Is G.E. the Real Reason Paulson Panicked in the Aftermath of Lehman? - Shrieking Cries Of Immelt Pain

Last night (just for kicks), I watched the BBC documentary from last year on the fall of Lehman and I was struck by two things. First, the "credit was frozen" meme went unquestioned -- we've come to expect that. But the second thing that struck me was that Neel Kashkari went out of his way to say that it wasn't just financial companies that were having problems with short-term borrowing, but that non-financial companies were, too.

- "We were getting calls from large American businesses, blue-chip businesses, saying they couldn't fund themselves, they couldn't make their payroll, they couldn't fund their inventory."

Now, there are a couple of ways to read this. On the one hand, he could just be lying to cover for the fact that he wanted to save his banker buddies (we're assuming he has some). On the other hand, he may just remember hearing rumors, from somewhere(?), about somebody having problems. But on the third hand, I suspect he knows exactly which large, blue-chip American business he's talking about, and what he really meant to say is, G.E. Because it was Jeff Immelt, remember, who was calling up Hank Paulson back in those halcyon days, saying "Save me, save me." It was G.E. (or what I like to call, "that large, blue-chip American finance company known as G.E.") that, of all the so-called non-financials, was in the most trouble.

Crazy thing is, that the CP market during the crisis isn't much different from the inter-bank market. There are clear signs of stress, and borrowing moved to the very short term, but there was never a systemic meltdown, freeze-up, etc. (Unless, apparently, your name happened to be G.E. or Citi.)

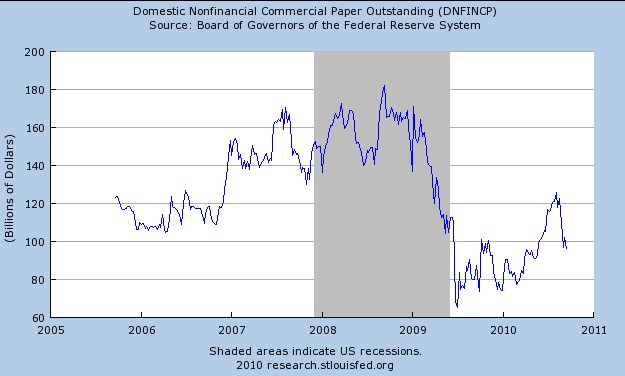

Here's total non-financial Commercial Paper outstanding during the crisis period. Nothing terribly unusual except that the entire market begins to shrink as the recession wears on and companies (like G.E.) began taking full advantage of the Temporary Liquidity Guarantee Program to issue govt.-guaranteed bonds. The real decline in total CP outstanding begins in early 2009, not in the immediate wake of Lehman.

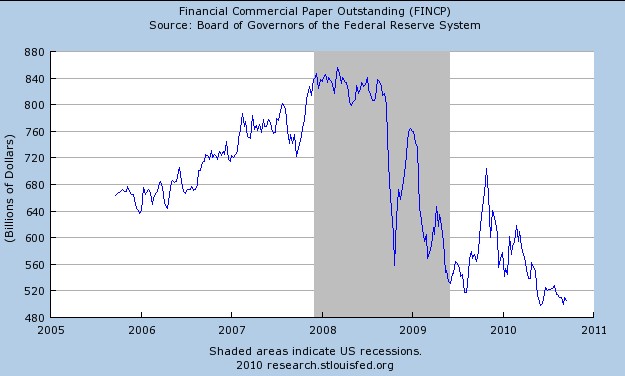

Here's the same chart for financials. You can't miss the cliff drop around August or September. But the spike back up comes just as the Fed begins purchases of CP through the Commercial Paper Funding Facility sometime after October 7.

