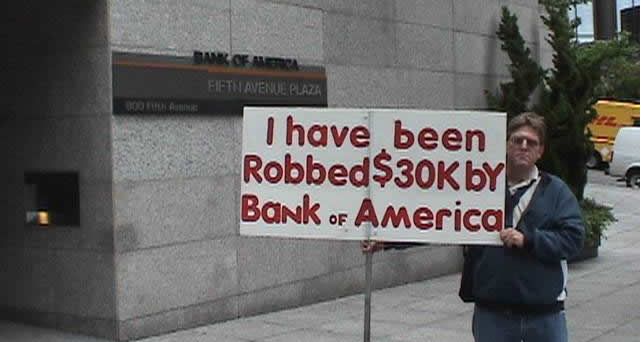

Bank of America Sued by Arizona, Nevada Over Fraud In Mortgage Modification Program

Legal actions against Bank of America are piling up, this time from Attorneys General in Nevada and Arizona, housing bubble ground zero.

---

(Bloomberg) - Bank of America Corp. was sued by Arizona and Nevada over home-loan modification programs intended to keep homeowners who borrowed from its Countrywide mortgage unit out of foreclosure.

Instead of working to modify loans on a timely basis, Bank of America proceeded with foreclosures while borrowers’ requests for modifications were pending, a violation of a 2009 agreement with Arizona to help borrowers facing the loss of their homes, Terry Goddard, the state’s attorney general, said yesterday in a statement.

“We are disappointed that the suit was filed at this time,” Dan Frahm, a Bank of America spokesman, said in an e-mail, referring to the Arizona suit. “We and other major servicers are currently engaged in multistate discussions led by Attorney General Miller in Iowa to try to address foreclosure related issues more comprehensively.”

All 50 U.S. states are investigating whether banks and loan servicers used false documents and signatures to justify hundreds of thousands of foreclosures. The probe, announced Oct. 13, came after JPMorgan Chase & Co. and Ally Financial Inc.’s GMAC mortgage unit said they would stop repossessions in 23 states where courts supervise home seizures, and Bank of America, the largest U.S. lender, froze foreclosures nationwide.

Misleading Consumers

The bank is accused in the Arizona and Nevada lawsuits filed yesterday of misleading consumers about requirements for the modification program and how long it would take for requests to be decided. The bank provided inaccurate and deceptive reasons for denying modification requests, according to the suits.

Continue reading at Bloomberg...

###

Arizona local report...

Related reading...

- UH OH!: Bank Of America Could Be Forced To Pay $20 Billion To Bond Insurers For Mortgage Loan Put-Backs

---

Jan 9, 2011 at 5:37 PM

Jan 9, 2011 at 5:37 PM

Reader Comments (12)

Bank of America Sued by Arizona, Nevada Over Mortgage Modification Program

http://dailybail.com/home/being-bank-of-america-means-never-having-to-say-youre-sorry.html

http://dailybail.com/home/bank-of-america-in-settlement-talks-over-mortgages.html

http://globalresearch.ca/index.php?context=va&aid=22444

http://www.youtube.com/watch?v=hRaRIHU3_04&feature=player_embedded#!

watch this one...

In any industry, conspiracy to price fix is illegal and is often prosecuted. Google price fixing and you'll find hundreds of examples.

Home loan modifications have nothing to do with borrowers, it is strictly used so the banks can receive disgusting amounts of money from people who work and save to price fix the housing market.

http://money.cnn.com/2010/12/07/real_estate/ladera_ranch_foreclosure.moneymag/index.htm

"On the one hand, the federal government has worked overtime to keep houses attractive, with super-low interest rates, higher conforming loan limits, and, until recently, a homebuyer's tax credit. Those moves have real costs, and low rates hurt savers even as they help owners.

Meanwhile, foreclosure moratoriums, mod programs, and bank delays have kept homes off the market, to the detriment of would-be buyers.

"They've done an amazing job of restricting supply and stimulating demand," says Sean O'Toole of ForeclosureRadar, which sells data on California foreclosures to investors."

Off topic, but this it the perfect immigration case :

http://taxdollars.ocregister.com/2010/12/10/festivus-for-the-rest-of-us-o-c-jail-style/70112/

A convicted drug dealer, who may or may not have an extensive criminal history, who probably has four children by different women (none of which he pays for) and are all on the public payroll for numerous government handouts, who doesn't work and has not contributed anything positive to our nation.

Part 2, the government system that coddles him and gives him what he wants at the taxpayer expense. I don't know his immigration status but you can probably guarentee if he hasn't been deported with the past issues, he probably isn't deported now.

Why is this perfect, sounds like all the other ones, he is not Hispanic, so we wouldn't have to worry about the DNC and RNC support from Mexico.

Oh, the irony...