Last night (just for kicks), I watched the BBC documentary from last year on the fall of Lehman and I was struck by two things. First, the "credit was frozen" meme went unquestioned -- we've come to expect that. But the second thing that struck me was that Neel Kashkari went out of his way to say that it wasn't just financial companies that were having problems with short-term borrowing, but that non-financial companies were, too.

- "We were getting calls from large American businesses, blue-chip businesses, saying they couldn't fund themselves, they couldn't make their payroll, they couldn't fund their inventory."

Now, there are a couple of ways to read this. On the one hand, he could just be lying to cover for the fact that he wanted to save his banker buddies (we're assuming he has some). On the other hand, he may just remember hearing rumors, from somewhere(?), about somebody having problems. But on the third hand, I suspect he knows exactly which large, blue-chip American business he's talking about, and what he really meant to say is, G.E. Because it was Jeff Immelt, remember, who was calling up Hank Paulson back in those halcyon days, saying "Save me, save me." It was G.E. (or what I like to call, "that large, blue-chip American finance company known as G.E.") that, of all the so-called non-financials, was in the most trouble.

Crazy thing is, that the CP market during the crisis isn't much different from the inter-bank market. There are clear signs of stress, and borrowing moved to the very short term, but there was never a systemic meltdown, freeze-up, etc. (Unless, apparently, your name happened to be G.E. or Citi.)

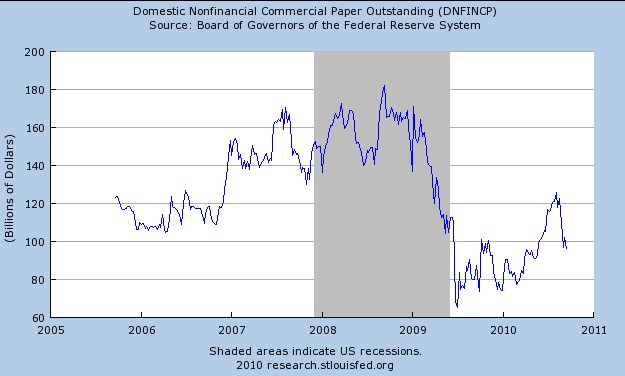

Here's total non-financial Commercial Paper outstanding during the crisis period. Nothing terribly unusual except that the entire market begins to shrink as the recession wears on and companies (like G.E.) began taking full advantage of the Temporary Liquidity Guarantee Program to issue govt.-guaranteed bonds. The real decline in total CP outstanding begins in early 2009, not in the immediate wake of Lehman.

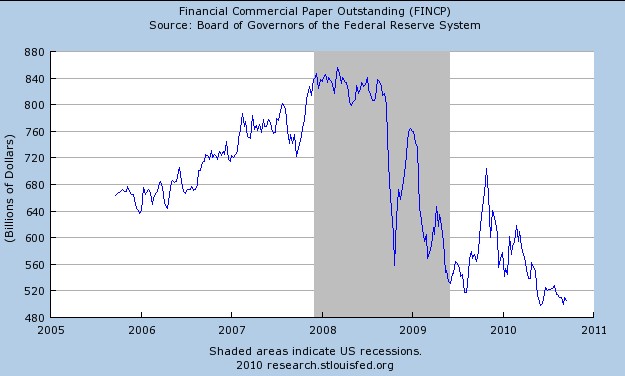

Here's the same chart for financials. You can't miss the cliff drop around August or September. But the spike back up comes just as the Fed begins purchases of CP through the Commercial Paper Funding Facility sometime after October 7.

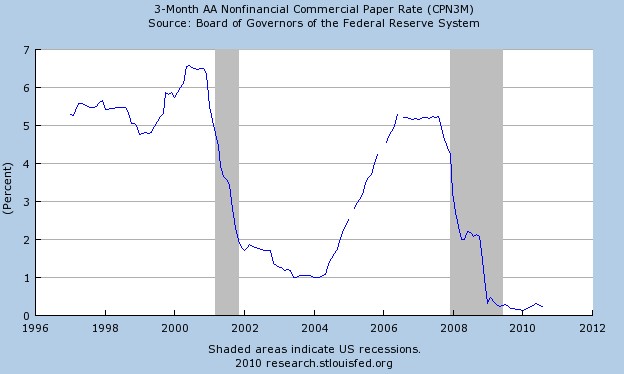

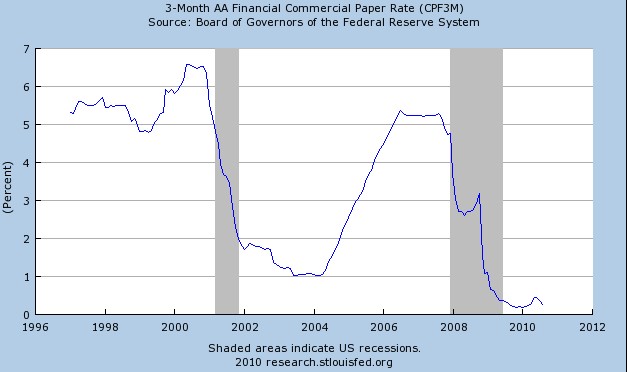

Finally, here are graphs of the rates on 3-month Commercial Paper, first for non-financials and then for financials.

Notice there is no massive spike in rates during the crisis. And what happened to all those blue-chip companies that couldn't make payroll or fund day-to-day operations? Are there actual confirmed reports of this, or just Jeff Immelt whining to Hank Paulson? From the revelations in Paulson's book, it sounds like it might have just been G.E. But no matter what, on October 7, four days after TARP was passed, the Fed announced the commencement of its Commercial Paper Funding Facility. Four days.

Here's what we know. The excuses for passing TARP were:

- 1) "the electronic run" on money market funds, which was taken care of by Treasury's 100% guarantee of all existing MMF accounts on September 19,

- 2) the near total lock-up ("freeze") of the interbank lending market, which Afonso, et al. have shown never quite happened, and for which the Term Asset Facility (TAF) picked up much of the slack anyway, or

- 3) the problems in the commercial paper market which supposedly kept companies from making payroll and whatnot, but this was almost instantly fixed when the Fed introduced the CPFF on October 7.

Again, the question has to be asked: Why was TARP necessary? Notice, the question is NOT "Was there really a crisis in the credit markets?" Clearly there was, but why TARP, when TARP had so little to do with fixing the ostensible problems and likely made all of them worse? If TARP was not really meant to save the financial system (and maybe it was -- I have great faith in human stupidity), then what was TARP meant to do? And more to the point, what was G.E.'s role in instigating the push for TARP? All evidence suggests that reports of large, blue-chip companies having difficulty funding operations can be attributed to one company: G.E.

Related: