Cyprus In 'Superhuman' Effort To Open Banks Thursday

Latest update from Cyprus.

---

Superhuman Effort to Reopen Cyprus Banks

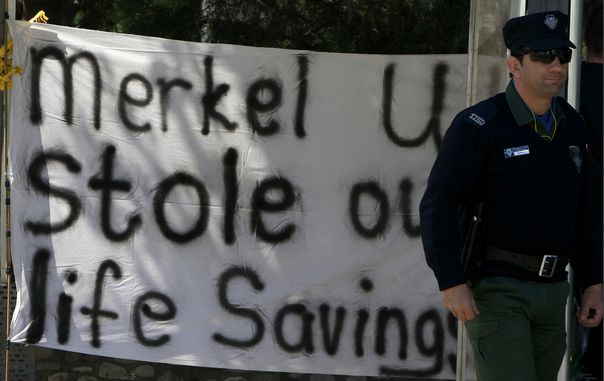

FRANKFURT (MarketWatch) -- Cyprus authorities are making a "superhuman" effort to ensure the country's banks reopen on Thursday, Cyprus central bank chief Panicos Demetriades said Tuesday, according to news reports. Banks have been closed for more than a week in an effort to prevent a run on deposits as Cyprus and its international lenders worked out a 10 billion euro ($12.9 billion) bailout of the tiny island nation. Plans to reopen some banks on Tuesday were shelved late Monday. Uninsured deposits of more than 100,000 euros at two of the country's largest banks may be subject to haircuts of as much as 40% under the terms of the bailout. Demetriades said capital controls that will be imposed to prevent deposit flight after the banks reopen will be "loose," but will apply to all banks in the country.

Cyprus capital controls to be "loose" but island-wide

(Reuters) - Capital controls imposed to avert a run on banks in Cyprus after a painful EU rescue plan will be "loose" but will apply to all banks on the island, the Central Bank governor said on Tuesday. "We aim for some restrictions which, in the words of the president, will be loose," Cyprus Central Bank governor Panicos Demetriades said. He said the measure would apply to all banks based on the island. Demetriades said the restrictions would be "temporary" but would not say how long they would last.

Bank of Cyprus CEO ousted by central bank

LONDON (MarketWatch) -- Bank of Cyprus Chief Executive Yiannis Kypri Yiannis Kypri has been fired by the central bank, after the lender earlier this week was saved from a meltdown through a bailout package for Cyprus, according to media reports. The ousting was ordered by the country's international lenders, with sources saying it was a necessary action to restructure the Cypriot financial sector, the Cyprus News Agency reported. Bank of Cyprus Chairman Andreas Artemis on Tuesday submitted his resignation, citing differences with the nation's central bank in relation to the recapitalization of the lender. The bank said later in a statement that the resignation had not been accepted.

Bank of Cyprus Chairman resigns

LONDON (MarketWatch) -- Bank of Cyprus Chairman Andreas Artemis on Tuesday submitted his resignation, citing differences with the nation's central bank in relation to the recapitalization of the lender as part of the Cyprus bailout agreement, according to media reports. Artemis said in his resignation letter that the Central Bank of Cyprus had appointed an administrator for Bank of Cyprus without letting the board know, Greek online news site ekathimerini.com reported. The chairman further alleged that the central bank had plans for a recapitalization of the lender ready in January, but did not notify the board, the news site said.

After Cyprus, euro zone will slip into depression

There are three big problems:

- The relatively successful Cypriot economy is about to be decimated

- The ‘rescue’ will lead to an exit of global funds from the euro zone

- Deposits are going to flee the other peripheral countries

Update from the WSJ

Senior Bondholders Look Warily at Cyprus Rescue (Google link to avoid paywall)

Dutch Finance Minister Jeroen Dijsselbloem, who heads the euro-zone finance ministers, reportedly said Monday that Cyprus's bailout deal could serve as a template for resolving future bank restructurings in Europe.

Up until now, senior bank bondholders in the euro zone had been exempted from taking losses on their investment, leaving taxpayers to take the brunt of the responsibility for supporting failed banks. The concern had been that touching senior bonds, a cornerstone of European bank funding, could rattle confidence across the region's financial system.

The forced losses on senior bondholders could return to haunt policy makers if stresses worsen in other fiscally-shaky euro states in the future, with investors in smaller lenders at the highest risk.

"The very public debate that has taken place has made it clear to everyone that bank creditors, all the way down to depositors, should expect to pay in future bailouts."

Most of Cyprus's contribution will come from deposits over €100,000 and junior bank bondholders. The total amount of senior Cypriot bank bondholders is small. According to European Central Bank data, Cypriot banks have issued €1.7 billion of debt securities, of which analysts estimate just €200 million is senior debt.

In Ireland's bailout, the troika—the IMF, the European Commission and the ECB—obliged the government to pay back senior bank bondholders. In all, Ireland pumped in €64 billion, equivalent to 40% of its economic output, to keep a broken banking system from collapse over the past five years. A significant part of those sums helped pay back international bank bondholders across six Irish banks.

While not in the euro zone, losses had been previously imposed on senior bank debtholders in Iceland and Denmark. The latter involved losses on two small Danish banks, Fjordbank Mors and Amagerbanken, in 2011. In 2008 Iceland nationalized its banks, completely wiping out the debt.

Father Of The Euro: "Italy Is Next After Cyprus"

Mar 27, 2013 at 2:21 PM

Mar 27, 2013 at 2:21 PM

Reader Comments (1)

And ask your self, with the prospects of a choice, to be kicked in the nutts, or slapped in your fase your intire life.

In all trasistionary epocs, there is a shurt and painfull rebirth of fundamntal systemic issues regarding currncys.

The Cypriots, have not, what Iceland have, their own currency, the Icelandic krona, and I understudd that Cypros hadd its own, once up on a time. The people needs to realise that YOU can aløter the game tomorrow.

Print and create a Ntional bank, eraze the dbth since its not YOURs at all, but is actually stolen on behalf of private corps, that growed to be to bigg to fail, the corruption is everywhere and in all of the levels of goverence.

Particilare, when its about Finnascial oversight and the implimenting of sound bissenissse rules and regulations.

And never again, lett foregin iintresses regain anywhere near the level again, this time YOU create YOUR of future, with YOUR won currency and monetary policy.

This is the endresult of soscialising debth, when the rigging of stocks/metals/everything also the CO2 lie and AGW the greatest scam in sience since Eisntein) is expoced, and now its YOUR/OUR savings.

The last resort is fast aproaching, the great war, that aløways follows monetary f...ups of this scale/scope, and for the Americans, their decline is manufactured, the trenistion of wealth is flowing into the BRICS from the very same RobberBarons that ruined Your land and enslaved Your people.

The great war will close the deal, its desigend for a long time ago.

The Russians will propbably laugh, but they are even dumber than the Americans, they to belive in their own Goverment, 100 years of imposing Pavlovs Rules, ding ding, runn rabbitt runn.

I just wait for the War, its comming and nobody cares, just talked and talked.

peace

“If by a "Liberal" they mean someone who looks ahead and not behind, someone who welcomes new ideas without rigid reactions, someone who cares about the welfare of the people-their health, their housing, their schools, their jobs, their civil rights and their civil liberties-someone who believes we can break through the stalemate and suspicions that grip us in our policies abroad, if that is what they mean by a "Liberal", then I'm proud to say I'm a "Liberal.”

― John F. Kennedy, Profiles in Courage

amen