CHART: Fed Surpasses China In U.S. Treasury Holdings

It's gotta be the Fed. How many times have you heard or read something along those lines in the last two years. As in, How can this insane rally in stocks keep going? It's gotta be the Fed. Or, How can 30-year Treasuries yield only 3.5%? It's gotta be the Fed. More pointedly...How can the U.S. government get foreigners to keep buying hundreds of billions of dollars in Treasuries every single month, when they get next to nothing in return -- are they suckers? It's gotta be the Fed.

Well guess what, ladies and gentlemen, it is the Fed. At the Federal Reserve Bank of New York, Brian Sack and his NYU interns have bought so many Treasury securities that the Fed now owns more U.S. debt than anyone else in the world, including China. China currently holds $896B. Japan owns $877B. And the Fed comes in at $1.108 TRILLION, and no sign of letting up.

This is the most recent chart we could locate and though not updated to reflect the changes of the past month, you get the idea. Did someone say monetization?

Fed Passes China in Treasury Holdings

The Federal Reserve has surpassed China as the leading holder of US Treasury securities even though it has yet to reach the halfway mark in its latest round of quantitative easing, according to official figures.

Based on weekly data released on Thursday, the New York Fed’s holdings of Treasuries in its System Open Market Account, known as Soma, total $1,108bn, made up of bills, notes, bonds and Treasury Inflation Protected Securities, or Tips.

According to the most recent US Treasury data on foreign holders of US government paper, China holds $896bn and Japan owns $877bn.

- “By June [the Fed] will have accumulated some $1,600bn of Treasury securities, likely to be in the vicinity of China and Japan’s combined holdings,” said Richard Gilhooly, a strategist at TD Securities. “The New York Fed surpassed China in the past month as the largest holder of US Treasury securities,” he noted.

The Fed is buying Treasury debt under two programmes. The largest is QE2, which began in November and is scheduled to involve $600bn of purchases by June.

It is also buying $30bn of Treasuries a month as it reinvests principal payments from its large holdings of mortgage debt and debt issued by government housing agencies – a programme dubbed QE lite.

By the end of June, the Fed plans to buy $800bn in Treasury debt under both programmes. Since November, the Fed has purchased $284bn of Treasuries.

“The end of QE2 will be a big test as rates are likely to rise once the Fed stops buying large amounts of Treasuries,” said David Ader, a strategist at CRT Capital. “We don’t know if that means a rise of 20, 30 or even 50 basis points for key yields.”

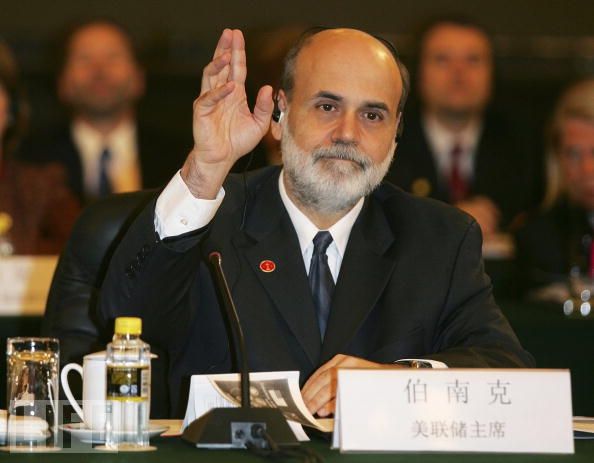

This is the room where Bernanke's magic happens...

Further Reading...

Mar 2, 2011 at 12:50 PM

Mar 2, 2011 at 12:50 PM

Reader Comments (9)

http://dailybail.com/home/ny-fed-prez-william-dudley-admits-that-debt-monetization-is.html

Fed passes China in Treasury holdings

http://ftalphaville.ft.com/blog/2011/01/31/474221/beware-the-special-treasury-market/

The Federal Reserve Bank of New York announced on Tuesday that it would accept the participation of money market funds with lower assets under management in the central bank’s future efforts at draining cash from the financial system.

http://www.ft.com/cms/s/0/716774bc-2e31-11e0-8733-00144feabdc0.html#axzz1DVrDBPR1

http://www.ft.com/cms/s/0/02502f66-32f4-11e0-9a61-00144feabdc0,dwp_uuid=9d04b7e0-e671-11df-95f9-00144feab49a.html#axzz1DVrDBPR1

Asset purchases by the US Federal Reserve do not cause rising food prices in countries such as Egypt, the central bank’s chairman Ben Bernanke said on Thursday.

“I think it’s entirely unfair to attribute excess demand pressures in emerging markets to US monetary policy, because emerging markets have all the tools they need to address excess demand in those countries,” he said.

http://www.ft.com/cms/s/0/5c4aeaea-2fbd-11e0-91f8-00144feabdc0,dwp_uuid=9d04b7e0-e671-11df-95f9-00144feab49a.html#axzz1DVrDBPR1

http://www.bloomberg.com/news/print/2010-10-15/fed-japan-treasury-holdings-set-to-surpass-china-chart-of-the-day.html

Speaking of that can't-put-my-finger-on-it feeling, what's up with the post's lead-off photo? There is no eye contact at all. The smiles are painted on. The Prez has been coached to lean in closer to the Chinese Premier, whose hand is almost complete ensconced in Obama's. And is Michelle Obama coated in... tanning butter?