Land of The Free And Home of The Broke: The United States of Insolvency

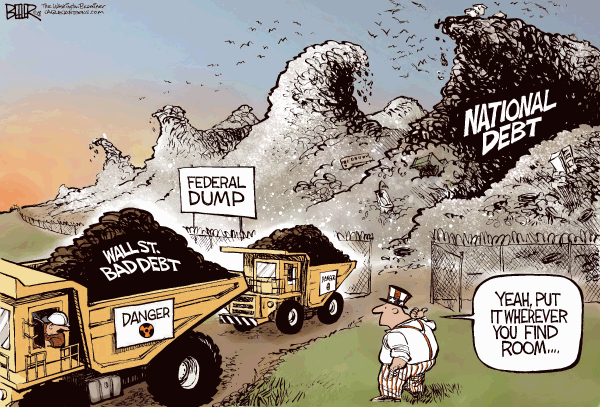

The heretofore unthinkable is getting some notice. The impending passage of the $800 billion federal stimulus is stoking the fires. We are a nation on an ever-steadying path to insolvency. David Walker was correct, we are Rome.

I have been waiting to do this piece for awhile. As a 21 year-old rookie at still fledgling CNN Washington in the summer of 1987, I got to know one of our senior producers while I rotated through the graveyard shift. Charlie covered the overnight from Washington and never had anything to do because Atlanta was in charge from our Larry King sign-off at 10 pm until they tossed back at 7 am the next morning. (This was the summer of Oliver North and the Iran Contra hearings and Atlanta wanted someone on stand-by in DC just in case.) Mostly, Charlie just read to pass the time and talked.

I heard nightly about the insolvency of our money-center banks because of bad loans to Latin America, the abandonment of the gold standard under Nixon and the burgeoning federal deficit then 2 years into Reagan's second term. This was back when an $80 billion dollar fiscal deficit got your attention. Thus unfortunately indoctrinated, I have been watching this build for 21 years and lecturing my unsuspecting friends and family with the details every step of the way. To be sure, I didn't think it would take this long to play out. Immigration and the huge boost it provided to social security (fica) revenues, without exacting a commensurate outlay, helped slow the train. Also aiding was the unexpected second wind our economy got in the late 90s as we became the world leaders in several new industries, and Washington reaped the associated windfall in tax revenues.

Never lost but simply delayed, the piper recently has made his way home. Here's some quick math that demonstrates where we are today. The total federal debt is almost $11 trillion. The deficit this year will be at least $2.5 trillion, and $1.5 trillion next year when the stimulus is included. This means a $15 trillion federal debt by the beginning of fiscal 2011. Now add $5 trillion more for the next 2 years in additional funds needed for the banking system, hopefully after having placed C, BAC, JPM and WFC into receivership, wiping out the bondholders and starting fresh with taxpayer dollars. The tally would then be $20 trillion at a minimum (very likely could be higher if the bank bailout costs grow.) Here's where it gets tricky, Bloomberg puts the cost so far of the bailouts at $9.7 trillion in outlays plus guarantees, and only part of this is in the above calculations. For simplicity, I am sticking with the $20 trillion figure assuming the total bailout cost to be $5 trillion and not the $10 trillion possible.

At $20 trillion in debt, assuming an average debt cost of 5%, (don't forget a lot of this debt is older and carries a higher cost, and that future debt will not likely be as cheap as it is currently), the interest on the debt would be $1 trillion, almost 3 times what we already can't afford. We have crossed the red line into fiscal oblivion, as we are now borrowing to pay the interest.

Let's examine some round numbers for the 2011 fiscal budget. With the failed attempt at a stimulus likely completed, we might finally return to our fiscal sense. Accordingly, let's take the 2008 budget outlay of $3.2 trillion (including TARP funds of $350 billion) and add 10% for the unchecked growth of general government including automatic increases for medicare and social security. The result is a $3.5 trillion federal budget for FY 2011. Now a quick look at receipts. If we are extremely lucky, receipts will have returned to 2008 levels of of $2.5 trillion. Under this semi-optimistic scenario, we are looking squarely in the face at a structural deficit of $1 trillion, in a normal fiscal year. At that point we will be borrowing $1 trillion just to pay interest on our federal VISA.

Just a few more calcualtions. This $1 trillion debt-interest figure will be 29% of the budget and more importantly 40% of total receipts. Folks, that is not sustainable. And we haven't discussed a couple of very contentious budget-accounting related issues. The first is that these budget deficit figures I've given are calculated on a cash accounting basis. Money in versus money out. As an example, they do not account for the monies that Congress steals (borrows) annually from the social security surplus to make it's budget numbers look about $200 billion less distateful. Furthermore, my numbers also don't account for the net present value of our future liabilities for social security and medicare. (And the unfunded liability for medicare alone is $32 trillion.) When these liabilities are taken into account, the deficit numbers are higher annually by several trillion and the total national debt becomes $56 trillion.

So, on the day after the Economist wonders aloud whether we are bankrupt already, it is time for everyone to start telling the truth. And the painful veritas is that the United States of America is now un-offically the United States of Insolvency. Sleep well, citizenry, if you are able.

Feb 15, 2009 at 10:33 PM

Feb 15, 2009 at 10:33 PM

Reader Comments (16)

Reading this post was very depressing, but you are right on the money. Keep up the great work!

- I get the need to increase entitlement spending in a recession to assist consumer spending for the unemployed.

But I can't believe the irresponsible packaging of the same old 'band-aid' approach to policy making that we've seen in the stimulus package. There is a recession, so the Democratic Congress writes a bill that consists of their 'to do' list. What it doesn't significantly address is the ongoing structural problems mentioned in these long term estimates of debt. Increased government spending may help the depth of the recession, but stimulus packages don't solve the problem of our impending bills.

Life for us (and our children) is about choices - and the impact they have on the world. What choices is the government not making to resolve potential insolvency?

winner.

I called my Senator this morning and directed his aide to read this article. Prolly will not read it. I hate what's happening.

http://www.guardian.co.uk/world/2009/feb/16/ireland-debt-recession

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/4623525/Failure-to-save-East-Europe-will-lead-to-worldwide-meltdown.html

The dominoes have begun to topple.

http://www.nytimes.com/2009/02/16/opinion/16krugman.html?_r=3

http://www.newsdissector.com/blog/2009/02/15/critiquing-cnbcs-house-of-cards-and-its-role-in-the-crisis/

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aId2BJIzu0cQ

Debt Default and Dollar Collapse

As long as people are adding links, this is my contribution.

http://www.bloomberg.com/apps/news?pid=20601085&sid=alUryW1gfwrE&refer=news

There aren't any Republicans or Teapartiers in the house. Damn DEMOCARTS have absolute control. LOL

http://market-ticker.org/akcs-www?blog=Market-Ticker&page=2