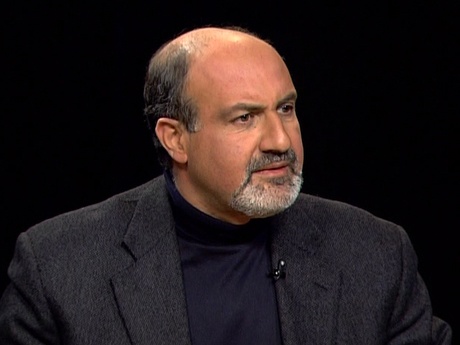

Taleb Says Obama's Stimulus 'Made Economic Crisis Worse'

Originally published in Sep. 2010.

---

That makes 3 racist tea partiers in the last 10 days telling Obama to stop the stimulus.

---

U.S. President Barack Obama and his administration weakened the country’s economy by seeking to foster growth instead of paying down the federal debt, said Nassim Nicholas Taleb, author of “The Black Swan.”

- “Obama did exactly the opposite of what should have been done,” Taleb said yesterday in Montreal in a speech as part of Canada’s Salon Speakers series. “He surrounded himself with people who exacerbated the problem. You have a person who has cancer and instead of removing the cancer, you give him tranquilizers. When you give tranquilizers to a cancer patient, they feel better but the cancer gets worse.”

Today, Taleb said, “total debt is higher than it was in 2008 and unemployment is worse.”

Obama this month proposed a package of $180 billion in business tax breaks and infrastructure outlays to boost spending and job growth. That would come on top of the $814 billion stimulus measure enacted last year. The U.S. government’s total outstanding debt is about $13.5 trillion, according to U.S. Treasury Department figures.

“Today there is a dependency on people who have never been able to forecast anything,” Taleb said. “What kind of system is insulated from forecasting errors? A system where debts are low and companies are allowed to die young when they are fragile. Companies always end up dying one day anyway.”

Must see:

Sep 19, 2011 at 10:47 PM

Sep 19, 2011 at 10:47 PM

Reader Comments (4)

http://www.businessinsider.com/interview-with-nassim-taleb-2010-4

http://www.bloomberg.com/news/2010-09-29/meredith-whitney-plans-report-on-weak-health-of-u-s-states-fortune-says.html

First on Tuesday — Spanish business daily Expansión reports that the market is expecting Moody’s to downgrade Spain below AAA this week — when it concludes the review it announced back in June. The rating agency has had Spain on AAA since 2001, but both Fitch and Standard & Poor’s have already cut the country to AA.

http://ftalphaville.ft.com/blog/2010/09/28/354516/spanish-spectres-in-the-market/

A new survey by AlixPartners LLP, a business-advisory firm, showed a growing share of Americans think it will take years for the economy to recover to “normal times.” Some 46% said it will be 2013 or later before that happens. A smaller 36% predicted a recovery sometime before 2013.

http://blogs.wsj.com/economics/2010/09/28/more-americans-expect-recovery-will-take-years/