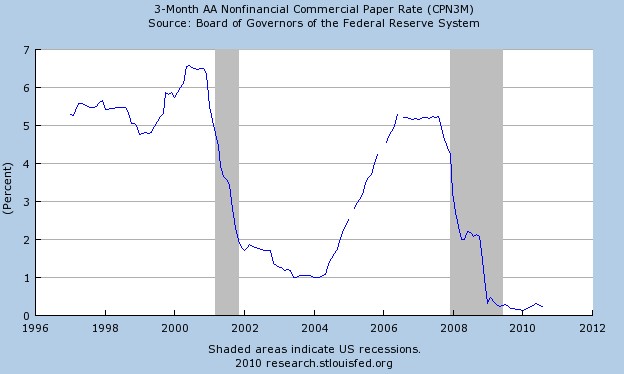

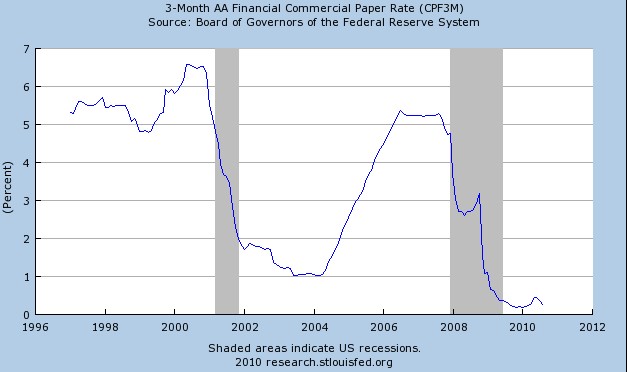

Finally, here are graphs of the rates on 3-month Commercial Paper, first for non-financials and then for financials.

Notice there is no massive spike in rates during the crisis. And what happened to all those blue-chip companies that couldn't make payroll or fund day-to-day operations? Are there actual confirmed reports of this, or just Jeff Immelt whining to Hank Paulson? From the revelations in Paulson's book, it sounds like it might have just been G.E. But no matter what, on October 7, four days after TARP was passed, the Fed announced the commencement of its Commercial Paper Funding Facility. Four days.

Here's what we know. The excuses for passing TARP were:

- 1) "the electronic run" on money market funds, which was taken care of by Treasury's 100% guarantee of all existing MMF accounts on September 19,

- 2) the near total lock-up ("freeze") of the interbank lending market, which Afonso, et al. have shown never quite happened, and for which the Term Asset Facility (TAF) picked up much of the slack anyway, or

- 3) the problems in the commercial paper market which supposedly kept companies from making payroll and whatnot, but this was almost instantly fixed when the Fed introduced the CPFF on October 7.

Again, the question has to be asked: Why was TARP necessary? Notice, the question is NOT "Was there really a crisis in the credit markets?" Clearly there was, but why TARP, when TARP had so little to do with fixing the ostensible problems and likely made all of them worse? If TARP was not really meant to save the financial system (and maybe it was -- I have great faith in human stupidity), then what was TARP meant to do? And more to the point, what was G.E.'s role in instigating the push for TARP? All evidence suggests that reports of large, blue-chip companies having difficulty funding operations can be attributed to one company: G.E.

Related:

Oct 11, 2011 at 11:37 AM

Oct 11, 2011 at 11:37 AM

Reader Comments (20)

Very well-put together story...i think you made the case...so let's answer the TARP question...that week was bloody f**king panic...Lehman failed...aig failed and was rescued...money-market funds got hit with a panic when one of them broke a buck...goldman's stock was in the 50s...blankfein convinced paulson that something big needed to be done...they spoke on the phone constantly during this period...paulson got together with bernanke...they called reid and pelosi...

This move was all about restoring confidence...he honestly wanted a huge headline number -- $700 billion was chosen -- the details didn't matter to him...that's why the original bill was 3 pages with no oversight...i don't think he even had a plan at that point of exactly how he would use the money...he even thought he might NOT have to use it...but he wanted the headline of Congress giving him $700 billion -- so world markets would have confidence that disaster had been averted...

So TARP originally was intended to end the panic in confidence...then as the weekend passed he realized that Congress wouldn't lay down without a serious proposal...so buying toxic assets became the idea...but it wasn't set in stone because the real idea was just to re-instill confidence...and this could be accomplished in many different ways...and of course TARP eventually became a capital infusion program...

I still owe you that book review of Bill Isaac's "Senseless Panic," but the argument he makes there is that Paulson et al. just fumbled the ball up one side of the field and down the other, and TARP scared the bejesus out of everybody.

http://acrossthestreetnet.wordpress.com/2009/03/08/can-you-say-fiduciary/

Or this one (which still hasn't won any awards).

http://acrossthestreetnet.wordpress.com/2009/02/04/ge-will-change-ticker-hfs/

---

I remember kashkari telling charlie rose this but it doesn't fit with how treasury behaved...the aftershocks of the lehman bankruptcy tore through world financial markets...they were not prepared for this...there was no order to lehman's bankruptcy...and TARP was very hurried and constantly in flux for the first few weeks...

i suspect kashkari might have expected a bailout back in 2008 after Bear but i think it was given a low priority as markets rebounded in the early summer of 2008...things were pretty good until september...then fannie and freddie, aig, and lehman all within a week...

