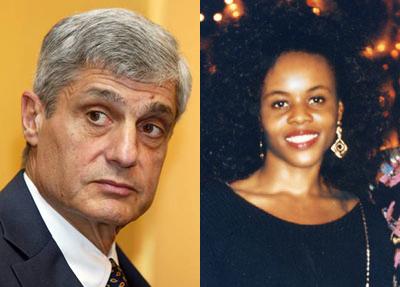

HE'S BACK: Bubble Architect Robert Rubin Returns To Wall Street (With A Sex Scandal)

Before you read another word, watch this 30-second clip of Nassim Taleb kicking Bob Rubin's ass. Now that you have some background, go get a stiff drink and a muzzle, because your screams might kill the neighbor's cat.

Rubin, the architect of the destruction of Glass-Steagal, he that railroaded Brooksley Born and her righteous attack on derivatives, he that presided over Citigroup and took $126 million in bonuses that you ultimately paid for through TARP. Yes Robert Edward Rubin class of 1956 from Miami Beach High who in 2007 began love-stalking much-younger quant trader Iris Mack, (she discussed it publicly at HuffPo):

I also remember teasingly inquiring as to whether he'd flown in on a Citigroup jet again. (He'd called me from one in December.) "It's one of the perks," he replied a bit sheepishly.

Things were much more relaxed by the time I walked him back to the Ritz - which was along the way to my South Beach condo. When we passed a homeless man along the way he made a bit of a show of opening up his fat leather billfold and producing a dollar -- "There but for the grace of God..." he remarked melodramatically -- and I gave him a lot of heat for that, because who exactly did he think he was kidding? I said give the man a job. Heck, you're the head of a bank! But when we reached the hotel entrance, the tension returned. He got this funny look on his face, and asked:

"Do you want to go upstairs and...cuddle?"

So that's what this is about. For a moment I was totally speechless and had to dig into my Harvard trained PhD brain to figure out what the hell he meant by "cuddling"! What can I say; once a teetotaling math geek, always a bit slow to pick up on signals from the menfolk. So the former Treasury Secretary had a "crush" on me! And not long afterward the former Treasury Secretary had his tongue down my throat and hands everywhere sort of like an octopus. But as soon as the thought entered my mind -- the former Treasury Secretary has his tongue down my throat?! -- I came to my senses a bit and awkwardly went back home before we both got too carried away. This is to say, I said to myself that there would be no other former Treasury Secretary appendages entering any other of my orifices.

Yes, that Robert Rubin. Today we get word that is returning to Wall Street. Joe Kernen and Andrew Sorkin discuss below:

Video: Bob Rubin returns -- CNBC (from this morning)

Aug 12, 2010 at 12:10 PM

Aug 12, 2010 at 12:10 PM

Reader Comments (8)

http://www.huffingtonpost.com/iris-mack/bob-rubin-just-wants-to-b_b_557621.html

Wells Fargo Overdraft Lawsuit: Bank Ordered To Pay $203 MILLION In Fees Over 'Unfair' Charges

The delinquency rate on home equity loans is higher than all other types of consumer loans, including auto loans, boat loans, personal loans and even bank cards like Visa and MasterCard, according to the American Bankers Association.

http://www.nytimes.com/2010/08/12/business/12debt.html?_r=2&hp

http://www.portfolio.com/views/blogs/capital/2010/04/08/rubin-declines-blame-for-economic-citigroup-meltdown#ixzz0wPjRFVNG

EDITORIAL: Bounce These Bozo Bankers

There's no shortage of blame, but if a vote were taken for mayor of the Citi of Fools, Robert Rubin, the most prominent member of the bank's board of directors, would almost certainly win hands down.

Rubin, a former treasury secretary, played a key role by leading Citi into a risky strategy of gambling on the weirdest and most exotic investments - like securities backed by subprime mortgages that probably would never be paid.

http://www.nypost.com/p/news/regional/item_GAUXISLWzCbfYqWhQWtDFO;jsessionid=BDDC4C32D12A2FFD04120A4E6BD889D9#ixzz0wPjXSVg2

http://blogs.abcnews.com/politicalpunch/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it.html

That is the way it always works, blame the lowest worker, the teacher, the scary union, the Chupacabra, or in Cincy, there is a push to blame a group of homeless people living under a bridge on Mitchell Avenue.

And the masses will always believe it is someone else, otherwise it would reveal to them the incompetence of their own voting patterns, and possible need to address the fact that they to might be responsible. No one wants to face that inner demon, so they just keep pointing at others till they feel better again...