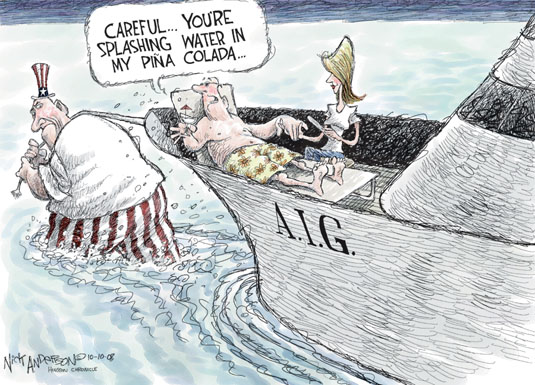

Bailout News Round-Up: AIG Needs More Cash, Citigroup Needs a Friend, George Soros Can't See The Bottom And Hillary Clinton is in China Requesting That They Continue To Fund Our Debt.

Cnbc's David Faber reported last night that AIG will show a loss of $60 billion for the quarter when they release their numbers next week, due to substantial asset writedowns particularly in their commercial real estate portfolio Discussions are apparently ongoing with the Treasury and Fed for additional taxpayer funds needed to keep the company in operation beyond next Monday. Seriously, how much of your money does Goldman Sachs deserve? If the connection isn't automatic, please consider that GS hedged their entire portfolio of questionable assets with AIG. Thus, as these assets plunge in value, GS looks to AIG for payment. When AIG runs out of money, they return to the Treasury begging for more of your cash. Pretty sweet work if you can find it.

Other stories early this morning include more hand-wringing over the banks plus reaction to and analysis of the home foreclosure mortgage bailout model that the Obama administration is pushing. Several more analysts say the plan will not work. In other news police in the UK prepare for a summer of economic protests and riots, Hillary Clinton is in China requesting nicely that they buy more of our soon-to-be worthless treasuries, and George Soros says he sees no bottom yet in the current economic crisis.

Tuesday's 50 Best Financial Stories Inside 1 Link

Feb 24, 2009 at 6:27 AM

Feb 24, 2009 at 6:27 AM

Reader Comments (16)

It's too late to stop funding aig's losses. They owe us enough already that we are forced to keep lending so that we might get our original monies returned. I do not think the eventual losses will be greater than $50 billion total to the government. Most of the money so far has been in the form of guarantees.

http://optionarmageddon.ml-implode.com/2009/02/17/bank-leverage-stats-123108/

As far as GE goes, it will depend on their charge-off ratios for this year. If thing get very difficult they will need a government bailout to the tune of $100 billion by Summer.

there are people from both sides of the spectrum. that is one of the beauties of the bailouts as it has united groups who would never normally be on the same side. and for the record i am like millions of American, fiscal conservative social liberal.

I believe in much smaller government (perhaps 50% smaller in dollar terms) and tolerance for others and their lifestyles.

We will need to cut spending dramatically in order to get deficits under control. The clinton story was interesting in that regard.

http://www.bloomberg.com/apps/news?pid=20601087&sid=apSqGtcNsqSY&refer=worldwide

At some point they will stop buying.

http://www.iht.com/articles/2009/01/07/business/yuan.php

"At first glance, the declining Chinese appetite for U.S. debt - apparent in a series of hints from Chinese policy makers over the past two weeks, with official statistics due for release in the next few days - comes at an inopportune time. On Tuesday, the U.S. president-elect, Barack Obama, said Americans should get used to the prospect of "trillion-dollar deficits for years to come" as he seeks to finance an $800 billion economic stimulus package."

http://www.pimco.com/LeftNav/Featured+Market+Commentary/IO/2009/Investment+Outlook+Bill+Gross+March+2009+Hairy+Lips+Sink+Ships.htm

“Where’s the bottom?” someone shouted at a recent PIMCO staff meeting. “Which market?” I shot back, which sort of ended the conversation, but provided little else in the way of an answer. The fact is (I should have said) that financial delevering affects most markets in the same way; they are similar trades. As unwinding leverage fails to be cushioned by a government check, prices go down on risk assets. Only the strong – or in this case – the highest quality assets survive. And so the bottom for risk assets is divorced and distinct from government guaranteed assets. “Where’s the bottom and where’s the top?” would have been a better question. No one knows of course, but we make educated guesstimates and try to communicate them to an enquiring public. We believe in giving a listener, as well as any one of our more than eight million individual clients, their money’s worth.

One thing I’ve never done however, is provide expert testimony in front of a congressional subcommittee. Newport Beach probably doesn’t have the cachet of Wall Street, or perhaps my style has always been a little irreverent or my brain a little irrelevant – I’m not sure. In any case, I thought I’d create my own virtual testimony to a hypothetical committee delving into the complexities of our financial crisis. What follows is what might have taken place last week.

Gross is quite arrogant. Upset that he's never been asked to testify.

This from Bloomberg opinion:

http://www.bloomberg.com/apps/news?pid=20601039&sid=aKytoVAjRt5s&refer=home

Feb. 23 (Bloomberg) -- It’s time to stop debating whether the U.S. is becoming Japan.

The U.S. already is Japan with near-zero interest rates, a broken financial system and politicians who don’t seem to realize the severity of the economy’s plight. The only question is whether the U.S. will be so lucky.

Lucky? Japan? Well, yes. For all its rigidities and idiosyncrasies, Asia’s biggest economy never fully collapsed. It never got near a depression, nor did deflation get out of control the way many analysts predicted following the implosion of the 1980s bubble economy.

The nation’s slide had a hydraulic quality. While asset prices plunged, the economy drifted lower at a glacial, almost managed pace for a decade until growth returned in 2002. Homelessness and crime ticked up a bit, yet Japan didn’t unravel. Households merely adjusted and lived off their savings. Even though considerable pain ensued and untold wealth was destroyed, Japan muddled along.

U.S. politicians who today say stimulus efforts are too big aren’t paying enough attention to the lessons from Japan.

http://ashizashiz.blogspot.com/2009/02/game-of-life.html?

http://www.bloomberg.com/apps/news?pid=20601109&sid=a3ZipCygZpsk&refer=home

Billionaire Perp Walk.