FINALLY! - Ireland Issues Threat To Billionaire Bondholders

See the rest of the photos - 25 pics - all black & white...

UPDATE - ICTU may support default option, O'Connor warns

There is no possibility of 1.8 million workers repaying around €200 billion in debts arising from the collapse of the banking system within any reasonable time frame, outgoing president of the Irish Congress of Trade Unions Jack O'Connor has said.

In an address to the organisation's biennial delegate conference in Killarney this morning he said that so far Congress had not supported the call for default on debts. However, he said that "we may well come to do so".

He said there was no moral justification for the proposition that "we should have to pay the recklessly accumulated debts of those at the top of the banking system".

Mr O'Connor said the country had to extricate itself from "the straitjacket" of the EU/IMF/ECB bailout agreement, which, he said, was suffocating any prospect of growth in domestic demand. He said without such growth there would be no appreciable recovery.

---

Original story appears below:

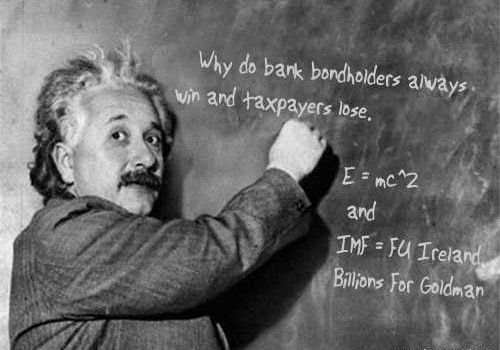

This is the heart of the bailout battle. Taxpayers vs. bank bondholders. In Ireland, the debate is front page news. On Friday, the leading opposition party, Fine Gael (pronounced feena gail), put forth a multi-point plan to deal with Ireland's banking and sovereign debt crisis. This weekend we made note of their plans to secure a $50B loan from the Federal Reserve, but perhaps more significant is their open threat to bank bondholders:

- "Fine Gael ... is committed to forcing certain classes of bond-holders to share in the cost of recapitalising troubled financial institutions. This can be done unilaterally for the most junior bondholders (owners of preference shares, sub-ordinated debt and similar instruments), but should be extended - ideally as part of a European-wide framework - for senior debt for institutions like Anglo Irish and Irish Nationwide that no longer have any systemic economic importance."

In other words, banks will be allowed (forced) to default on debts they owe to some of their creditors, including Goldman Sachs. In the post-bailout world, and outside of Iceland, this simply is not done. Even though, as we pointed out months ago, it's going to happen eventually anyway.

If it isn’t clear yet, Ireland will default on its bank guarantee. The IMF bailout of French, German and British banks is more than the Irish economy can afford, and far more than the Irish people are willing to allow....

Again, the only option -- the only viable option I should say (even if the Cowen’s and Lenihan’s of the world are too thick to see it) -- is to default. We’re not talking, of course, about defaulting on Irish government bonds, but defaulting on the ill-advised bank guarantees that went into place in the fall of 2008.

At the largest banks (Allied Irish Banks, Bank of Ireland, et al.) the plan appears to only threaten junior creditors. But at the notorious Anglo-Irish Bank, they are threatening to whack ALL bondholders (as they should).

Now, Fine Gael is being very careful how they word their ostensible plan. Notice that they include a reference to the debt restructuring occurring in the context of "a European-wide framework." That is because the terms of the EU bailouts of the Irish banks preclude any kind of bondholder haircuts without European approval. If that's the case -- that the EU and the ECB will still have a veto over any moves by the Irish government -- then this is just mamby pamby stuff meant to fool Irish voters. It will never happen.

However, Fine Gael also says:

- "Should some credible combination of these (above) options prove not to be available from Europe, the next Irish Government [ i.e. the Fine Gael-led government] would -- in order to restore its own credit worthiness -- be left with little choice but to unilaterally restructure the private debts of those Irish banks in greatest need of recapitalisation."

This is an astounding claim. Or maybe it's a threat. Ever since the financial crisis started, only Iceland has actually chosen to allow bank creditors to eat their own losses. Save Iceland, every single government has, in one way or another, protected bank bondholders. And yet, here we find Fine Gael firing a shot across the bow, not just towards Ireland's bank bondholders, but at bondholders around the globe. Until now, Iceland has been an outlier, the exception that proves the rule (the rule that protects bank bondholders at all costs). However, that could change quickly.

If Ireland also moves to force a haircut on bank bondholders, we may see other countries follow suit, with some reneging on their own sovereign debt (think Greece). Haircuts for bondholders are likely to happen because they are both politically popular, and because many nations (like Ireland) are simply unable to service the debt load that has been foist upon them. Writing in the Irish Independent just yesterday, Brendan O'Connor quotes a friend who works in the financial markets who had this to say about the Irish government's plans to pay off their banks' debt:

- "They look like f**king eejits paying it off. This is a game, and they need to start playing it."

