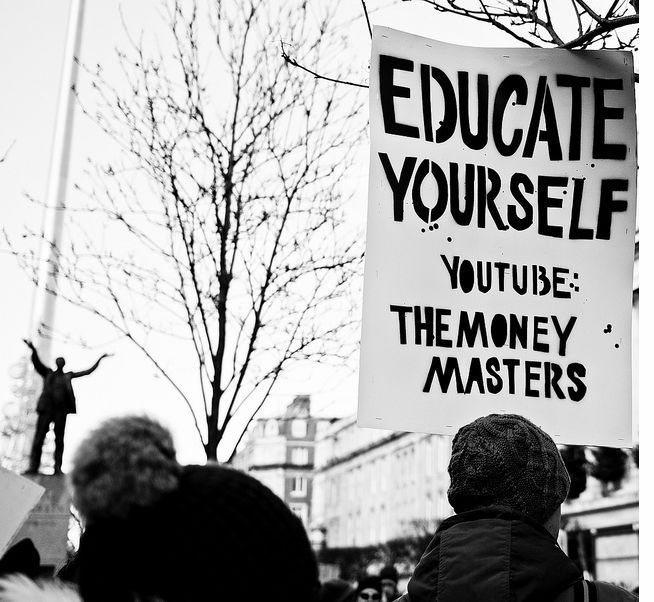

http://jana-murray.com/is-the-federal-reserve-bank-and-imf-seeking-to-overthrow-the-united-states-constitutional-form-of-government/

http://www.xat.org/xat/worldbank.html

The citizens of Dumbfuckistan are only to happy to ablige.

Congrats on your quantcast numbers..I was checking how popular your website has become over the past year. looking great! keep up the great job and the awareness!!

Sell the market short!

Read more: http://www.businessinsider.com/how-michigan-is-preparing-for-a-tsunami-of-financial-crises-2011-2#ixzz1DOJfyJj9

http://www.businessinsider.com/6000-workers-sit-in-as-the-first-suez-canal-strike-has-begun-2011-2

Northern Sinai heating up.

http://www.themedialine.org/news/news_detail.asp?NewsID=31324

how could you not be skeptical when the market has been up every single day since September 1, 2010. market is so set up and artificial. I'm taking my retirees money off the table and telling them to run with the money.

how could you not be skeptical of the markets when the market has been up every single day since September 1, 2010. I'm taking my retirees money off the table and telling them to run!

Did you ever end up selling OPEN short? (I know next to nothing, but I wouldn't have had the balls to do it in "Bernanke's Market.")

its very hard to short stocks in "B market". I have stayed away from shorting, but im looking for any weakness and i will be shorting. There are a lot of over valued stocks in this market that keep going higher.

I have sold alot of my clients holding on this manipulation and advised my clients to use this fake rally to take money off their table. I think only time will tell if i did a good thing.

I think OPEN, LULU, NFLX could be good shorts. Not now, but maybe around May.

best,

SS