Entries by DailyBail (6219)

Financial Comedy Genius: South Park Is In Recession And Needs A Bailout (Video)

I try to restrain my descriptions, but the following South Park video clips are bailout comedy gold.

Countrywide & Ameriquest Home Mortgage TV Commercials (Comedy Video)

A collection of home mortgage commercials (mostly comedy) from the bubble daze.

Ameriquest Home Loan Commercial #1...Mistaken Robbery.

Eight more after the jump.

AIG Bailout News: $230 Million MORE In AIG Bonuses Still To Be Paid In 2009 (David Faber CNBC Video and Links)

AIG bonuses may come under scrutiny again as an additonal $230M is expected to be paid out, reports CNBC's David Faber.

Watch the clip to the end. David asks some very interesting hypothetical questions in the final 30 seconds. The issue is non-TARP companies having to compete with huge bonus offers made to employees of bailed out banks. This case deals with Citigroup, but it's happening everywere. Mark Haines is clueless, again.

Call The Treasury Secretary TODAY (phone numbers included): CNBC's Steve Liesman Interviews Tim Geithner. Broadcast March 25

This interview was shown on CNBC's Power Lunch about an hour ago. Liesman does a slightly better job than banking apologista Erin Burnett. Her on-camera gladfest earlier this week with Geithner was the high-school cheerleader interviewing the head of the Spanish club.

Yet Liesman whiffed just like Erin for failing to ask the most pertinent question of all. Why aren't bank debt holders being asked to absorb some of the banking losses? It's Bill Gross versus your family. Why do he and other bank bondholders come out whole and GM bonholders are asked to take massive hits?

Political influence of the largest banks. They own Geithner and it's disgusting.

If this makes you upset, call Treasury RIGHT NOW and tell them how you feel:

202-262-2960 and 202-262-2000

Video of Geithner interview is after the jump.

See also:

Recent Story Thumbnails (newest at the bottom)

Bailout Halleleuiah: We Praise Maxine Waters For Finally Asking The Goldman Question (Video)

This is my favorite moment from today's Congressional testimony of Geithner and B-52. It's 5 minutes of pie and porn as California Rep. Maxine Waters forces Timmaaay to listen while she recounts the litany of inappropriate Goldman Sachs influence at Treasury and on financial crisis policy .

Finally, somebody had the sack to ask Tim about it publicly. She would have been better served to concentrate on Goldman's role in the AIG decision (why was Lloyd Blankfein at the AIG rescue meeting last Fall?). But we applaud her nonetheless for her insight into how much better I would feel after hearing her scrotum smack Tim's forehead.

There is still one more question that TG and Bernanke need to answer publicly.

No Need To Bailout Seeking Alpha: Discussion Of Bank Bondholders Vs. Taxpayers With Felix Salmon, Brad Delong, James Kwak (And The Daily Bail)

Credit to Seeking Alpha editor Mick Weinstein for organizing and hosting an outstanding discussion of Tim Geithner's banking rescue program (ppip) this afternoon. It was a live discussion between the panelists, and in the 2nd portion the editor chose 7 questions from the writers and readers who were following.

I have never mentioned it here (but in the interest of full disclosure), I am a contributor for Seeking Alpha. They began picking up my stories about 3 weeks ago.

Here is the panelist exchange with regard to my question. It's mentioned twice because James Kwak brought it up before waiting for the moderator to introduce it.

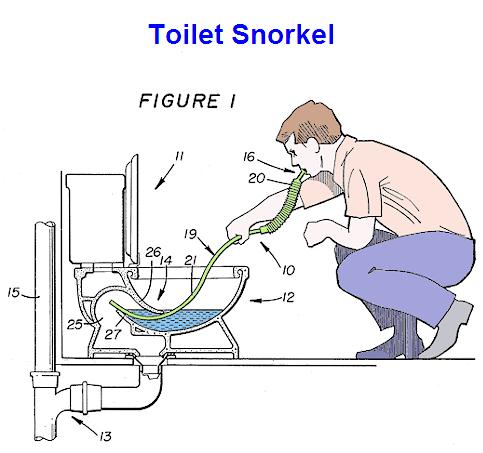

The Great Unclog of 2009: Industrial Strength Drano, Anyone?

Updated on Mar 25, 2009 at 3:42 AM by

DailyBail

DailyBail

Why Paul Krugman, James Galbraith, Simon Johnson and John Hussman are right and Brad Delong, Tim Geithner and Lawrence Summers are clueless eunuchs. The issue is Treasury Secretary Geithner's solution to the banking crisis revealed this morning, which by the way falls entirely on you. Bank bondholders like Bill Gross are not even being asked to carry their own tampons.

The mother of all bailouts is really the mother of all uncloggings.

My argument with Brad Delong's thesis is simple.

Nobel Laureate Dr. Joseph Stiglitz Says "The Geithner Plan Amounts To Robbery Of The American People"

Joseph Stiglitz lambasted the White House bailout plan for Wall Street this morning. It's a brutal rebuttal to the lies and half-truths we were fed all day yesterday by Timmaaay's minions. Geithner's plan is a thinly-veiled attempt to funnel even more taxpayer cash directly onto the balance sheets of failed banks.

It is intellectually dishonest and morally bankrupt. Congress voted a certain amount for TARP, and now Geithner is multiplying that sum without going back to Congress by experimenting with FDIC guarantees. That might be a good way of raising lots of cash for the banking system, but it's a very bad way of getting political support.