80% Of Citigroup Mortgages Were Defective

Buried at the bottom of a Bloomberg story this morning, I found this:

Richard M. Bowen, former chief underwriter for Citigroup’s (nyse:C) consumer-lending group, said he warned his superiors of concerns that some types of loans in securities didn’t conform with representations and warranties in 2006 and 2007.

“In mid-2006, I discovered that over 60 percent of these mortgages purchased and sold were defective,” Bowen testified on April 7 before the Financial Crisis Inquiry Commission created by Congress. “Defective mortgages increased during 2007 to over 80 percent of production.”

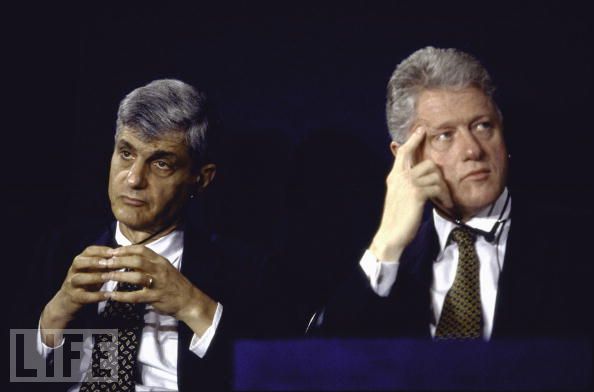

It looks like fraud, it walks like fraud, but Robert Rubin would say:

"It's not fraud. Now hurry, someone stop Brooksley Born."

---

Links:

Oct 21, 2010 at 11:44 PM

Oct 21, 2010 at 11:44 PM

Reader Comments (6)

http://www.informationclearinghouse.info/article26646.htm

http://www.informationclearinghouse.info/article26641.htm

http://www.niemanwatchdog.org/index.cfm?fuseaction=ask_this.view&askthisid=481

http://www.bankruptingamerica.org/2010/10/21/more-waste-fraud-and-abuse-from-bell-ca/

http://2.bp.blogspot.com/_AG0NMLjCoX4/R3xueMMbUjI/AAAAAAAAAhI/RlEcJ0WtHh4/s400/Turkel02.jpg

http://www.bloomberg.com/news/2010-10-22/ppip-funds-surge-36-on-average-in-first-year-treasury-says.html