O'Connor goes on to say,

- "This is a guy who knows private sector bondholders backwards. He has worked with them for years in mergers and acquisitions and he points out that haircuts are an accepted part of the game when things go wrong. And not only will the big private equity houses like Blackstone and KKR accept a haircut when things don't work out, they'll be back again to fund the next merger or acquisition. Because it's just part of the game. You win some, you lose some, but you don't stop playing just because you lose now and then."

Irish politicians have been way behind the ball on this. The idea of giving haircuts to bank bondholders is a part of the public discourse now in countries like Ireland. And more and more it's becoming a central political issue. When I was there this summer, many people still didn't realize that the bailouts were for the benefit of bank bondholders. At this point, after all the protests and debate over the IMF bailout of European banks, I would venture that things have changed considerably -- most Irish people are now well aware that they are being sacrificed for the likes of Goldman Sachs and Soc. Gen.

Expect more developments in the coming days and weeks.

Further reading...

DailyBail

DailyBail

Update on this story from February.

Reader Comments (25)

http://www.cnbc.com/id/41439800

Nasdaq Hacked

http://online.wsj.com/article/SB10001424052748704709304576124502351634690.html?mod=WSJ_hp_mostpop_read

Sources tell CNBC that major elements of the Treasury plan include a call for an increase in the cost of government-backed mortgage insurance, essentially a hike in the fees charged to borrowers. Treasury is also expected to endorse a reduction of the government's share of the mortgage market, to less than 50 percent from the current 95 percent.

In addition, Treasury is expected to propose reducing the maximum size for mortgages guaranteed by the government, to $625,500 from the current $730,000. The limit was temporarily raised in September.

http://www.cnbc.com/id/41429486/

If we had to bet, though, we'd bet that the Obama administration will propose folding Freddie Mac into Fannie Mae.

A merger of Fannie and Freddie’s would likely allow for cuts to personnel and overhead, since the two companies have identical and redundant functions. It would also be a major, fundamental change that would allow the administration to claim it was not allowing the two companies to continue as they had before they failed.

Recall that the purpose of having two distinct entities was to force them to compete. Fannie Mae originally had a monopolistic lock on the secondary mortgage market. Two years after the Johnson administration took Fannie off-balance sheet in 1968, Freddie was created to provide competition.

http://www.cnbc.com/id/41430615

http://poorrichards-blog.blogspot.com/2011/02/all-ambassadors-called-back-to.html

The derivative books of the TBTFs are NOT hedged. It is proven to be mathematically impossible.

http://letthemfail.us/archives/7439

How much more wage and savings destruction will the world's bailout payers take up their asses in the form of austerity before we all unite and say: "We're all Iceland now".

Ireland, go Iceland lads, just go hard down Iceland with it. Just change that R to a C me boys and go ICELAND!

http://www.irishtimes.com/newspaper/breaking/2011/0705/breaking28.html

[snip]

There is no possibility of 1.8 million workers repaying around €200 billion in debts arising from the collapse of the banking system within any reasonable time frame, outgoing president of the Irish Congress of Trade Unions Jack O'Connor has said.

In an address to the organisation's biennial delegate conference in Killarney this morning he said that so far Congress had not supported the call for default on debts. However, he said that "we may well come to do so".

He said there was no moral justification for the proposition that "we should have to pay the recklessly accumulated debts of those at the top of the banking system".

Read that twice.

The bankster threats are empty. They have nothing.

What happens next is anyone's guess.

http://www.zerohedge.com/article/guest-post-where-taxes-are-so-low-some-people-might-actually-pay%E2%80%A6

[snip]

Bulgaria is, after all, an EU member… though they likely fabricated their financial statements to gain entry in the same way that Greece did.

Simply put, Ireland’s decline will be Bulgaria’s gain, and the influx of foreign investment will be of great benefit to this economy and asset prices.

This in 4 hours ago.....

http://www.sofiaecho.com/2011/07/05/1118287_israeli-bulgarian-government-ministers-to-meet-in-sofia

I've been keeping tabs on this for awhile.....

http://www.icenews.is/index.php/2011/07/05/icelandic-fm-on-palestinian-visit/

[snip]

Iceland’s foreign minister is on his way to Gaza and the West Bank for a visit that is not scheduled to take in Israel.

Ossur Skarphedinsson is travelling to Gaza through Egypt and it is believed he will get there tomorrow. He will use his time in the Middle East to assess the situation there first hand, DV reports.

Following this, Skarphedinsson will travel through Jordan to get to Ramallah in the West Bank (referred to as Palestine in DV) to meet with Palestinian leaders.

http://www.irishtimes.com/newspaper/breaking/2011/0706/breaking29.html

[snip]

Ireland's credit rating may be cut to junk by Moody's Investors Service after Portugal yesterday lost its investment grade rating, analysts said today.

Moody's, which slashed Portugal four notches yesterday to Ba2 from Baa1, in April lowered Ireland's credit rating to the lowest investment grade Baa3 and left country's outlook on negative.

