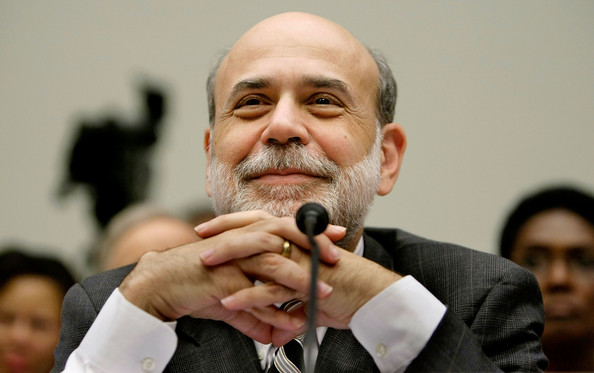

Bernanke Defends Lehman Actions To His 'Deathbed'

Read Bernanke's complete testimony to the FCIC here...

--

Washington - Federal Reserve Chairman Ben S. Bernanke, in a confidential talk with the commission probing the causes of the financial crisis, said he would defend to his “deathbed” his actions prior to the bankruptcy of Lehman Brothers Holdings Inc.

“I will maintain to my deathbed, that we made every effort to save Lehman, but we were just unable to do so because of a lack of legal authority,” Bernanke said, referring to the 2008 failure that intensified a crisis that Bernanke said was the worst in history, according to an 89-page transcript of the interview by the Financial Crisis Inquiry Commission.

The record of the session, made public yesterday, shows Bernanke using less-guarded language than his speeches and testimony as he answers questions from panel members. In accounts that are similar in substance to his public statements, he says Germany’s labor system is “less efficient” than the U.S.’s, talks about the “blogosphere” and tosses out a reference to the 1968 disaster-novel “Airport.”

Bernanke, 57, defended the Fed’s supervision of individual banks while saying the central bank was “to some extent, culpable” for not regulating subprime mortgages.

“The Fed didn’t do a perfect job, but -- and lots of things that we see now that can improve and are improving,” he said. “But I don’t think we were particularly culpable on the supervision part relative to the rest of the world.”

The FCIC initially said last week the Bernanke interview would be withheld and transferred to the National Archives, which would make it public in five years. The session was originally considered confidential, and the panel sought the Fed’s agreement to make it public, said Tucker Warren, a spokesman for the panel. The central bank agreed late Feb. 11 to its publication, Warren said.

Continue reading at Bloomberg...

---

FCIC Interviews - Full List A-Z

---

Video - Bernanke: "We did not have the option of saving Lehman" - Mar. 15, 2009

--

See this story for the truth on Lehman's failure...

Feb 18, 2011 at 3:29 AM

Feb 18, 2011 at 3:29 AM

Reader Comments (9)

http://www.reuters.com/news/video/story?videoId=188138200&videoChannel=5

G-20 in Paris

Bernanke speaks on world economy

Regulators hold meeting regarding May 6, 2010 flash crash

http://truthingold.blogspot.com/2011/02/silver-baby.html

Foreign Lenders Weigh Restructuring to Free Up Cash; a Footnote in Barclays's Finance Statement .

http://online.wsj.com/article/SB10001424052748704657704576150443241518166.html?mod=WSJ_hp_LEFTWhatsNewsCollection

[snip]

Some foreign banks are moving to restructure their U.S. operations to avoid one of the most-burdensome requirements of the new Dodd-Frank law.

In November, Barclays PLC quietly changed the legal classification of the U.K. bank's main subsidiary in the U.S. so that the unit would no longer be subject to federal bank-capital requirements. Several other banks based outside the U.S. are considering similar moves, according to people familiar with the matter.

Republicans employ new tactic to slow Dodd-Frank

http://www.reuters.com/article/2011/02/17/us-financial-regulation-idUSTRE71G6Z720110217

[snip]

(Reuters) - Republicans aiming to unhinge the Dodd-Frank financial reform legislation have turned to a new line of attack and have told the U.S. Treasury, Federal Reserve and other regulators to do more due diligence, according to a letter obtained on Thursday

keep up the job everyone!

http://www.youtube.com/watch?v=sVHyJUwsJ6E&feature=related

Stay tuned.......................(grin)

http://www.reuters.com/article/2011/02/18/us-g-idUSTRE71G4FX20110218

[snip]

(Reuters) - China rejected plans to use real exchange rates and currency reserves to measures global economic imbalances, casting doubt on the ability of Group of 20 major economic powers to reach agreement at a meeting on Friday.

http://www.pressherald.com/news/in-foreclosure-suit-two-counts-against-gmac-thrown-out-_2011-02-18.html

[snip]

PORTLAND - A federal judge has dismissed two of the three counts against GMAC Mortgage Co. in a class-action lawsuit filed on behalf of several Maine homeowners.

The lawsuit in U.S. District Court alleges that GMAC used fraudulent paperwork to illegally speed foreclosure cases through the state's court system.

Judge D. Brock Hornby, in a decision filed Wednesday, sided with GMAC as he dismissed one allegation of abuse of process and an allegation of fraud on the court.................

...............Jeffrey Stephan, a GMAC processor based in Pennsylvania, admitted under oath that he signed more than 10,000 foreclosure documents a month and did not verify the information that those documents asserted, as required by law in Maine and several other states.

That practice by GMAC and other lenders, dubbed "robo-signing," prompted attorneys general in all 50 states to announce in October that they would investigate the practices of GMAC, JPMorgan Chase, Bank of America and other leading mortgage companies.