Bernanke & FED Warlords Head Back To Jekyll Island To Celebrate 100 Years Of Printing

---

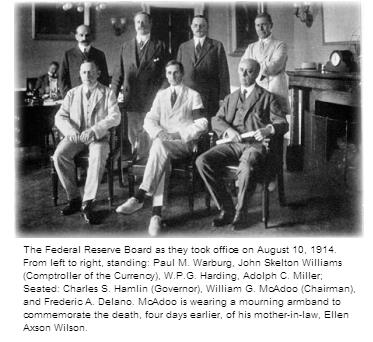

Before 1913, the U.S. Treasury had the sole right to print our currency. A Christmas Eve vote by Congress established the Fed, and changed the printing relationship forever. A rare photo of the founders of the Fed is at the bottom of the story.

Conference - A Return to Jekyll Island: The Origins, History, and Future of the Federal Reserve

Federal Reserve Bank of Atlanta and Rutgers University

November 5–6, 2010, Jekyll Island Club Hotel, Jekyll Island, Georgia

This special conference marks the centenary of the 1910 Jekyll Island meeting that resulted in draft legislation for the creation of a U.S. central bank. Parts of this draft (the Aldrich plan) were incorporated into the 1913 Federal Reserve Act. To commemorate the 100th anniversary of the drafting of the Aldrich plan, the conference will take place at the Jekyll Island Club Hotel on Jekyll Island, Georgia—the same building where the 1910 meeting occurred.

The conference's discussions focus on three themes: the origins of the Fed and lessons from the pre-1913 era, how closely the Fed's actual performance has adhered to the original vision expressed by the framers of the Aldrich plan, and what the Fed's almost 100-year track record teaches us about its role going forward.

Read the history as told by the New York Fed...

Full story on the Fed's centennial celebration is below.

---

Wikipedia on Jekyll Island and the creation of the Fed.

Jekyll Island was the location of a meeting in November 1910 that may have hastened the creation of the Federal Reserve. Following the Panic of 1907, banking reform became a major issue in the United States. Senator Nelson Aldrich (R-RI), chairman of the National Monetary Commission, went to Europe for almost two years to study that continent's banking systems. Upon his return, he brought together many of the country's leading financiers to Jekyll Island to discuss monetary policy and the banking system, an event which some say was the impetus for the creation of the Federal Reserve.

On the evening of November 22, 1910, Sen. Aldrich and A.P. Andrews (Assistant Secretary of the Treasury Department), Paul Warburg (a naturalized German representing Kuhn, Loeb & Co.), Frank A. Vanderlip (president of the National City Bank of New York), Henry P. Davison (senior partner of J. P. Morgan Company), Charles D. Norton (president of the Morgan-dominated First National Bank of New York), and Benjamin Strong (representing J. P. Morgan), together representing about one fourth the world's wealth at the time. They left Hoboken, New Jersey on a train in complete secrecy, dropping their last names in favor of first names, or code names, so no one would discover who they all were. The excuse for such powerful repsentives and wealth was to go on duck hunting trip on Jekyll Island.

---

By Michael Snyder

The Federal Reserve is going back to Jekyll Island to celebrate the 100 year anniversary of the infamous 1910 Jekyll Island meeting that spawned the draft legislation that would ultimately create the U.S. Federal Reserve. The title of this conference is "A Return to Jekyll Island: The Origins, History, and Future of the Federal Reserve", and it will be held on November 5th and 6th in the exact same building where the original 1910 meeting occurred. In November 1910, the original gathering at Jekyll Island included U.S. Senator Nelson W. Aldrich, Assistant Secretary of the Treasury Department A.P. Andrews and many representatives from the upper crust of the U.S. banking establishment. That meeting was held in an environment of absolute and total secrecy. 100 years later, Federal Reserve bureaucrats will return to Jekyll Island once again to "celebrate" the history and the future of the Federal Reserve.

Sadly, most Americans have no idea how the Federal Reserve came into being. Forbes magazine founder Bertie Charles Forbes was perhaps the first writer to describe the secretive nature of the original gathering on Jekyll Island in a national publication....

Picture a party of the nation's greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily riding hundred of miles South, embarking on a mysterious launch, sneaking onto an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was once mentioned, lest the servants learn the identity and disclose to the world this strangest, most secret expedition in the history of American finance. I am not romancing; I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency system, was written... The utmost secrecy was enjoined upon all. The public must not glean a hint of what was to be done. Senator Aldrich notified each one to go quietly into a private car of which the railroad had received orders to draw up on an unfrequented platform. Off the party set. New York's ubiquitous reporters had been foiled... Nelson (Aldrich) had confided to Henry, Frank, Paul and Piatt that he was to keep them locked up at Jekyll Island, out of the rest of the world, until they had evolved and compiled a scientific currency system for the United States, the real birth of the present Federal Reserve System, the plan done on Jekyll Island in the conference with Paul, Frank and Henry... Warburg is the link that binds the Aldrich system and the present system together. He more than any one man has made the system possible as a working reality.

It was a system that was designed by the bankers and for the bankers. Now, the bureaucrats running the system are returning to Jekyll Island to congratulate themselves. Those attending the conference on November 5th and 6th include Federal Reserve Chairman Ben Bernanke, former Fed Chairman Alan Greenspan, Goldman Sachs managing director E. Gerald Corrigan and the heads of the various regional Federal Reserve banks. You can view the entire agenda of the conference right here. It looks like that there will be plenty of hors d'oeuvres to go around, but should the Federal Reserve really be celebrating their accomplishments at a time when the U.S. economy is literally falling to pieces?

Today, 63 percent of Americans do not think that they will be able to maintain their current standard of living. 1.47 million Americans have been unemployed for more than 99 weeks. We are facing a complete and total economic disaster.