The ratings company cut Portugal's rating in part because the nation may not be able to return to debt markets in the second half of 2013.

Note: there are a couple of other good articles in todays edition of the Irish times.

When they loaded the cholera epidemic, the Spanish flu epidemic, the IRS, The Council on Foreign Relations, Jehovah's Witnesses and the Raptures, the Federal Income Tax, and World War I on top of this sole logical extrapolation of centralized banking, people had a lot to think about at one time, on top of their competitive and exhausting job.

Like a pod of dolphins or school of sharks attacking a school of aku tuna, the 'chicken' of the sea, they take turns zipping through the school, which makes the aku (and other schooling fish) panic and swim closer together for safety and it thus becomes easier to get a mouthful of prey on each pass. Like Clinton's order to get everybody buying a house at 1% and then a few years later, jacking the interest way up and sending in the robo-repos. Not very nice. And I might add, "it's not nice to fool around with mother nature. You never can tell when you have been transformed from a dolphin to a sprat like Tim Geithner and that mutual fund you see up ahead is really a little worm on the forehead of an angler fish, or the wiggling dropped tail of a gecko about to return as godzilla with the public approval necessary for the job he is about to do on his attacker.'

Fascism assures there are plenty of soldiers to protect the swine from justice for the evil they do. You TV watching jelly heads need to 'cut the cord' , dump your TV, and catch up. You are way back there and here come the lions. OOOPS!! They just grabbed another one.

Insight man - you got it in spades!

Suggestions?

Mouser

Since the banksters know that many have figured out the fraud angle, they created derivatives. If you look at the explanation on the "let them fail" page, it speaks to one side of the story. However, given the behavior of Papandreou who bought credit default swaps that could have save his country and the PRIVATIZED them to a company that had his brother-in-law among its shareholders, I think that every citizen in this world should do what the Spanish have done--SUE THE GOVERNMENT TO FIND OUT WHAT THE DEBT IS COMPRISED OF. How much of it is actual expense? how much of it is speculative debt caused by the unauthorized purchase of credit default swaps or real-estate back derivatives (fraudulent in their very inception)? Who is actually holding this debt and expecting to be paid back? Who tried to profit from government service?

Then, sue the investment banks that OVERSOLD real-estate-backed derivatives by trillions and demand the money back. Bankrupt the damn Goldman Sachs vampires. Then, assess what is really owed (if anything) and prosecute the public servants that tried to "cash in" on their employment. Repudiate this debt.

MK

I suggest a "bigmac haircut" :-)

People embrace ignorance like mommy's left tit. National Geographic did a video called Nile Crocodiles: Here be Dragons. In this video, after a huge herd of wildebeest line up along the river to drink, the crocodiles move in. Some wise wildebeests back away. I timed this one incident where it takes just less than 1.75 seconds for a one ton crocodile to go from being completely submerged to grabbing a wildebeest on dry land and then be completely submerged again with the 250 lb. wildebeest also completely submerged.

I like to tell people that their mothers told them two big lies. And my mother was no slouch. We should all love our mothers. Some people grow up around older stronger and smarter cousins like I did, so we can learn that mama was lying when she said these lies. That we are perfect and safe.. Learning to really play football with the big guys really helped. Those two lies that Christian, Jew, Muslim, Catholic, Hindu, Shinto, Bantu, birds, monkeys, badgers, mice, etc. tell their children are 1) You are perfect. And 2) You are safe. The sooner people get over that horseshit, the better. Spoiled isolated brats with stunted survival instincts coupled with a poor idea of nature and the reality outside mom's influence can really mess things up. Geithner NEVER HAD A JOB BEFORE THEY PUT HIM IN CHARGE OF IMPLIMENTING AND SHAPING A CORRUPT SET OF POLICIES. He has earned millions of severe beatings, as have others, for their violations of the publc trust in the thefts of so much 'coin equity' before leaving valueless derivative paper behind. These idiots do not understand the personal sacrifice that goes into honest work. They steal and always have.

The Bush deregulation of the banking and stock market gives the legal avenues by which to steal, but not the good sense to obstain. Hate Greenspan but he warned against the exhuberant use of derivatives. The banksters have never been waylayed on the football field by somebody three times their size who was 'given instructions'. They never learned to check exhuberance with humility and grace while following the rules as a kid. George H.W. Bush and friends killed the rules.

Currently, mentions of the HAARP attacks on the U.S. are being censored and checked by the illegal government terrorists and private terrorists actually carrying out the attacks. This censorship is not legal because the public's lives and safety are being terminated and otherwise violated. ARCO, Raytheon (of 9-11 fame) and the English owners figure prominently. The facilities are being used to kill and destroy America through weather manipulation and the a_______ at the top are being coy about it. A segment of the U.S. government and the S&Bs did 9-11, DH oil well, this financial piracy, etc. all to benefit a foreign power. The CFR is their smokescreen. The TV set is their instrument. The Fed and the CFR started out as almost the same exact group.