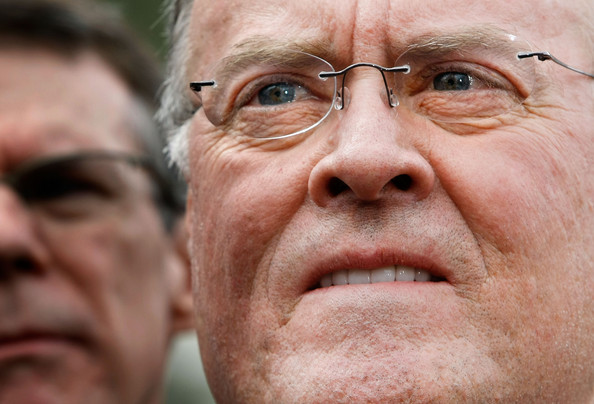

Who Is Most Heinous...Paulson, Lewis Or Bernanke?

Pretty solid CNBC video discussing Ken Lewis, Henry Paulson and the Bank of America takeover of Merrill Lynch. They pose the question: who's the bad guy?

Ken Lewis is guilty of having the most-hated face in all of failed banking. He should be indicted for ugly. And for insulting my intelligence everytime he's on TV. His purchases of Countrywide and Merrill Lynch, both at substantal premiums, makes him the stupidest CEO in recent memory.

Paulson is guilty of leading the effort to have the SEC grant Wall Street an exemption to the leverage cap in 2004. Paulson is also the most likely to trash your house, screw your wife and steal your job while you are on vacation. Ask Corzine.

Bernanke is guilty of turning the Fed's balance sheet into a cesspool. Bloomberg and Mark Pittman reported today that the Fed will still NOT release details on the more than $2 trillion in loans it has made to the various and sundry.

And all three are guilty of not anticipating the global financial crisis. Once it began to show itself in 2007, each miscalculated the severity. Contained. Sub-prime only. Move along. Nothing to see here.

Hey geniuses, when a condo in Santa Monica goes from $300k in 2000 to $1.1M in 2006, then we are gonna have banks with problems. Capisce, you friggin' idiots.

Let's see what you got.

Apr 24, 2009 at 3:58 PM

Apr 24, 2009 at 3:58 PM

Reader Comments (5)

Psssst. Hey Liesman, what about Bernanke?

Bunning on "the AIG" and the back-door bailout to Goldman Sachs: "This should come as no surprise given the incestuous relationship of the former Secretary of the Treasury, Henry Paulson, and Goldman Sachs."

Bunning on Bernanke: "By the way, did anyone see the PUFF PIECE they did on Bernanke on 60 Minutes, Sunday? I was eating dinner and almost THREW UP watching it."

"And if I see one more puff piece on Ben Bernanke...UGGGHHH!"

http://src.senate.gov/public/_files/radio/bunningnewsconf3_17_09.mp3

To those trustees and investors so lacking in imagination that they believe THEIR claim as a beneficiary is based on the same pipe dreams that came about when they thought they had landed a big fat fish, you trustees and investors did not land a big sucker. You promised to provide a service and to maintain the loyalty implied by your contract with your client. If you bet on derivatives, too bad. Greenspan warned against it. Your job ain't all that complicated, your parents were slobs.

You act like a deer frozen in the headlights of an oncoming car. You repeatedly decided to act stupid and dishonest and hope Jesus still suffers fools. Your clients aren't Jesus. The Bible says that even God has his limits.