I still find the whole thing unbelievable. Either Paulson, et al. were in some way up to no good, or they were just plain stoopid. And after Bear, I just don't see how they could have been THAT stoopid. Because Bear showed in no uncertain terms that these firms' dependence on short-term/overnight financing, using shitty collateral, was likely to cause them to fail. I mean, it sounds like the most Paulson ever did was have lunch with Dick Fuld. Trying to reason with Dick Fuld was probably less productive than trying to reason with my 4-year old. Even my 8-year old knows that leverage can easily bite you in the ass. Arrrgggh.

And Kashkari, Bernanke and Geithner all kept their jobs or got promotions for the stupendous job they did avoiding a meltdown.

---

If you remember Bernanke was taking care of this part...there were several FED programs put in place after Bear that mitigated this problem...i don't remember their names but they were a big part of the reason for the rally that ensued in the markets...i honestly believe they were stupid...and they weren't aware of the dangers at AIG...i doubt that was even on the radar until late august...

if the bailout was planned ahead of time then blankfein would have been told...and if he knew it was coming, no way he reaches out to warren buffett for that $10 billion on tough financial terms...they paid a lot for that capital, and he did it to survive...blankfein didn't know TARP was coming...

And several other bank CEOs didn't even want the TARP capital...if you remember it was forced on them...i posted a link yesterday of Barry Ritholtz saying all of TARP was basically a ruse to bailout Citigroup...and maybe bank of America...and i think that's kind of true...

I would guess Blankfein is one of the CEOs who did NOT want TARP capital...and all the restrictions that came with it...

---

Oh, right! -- the TAF and the 28-day repo facility (how can you be an expert if you don't know the acronyms?) Thanks for reminding me -- I had forgotten that BB had it all under control.

And Geithner had people inside Lehman -- I'm sure they would have noticed if something wasn't on the up and up.

---

Good point.

Judge Says Obey the King’s Commands…

http://www.wnd.com/index.php?fa=PAGE.view&pageId=209357

"Our arms were cut off last time," said Jensen. "Our legs are being cut off this time."

"We got absolutely slammed today," said Paul R. Jensen, lead counsel for the defense. "It's impossible for us to have a fair trial under these rulings."

In her decision, Lind, acting as judge in the case, censored the last remaining arguments Lakin planned to make in his defense: motive and duty. Lakin had intended to explain his motive for disobeying the order and contend that it was his duty as a good soldier to disobey orders that he believes to be illegal.

"Suck it in and cope"...

http://www.youtube.com/watch?v=TYHQLNb3zGA

FU Charlie Munger!!!

http://www.youtube.com/watch?v=EemTva8GW3g

The notion of using $700B to purchase toxic assets was ridiculous because, as Dr. P recently pointed out, the cheaper fix was to kill MTM.

Hank Paulson knew it, too, and knew it before TARP passed:

"Behind the scenes, Mr. Paulson had already moved away from the idea [toxic asset purchases]. On Sept. 29, he watched as markets swooned in reaction to the House's initial rejection of the $700 billion bailout bill. Mr. Paulson began to realize then that asset purchases wouldn't be enough to turn markets around, according to a person familiar with his thinking.

"The day after the vote, Mr. Paulson ordered his staff to start figuring out how an equity-investment program might work instead."

http://online.wsj.com/article/SB122662361011226767.html

So I think DB's take is accurate as well. And that Hank Paulson is a scum-sucking pig.

Right on about Munger, Z. Max Keiser did a number on him Tuesday, check it out if you haven't already.

1 issue regarding fasb 157 and MTM accounting...the rule change didn't happen until may of 2009...and only after a HUGE amount of congressional pressure on FASB to change the rule...in the fall of 2008 and all the way up to the rule change, bernanke shockingly said fair-value accounting rules should not be altered to help the banks...

So i don't think paulson was confident at the time (fall 2008) that they could get MTM changed...it was a long slog...the former head of FASB...robert hertz (i think that was his name) resigned not too long ago...he hated losing the idnependence of his group to congress...

I remember leading up to the rule change, there were some in congress who threatened to pull funding for FASB...

In retrospect i'm sure bernanke, paulson, geithner and the others wish they had just pushed to change the MTM accounting rules earlier...probably 75% of the massive bank writedowns could have been avoided...

And for the record, I support truth in accounting...so i hated the rule change...banks have assets marked at par that aren't worth 20 cents...HELOCs are a great example...

The bottom line on TARP (and all the other bailout programs) is that almost no one has been held accountable. And almost everyone, even those most responsible, have kept their jobs, been promoted, been awarded huge bonuses, or have ridden off into the sunset with millions in ill-gotten gains. Our entire monetary and fiscal order has been rearranged to serve the interests of a few at the very top of the pyramid. The middle class has borne most of the risk. And much of that risk is still with us, whether in terms of currency, the national debt, or social and political unrest.

