Listen To John Thain's Interview With The Financial Crisis Commission: 'We Should Have Grabbed And Shaken Paulson & Geithner To Save Lehman'

Audio - John Thain's testimony with investigators from the FCIC

Video - Paulson: "I never once considered" saving Lehman - Sept. 15, 2008

Video - Bernanke: "We did not have the option of saving Lehman" - Mar. 15, 2009

--

UPDATE: New revelations about the decision to let Lehman go bankrupt.

1:19:00 FCIC lawyer says that some witnesses have said that there WAS a deal to save Lehman among the banks meeting at the NY Fed on the weekend of September 12-14 and that the deal involved as much as $30-40 billion.

1:37:45 Thain makes it clear that the reasons given by Paulson and Geithner -- at the time -- for not saving Lehman were 1) criticism of the Bear Stearns bailout, 2) reluctance to “bail out Wall St.” and 3) a need to reinforce market discipline. In other words, letting Lehman fail was a political CHOICE, not a legal necessity.

--

New audio recordings of John Thain's testimony emerge from the FCIC investigation. Among other things to come to light from the testimony, the former Merrill CEO and part-time interior decorator now says that the Titans of Finance who met at the NY Fed in September 2008 should have done more to convince Paulson and Geithner to save Lehman. Thain also said that, "Allowing Lehman to go bankrupt was the single biggest mistake of the financial crisis.” It's funny, common criminals can usually get their story straight and stick to it, but Paulson, Bernanke, Geithner and Thain still can't make up their minds on whether they CHOSE to let Lehman go under, or whether they had no other choice. (As usual, we've got it on video. See below.)

In any case, letting Lehman go was the best decision Fed and Treasury made. In fact, whether or not it was done for the right reasons, letting Lehman fail was the ONLY THING THEY GOT RIGHT. Every subsequent decision served only to save the bacon of failed bankers, protect billionaire bondholers, and prolong the real crisis for average Americans.

--

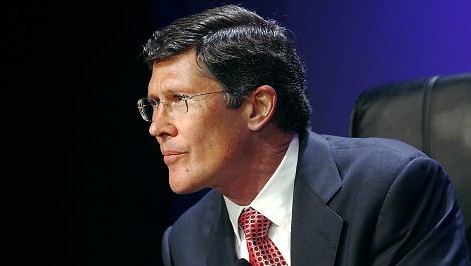

Thain Says He Should've `Grabbed, Shaken' Paulson to Aid Lehman

By Hugh Son (Bloomberg)

Merrill Lynch & Co.’s former Chief Executive Officer John A. Thain said Wall Street leaders should have tried harder to convince U.S. regulators they needed to prevent the failure of Lehman Brothers Holdings Inc.

Banking chiefs weren’t “strong enough” during 2008 meetings in insisting that then-Treasury Department Secretary Henry Paulson reverse his opposition to a U.S.-led rescue of Lehman, Thain told the Financial Crisis Inquiry Commission, according to audio files released yesterday.

Lehman, based in New York, filed the largest bankruptcy in U.S. history, roiling markets and helping contribute to the bailout of insurer American International Group Inc. and the purchase of Merrill by Bank of America Corp. Days before Lehman’s September 2008 collapse, Paulson convened CEOs including Thain, Lloyd Blankfein of Goldman Sachs Group Inc. and Jamie Dimon of JPMorgan Chase & Co. to try to get the banks to help fund a rescue.

“We collectively, the group of us, we should have just grabbed them and shaken them and said, ‘Look, you guys cannot do this,’” Thain told FCIC interviewers in a Sept. 17, 2010, interview. “Allowing Lehman to go bankrupt was the single biggest mistake of the financial crisis.”

--

Oh, What a Tangled Web We Weave...

Video - Paulson: "I never once considered" saving Lehman - Sept. 15, 2008

--

Video - Bernanke: "We did not have the option of saving Lehman" - Mar. 15, 2009

--

See this story for the truth on Lehman's failure...

More audio files...

Dr. Pitchfork

Dr. Pitchfork

--

Reader Comments (5)

Greece slams IMF-EU interference

With vast crisis payments and sharply lower tax revenues making it difficult for the government to balance its books, Obama will set out an austerity plan that will help set the tone for next year's presidential race.

http://www.activistpost.com/2011/02/obama-struggles-to-balance-budget-cuts.html

http://www.cnbc.com//id/39869844