Insane America: Obama Wants You to Bailout the Asshats Who Live Next Door

Updated on Feb 19, 2009 at 3:59 PM by

DailyBail

DailyBail

Have we lost our collective minds. I woke up this morning, and apparently I now live in Havana, where Castro is leading a parade of unemployed clowns all driving '57 Chevys. Team Obama: pehaps you missed the message the American people have been trying to communicate. Stop The Bailouts. All of them. And we sure as hell did NOT want you to extend the bailout to homeowners. This is a country of responsibility, and you are giving those who played by the rules the middle finger salute.

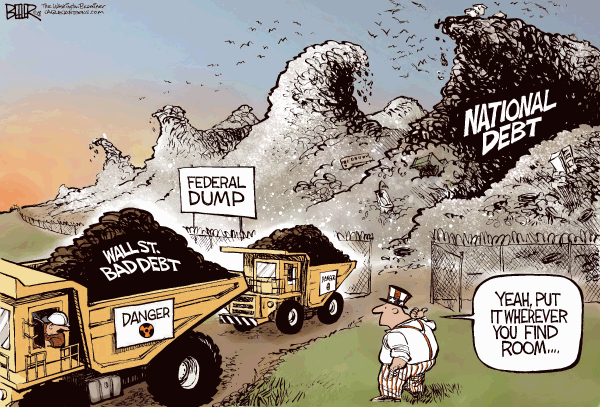

The newest twist on government bailouts commenced officially today with relief for your irresponsible neighbor. You are now paying for his greed and stupidity, and perhaps even the Hummer and Corvette he bought with his home equity loan that he'll never re-pay. Yes, you are footing the bill for his vehicles as well. It's all pooled capital. He purchased near the top with no money down, got a $200k home equity ATM, bought all his toys, walked away from the house and both mortgages last year when prices plummeted. No recourse. Before walking away, he secured a mortgage on a newer home 2 blocks away that was a short sale. He got in the newer house for 50% less than he paid for the 1 across the street from you. His credit is now damaged from the walkaway, but in 3 years that will disappear. And guess what, his new short sale purchase now qualifies for mortgage assistance under Team Obama's Plan to Save the Asshats.

Since the Mortgage Foreclosure Bailout Plan was announced Wednesday the outrage has been palpabe. For most taxpayers, the ongoing bank and auto bailouts, though more costly and extremely un-popular, do not resonate personally. But bailing out an irresponsible neighbor who purchased more house than he could afford is understood by everyone. Particularly our most maligned housing sub-group, renters, all of whom made an intelligent choice NOT to participate in the real estate bubble, yet now are being asked to subsidize the mistakes of those who did. Considering that renters already get shafted by the unfair tax subsidies given to homeowners, this proposal accomplishes nothing further than reminding them how worthless they are in the eyes of Washington.

Reuters says Obama's home foreclosure mortgage bailout plan will cost taxpayers $275 billion to help 9 million homeowners and yet most analysts believe it simply won't work. Housing prices nationwide still have much further to fall as evidenced by this must-see chart from Yale economist Robert Shiller. Yet Obama and his team seem focused on slowing the decline at great expense until it has been proven indisputably that we are the new Japan. Where is the change, President Obama. Every day your administration feels more like the last 20 years of Bush-Clinton incest.