Meet The Fed’s QE2 Traders, Buying Bonds By The Billions

That's it. That's the room where Bernanke's magic happens. Incredibly underwhelming for money printing ground zero. Maybe next year, the Helicopter will drop some cash for new computers. Reminded me of this story...

There are quotes from the Fed's head trader Brian Sack, though there is no mention or explanation of his meetings with Goldman Sachs FX Committee, as Zero Hedge detailed recently.

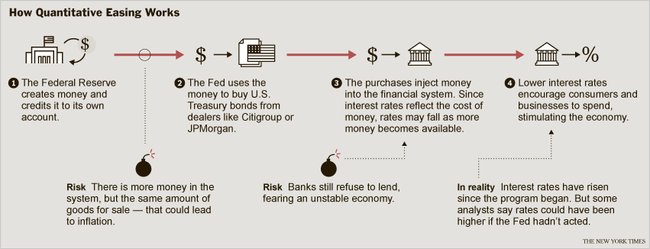

Full profile from the NYT inside, and more - video, links, QE2 infographic.

---

Meet the Fed's QE2 Traders

In a spare, government-issue office in Lower Manhattan, behind a bank of cubicles and a scruffy copy machine, Josh Frost and a band of market specialists are making the Fed’s ultimate Wall Street trade. They are buying hundreds of billions of dollars of United States Treasury securities on the open market in a controversial attempt to keep interest rates low and, in the process, revive the economy.

To critics, it is a Hail Mary play — an admission that the economy’s persistent weakness has all but exhausted the central bank’s powers and tested the limits of its policy making. Around the world, some warn the unusual strategy will weaken the dollar and lead to crippling inflation.

But inside the Operations Room, on the ninth floor of the New York Fed’s fortresslike headquarters, there is no time for second-guessing. Here the second round of what is known as quantitative easing — QE2, as it is called on Wall Street — is being put into practice almost daily by the central bank’s powerful New York arm.

Each morning Mr. Frost and his team face a formidable task: they must try to buy Treasuries at the best possible price from the savviest bond traders in the business.

The smallest miscalculation, a few one-hundredths of a percentage point here or there, could unsettle the markets and cost taxpayers dearly. It could also embolden critics at home and abroad who say QE2 represents a dangerous expansion of the Fed’s role in the markets.

“We are looking to get the best price we can for the taxpayer,” said Mr. Frost, a buttoned-down 34-year-old in a striped suit and rimless glasses.

Whether Mr. Frost will reach that goal is uncertain. What is sure is that market interest rates have risen, rather than fallen, since the Fed embarked on the program in November. That is the opposite of what was supposed to happen, although rates might have been even higher without the Fed program.

Mr. Frost’s task is to avoid paying top dollar for bonds that could be worth less when the Fed tries to sell them one day.

Louis V. Crandall, the chief economist at the research firm Wrightson ICAP, said Wall Street bond traders were driving hard bargains. The Fed has tipped its hand by laying out which Treasuries it intends to buy and when, giving the bond houses an edge.

“A buyer of $100 billion a month is always going to be paying top prices,” Mr. Crandall said of the Fed. “You can’t be a known buyer of $100 billion a month and get a good price.”

Nevertheless, Mr. Frost and his team have been praised on Wall Street for creating a simple, transparent program. Neither the Fed nor Wall Street wants any surprises. The central bank is even disclosing the prices at which it buys.

Mr. Frost and his team work out of a small, beige corner office with arched windows that used to be a library. There, at about 10:15 most workday mornings, one of them pushes a button on a computer. Across Wall Street, three musical notes — an F, an E and a D — sound on trading terminals, alerting traders that the Fed is in the market.

On one recent Tuesday morning, what Mr. Frost and his five young colleagues did over a 45-minute period might have unsettled even a seasoned Wall Street hand: they bought $7.8 billion of Treasuries.

Mr. Frost and his team drew up the daily schedule for what the Fed calls its Large-Scale Asset Purchase program. And that program is, by any measure, large scale: through next June, these traders will buy roughly $75 billion of Treasuries a month — on top of another $30 billion it is reinvesting in Treasuries from its mortgage-related holdings.

Continue reading at the NYT...

---

---

QE2 for Dummies...

More detail on this clip is here:

---

Related stories...

Feb 4, 2011 at 7:03 PM

Feb 4, 2011 at 7:03 PM

Reader Comments (6)

http://blogs.wsj.com/economics/2009/04/17/who-is-brian-sack/

http://dailybail.com/live-beat/marshall-auerback-just-called-you-a-deficit-terrorist.html

http://dailybail.com/home/whitewash-on-wall-street-how-henry-paulson-created-the-finan.html

Nano-crapmagic money printing for dummies.

Thoughts from Bullard, Lockhart, Fisher and the rest of B-52's henchmen. Solid Reuters fact box with QE positions and quotes from all 12 Fed Governors. Plus, why the super-bullshitastic efforts by the Helipcopter will fail.

http://dailybail.com/home/fed-fighting-where-do-they-stand-on-qe2-check-out-this-qe-qu.html

http://dailybail.com/home/dylan-ratigan-stephen-a-smith-captured-politicians-need-to-g.html