The message is that the guys at the top get served first, at our expense. And the buck stops nowhere. (I think John Carney said that at one point.)

All the talk about getting the TARP paid back is a red herring. If someone breaks into your house, tears the place up, and then sticks a gun to your head demanding $700B, you don't thank him when he pays you back. Because a) you had a gun stuck in your face, and b) your house is still a freakin' mess.

1) GE and leverage. Not too much talk about leverage these days, huh? Wonder why. GE was a wreck in the making for a long time. The business model changed when Welch and others knew that GE could not sustain its large growth as a maker of things (fridges, engines, polymers, wind turbines, whatever). It had to enter the financlal world and buy bizzes, shitty or not, and enter/buy it did. GE growth was a debt-fueled buying spree. Personal example: my wife worked for a mid-large REIT company bought by GE Capital (real estate division) in 2002. GE WAAAAY overpaid, but did not care because as long as they were "growing," all was good. Then, GE Capital melts down during the crisis, Immelt calls Hank...you know the rest...

2) DB is right. GSuchs and Blankfein was in real trouble and did not know TARP was coming. Their behavior proves this. Warren "I get greedy when others get scared" Buffett gets called to save GS. Buffett proposes a fast and really bad deal (for GS) on his way to get ice cream at DQ with his gandkids--take it or leave it Lloyd and Gary. GS takes it, and continues to "take it" as Buffett gloats ("Lloyd pays me $16 every second...tick, tock...I love it..."). Then GS rushes to convert to bank-holding status...

3) 2.5 years later, all this shit makes me sick...still...

part's to be so locked in the MACRO economics mindset and miss the big 'cleaning out of the cash drawer' picture here.

periodically, the Rothschilds (FED) loot the U.S. wealth using artifice and fraud, create fake financial dilemma's that are wholly

fabricated in board rooms and in far away parlors in Geneva and London where the Rothschilds take tea every day at 3:30 p.

there's nothing particularly new going on here. they pull this periodically to fleece the american sheeple, with help of the wholly

bought and paid for government 'kabuki theatre' gang that keeps your eyes off the Rothschilds ball.

if this nation recovers from this fleecing, it'll happen again and again. you people never learn. you NEVER LEARN.

GE may ship $10 billion in work overseas as U.S. trade bank languishes

http://www.reuters.com/article/2015/07/30/us-usa-eximbank-general-electric-idUSKCN0Q42J920150730

General Electric Co is taking steps to shift some U.S. manufacturing work overseas now that the U.S. Export-Import Bank will be shuttered at least until September, the industrial giant's global operations boss told Reuters on Thursday.

GE Vice Chairman John Rice said the conglomerate is bidding on over $10 billion worth of projects that require support from an export credit agency (ECA) like Ex-Im.

With Ex-Im unable to extend new loans or guarantees thanks to an effort by congressional Republicans to shut it down, GE is arranging with ECAs in other countries to finance the deals involved, with much of the production going to GE plants in those foreign locations. The prospective government partners include Canada, the United Kingdom, France, Germany, China and Hungary, he said.

"We're submitting the tenders now. So we are identifying where we'll bid this and the ECA support that comes with it, and it's not in the United States," Rice told Reuters in a telephone interview from Atlanta

Ex-Im has been unable to consider any new financing requests since Congress allowed the bank's charter to expire on June 30.

Rice's comments come as the U.S. Congress starts a five-week summer recess with no clear path to revive Ex-Im in the months ahead. A group of conservative Republicans, who say the 81-year-old trade bank is a nest of "crony capitalism" that doles out government welfare to GE, Boeing Co and other wealthy corporations, want to keep it closed for good.

An effort to revive the bank as part of a multi-year transportation bill won strong support in the U.S. Senate, but stalled this week when the House of Representatives approved a short-term funding extension without the Ex-Im provision.

Boeing chairman Jim McNerney on Wednesday said the aircraft maker was actively looking at moving "key pieces" of its operations to other countries that could offer export credits.

Rice, who is based in Hong Kong, said GE is not moving to shift work and jobs overseas "just to make a point" to Congress, but to win contracts that require export credit agency support. "We're doing this because if we don't, we can't submit a valid tender," he said.

In one such power-sector bid, for example, GE would do final assembly work on its aero-derivative gas turbine power generation units at GE plants in Hungary or China instead of a factory in Houston. It already has capacity in place, and export credit agencies willing to support the work, he said.

"Next year, if we win this bid, work that would have been in Houston will be someplace else," Rice said.

GE also is seeking financing from another country's export credit agency to save a $350 million locomotive deal with Angola that has lost access to Ex-Im support, Rice said.