QE 2.0 COUNTDOWN: Goldman Predicts Bernanke Will Begin Massive Asset Purchases In November

According to Goldman Sachs, the Fed will announce the QE v.2.0 program for asset purchases, a new $1 trillion in U.S. Treasuries, as early as November. Goldman recently cut their U.S. GDP growth estimate for Q3 and Q4, so this announcement fits their macro view.

That's $1 trillion more of pure, unadulterated national debt monetization. These are the actions of a desperate Bernanke who fears deflation above all else.

Chris Warren wrote last week that the new QE will fail miserably. PIMCO's Bill Gross has made a $8 billion bet against deflation, details of which were released today. And China is showing an increased willingness to threaten Geithner with massive Treasury dumping.

---

The U.S. Federal Reserve could announce a new program of asset purchases to support a weak economy as early as November, according to Goldman Sachs Group Inc.

“We don’t expect this at the Sept. 21 meeting, but in November or December there’s certainly a possibility that it will be announced,” Jan Hatzius, chief economist at the bank, said Tuesday. He added the Fed is likely to buy U.S. Treasurys worth around $1.0 trillion to kick-start the economy.

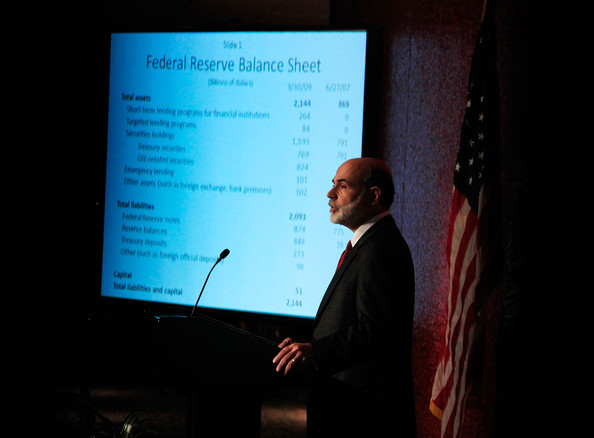

To fight the financial crisis in 2008 and 2009, the Fed bought $1.7 trillion in mainly mortgage-backed securities, a move that helped to keep mortgage and other long-term borrowing rates low. That program ended in March. But with the recovery slowing, the Fed said Aug. 10 that it would reinvest the proceeds of mortgage bonds into U.S. Treasurys to prevent its portfolio of securities from shrinking. The question now is whether the central bank will start a new program of asset purchases that would increase the size of its $2.0 trillion balance sheet further.

Goldman Sachs expects this to happen soon given the weakness in the U.S. economy as a result of lower business inventory accumulation and a fading fiscal stimulus. The bank expects the U.S. unemployment rate to creep back up to 10% by early 2011 from 9.6% in August and to stay around that level for most of the year.

U.S. inflation is predicted to continue slowing to 0.5% by the end of next year from around 1.0% currently. That would be well below the Fed’s informal target of between 1.5% and 2.0%.

The upcoming meetings of the Fed’s policy-setting committee this year are Sept. 21, Nov. 2-3 and Dec. 14.

##

Links:

Sep 16, 2010 at 1:29 AM

Sep 16, 2010 at 1:29 AM

Reader Comments (10)

Described as a financial economist at the SEC, Wolf was asked to come up with an answer to the following existential question of the financial crisis: How much did Citigroup benefit from misleading investors about its true subprime exposure?

Wolff answered the question pretty narrowly, according to a court filing in the SEC’s civil case against Citigroup.

He calculated that Citigroup’s ultimate disclosure that it understated its subprime exposure by $43 billion caused the company’s bond prices to fall 0.65 percentage point more than similar bonds. And the benefit of issuing $19 billion of bonds in the months leading up to that November 2007 disclosure than it would have paid in interest costs had buyers known of the bank’s true finances amounted to as much as $123 million. Alternatively, Wolff concedes, the benefit to the bond prices may have been negligible if you assume that the decline in prices owed to factors other than the disclosure, such as the resignation of CEO Chuck Prince.

The question now is whether the explanation will persuade a federal judge to approve the $75 million settlement of the SEC’s charges against the bank. The SEC alleges that Citi understated its subprime exposure by $43 billion from July to November 2007.

http://blogs.wsj.com/deals/2010/09/09/how-much-should-citi-holders-pay-for-the-banks-mistakes/

http://online.wsj.com/article/SB10001424052748703743504575493841164082512.html?mod=WSJ_newsreel_opinion

http://online.wsj.com/article/SB10001424052748704554104575435563989873060.html?mod=WSJ_hp_mostpop_read

Interesting list...

The TV host has a point when he says a limitless view of state power is un-American.

http://online.wsj.com/article/SB10001424052748704554104575435942829722602.html?mod=WSJ_hp_mostpop_read

http://online.wsj.com/article/SB10001424052748704652104575493900247018126.html?mod=WSJ_hp_mostpop_read

The answer is hell no...

But others argue it's far too early to write off the newest tea-party favorite, who stunned the political world Tuesday by toppling Republican fixture and nine-term congressman Mike Castle in the party's Delaware Senate primary.

"This one may not be easy, but it's far from over," said Terry Strine, former head of the Delaware Republican Party.

Democrats cheered the O'Donnell upset, saying it all but certainly ensures that the seat, formerly held by Vice President Joe Biden, will remain in Democratic hands. Ms. O'Donnell, the Democrats believe, is too flawed a candidate to win.

http://online.wsj.com/article/SB10001424052748703743504575494252317649106.html?mod=WSJ_newsreel_us

And THAT is today's American History Lesson.

When they wake up, it will be to late. ((( "God Help the Stupid" )))

Ever see the movie IDIOCRACY?

THAT'S what the U.S. has become. And for basically the same reasons outlined in the movie; idiots vasty out-reproducing the rest of the population.