According to Goldman Sachs, the Fed will announce the QE v.2.0 program for asset purchases, a new $1 trillion in U.S. Treasuries, as early as November. Goldman recently cut their U.S. GDP growth estimate for Q3 and Q4, so this announcement fits their macro view.

That's $1 trillion more of pure, unadulterated national debt monetization. These are the actions of a desperate Bernanke who fears deflation above all else.

Chris Warren wrote last week that the new QE will fail miserably. PIMCO's Bill Gross has made a $8 billion bet against deflation, details of which were released today. And China is showing an increased willingness to threaten Geithner with massive Treasury dumping.

---

The U.S. Federal Reserve could announce a new program of asset purchases to support a weak economy as early as November, according to Goldman Sachs Group Inc.

“We don’t expect this at the Sept. 21 meeting, but in November or December there’s certainly a possibility that it will be announced,” Jan Hatzius, chief economist at the bank, said Tuesday. He added the Fed is likely to buy U.S. Treasurys worth around $1.0 trillion to kick-start the economy.

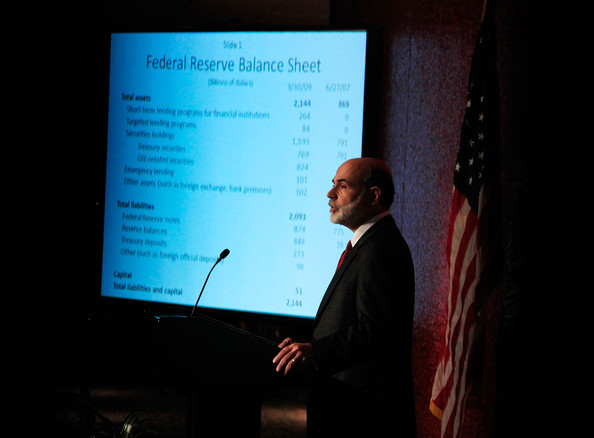

To fight the financial crisis in 2008 and 2009, the Fed bought $1.7 trillion in mainly mortgage-backed securities, a move that helped to keep mortgage and other long-term borrowing rates low. That program ended in March. But with the recovery slowing, the Fed said Aug. 10 that it would reinvest the proceeds of mortgage bonds into U.S. Treasurys to prevent its portfolio of securities from shrinking. The question now is whether the central bank will start a new program of asset purchases that would increase the size of its $2.0 trillion balance sheet further.

Goldman Sachs expects this to happen soon given the weakness in the U.S. economy as a result of lower business inventory accumulation and a fading fiscal stimulus. The bank expects the U.S. unemployment rate to creep back up to 10% by early 2011 from 9.6% in August and to stay around that level for most of the year.

U.S. inflation is predicted to continue slowing to 0.5% by the end of next year from around 1.0% currently. That would be well below the Fed’s informal target of between 1.5% and 2.0%.

The upcoming meetings of the Fed’s policy-setting committee this year are Sept. 21, Nov. 2-3 and Dec. 14.

##

Links: