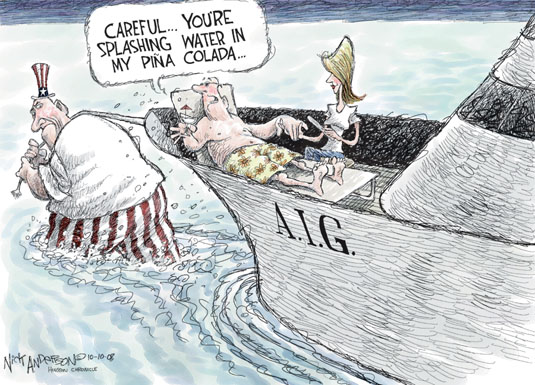

Cnbc's David Faber reported last night that AIG will show a loss of $60 billion for the quarter when they release their numbers next week, due to substantial asset writedowns particularly in their commercial real estate portfolio Discussions are apparently ongoing with the Treasury and Fed for additional taxpayer funds needed to keep the company in operation beyond next Monday. Seriously, how much of your money does Goldman Sachs deserve? If the connection isn't automatic, please consider that GS hedged their entire portfolio of questionable assets with AIG. Thus, as these assets plunge in value, GS looks to AIG for payment. When AIG runs out of money, they return to the Treasury begging for more of your cash. Pretty sweet work if you can find it.

Other stories early this morning include more hand-wringing over the banks plus reaction to and analysis of the home foreclosure mortgage bailout model that the Obama administration is pushing. Several more analysts say the plan will not work. In other news police in the UK prepare for a summer of economic protests and riots, Hillary Clinton is in China requesting nicely that they buy more of our soon-to-be worthless treasuries, and George Soros says he sees no bottom yet in the current economic crisis.

Tuesday's 50 Best Financial Stories Inside 1 Link