Today, the Federal Reserve has more power over the economy than any other single institution in the United States. It is the Fed that primarily determines if we will see high inflation or low inflation, whether the money supply with expand or contract and whether we will have high interest rates or low interest rates. The President and the U.S. Congress have far less power to influence the economy than the Federal Reserve does.

As this election has demonstrated, the American people are absolutely furious about the state of the U.S. economy, but American voters have been mostly blaming our politicians. They just don't understand that it is actually the Federal Reserve that has the most control over the performance of the economy.

It would be hard to understate how powerful the U.S. Federal Reserve really is in 2010. U.S. Representative Ron Paul recently told MSNBC that he believes that the Federal Reserve is actually more powerful than Congress.....

- "The regulations should be on the Federal Reserve. We should have transparency of the Federal Reserve. They can create trillions of dollars to bail out their friends, and we don’t even have any transparency of this. They’re more powerful than the Congress."

So how has the Federal Reserve performed over the years?

Well, since 1913 inflation has been on a relentless march upwards, U.S. government debt has increased exponentially and the U.S. dollar has lost over 96 percent of its value.

That is not a record to be celebrating.

The truth is that the Federal Reserve was created to enslave the United States government in an endlessly expanding spiral of debt from which it would never be able to escape. As I wrote about yesterday, that is exactly what has happened. The U.S. government debt is escalating at an exponential rate. It is a trap from which the U.S. government will never be able to get out of under our current system.

Now many at the Federal Reserve are touting more "quantitative easing" as the solution to our economic problems. But anyone with a brain should be able to see that creating a gigantic pile of paper money out of thin air and dumping it into the economy is only going to make our long-term problems even worse.

But the Federal Reserve system was never designed to benefit the American people. It was designed to make massive amounts of money for the banking establishment. As I wrote about in "11 Reasons Why The Federal Reserve Is Bad", the Federal Reserve was created to transfer wealth from the American people to the U.S. government and from the U.S. government to the super wealthy.

The sad truth is that the Federal Reserve is at the very core of our economic and financial problems, and that is nothing to celebrate.

Nov 4, 2010 at 6:08 AM

Nov 4, 2010 at 6:08 AM

Reader Comments (18)

http://www.zerohedge.com/article/bernanke-chumps

http://www.npr.org/blogs/money/2010/11/03/131043062/federal-reserve

http://delong.typepad.com/sdj/2010/11/the-mountain-labored-and-gave-birth-to-a-mouse.html

To take $7 billion a year of duration risk off of the private sector's books in a global economy that still has more than $60 trillion of financial assets is a change in "credit conditions" equivalent to what would be achieved in normal times by a coordinated one basis point reduction in short-term interest rates by the world's central bankers.

http://www.voxeu.org/index.php?q=node/5739

what a joke!!

BTW, can you look at OPEN (opentable) this pig is trading at $70 a share, has a P/E of 200. I really want to short it. What you think?? this market is so artifically overbought.

Paul Warburg - Kuhn, Loeb & Company / Rothschild son became an advisor to FDR.

Benjamin Strong - JP Morgan, He served as Governor of the Federal Reserve Bank of New York for 14 years until his death.

A. Piatt Andrew - (R)Assistant Secretary of the Treasury and Special Assistant to the National Monetary Commission / Congressman

Frank Vanderlip - President of the National City Bank of New York

Henry Davison - JP Morgan

Both parties were involved... As they are today protecting their child.

you could have made the same argument about open anytime over the last year and a half and you would have gotten burned. it is a CRAZY market -- in everything. I have so much cash and i have no idea what to do with it. even short-term treasuries don't seem worth the risk and/or bother for the pittance you might get in return.

that said, open is making what looks to be a double top at around 70, but... if BB queases out another trillion or two... yikes. just look at today -- BB commits to print 600 B, jobless claims spike back up to the 450K range AND the indexes pop over 1%. INSANE. sell 'em short, but be prepared to cut your losses early.

thanks for the history gomp...a long tangled, deceitful web...

well, having been a short for almost 15 years now, shorting the .coms in the late 90s and early 2000s I have learned if you think you are going after an overvalued company and you initially take lossed, you have to stick with your call. In fact short even more if the prices go up on you...once the shit hits the fan, the compnay falls apart and stock prices will follow. And you can make a ton of money.

I think OPEN has that potential. When the momo runs out this stock could be back in the teens or single digits in few years. Im also looking LULU, very overvalued, CRM, ect ect..

As far as getting yield, what you think about buying quality names that pay good dividends..like at&t or verizon that pay 6% Pfizer paying 4%, CTL paying 7% ect ect...??

Once the stocks falls apart, look out!!!!

That is the moral of this story.

Gobie will just blame the Democrats...

http://video.google.com/videoplay?docid=6507136891691870450#

Nov 3, 2010 at 2:58 PM | Z

If the link doesn't work, copy and paste it to the address bar.

Nov 3, 2010 at 2:59 PM | Z

yep, in all seriousness i think you're right about OPEN -- especially if you've got the balls and know-how to do it. (i don't). it's just crazy how openly BB can manipulate the market if he wants to -- and everyone willing to go along with him.

great idea on PFE, etc. i remember looking at it back in Nov of '08 or maybe it was around March of '09 and the yield was about 10%. wish i had bought it then, but was worried about the health care bill . should have known it was NEVER going to hurt big pharma.

question for you -- how safe do you think those dividends are?

ss might have a better handle on it...

http://www.ny.frb.org/aboutthefed/history_article.html

Interesting reading....

As long as the citizen zombies dont care enough to rein in their politicos- they should keep their mouths shut and submit to the swindler's rape of their rights and wealth.

so now you pay