Friday

Feb182011

The Federal Reserve Sponsors PROPAGANDA Contest On YouTube - End The Fed Movement Fires Back With GENIUS

There are Brian Sack fingerprints all over this, not unlike daily S&P 500 futures.

Long live Mark Pittman, champion of Fed transparency.

---

From the St. Louis Fed website:

- The St. Louis Fed is sponsoring a YouTube video contest. We want your original video, illustrating the importance of an independent central bank. And not just the independence of the Federal Reserve, but central banks in general. What makes independence for a nation's central bank important? Why should they steer clear of politics? How does independence affect inflation and economic activity? Let us know through your video creation!

Here is the propaganda video advertising the propaganda video contest:

- Prizes will be awarded to the top four videos:

* First place: $1,000 U.S. Savings Bond

* Second place: $750 U.S. Savings Bond

* Third place: $500 U.S. Savings Bond

* People's Choice: $250 U.S. Savings Bond

In response to this blatant propaganda effort, the good folks at Economic Policy Journal are sponsoring their own, parallel End The Fed video contest. And the prize for the winner?

- The St Louis Fed awards a series of prizes, the first one being a $1,000 face value U.S. Savings bond, that will be worth when you receive it only $500 and won't be redeemable at $1,000 for 17 years (Good luck inflation wise with that)

- Our award only goes to the top prize winner, but it will be a one ounce gold coin (currently worth approx. $1400). You will be able to sell it immediately for its full value, if you choose, or hold as it protects you against Fed created inflation.

---

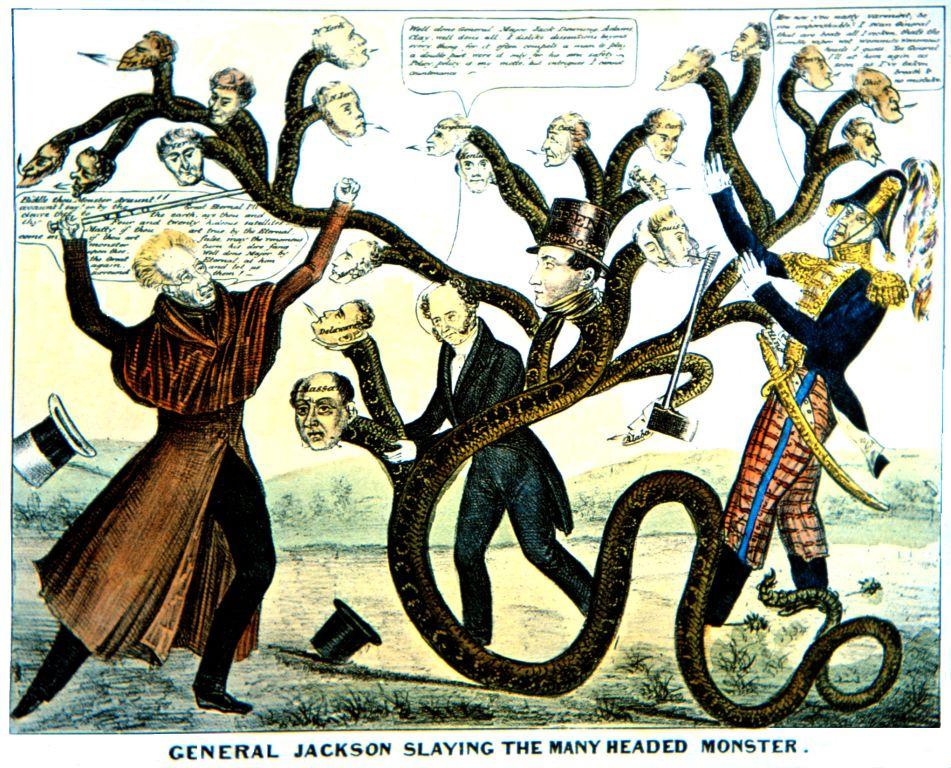

Here's how one 19th-century "YouTuber" depicted Andrew Jackson slaying that "Many-Headed Monster," the Second Central Bank of the United States.

Feb 18, 2011 at 12:02 PM

Feb 18, 2011 at 12:02 PM

Reader Comments (16)

http://www.huffingtonpost.com/mike-lux/the-big-banks-battle-agai_b_822236.html

The number of borrowers who owe more on their mortgages than their homes are worth took a huge leap in the fourth quarter of 2010. A full 27 percent of borrowers are now “underwater” on their mortgages, up from 23 percent in the previous quarter, according to a new report from Zillow. Foreclosure moratoriums and falling home prices are to blame.

http://www.cnbc.com/id/41483676

national meet-ups on walking away...

Fannie's Scandalized, Freddie's Dead -- and the Next Financial Meltdown May Have Already Started

Congress warned over states' bankruptcies

'Overconfident' IMF downplayed risks in run-up to financial crisis

International Monetary Fund failed to spot looming crash and praised US and UK financial regulation, says damning report

The International Monetary Fund (IMF) has issued its clearest warning to date that the latest US fiscal stimulus is ill-judged, unlikely to do much for growth and raises the risk of a bond crisis over the medium term.

http://www.telegraph.co.uk/finance/globalbusiness/8281897/IMF-chides-US-for-fiscal-folly.html

Asian and Middle-East investors have thronged to buy the first issue of AAA-rated bonds by the eurozone's new bail-out fund, marking a key moment in the evolution of Europe's monetary union.

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/8282038/Asian-investors-lead-massive-demand-for-first-Euro-bail-out-bond.html

Bank claims Madoff trustee's lawsuit raises questions that bankruptcy court cannot answer, and seeks to have case moved to federal court

http://www.guardian.co.uk/business/2011/feb/09/jp-morgan-seeks-jury-trial-bernard-madoff-lawsuit

Vibrant exports will save Spain, and perhaps the euro

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/8322035/Vibrant-exports-will-save-Spain-and-perhaps-the-euro.html

http://www.google.com/hostednews/ap/article/ALeqM5j2et-6UzD0IgMOqIH3vtFmowOf_w

While the video's producer (Bernanke) had an unlimited budget, he produced a video that's ridiculous (a boom mike for a way-too-long handshake, uhhh, sure), cheesy (alien eyeball effects for the ginger chick, really Ben?), geometrically amiss (what's with the rearview mirror shot at :21, Ben; is the mirror outside the car, or is she driving in England?), and historically flawed (why is a central bank's independence important, the vid asks? it isn't, as the first few decades of the U.S. amply demonstrated).

In sum, Ben's video amply embodies the Fed itself: incompetent on its face.

Interesting Qui Tam Suit - A Model?

http://market-ticker.org/akcs-www?post=179887

[snip]

Oh oh.

This has an interesting twist to it. As Zerohedge pointed out, there is a "blow your own brains out" problem no matter which way the case goes.

If the plaintiffs lose, that is, it is found that the corporations were government instrumentalities, then their S-1 originally and their quarterly reports and other statements forward from there were all falsely-filed, asserting that Fannie and Freddie are in fact corporations. In this case the US Treasury is likely on the hook for the loss in shareholder value and will almost-certainly get instantly sued, and further, so will the principals involved in the deception. While the US Government may avoid liability under sovereign immunity, the individual actors are potentially exposed on a personal level due to the fact that they violated that which is clearly set forth in the Congressional Record with regard to the disgorgement of Fannie from Federal Control and the creation of Freddie as a private, for-profit corporation. That is, the qualified personal immunity of a government actor only extends as far as their statutorily-provided mandate and duties. Step beyond that boundary and you can be held personally responsible.

A. more

B. less

C. nothing

http://www.marketwatch.com/story/fed-dictator-bernanke-needs-to-be-toppled-2011-02-15